This article was coproduced with Dividend Sensei.

Very rarely is there a sea change on Wall Street – a change in tone, sentiment, and fundamentals that can flip the script and make or break your portfolio dreams.

Howard Marks is likely right that the age of free money is over forever. And thank god it is because otherwise IPOs of $150 billion market caps with zero sales would have become the norm.

Rivian (RIVN) IPOed at the end of 2021 at the tail end of the Pandemic stimulus speculative frenzy. It was worth $150 billion right after IPO, twice that of Ford (F) and GM (GM), with zero sales and no expectations for profitability through at least 2028.

Well, today, the world has returned to sanity, as Mr. Marks explains.

This is the return to the old normal, when money costs something and easy money from speculation will be much harder to come by.

It’s the revenge of the real economy. Companies with real fundamentals that generate real value will lead the way to a brighter tomorrow.

A REIT Blue-Chip Bargain Opportunity You Don’t Want To Miss

REITs have fallen 33% off their January 2022 highs in one of the worst REIT bear markets in the last decade.

I know what you’re thinking.

“Rates are skyrocketing, and buying REITs now is like stepping in front of a moving train!”

Guess what? Everyone agrees with you!

REITs have been more popular since March 2009. Yes, during lockdowns in the pandemic crash, investors were more bullish on REITs than today!

-

GDP contracting at -32% back then, today growth of 3%

Timing the bottom of any bear market is impossible, but I can say with high confidence that this REIT bear market is likely close to bottom, and here’s why.

|

REIT Bear Market |

Peak Decline |

|

1973 to 1974 |

-34% |

|

1990 |

-15% |

|

1998-1999 |

-21% |

|

2007-2008 |

-68% |

|

2013 |

-14% |

|

2015 |

-15% |

|

2016-2017 |

-15% |

|

Pandemic |

-25% |

|

2022-2023 |

-30% |

|

Average |

-26% |

|

Median |

-25% |

(Source: NAREIT)

The median REIT bear market decline since 1973 is a 25% decline and the average is 26%.

Even in the 1970s, as rates doubled from 5% to 11%, REITs only fell 34%.

Outside of the Great Recession, when capital markets that are the sector’s lifeblood melted down, REITs have never fallen more than 34% from record highs.

And right now, they’re -33%.

Interest Rates Aren’t A Threat To Blue-Chip REITs

After 15 years of free money, where the Fed and interest rates were all that mattered, it’s hard to stop thinking like REITs as a bond alternative.

But for over 50 years, there has been zero long-term correlation between REITs and 10-year yields.

Since 1972, had you known precisely what 10-year yields would do in any given year, you’d have been able to predict just 2% of REIT returns.

OK, but that’s over 50 years. My god, man, you’re asking me to buy REITs when Jamie Dimon is warning that the Fed might have to go to 7%, former St. Louis Fed President Bullard is warning about 6.5%, and BlackRock thinks 10-year yields might go as high as 6%!

I haven’t lost my mind. I’m crazy like a fox.

|

Year |

Equity REIT Returns |

Average 10-Year Treasury Yield |

|

1972 |

8% |

6.2% |

|

1973 |

-16% |

6.9% |

|

1974 |

-21% |

7.6% |

|

1975 |

19% |

8.0% |

|

1976 |

48% |

7.6% |

|

1977 |

22% |

7.4% |

|

1978 |

10% |

8.4% |

|

1979 |

36% |

9.4% |

|

1980 |

24% |

11.4% |

|

1981 |

6% |

13.9% |

|

1982 |

22% |

13.0% |

|

1983 |

31% |

11.1% |

|

1984 |

21% |

12.5% |

|

1985 |

19% |

10.6% |

|

1986 |

19% |

7.7% |

|

1987 |

-4% |

8.4% |

|

12 Year Period |

1061% |

9.4% |

|

Average Gains When REITs Were Rising |

13.7% |

8.7% |

(Source: NAREIT)

Starting from 1972, before the second worst REIT bear market in history began, REITs tripled by 1981. The entire time, interest rates were rising.

They doubled and rose to a peak of 16% in 1981.

The stock market? Flat for 13 years.

