The Elephant

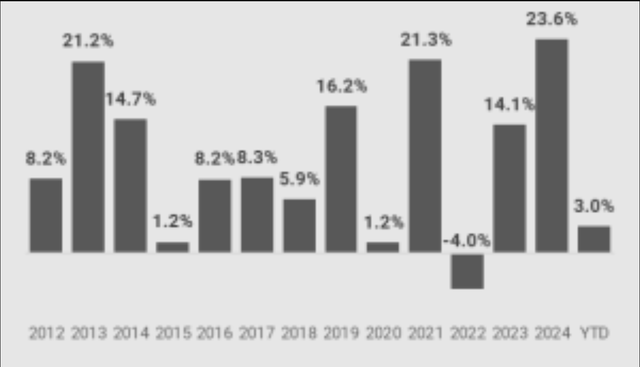

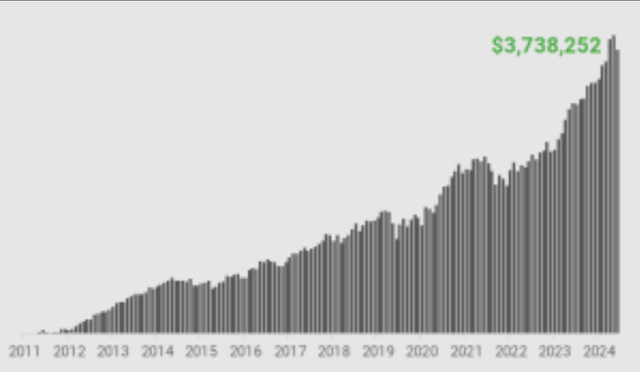

The Value Fund finished Q1 +3.0% net of fees and expenses. (1) Currency movements were immaterial.

Markets had a challenging start to 2025, with elevated volatility across the major indices. For Q1, the S&P/TSX finished +1.5%, the S&P500 -4.2% and the Nasdaq –10.2%. (2) President Trump’s “Liberation Day” tariff announcement on April 2 has sent the markets another ~10% lower this past week.

The recent selloff has erased over $6 trillion of market value. While our portfolios have not been entirely immune to the current turmoil, we are weathering this storm better than most as our financial house is made of brick (quality companies with solid balance sheets and purchased when cheap). With limited debt and attractive economics, our portfolio companies can effectively adapt to tariffs, inflation, higher interest rates, recessions, and other negative surprises that may arise.

The selloff has us excited about the price declines of companies that we have long admired. We invite you to read on to learn about our response to the current market turmoil.

Portfolio Update

The top contributor to the portfolio in Q1 was Berkshire Hathaway (BRK.B), with a return of +17.5%. Berkshire finished 2024 on a strong note, with operating earnings rising 27.1% from the prior year. The Insurance and Utilities & Energy segments showed stark improvement, with profits increasing 66% and 60% respectively year-over-year. With over $300 billion of idle cash at year-end, Buffett may finally be getting his opportunity to bag an elephant. Like his major acquisitions of the past, these moves drive the future growth of the company’s cash generation machine.

Vertex Pharmaceuticals (VRTX) was our second-best performer in the quarter, +20.4%. Growing demand for its Cystic Fibrosis (CF) franchise continued to generate substantial free cash flow. Vertex remains focused on diversifying its product portfolio and recently launched two new approved therapies: Alyftrek and Journavx. Alyfrtek is an improvement to VRTX’s CF portfolio, offering a once-daily dosing regimen that is far more convenient for patients. Importantly, it covers 31 additional rare mutations of CF for which no previous treatment existed. Journavx, a non-opioid pain signal inhibitor for acute pain, is beginning to ramp up sales as physicians gain confidence in its real-world efficacy and as VRTX advances reimbursement negotiations with payors. We believe that Journavx has the potential to become a blockbuster therapy, providing significant quality-of-life improvements to patients. In addition, VRTX is developing therapies for chronic pain that utilize a similar mechanism of action—blocking selective sodium channels—to inhibit the transmission of pain signals with little off-target effects. Success would be great news for shareholders, but more importantly, offer a powerful alternative to opioids and help combat the opioid crisis.

