By Erik Norland

At a Glance

- Signs of a slowing labor market and strained household finances are emerging

- Lower options prices across most asset classes suggest that markets may be under-pricing risks

We’re halfway through the decade, so what are the key risks and opportunities for 2025?

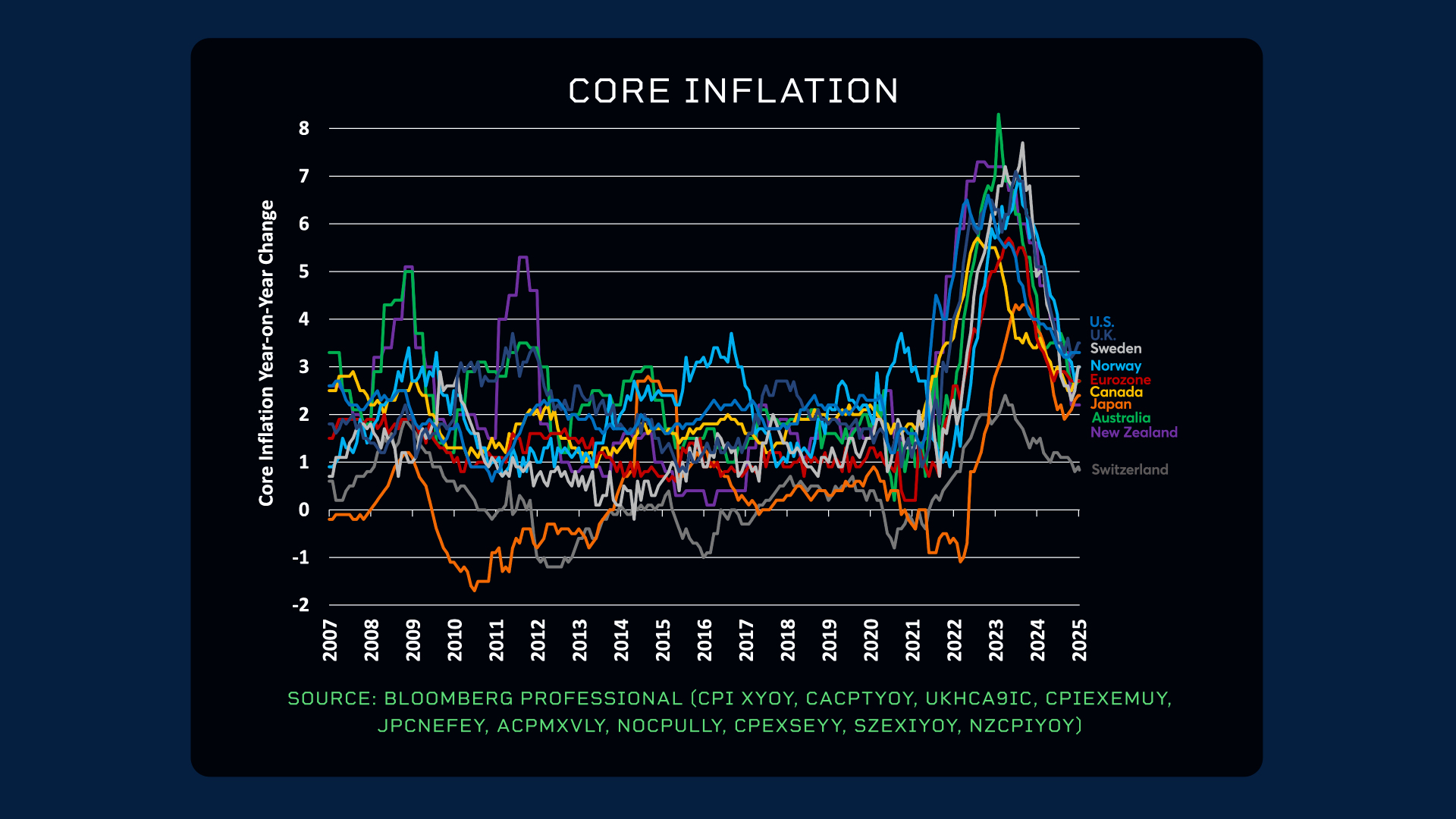

Inflation and Interest Rates

U.S. core inflation is still at 3.3%, nearly a percent and half above the Fed’s target rate – and the U.S. isn’t alone. Core inflation is running above central bank target rates just about everywhere in the world outside of China. As this year begins, bond yields so far have been rising sharply around the world in anticipation of fewer-than-previously-anticipated rate cuts.