REITs? 3X, and that’s if you bought before the bear market began.

If you bought at the bottom of the bear market, after REITs were down 34%, like today, you made 12X your money while the stock market went nowhere.

This is the kind of sea change that Howard Marks says comes around very rarely, a once-in-a-generation opportunity.

Value and growth cycle over time, sometimes taking 10 or 15 years.

Well, it’s been 15 years, and now the stars have aligned for the best REIT bull market in a decade or more.

Statistically, there’s a 97% chance that REITS are within 2% of their ultimate bottom.

-

As close to someone ringing a bell at the bottom as you’ll ever find on Wall Street

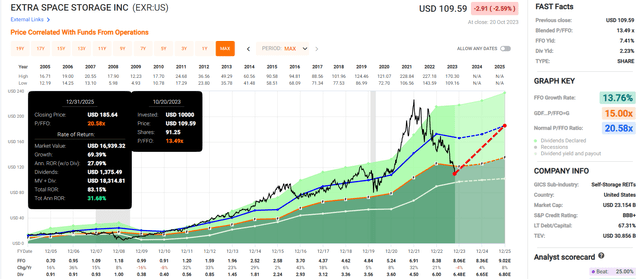

So let me share why we consider Extra Space Storage (NYSE:EXR) one of the best low-risk, recession-resistant Ultra SWAN REITs to buy during this historic opportunity.

EXR is almost 40% undervalued and a Buffett-style “fat pitch” Ultra Value buy.

The Last Time Investors Hated EXR This Much

|

Time Frame (Years) |

Annual Returns |

Total Returns |

|

1 |

135% |

135% |

|

3 |

78% |

462% |

|

5 |

59% |

908% |

|

7 |

54% |

1969% |

|

10 |

38% |

2430% |

|

15 |

24% |

2297% |

(Source: Portfolio Visualizer Premium)

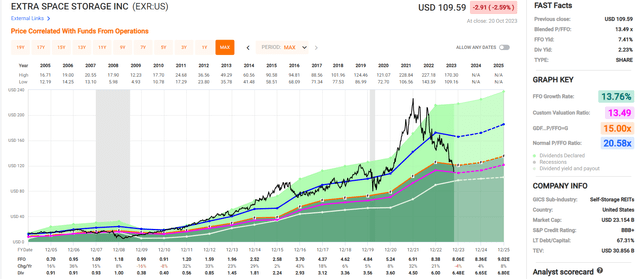

Lowest Valuation In 14 Years!

FAST Graphs, FactSet

6% very safe yield and Buffett-like return potential from an Ultra SWAN bargain hiding in plain sight.

If you love this business and you’re not buying today, you’re doing it wrong.

A Perfect REIT For Recessions

Extra Space Storage isn’t the oldest REIT (founded in 1977) nor a dividend aristocrat. EXR’s claim to fame has been one of the best growth rates in REITdom, 14% annually, more than double the sector’s growth rate.

That has helped power 16% annual returns since its IPO in 2014, turning $1 into $17.5 compared to the S&P’s 446% return.

That’s thanks to acquiring 3,600 properties over the last 19 years, totaling 2.8 million storage units and 280 million square feet.

-

101 Empire State buildings worth of storage space

-

just over 50% of all the office space in Manhattan worth of storage space

Most of that time, EXR has been blessed with the brilliant vision of CEO Joe Margolis, who joined the board in 2007, became chief investment officer, and took over the top job in 2017.

Margolis is a fan of solid balance sheets, which is more important than ever for any REIT in a higher, more extended world.

-

net debt/EBITDA of 4.8 vs six or less safe

-

fixed-charge coverage ratio 4.3 vs. 2+ safe

EXR has a BBB+ stable credit rating and almost $2 billion in liquidity.

Low cost of capital is everything in this sector where cap rates are rising, and the opportunity for solid REITs to grow even stronger will make or break fortunes in the coming years.

REIT acquisitions don’t boost growth all that much. That’s because REITs have to issue stock to pay for some of the deal, and that dilution means that FFO/share only gets a modest boost.

EXR is different, though. Their approach to M&A is Buffett like. Specifically, EXR will buy low-cost, independently run storage facilities, which trade at a discount compared to publicly traded storage REITs.

