The housing market has been surprisingly strong in this interest rate cycle. The strong demand for new homes coupled with a chronic supply shortage has paved the way for homebuilders to enjoy robust sales growth, healthy margins, and improved profitability. Leading U.S. homebuilders have been the biggest winners in this cycle. Although I invested in a few homebuilders back in 2020 during the Covid crash, I distanced myself from this industry last year as I thought growth would be limited. A deceleration in growth has indeed occurred, but in all fairness, I would have done well to remain invested in the housing sector, especially large-scale homebuilders.

In July 2023, I thought Lennar Corporation’s (NYSE:LEN) cheap valuation was deceptive as the company had almost always traded at such cheap valuation multiples in the five years leading up to my article. However, I was not bearish on Lennar stock as I acknowledged the company’s strong liquidity profile and the room for a multiple expansion in the best-case scenario. Since then, Lennar’s earnings multiples have indeed expanded despite a deceleration in growth, leading to a 40% surge in its stock price against the S&P 500’s 23% gain during the same period.

With Lennar Corporation scheduled to report earnings next week, I am revisiting the company today to assess whether a re-rating is needed.

Lennar Earnings Preview

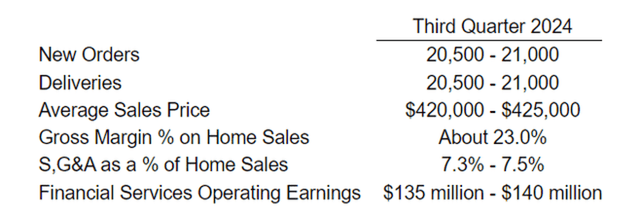

Lennar Corporation is scheduled to report Q3 earnings after the closing bell on September 19. Lennar is on pace to deliver 80,000 units this year, and the company is projected to report new deliveries and new orders of between 20,500 and 21,000 for the third quarter. The company has guided for a gross margin of 23% for the quarter, largely in line with the last couple of quarters.

Exhibit 1: Lennar’s Q3 guidance

Lennar Corporation

More than the earnings for the past quarter, I am interested in the company’s discussion of a few key developments to evaluate the long-term outlook for the company.

- The progress of the transition toward an asset-light business model, which is centered around the spinoff of non-core assets.

- The management’s discussion of how the company is navigating higher construction costs and labor shortages in the market.

- The expected discussion on how declining mortgage rates would impact the demand for new homes in key markets.

In addition to these, I would also welcome a discussion about Lennar’s geographic performance to understand the company’s regional performance, which is key to assessing the long-term demand trends.

The Affordability Crisis Lingers On Despite Cooling Mortgage Rates

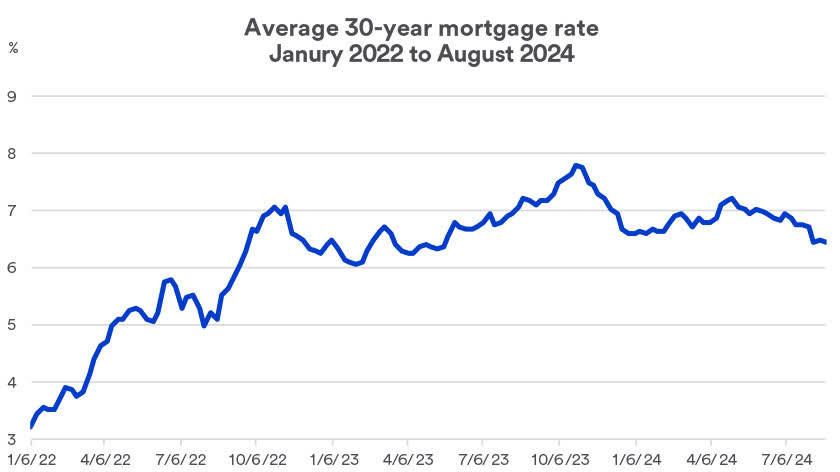

In October 2023, interest rates for home loans were about 8%, making houses expensive and reducing the demand for home ownership. Although rates have since dropped to 6.44%, barriers to homeownership remain, especially for first-time buyers.

Exhibit 2: Average 30-year mortgage rate

U.S. Bancorp

The housing affordability crisis lingers for several reasons.

Home prices remain elevated, with the national median home price reaching a new high of $360,000 in Q2 after registering almost 5% YoY growth. Mortgage rates, despite cooling down, are also above historical averages. Another key indicator that reveals the affordability crisis is the increased housing costs. According to ATTOM’s Q2 Home Affordability Report, major housing expenses accounted for 35.1% of the average national wage in the second quarter, marking the highest levels seen since 2007. For context, this is substantially higher than the lending guidelines of 28%.

A continuation of the affordability crisis is not good news for Lennar from a long-term perspective given that it forces the company to offer more incentives and discounts to attract homebuyers, potentially leading to a contraction in profit margins. Not to forget, homebuilding costs remain elevated, putting pressure on margins.

The expected rate cuts next week should bode well for Lennar and other homebuilders, but I do not believe that it would be sufficient to reverse the affordability crisis in the foreseeable future.

Strategic Asset Dispositions And Community Expansion

Lennar recently divested The Brook on Janes Apartments for $69 million as part of its strategy to reduce exposure to non-core multifamily assets. This particular decision was part of the restructuring efforts by Lennar with a focus on the assets of Quarterra, a division within its multifamily segment that incurred losses in 2023. Proceeds from these divestitures are estimated to be around $250 million in the second half of 2024, with Lennar repatriating capital from previous multifamily engagements to focus on core homebuilding operations.