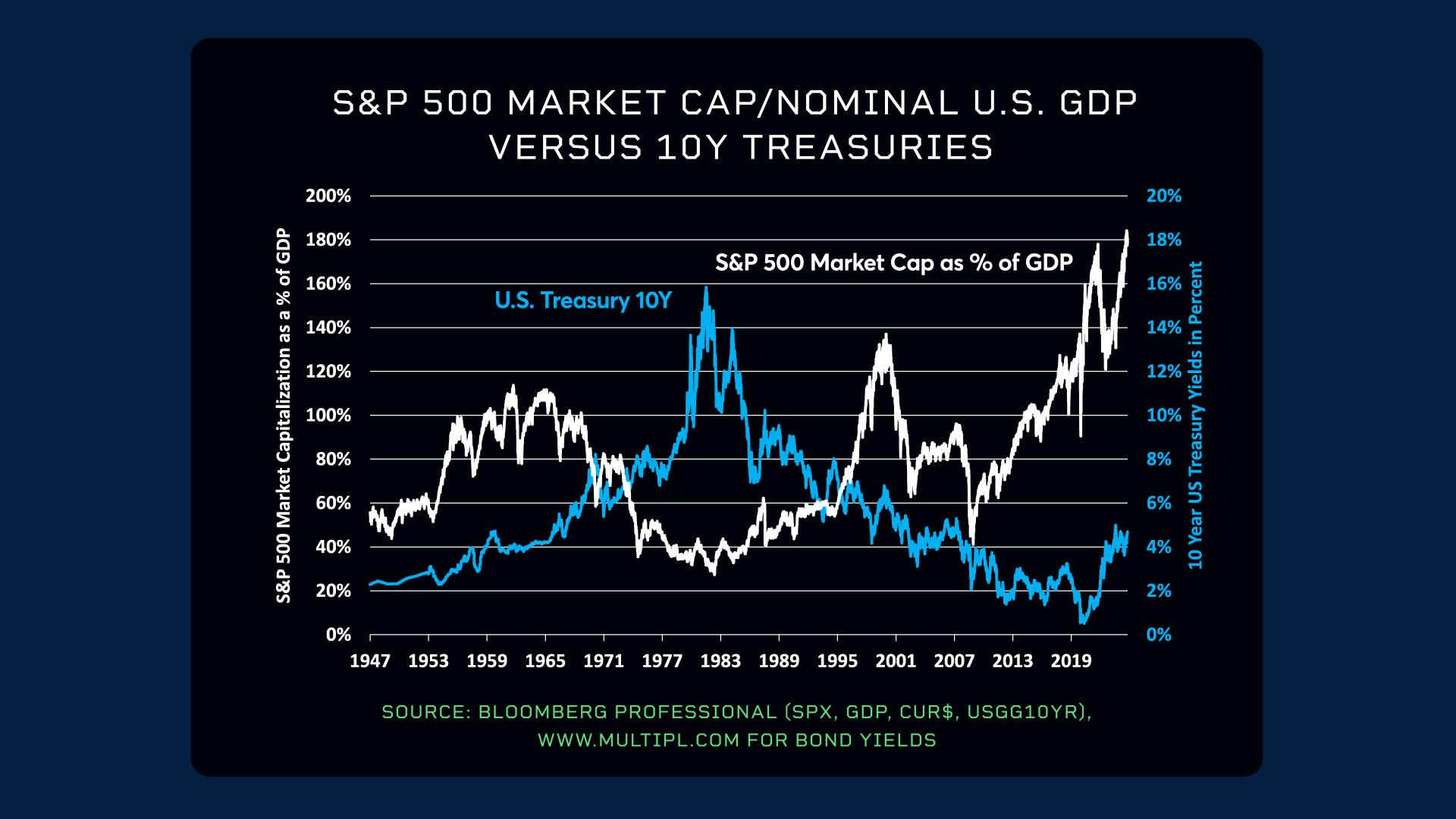

Equity Markets

The S&P 500 was up over 20% in each of the past two years, but now valuations may be getting stretched. Will higher bond yields destabilize the equity market and eventually provoke a correction?

Employment and Growth

While the U.S. continues to generate jobs at a decent pace, there are some signs that the labor market is slowing, and household finances are under strain from the cumulative impact of higher interest rates. Defaults on private credit are also rising sharply, so an economic slowdown is possible in the U.S. Much of the world is already growing slowly.

Options Markets

Across almost every asset class – including stocks – options prices are near historic lows. Are markets under-pricing risks? If so, could implied volatility on options rise significantly?

A New U.S. Administration

A new administration is arriving on January 20 in Washington, D.C. which could have big impacts on tax, tariff and U.S. foreign policy, potentially impacting a variety of different markets including currencies, oil, gold, equities and interest rates.

As we head into this new year, one of the big questions is if we’re all underpricing the amount of risk in the system.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here