Our third top performer in the quarter was Check Point Software Technologies (CHKP) +22.1%. CHKP’s enterprise cybersecurity solutions continue to gain traction in the market, supported by growing demand for advanced network security. Recently appointed CEO Nadav Zafrir, a pioneer in the Israeli cyber-security market, has bolstered the company’s executive sales force in efforts to accelerate growth. CHKP is well-capitalized, with over $2.5 billion of excess cash on the balance sheet, and continues to actively repurchase its own shares.

Rounding out our top 5 performers in Q1 were Elevance Health (ELV) +17.9% and Intercontinental Exchange (ICE) + 15.8%. As mentioned in the last Scorecard, we believe the sell-off in ELV over the past year has been overdone, and the stock is trading at a significant discount to our estimate of its intrinsic value. The recent rebound reflects a partial correction of that mispricing. ICE continues to perform well as a significant portion of its earnings is driven by transaction volume on its exchanges and increasing demand for financial data, both of which generally increase when panic-induced volatility hits the markets.

Our biggest laggard in the first quarter was Alphabet Inc. (GOOG) -18.3%. Shares sold off following the company’s year-end earnings release in February, where it announced plans to increase capital expenditures by a substantial $23 billion in 2025. Recently, GOOG also announced its intention to acquire cybersecurity firm Wiz Inc. for $32 billion, aiming to strengthen its position in the cloud computing market. The scale of these investments is substantial, but we note that GOOG generated $116 billion in operating profits during 2024 and ended the year with $93 billion of excess cash on its balance sheet. In our opinion, the increased capital expenditures are necessary to maintain GOOG’s position in its core search market. Beyond search, GOOG continues to build value across YouTube, Google Cloud, Waymo, and DeepMind, all of which leverage GOOG’s enviable infrastructure.

Our second-largest contractor in the quarter was American Express (AXP). AXP finished 2024 on a strong note, with earnings growing 23% for the year. While provisions for credit losses increased, reflecting a more cautious credit outlook, net write-off rates remained below historical averages, indicating strength in the underlying credit quality. AXP remains well-capitalized, and its affluent customer base is expected to fare better than the general economy in the coming months. However, the stock was not cheap, and we trimmed our position in Q1.

One thing that is common across both our top performers and contractors is that they are well-capitalized businesses with durable competitive positions in their respective markets. That is by design. Companies that operate from a position of strength are better positioned to navigate market downturns and often emerge in a stronger position as competitors go bankrupt or are acquired. Moreover, many of our portfolio companies actively repurchase their own stock. Lower stock prices allow them to repurchase a greater percentage of their outstanding shares, leaving remaining shareholders with a larger claim on future cashflows. This is a powerful and tax-free mechanism for long-term value creation.

We made one new purchase in the quarter: Icon PLC (ICLR). ICLR is a leading contract research organization (CRO) based in Ireland that manages clinical trials for pharmaceutical and biotechnology companies worldwide. Despite some uncertainty driven by recent personnel changes at the Food and Drug Administration (FDA) and the Centers for Disease Control and Prevention (CDC), we believe that new drugs and medical devices will continue to be developed, and scientific progress will continue. New drugs require rigorous clinical testing before reaching the market. As a leading CRO, ICLR will capture its fair share of clinical trials once the dust settles.

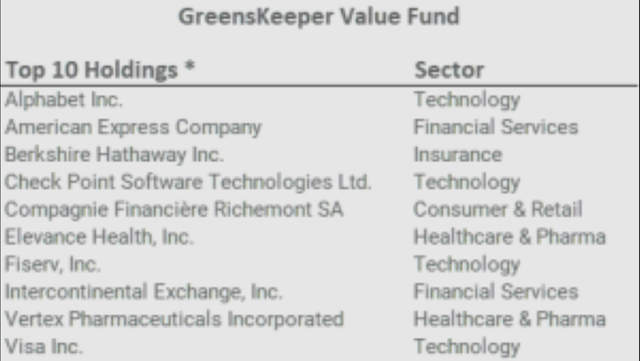

Our top ten holdings as of the end of Q1 are listed below. We recently released our 2024 annual report, which provides more detailed information on the portfolio and can be found here.

* As of March 31, 2025. The Value Fund’s holdings are subject to change and are not recommendations to buy or sell any security.

