One of the best income stocks that passive income investors can find in the high-yield market right now is Rithm Capital (NYSE:RITM), in my view.

The mortgage trust is well-diversified, is actively working on adding new revenue streams and just comes out of a very profitable and successful third quarter. The Sculptor Capital transaction is expected to close in November, on revised term.

For the second time in a row, Rithm Capital has reported strong dividend coverage due to non-recurring sales of excess Mortgage Servicing Rights [MSR]. The dividend yield of 11% is not only covered by distributable earnings, but has a very high margin of safety and has room to grow.

The stock is now selling at an exaggerated 26% discount to book. Strong Buy.

My Rating History

The creation of a new revenue stream, resulting from the acquisition of Sculptor Capital, was one reason for me to recommend the mortgage REIT to passive income investors a couple of months back. Persistently high dividend coverage driven by excess MSR sales and potential for dividend growth continue to make RITM stock a Strong Buy.

Sculptor Capital Deal Set To Close In November

Rithm Capital announced in July that they planned to acquire alternative asset manager Sculptor Capital for $639 million. The asset manager had more than $34 billion of AUM and the acquisition offered diversification potential for Rithm Capital as well as an entry into the third-party capital management business.

The acquisition only recently was approved by both companies’ boards of directors after Rithm Capital raised its bid to $12.70 per share, representing a premium of 13.9% over the initial bid of $11.15 per share. The deal is expected to close in November.

Mortgage Servicing Rights And Dividend Coverage

In the last two quarters, Rithm Capital’s dividend coverage ratio has substantially improved due to the mortgage REIT selling excess MSR.

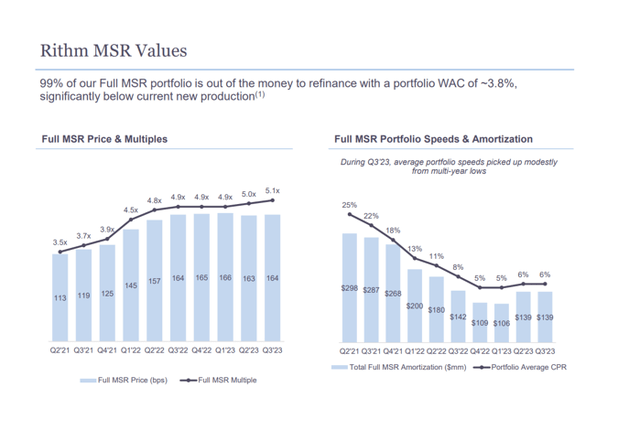

MSR are a special-kind of mortgage-related investment because their values (valuation multiples) tend to increase during periods of steepening interest rate curves.

MSR become more valuable during rising-rate environments because of slowing prepayment speeds which in turn results in higher servicing income.

Multiples for MSR have increased substantially in the last year as the central bank moved aggressively to contain four-decade high inflation rates.

After real estate and other securities, MSR were the second largest asset class on Rithm Capital’s balance sheet, with a fair value of $8.7 billion.

MSR Values (Rithm Capital Corporation)

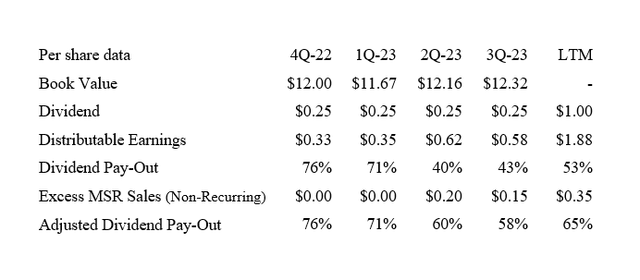

Rithm Capital earned $0.58 per share in distributable earnings in the third quarter and the trust paid out just 43% of these earnings as dividends, primarily due to new sales of excess MSR. These MSR sales boosted distributable earnings by $0.15 per share in the third quarter. The payout ratio in the last twelve months was 53%, so I continue to rate Rithm Capital’s 11% dividend yield highly.

