Uber’s (NYSE:UBER) business has finally achieved profitability, on the back of higher margin advertising revenue and a more favorable competitive environment. While the cost discipline demonstrated by the company in recent years is admirable, Uber must find avenues to support growth as the market approaches saturation and faces an existential threat from robotaxi service providers. Uber is confident it can navigate these challenges, but the company’s valuation leaves little room for error.

Market

Uber is currently facing a highly variable demand environment, with post-pandemic normalization leading to increased demand for mobility services, partially offset by a softening of demand for delivery. In addition, freight markets have been weak due to a decline in consumer spending on products and a supply chain bullwhip effect. Some of this demand variability should begin to even out in coming quarters, leading to a further moderation in headline growth.

From a competition perspective, Uber’s main markets continue to be dominated by two players, although competition appears to be easing. The rapid shift in interest rate environment over the past 18 months is likely at least partly responsible for the improvement in profitability in ride sharing. The increase in the cost of capital has caused ridesharing companies to pull back on spending.

Lyft was not competitive on pricing, but this has changed over the past 12 months. Uber now believes that its pricing is generally comparable to Lyft’s. Despite this, Uber’s share of gross bookings continues to be at or close to all-time highs.

Uber

Much of Uber’s current efforts are focused on providing a greater range of services so that it can maximize revenue and profits. For example:

- Uber Reserve – allows users to schedule rides up to 90 days in advance

- Uber for Business – allows businesses to manage and track business travel and meal programs. A higher percentage of Uber for Business trips are on a premium product, like comfort.

- Uber Health – enables healthcare organizations to arrange rides and services on behalf of others (patients, caregivers, etc.)

- UberX Share

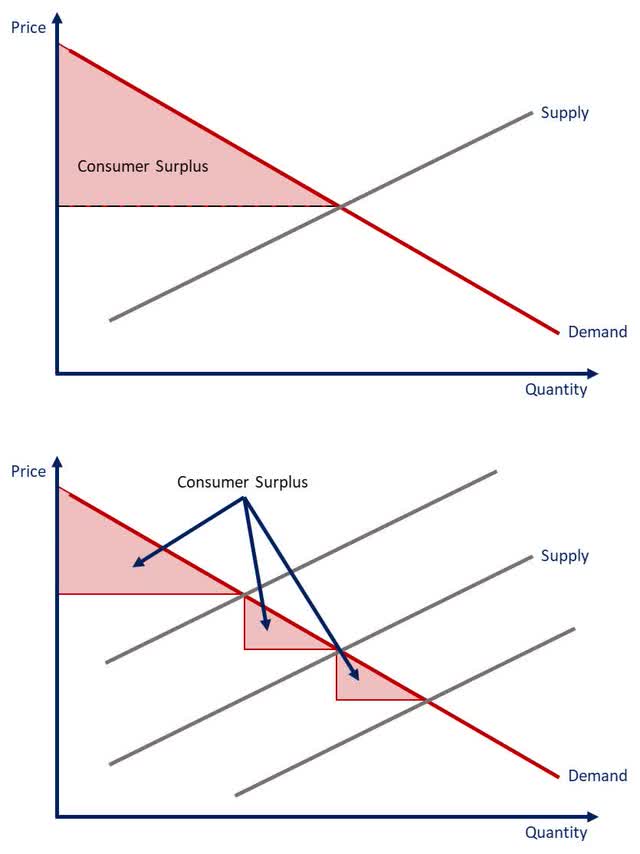

This portfolio of products is currently at an 8 billion USD gross bookings run rate and is growing over 80% YoY. Uber also offers a range of service levels that help with price discrimination, like Uber Black and Uber Comfort. Offering a range of products across price points should help to drive growth and profitability, albeit at the expense of consumer surplus.

Figure 1: Increased Profits Through Differentiation (source: Created by author)

Uber’s new products are also extending the company from its traditional ridesharing background into more general transportation services. Uber now offers high-capacity vehicles at a low price point through its Uber Shuttle service. These vehicles that can support 7-50 people at a time, running on fixed routes and timings across several cities in India, Mexico, Brazil, and Egypt. In the UK, Uber recently added the ability to book train and bus tickets.

Uber’s growth is also being supported by a number of international markets (Germany, Spain, Japan, Korea, Turkey, Argentina, amongst others) which are providing high growth, with Uber referencing a pool of bookings worth around 3 billion USD growing over 100% YoY.