Then, it improves them through rebranding and tech updates, which increases their value to customers, resulting in faster rent growth and capital appreciation.

That’s the power of brilliant management, which EXR has, even if the stock price says otherwise.

FAST Graphs, FactSet

EXR has been cut in half from a peak multiple of 33X FFO. That was a historical 65% premium, and now it has become almost 40% undervalued.

We were pounding the table to trim EXR in late 2021, and now we’re pounding the table to buy at the lowest P/FFO in 14 years.

Why? Isn’t there a recession coming next year? EXR is expected to grow by 4% next year and 8% in 2025.

Remember how EXR’s growth plan is to buy cheap properties and fix them up? Do you know where it gets those deals from? It’s the largest third party storage property manager in the country.

That means EXR manages many mom-and-pop facilities for others, collecting fees while learning the best opportunities it can buy.

When rates rise? Panic in the real estate market means that independent small-time operators feel the squeeze.

EXR has the deep pockets to buy these properties at the best valuations in years.

EXR also is a master of improving properties through technology, including online rentals, QR codes, agent-assisted rentals, etc.

-

55% of M&A sources through its 3rd party management company

-

40% of rent comes from tech-enhanced platforms

However, it can get a new customer if it has figured it out and is executing very well.

Now factor in that Americans bought a lot of stuff in the Pandemic, rental demand is near record highs, and you can see why we’re so bullish on EXR.

In 1988, 2.5% of Americans rented a storage unit. Now it’s 10.5% and climbing.

-

a secular growth business courtesy of Americans buying too much stuff

-

and housing shortage, meaning millennials can’t buy bigger homes

Solid Growth Prospects For Years To Come

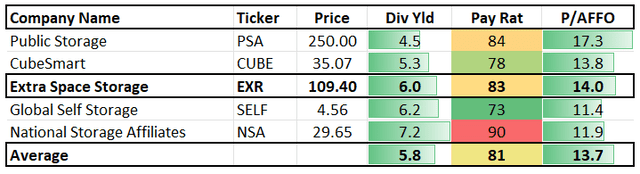

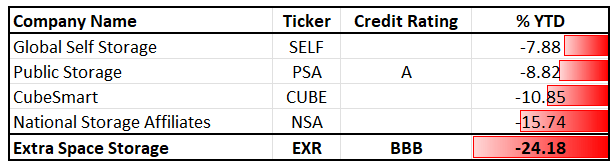

EXR is the second largest self-storage REIT behind Public Storage.

Or at least that was its size before it agreed to buy Life Storage in a $47 billion deal back in April, expected to close by the end of the year.

EXR will now own more than 3,500 properties with a 13% market share. It will be the industry titan with the best economies of scale, yet it still has plenty of growth runway.

It will manage about 1,200 properties for third parties, all potential future acquisitions. And heck, it might buy another peer. Depending on how the election goes, EXR could merge with Public Storage.

In such a fragmented market, even the three top players combined only own about 28% of the market, showing you just how much M&A-fueled growth potential exists for EXR.

This year, same-store NOI is up 5.5% year-to-date, courtesy of record 94.5% occupancy and strong pricing power. Inflation is at 3.7%, and EXR can pass on about 2% real pricing power to customers.

Even in recessions, like the Great Financial Crisis, when unemployment soared to 10%, EXR’s revenue only fell 2.9%. It was flat in the Pandemic when the economy contracted at a 32% annualized rate.

Can you see why EXR is expected to post solid 4% growth in the mildest recession in history?

Analysts currently expect a 6.3% long-term growth from EXR, which is similar to the 6% growth rate of the sector.

However, EXR offers a 1% higher yield than the sector, and its valuation profile is far superior.

But how accurate are these analyst forecasts?

In the last decade, outside of a very small margin of error, EXR has always caught growth forecasts. How small of a margin of error? 2%.

What kind of long-term returns can you expect from EXR, given the current growth outlook? 12% to 13% per year long term.

That might not sound exciting for a REIT whose average rolling returns have been between 21% and 24% since 2004.