Trump’s Tariffs – A Canadian Perspective

Tariffs. Trade wars. Stock markets are selling off and flashing danger. Reading the headlines these days can be depressing. Many Canadians are scared about the economy and their investment portfolios. Some have good reasons to worry.

We do our best not to wade into politics, but the escalating trade war has become the elephant in the room. Numerous client inquiries about our perspective compel us to share our thoughts on these issues and how we are navigating them.

Buying Canadian to support local businesses can be both patriotic and an effective way to send a message of consumer protest in the face of the current hostility.

US companies facing declining demand will raise complaints with the Trump administration and pressure change. That said, allowing your political views to influence your stock investments is unwise. Don’t just take our word for it.

“If you mix your politics with your investment decisions, you’re making a big mistake.”

—WARREN BUFFETT

That doesn’t mean that the current tariffs and escalating trade war should be ignored when it comes to your investments. On the contrary, we are spending a significant amount of time thinking about how things will evolve and the impact on our portfolio companies. However, Canadian investors should avoid drastic measures, such as boycotting US stocks.

The White House has been home to 47 presidents of varying parties. A few have been exceptional, some have been terrible, and most fall somewhere in between. Presidents, along with Congress, have the power to enact policies that can be beneficial or damaging. But their impact often proves to be of minor consequence to the American economy. The current administration’s policies may be an exception.

Power is intentionally divided between the three branches of the US government. Currently, the judicial branch is the only one attempting to rein in rule by presidential fiat and speaking truth to power. Given the risk of a deteriorating economy and flagging consumer confidence, we believe that pressure will grow for Congress to reassert itself and protect its turf.

What has remained constant, at least since the end of World War II, is that the US is home to the world’s best companies and the world’s most dynamic economy. Corporations flock there because the US has the world’s deepest and most developed capital markets. Many European and Asian companies choose to list their shares there for this very reason. As a result, the US stock market accounts for approximately 60% of global market capitalization.(3)

America’s world-leading universities are a magnet for the world’s best and brightest. The American system fosters capital formation and rewards risk-taking. While people may disagree about the fairness of the US system of taxation and wealth distribution, there is no question about the US economy’s—and capitalism’s—ability to create wealth. As a result of these factors, the US is home to the world’s reserve currency, which affords the country numerous advantages.

So, given the outright hostility of the current Trump administration towards its erstwhile friend north of the border, what is a Canadian investor to do? First, let’s remember that Canada represents 0.5% of the world’s population and 2.0% of global GDP.(4)

Considering these facts, it’s surprising that many portfolios we inherit from new clients have most of their holdings in Canadian stocks. This tendency is known as home-country bias, a common investing pitfall that is prevalent worldwide.

For Canadians in a mood to protest and concerned about potentially supporting the Trump administration by investing in US stocks, allow us to reframe the issue.

The companies that we invest in at GreensKeeper are typically mature and generate prodigious free cash flow. They don’t require additional equity capital from the markets. On the contrary, they often buy back their shares and pay healthy dividends. Owning shares in these great businesses is simply choosing to be a part owner of their future success.

Choosing not to invest in these US companies as a form of protest will prove fruitless. They don’t require capital, and given the size of the US capital markets, they won’t notice.

Another wrinkle is determining exactly what constitutes a “US company.” For example, we own shares of Lululemon (LULU). The company was founded in Vancouver and is still based there. But its stock trades solely in the US. Moreover, 56% of its sales are in the US, versus 21% in Canada. We consider LULU to be a Canadian company with worldwide operations.

Similarly, many of our US companies are global businesses that derive a significant portion of their revenue outside the US (e.g., S&P Global (SPGI), Visa (V)). By convention, we define them as US businesses. However, the reality of the situation is more complex. We view them as global companies that happen to be headquartered in the US. Investing, like much of life, is nuanced.

Our goal at GreensKeeper is to make money for our clients while prudently managing risk. We do that by investing in the world’s best companies, provided they are based in the West. Avoiding the world’s largest economy would be both unwise and nearly impossible.

If history is any guide, the current trade war is likely to end badly for all involved:

“[T]ariffs will harm America’s economy, too…. The fact that [Trump’s] belief in protectionism is fundamentally flawed may not sink in for some time, if it ever does.”