Membership is another focus area for Uber as it promises to reduce churn and increase user spending. While this may be a near term headwind for the business, increasing user LTV/CAC ratios will be critical driver of improved profitability in the long run. Uber One members are profitable, but margins are lower because Uber is incentivizing members. This is offset by the fact that members spend 4x more on a monthly basis and member retention is about 50% greater than non-member retention. Uber currently has something like 12 million members, with membership numbers doubling YoY, and around 25% of the company’s gross bookings come from memberships. Uber is also trying to upsell monthly members to an annual membership.

Advertising is another important area of Uber’s business, as it provides an incremental source of growth and has high margins. Uber’s advertising business currently has an annual run rate of over 650 million USD, with a 1 billion USD target for 2024. This appears to be a solid revenue stream as well, with Uber suggesting a return on ad spend in the 7-9x range. Most of the advertisers on the platform are SMBs, although Uber is trying to increase penetration amongst CPG companies, enterprise customers and companies like Apple. The economics of this business are not really known at the moment, and Uber is likely investing fairly heavily in attracting advertisers and developing its ad product, but it seems likely that growth of the advertising business is in large part responsible for Uber’s transition to profitability.

Autonomous Vehicles

With its recent transition to profitability, Uber is having its moment in the sun, but investors should not forget that the transportation, delivery and freight markets are likely to face a serious shakeup over the next decade, with the rollout of autonomous vehicles gaining steam. It should also be noted that Uber’s revenue likely follows a power law distribution across cities, meaning that only a relatively small number of important locations need to be disrupted by robotaxis for Uber’s business to begin to struggle.

AVs could lead to more riders, as it will lower mobility costs, but depending on how the market evolves, it could increase competition or result in Uber being disintermediated completely. Uber has partnered with Waymo, amongst other companies, and believes that it can be a routing layer between supply and demand, allocating demand to autonomous partners when it makes sense. This vision will likely require that the supply of robotaxis is fairly diffuse, with a number of competing service providers. If there are only 1-2 service providers, Uber is likely to be disintermediated. At this stage, it seems prudent to assume that AVs will be a fairly concentrated market. The technology is complex and the heavy reliance on data creates global economies of scale. There are also likely to be significant economies of scale involved in building and maintaining a fleet of vehicles, which supports the development of a concentrated market.

The robotaxi threat is likely to take time to play out though, due to the complexities involved in developing the technology, regulatory uncertainty and safety concerns. Despite this, progress is being made, and appears to have accelerated in the last 1-2 years. Waymo recently expanded its fully autonomous taxi service city-wide in San Francisco, after being spun out from Alphabet in 2016 and initially offering services in a public trial in Phoenix in 2017. Waymo and Cruise both recently received approval from California’s Public Utilities Commission to charge riders for autonomous rides without a safety driver, day and night. Cruise has announced testing in 14 new cities and is targeting 1 billion USD revenue in 2025. Seattle, San Diego, Miami, Nashville, Raleigh, Charlotte, Atlanta and Washington, D.C. Dallas and Houston are closest to commercial service.

A wider spread rollout of robotaxis is an interesting development, as it will provide a greater volume and variety of data, which should lead to improved performance. Commercialization also provides cash flow, which will help to support the development of businesses that have so far been a black hole for cash. For example, Waymo reportedly spent at least 1.1 billion USD on autonomous vehicle development between 2009 and 2015. This could also represent an inflection point in the market, as Cruise’s CEO has suggested that the underlying technology is now adapting relatively quickly to new environments.

It is also a risky period though, as the proliferation of robotaxis is raising awareness of both the pros and cons of the technology. If large scale data demonstrates adequate performance, the regulatory environment is likely to become more favorable. A wide-spread rollout could also lead to coordinated action on regulations. High profile incidents that anger the broader population have the potential to set the technology back though.

A recent study of Waymo’s autonomous vehicles led by Swiss Re suggested that they are safer than human-driven vehicles, supporting broader adoption of the technology. Based on over 3.8 million miles driven by Waymo without a human behind the wheel, there were zero bodily injury claims and a significant reduction in the frequency of property damage claims. Swiss Re believes that the results are highly significant but given a human driver baseline of 1.11 bodily injury claims per million miles, more data may be needed to be sure. In addition, it is likely extremely difficult to compile data for humans and robotaxis where the vehicles face similar risk environments, adding to uncertainty in any analysis.

While the technology is improving, it has not all been smooth sailing for autonomous vehicles in recent years, with Cruise facing the ire of protestors, as well as scrutiny from incidents with pedestrians and emergency vehicles. Waymo has also scaled back its Via self-driving truck ambitions, although the reason for this is unknown. A number of employees have been laid off and the timeline for commercialization has been pushed back. Waymo plans to continue working with Daimler on a driverless truck though.