But thanks to its table-pounding 40% discount to fair value, EXR can still deliver Buffett-like returns for the next decade.

Valuation: Outrageously Great Buying Opportunity

Just take a look at the incredible opportunity for Extra Space.

Fundamentals Summary

-

yield: 5.9%

-

dividend safety: 91% very safe (1.45% dividend cut risk)

-

overall quality: 91% medium-risk Ultra SWAN

-

credit rating: BBB+ stable (5% 30-year bankruptcy risk)

-

long-term growth consensus: 6.3%

-

long-term total return potential: 12.3% vs 10.2% S&P 500

-

current price: $109.59

-

historical fair value: $179.41

-

discount to fair value: 39% discount (Ultra Value Buffett-style “fat pitch”) vs 6% overvaluation on S&P

-

10-year valuation boost: 5.1% annually

-

10-year consensus total return potential: 5.9% yield + 6.3% growth + 5.1% valuation boost = 17.4% vs 10.1% S&P

-

10-year consensus total return potential: = 397% vs 160% S&P 500.

A potential 5X return within a decade, and you don’t have to wait nearly that long to earn Buffett-like returns.

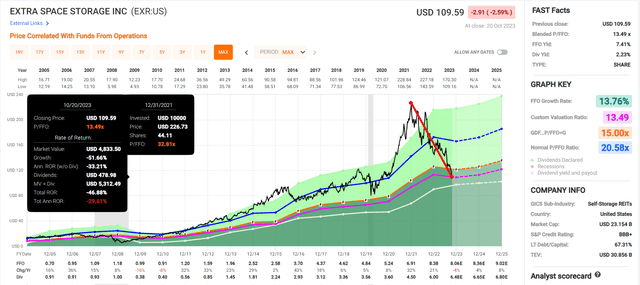

EXR 2025 Consensus Total Return Potential

FAST Graphs, FactSet

EXR is trading at about 13X FFO compared to a historical fair value of 20X to 21X. That means a potential 70% upside within 12 months if EXR grows as expected and returns to historical fair value.

|

Rating |

Margin Of Safety For Medium-Risk 13/13 SWAN Quality |

2023 Fair Value Price |

2024 Fair Value Price |

12-Month Forward Fair Value |

|

Potentially Reasonable Buy |

0% |

$175.75 |

$180.17 |

$179.41 |

|

Potentially Good Buy |

5% |

$166.96 |

$171.16 |

$170.44 |

|

Potentially Strong Buy |

15% |

$149.39 |

$153.14 |

$152.50 |

|

Potentially Very Strong Buy |

25% |

$125.22 |

$135.13 |

$134.56 |

|

Potentially Ultra-Value Buy |

35% |

$114.24 |

$117.11 |

$116.62 |

|

Currently |

$109.59 |

37.64% |

39.17% |

38.92% |

|

Upside To Fair Value (Including Dividends) |

66.28% |

70.32% |

69.62% |

Risk Profile: Why Extra Space Storage Isn’t Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile. The sector has reaped the benefits of pandemic-related trends over the last several years, but lower demand is expected going forward as the environment normalizes.

Macroeconomic trends such as migration, urbanization, and home affordability can change over time and can have a significant impact on the demand for self-storage. Additional demand drivers like pandemic-related disruptions, decluttering trends due to the work-from-home dynamic, strong economic recovery, and a vibrant housing market have resulted in historically high occupancy rates and strong rental growth for the sector. A return to a so-called more normal environment can weaken the additional demand from the disruptions over the past three years. This will have a material impact on the company as occupancy levels and rents head lower.“ – Morningstar

In addition, EXR’s risk profile includes:

-

supply growth risk (easy-to-build storage facilities other than the west and east coasts)

-

short-term growth risk (should interest rates remain 5% for a decade)

-

cost of capital risk: share price stays low long enough it will slow the growth rate

-

minimal modest economic cyclicality during most recessions

-

leases are short-term (month-to-month in many cases) so churn risk is elevated relative to other REITs

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

DK uses S&P Global’s global long-term risk-management ratings for our risk rating.