Adjusting for the impact of excess MSR sales in both 2Q-23 and 3Q-23, since they are non-recurring, the payout ratio still looks quite good: Rithm Capital’s adjusted dividend payout ratio was 58% in 3Q-23 and 65% on an LTM basis. Thus, the mortgage trust’s dividend, with or without incremental MSR sales moving forward, should be reasonably safe.

Pay-Out Ratio (Author Created Table Using Trust Information )

Selling At An Unreasonable BV Multiple

Selling MSR at a time when MSR multiples are extended is a good strategic decision. I want Rithm Capital to sell such assets at or near the peak of the present rate-hiking cycle.

The possibility of the central bank lowering interest rates next year has weighed on Rithm Capital’s valuation multiple recently. MSRs tend to lose value during falling rate periods, suggesting that the present compression in Rithm Capital’s multiple is driven by uncertainty about the steepness of the yield curve moving forward.

With that being said, I think that passive income investors are exaggerating the situation a bit here as Rithm Capital has a diversified real estate portfolio and is protected against a number of possible interest rate paths through investments and a number of different mortgage assets such as real estate securities, MSRs and single family homes.

Furthermore, Rithm Capital has historically deployed capital opportunistically, suggesting, for instance, that MSRs could become attractive again as an anti-cyclical investment for the mortgage trust during the next downcycle in rates.

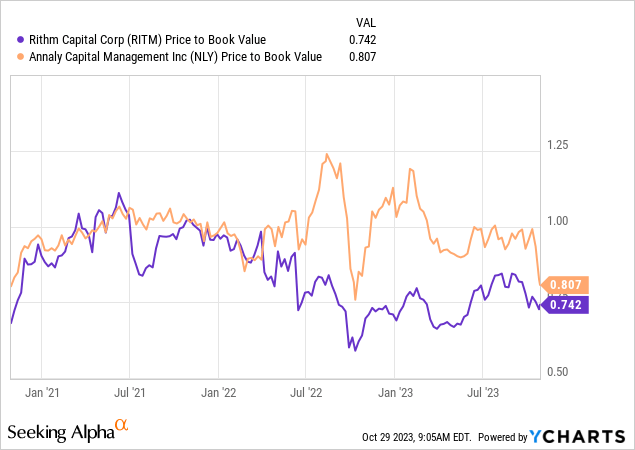

Presently, the 26% discount to book value for Rithm Capital seems rather extreme and unjustified (again), particularly because a mortgage trust like Annaly Capital Management (NLY), which also owns MSR, has a much smaller discount of 19%, despite being less diversified than Rithm Capital and posting a substantially higher payout ratio.

Rithm Capital has not only room to grow its dividend (as opposed to Annaly Capital Management), but also a much better risk/reward relationship due to its more diversified mortgage/real estate investment strategy.

Quantitative Easing And MSR Exposure: A Key Risk For Rithm Capital

Rithm Capital has positioned itself for a variety of interest rate environments as its investments include MSR as well as a lot of traditional mortgage assets such as real estate loans and real estate securities.

Once the central bank turns back to quantitative easing (which I anticipate for 2024) and brings long-term interest down, I would expect growing pressure on the valuation of Rithm Capital’s sizable MSR investments.

Taking into account the trust’s large excess dividend coverage even when excluding MSR sales, I think that the dividend as such will be sustainable.

My Conclusion

The third quarter was a good quarter for Rithm Capital and the mortgage REIT just announced that it is finalizing the acquisition of Sculptor Capital at a higher price, but which adds an alternative asset management income stream to its diversified portfolio of mortgage assets.

The acquisition of Sculptor Capital was good news for passive income investors, but what was even better news was that the dividend payout ratio was just 43% (58% adjusted for non-recurring MSR sales), suggesting that the excessive discount to book value is not really justified, and neither are concerns about the trust’s 11% dividend yield. Strong Buy.

Read the full article here