Financial Analysis

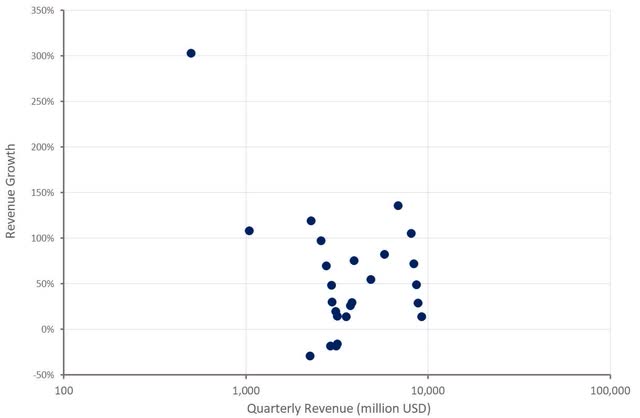

After a period of distortion caused by the pandemic, Uber’s growth is rapidly approaching the single-digit level. Revenue increased roughly 14% YoY in the second quarter, down from approximately 29% in the first quarter. Between pricing, frequency and users Uber believes it can maintain double-digit growth though.

Uber has stated that drivers are currently the limiting factor in growth. As a result, the company is trying to add more drivers and improve retention and engagement. Uber believes that labor environment is now looser than it has been, with around 70% of drivers stating that they’re using Uber due to inflationary pressures.

Figure 2: Uber Revenue Growth (source: Created by author using data from Uber)

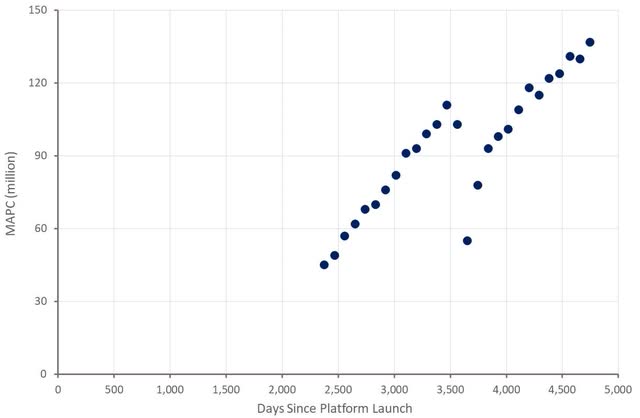

User growth is rapidly returning to its pre-COVID trend, with no real sign of a slowdown in sight. In Uber’s developed markets, less than 30% of adults aged over 18 have ever used Uber, potentially providing a significant growth runway.

Figure 3: Uber Monthly Active Platform Consumers (source: Created by author using data from Uber)

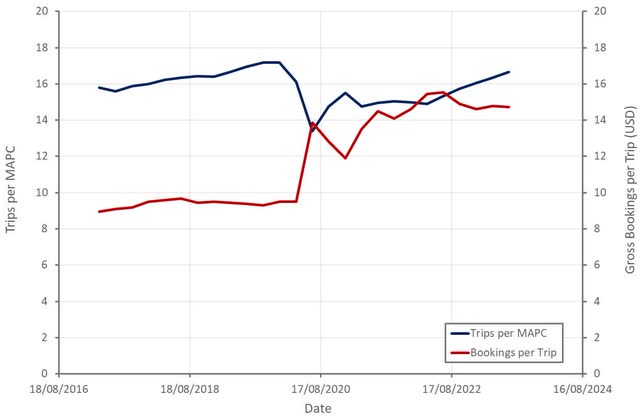

Average frequency is still down from pre-COVID levels, but it is difficult to know whether this is just due to a shift in the user base. Spend per trip is up significantly, which more than offsets the lower frequency.

Figure 4: Uber Trips (source: Created by author using data from Uber)

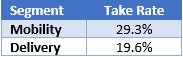

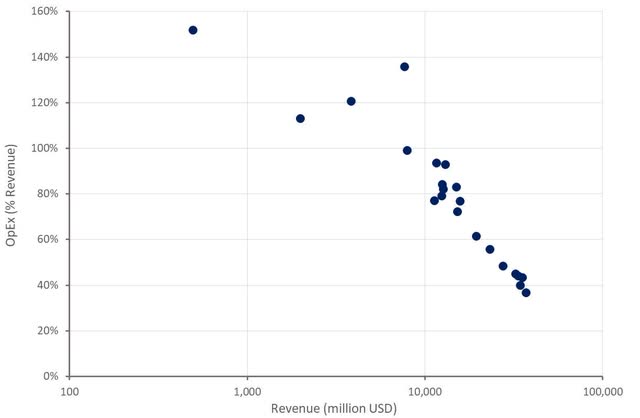

Take rates are up, although Uber’s Mobility take rate is elevated by the UK merchant model, with the company stating that the underlying take rate in the second quarter was 21.1%, driven lower by supply investments in international markets like LatAm and APAC.