-

S&P has spent over 20 years perfecting its risk model

-

which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics

-

50% of metrics are industry-specific

-

this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company’s risk management compared to 8,000 S&P-rated companies covering 90% of the world’s market cap.

EXR Scores 43rd Percentile On Global Long-Term Risk Management

S&P’s risk management scores factor in things like:

-

supply chain management

-

crisis management

-

cyber-security

-

privacy protection

-

efficiency

-

R&D efficiency

-

innovation management

-

labor relations

-

talent retention

-

worker training/skills improvement

-

occupational health and safety

-

customer relationship management

-

business ethics

-

climate strategy adaptation

-

sustainable agricultural practices

-

corporate governance

-

brand management

EXR’s Long-Term Risk Management Is The 155th Best Risk Manager In The Master List (28th Percentile In The Master List)

|

Classification |

S&P LT Risk-Management Global Percentile |

Risk-Management Interpretation |

Risk-Management Rating |

|

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL |

100 |

Exceptional (Top 80 companies in the world) |

Very Low Risk |

|

Strong ESG Stocks |

86 |

Very Good |

Very Low Risk |

|

Foreign Dividend Stocks |

77 |

Good, Bordering On Very Good |

Low Risk |

|

Ultra SWANs |

74 |

Good |

Low Risk |

|

Dividend Aristocrats |

67 |

Above-Average (Bordering On Good) |

Low Risk |

|

Low Volatility Stocks |

65 |

Above-Average |

Low Risk |

|

Master List average |

61 |

Above-Average |

Low Risk |

|

Dividend Kings |

60 |

Above-Average |

Low Risk |

|

Hyper-Growth stocks |

59 |

Average, Bordering On Above-Average |

Medium Risk |

|

Dividend Champions |

55 |

Average |

Medium Risk |

|

Extra Space Storage |

43 |

Average |

Medium Risk |

|

Monthly Dividend Stocks |

41 |

Average |

Medium Risk |

(Source: DK Research Terminal)

EXR’s risk-management consensus is in the bottom 28% of the world’s best blue-chips, on par with the likes of:

-

Kimberly-Clark: Ultra SWAN dividend aristocrat

-

Altria: Ultra SWAN dividend king

-

Raytheon: SWAN dividend aristocrat

-

Carlisle Companies: Ultra SWAN dividend champion

-

Exxon Mobil: SWAN dividend aristocrat

The bottom line is that all companies have risks, and EXR is average and at managing theirs, according to S&P.

How We Monitor EXR’s Risk Profile

-

16 analysts

-

two credit rating agencies

-

18 experts who collectively know this business better than anyone other than management

“When the facts change, I change my mind. What do you do, sir?”

– John Maynard Keynes

There are no sacred cows. Wherever the fundamentals lead, we always follow. That’s the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

iREIT®

Bottom Line: Extra Space Storage: A 6% Yielding Buffett-Style “Fat Pitch” Ultra Value Buy

I know it seems crazy. Rates are soaring, REITs are crashing, and the pain feels like it will never stop.

The worst bond bear market in history has been thrashing REITs for almost two years, and many income investors feel the siren song of cash yielding 5.6%.

But remember that EXR or any REIT are not and never will be bond alternatives.

EXR is a thriving business run by a skilled and adaptable management team. It’s expected to grow FFO by 6% to 7% over time and dividends at a rate of 4% to 5% for the foreseeable future.

Bonds never grow their coupon payments. Bonds only lose purchasing power to inflation. It’s what they were designed to do.

If you’re an income investor who likes REITs, now is the time to buy.

Not tomorrow, not next week, now.

Maybe rates keep going up a bit more, or even a lot more.

But history is very clear on this. At some point, REITs will turn around and rocket higher, and it will be potentially even more shocking to investors than the current bear market.

I can’t tell you when that will happen, but I can tell you this. Never in history has a long-term investor regretted buying EXR at a 13 FFO, and I can say with 80% certainty that this won’t be the first time.

If you aren’t buying EXR at the lowest valuation in 14 years, you likely just don’t want to own this business.

“Be greedy when others are fearful.” – Warren Buffett

“Wait for a fat pitch and then swing for the fences.” – Warren Buffett

iREIT®

Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Read the full article here