Lennar continues to grow its core homebuilding business by entering new high-demand markets, such as Phoenix, Arizona. Middle Vistas is one such project. It is situated close to the TSMC plant that is expected to create 4,500 jobs and has 228 homesites featuring popular models, including the Next Gen Latitude floor plan. This brings Lennar’s offerings in Phoenix to over 700 homesites.

Lennar, during the second-quarter earnings call, confirmed that its non-core asset spin-off strategy is back in play, and the recent divestitures suggest the company is executing this strategy. Commenting on this strategy, which is expected to help Lennar emerge as an asset-light business, co-CEO Stuart Miller said:

I am pleased to inform you that we have made substantial progress over the last 90 days, and we confidentially submitted a draft registration statement to the SEC a few weeks ago. We are currently looking at approximately a $6 billion to $8 billion of land that we expect to spin-off into a new public company with no associated debt. The goal of this spin-off is to accelerate our land-light strategy which would allow for off-balance sheet pricing of the land assets. We are excited about the opportunities that we believe this spin-off will bring us to the innovations that we have developed for the operation of the spun-off entity.

An asset-light business model should enable Lennar to minimize land ownership in the future while focusing on operational efficiency improvements. The company, finally, will be able to reduce its reliance on land appreciation speculation and land development to drive profitability higher with an unwavering focus on homebuilding, in which Lennar specializes.

An asset-light model will also provide Lennar with flexibility. In addition, as Lennar executes this transition, the company is well-positioned to benefit from substantial cash flows resulting from the sale of assets, which should position the company to weather any downturn in demand for new homes if macroeconomic conditions do not improve as expected following the September rate cut.

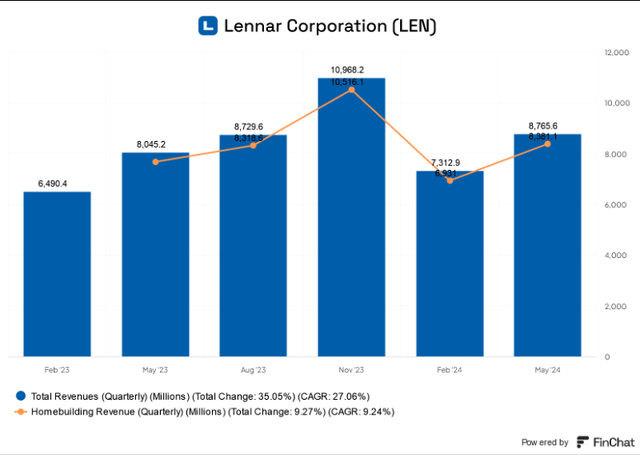

Lennar’s Recent Financial Performance Highlights The Strong Execution

Lennar operates under three business segments: homebuilding, financial services, and multifamily. The homebuilding segment accounts for the majority of revenues and EBIT, with 95.6% of revenues and 90% of EBIT in the second quarter coming from this segment.

Exhibit 3: Lennar revenue

FinChat

Lennar recorded year-over-year revenue growth of 9% for Q2 2024, with earnings of $3.45 per share, marking a 14.6% YoY increase. The gross margin expanded to 22.6%, while the net margin slightly declined to 15.1%. The continued strong financial performance demonstrates Lennar’s efficiency and ability to adapt to changing circumstances.

Lennar’s Valuation Is Reasonable

There’s a lot to like about Lennar. The company’s expected transition to an asset-light model, exposure to fast-growing markets, and the prudent management team are some of the reasons that make Lennar a top homebuilder stock when macroeconomic conditions are favorable. However, I believe the strong market performance this year (LEN is up 21% YTD) has accounted for most of these positive business characteristics, including the expected rate cut. In fact, given stock markets tend to be forward-looking, I believe most of the YTD gains have come on the back of rate cut expectations.

As noted earlier, Lennar’s earnings multiple has expanded since my previous article. The company is currently valued at a forward P/E of 12.6 compared to the 5-year average of around 8.5, which suggests the market has rewarded the company’s expected transition while accounting for the possible demand boost resulting from low rates.

To get a better idea of Lennar’s valuation from a peer comparison perspective, I conducted a multiples-based valuation with a focus on P/E ratios. Below are the peer companies that I used in my model.

- D.R. Horton, Inc. (DHI).

- KB Home (KBH).

- NVR, Inc. (NVR).

- PulteGroup, Inc. (PHM).

- M/I Homes, Inc. (MHO).

My target was to estimate the intrinsic value of Lennar based on a benchmark consisting of these peer companies. To assess whether Lennar deserves to trade at a premium to this benchmark, I evaluated several financial performance metrics of this peer group, including but not limited to projected net income growth for the next five years, historical net income growth, projected operating profit margins for the next five years, and current trading multiples. The benchmark forward P/E comes to 9.8, and based on the expectations for the aforementioned variables, I believe Lennar should trade at a premium of around 15% to 25% given that the company is transitioning to an asset-light model.

Based on these assumptions, in the best-case scenario, Lennar deserves to trade at a forward earnings multiple of 11.9, which implies a fair value of $183.04 per share. At a market price of close to $178, Lennar seems to be fairly valued.

Takeaway

Lennar Corporation is likely to benefit from a favorable move in mortgage rates with the Fed expected to cut rates next week. However, this will not reverse the housing affordability crisis immediately, and on top of that, I believe the expected positive impact from rate cuts is already factored into Lennar’s current market valuation. When Lennar reports Q3 earnings next week, the company is likely to provide encouraging data about its transition to an asset-light model, which may reflect positively on LEN stock. However, I believe the company is fairly valued today, which leaves little margin of safety for investors.

Read the full article here