—THE ECONOMIST, MAR 8, 2025

“Mr. Trump has an economic development model based on the fantasy of ‘import substitution.’ That model kept India poor for decades.”

—WSJ EDITORIAL BOARD, MAR 28, 2025

The one US export that the current administration’s policies are sure to increase is anti-Americanism. Trust, like reputation, takes many years to build and can disappear in an instant.

Our view is that the intentional dismantling of free trade and the liberal economic order established by the US post-World War II is unwise and not in America’s long-term interests. But whether we agree with the wisdom of the current policies emanating from the White House is irrelevant. We have no control over what the Trump administration will do next.

To be successful as an investor, one needs to be rational and objective. The stock market is not a place where showing one’s loyalty to a particular political party leads to a winning strategy. The person on the other side of a trade doesn’t know who you are and doesn’t care.

The best thing we can do for our clients is to continually evaluate how things will evolve, how our portfolio companies will respond, and the financial impact of the escalating trade war on their businesses. We are trying to avoid companies and sectors that are likely to be materially impacted unless an overreaction to these risks leaves those stocks underpriced.

Perhaps some good will come out of all this for Canada. Canadian businesses should use this moment as a wake-up call to diversify their export markets. Our politicians should be pressured to lower internal trade barriers and stop favouring protected industries at the expense of all Canadian consumers.

Canada’s economy is heavily reliant on trade with the elephant to our south. We don’t know exactly how and when the escalating tariff war will end. But to our thinking, this too shall (eventually) pass. The best companies, like the human species, are successful because they adapt. And we wouldn’t bet against the American Republic still thriving and ushering in its 48th president with a different agenda four years from now.

Canadian investors who ignore the risks of placing their capital in harm’s way by investing in businesses that are disproportionately affected by these measures will likely come to regret it.

The Market Selloff

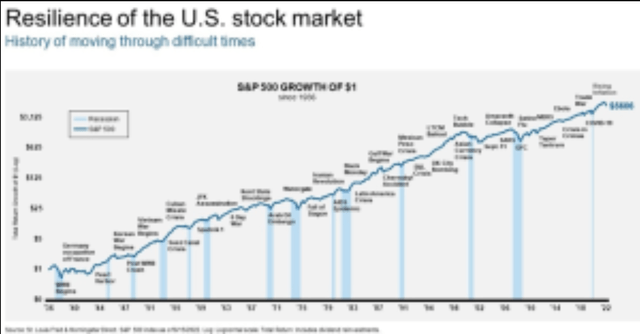

Sharp market corrections trigger fear in most people, leading to poor decision-making. This panic creates an opportunity for those who stay rational and are prepared to act. Market volatility is the price that equity investors pay for superior long-term outperformance compared to bonds. The graphic below illustrates that periodic crises are merely blips in the market’s longer-term inexorable rise.

Successful investors learn to overcome temporary feelings of discomfort and purchase stocks when the market is in disarray. It helps to remember that stocks become less risky and more likely to deliver superior returns after they have declined in price. That may seem somewhat counterintuitive, but it is true. For long-term investors like GreensKeeper, fear is our friend.

“The world is overwhelmingly short-term focused.”

—WARREN BUFFETT

We don’t know if the market will continue trading lower in the coming weeks and months (no one does). That isn’t the game we play. Instead, we are focused on valuations and the prices at which we know we are getting value for our investment dollars.

Michael Van Loon and I are scouring our watchlist and company reports at a rapid clip. Revisiting companies that we have long admired to determine if they are cheap enough to be attractive at current prices. We know from experience that opportunities to acquire great companies at a bargain price are rare and typically arise when things seem darkest.

We recommend that you do yourself a favour and stop obsessively watching the markets. That’s our job. Instead, turn on the TV and watch something that keeps you calm or brings you joy. This week, one of my favourites comes to mind: enjoy the Masters!

Michael P. McCloskey | President, Founder & Chief Investment Officer

|

Footnotes (1) All returns and Fund details are: (a) based on Class F units; (b) net of all fees; and (c) as of March 31, 2025. (2) Index returns are for the total return indexes, including dividends and measured in Canadian dollars, the Value Fund’s reporting currency (3)Source: Worldometer, Goldman Sachs. (4)Source: Worldometer. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here