Table 1: Uber Take Rate (source: Created by author using data from Uber) Figure 5: Uber Take Rate (source: Created by author using data from Uber)

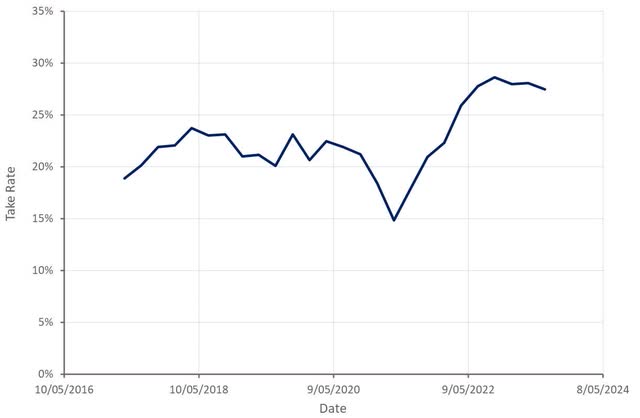

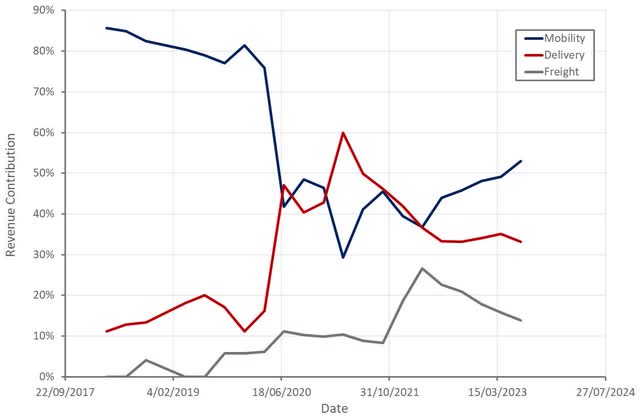

Uber’s profitability has been improving rapidly in recent periods, with the company having a 7% incremental margin target. The improvement in profitability is being driven by a shift in revenue mix, operational efficiency and operating cost control.

Figure 6: Uber Revenue Contribution by Segment (source: Created by author using data from Uber)

For example, algorithmic improvements have led to something like a 20% reduction in cost per transaction over the last year. The rapid growth of Uber’s advertising business has also been a significant margin tailwind. Some of these improvements have been offset by weakness in freight and shipping markets though. Insurance costs are also significant for Uber and have been rising sharply. In response, Uber has raised its booking fees in certain markets.

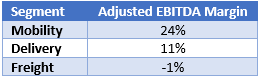

Figure 7: Uber Operating Expenses (source: Created by author using data from Uber) Table 2: Uber Adjusted EBITDA Margin by Segment (source: Created by author using data from Uber)

Valuation

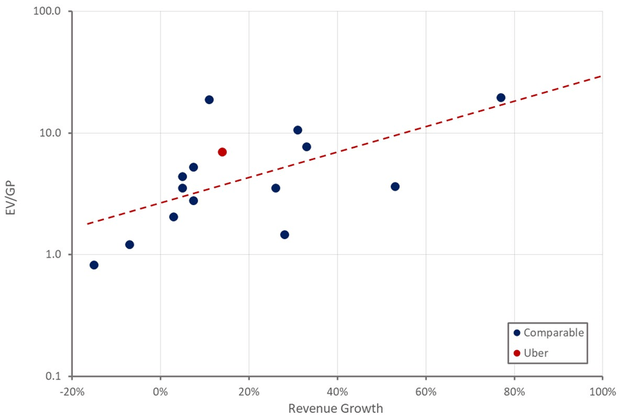

The merit of an investment in Uber at this point is heavily dependent on how much the company can increase its profit margins, and whether robotaxis begins to negatively impact the business at some point. If Uber can eventually raise its profit margins to the mid-teens, it would be fairly attractively priced at the moment. I think there is a high probability that a strong drive for margins will eventually result in consumer pushback or increased competition though.

I also feel that over a 5-10 year timeframe there is a reasonable probability of autonomous vehicles beginning to negatively impact Uber’s business, making an investment in Uber a high-risk proposition. While this view has a high chance of being wrong, I don’t believe the stock offers sufficient upside to warrant an investment.

Figure 8: Uber Relative Valuation (source: Created by author using data from Seeking Alpha)

Read the full article here