Many biotechnology equities have languished over the last several quarters and years. Several peaked in late 2020 and early 2021, but most subsequently fell to valuations during or before the pandemic lows hit in early 2020. Several constituents within the biotechnology industry have recently performed well due to acquisitions and some clinical trial results and/or drug approvals, and the industry as a whole appears to be going through a revaluation. I believe that the SPDR S&P Biotech ETF (NYSEARCA:XBI) is a reasonable way to broadly allocate into the industry at this time.

A large number of biotech equities underwent substantial appreciation in 2020, only to lose all their gains throughout 2021 and 2022. Since then, the industry has remained range bound and few constituents have been able to come close to their former highs. XBI is a modified equal-weighted ETF with about 139 holdings, though that number is subject to change due to M&A activity.

Due to XBI’s equal weighting and lack of concentration, the ETF’s performance is emblematic of the industry on the whole. The below monthly candlestick chart shows XBI’s performance over the last decade, including the post-pandemic pop and fizzle. Since then, shares have remained in a similar range to where they were stuck in the two years prior to the pandemic. Back then, too, $100 appeared to be a difficult point of resistance for XBI, but it now appears to be breaking through.

XBI monthly candlestick chart (Finviz.com with red line by Zvi Bar)

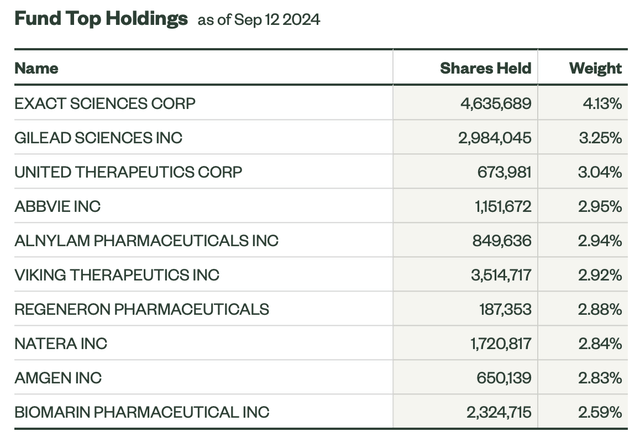

XBI’s equal weighting makes it less susceptible to individual equity movements, whether to the upside or downside. Also, not being market-weighted makes the fund considerably less correlated to broader pharmaceutical industry and healthcare sector movements. Below is a list of XBI’s top holdings, indicating no constituent makes up more than five percent of the ETF.

XBI’s top 10 holdings (SSGA XBI ETF web page)

For XBI to outperform, it would likely require either several constituents to perform exceedingly well, or for there to be an industry-wide revaluation higher. I believe both are possible here, where biotechnology equities have the capacity to benefit from computer learning in a manner that might eliminate costs through simulated trials and more advanced identification of treatments with a high probability of success. Larger pharmaceutical companies may also utilize such capacities to determine whether to acquire new assets.

Since the start of 2024, XBI has made many unsuccessful attempts to breach resistance at about $102.50. Shares first bounced off that ceiling in late February and early March, only to decline by about 20% into the end of April. Shares subsequently climbed back up above $100 again in July and August, but consistently failed to breach this point of resistance.

XBI daily candlestick chart (Finviz.com)

Still, while unable to breach this resistance, XBI made a series of higher lows over the summer. Earlier this September, XBI made a higher low at about $96 before reversing and pushing above $100. I believe it is likely that XBI will soon press up against the $102.50 level and that it is likely to soon break out of its tightening trading range.

At the same time, given the tight trading range that XBI has traded within over the last several weeks indicates that shares are unlikely to decline below $96 without finding some level of support. There also appears to be a considerable level of support at around $90. Because of this, XBI appears to offer reasonable value at risk, with the potential for it to break out here.

Another reason to presume that XBI may break out here is that biotechnology equities may benefit from the Federal Reserve initiating a rate cut cycle. Biotechnology is largely speculative and therefore a highly financed endeavor. Lower interest rates reduce the cost of borrowing, making it less expensive to fund research. Further, the absence of a higher risk-free rate of return entices investors to take more risk.

Risks

Biotechnology is speculative and subject to above-average volatility when compared to the broader market. As a result, XBI and its constituents may sustain more substantial declines during a broad market sell-off. Further, this industry has above-average sensitivity to the election cycle and may sustain a sell-off in advance of the forthcoming election. This would especially be the case if a candidate were to make drug pricing a particular target or talking point.

Drug pricing is also subject to change, including medicare renegotiations that lessen the revenue and profitability of treatments. Similarly, new drug approvals can substantially alter the performance of existing treatments due to substitution.

Conclusion

I believe XBI’s recent momentum is likely to continue, and the ETF may finally be ready to break out and through upward resistance at around $102.50. This breakout could occur in the near term and potentially coincide with the initiation of the Federal Reserve lowering interest rates. If XBI can break through this level, I believe it is likely to be the start of an extended period of biotechnology outperformance that could take the ETF substantially higher. Further, XBI appears to have significant support at levels roughly five and ten percent below current trading levels.

Read the full article here