There is a select group of companies that are excellent and offer a combination of a business model with moats, and great prospects and deserve to be traded at a valuation above the market average for these reasons. This is the case with Nvidia (NVDA), Microsoft (MSFT), Ferrari (RACE), and even Intuitive Surgical (ISRG).

For Brazilian and other Latin American companies, it’s a little difficult to find these characteristics, but they do exist, and Weg (OTCPK:WEGZY) is a good example of this. Over the years, the company has evolved exceptionally and built an excellent company. At the same time, it is priced in line with large technology companies because of the optimism surrounding the company.

Weg: One of Brazil’s Best Companies

Weg is a verticalized industrial company focused on the industrial production of a series of products, such as electro-electronic equipment, and other equipment related to electrical energy such as transformers, substations, as well as other commercial motors. According to the company itself, Weg has a number of competitive advantages, such as verticalization, scale production, diversification, modular expansion, and financial strength.

Weg Investor Presentation

Diversification goes beyond sectors and products, since ~47% of revenue comes from Brazil, 25% from North America, 14% from Europe, and the rest is divided between the other regions of the globe. I.e., unlike other Brazilian theses where there is a very high exchange rate risk and sensitivity to the domestic economic scenario, Weg has a geographical diversification which, together with other moats, allows it to mitigate these risks to a great extent.

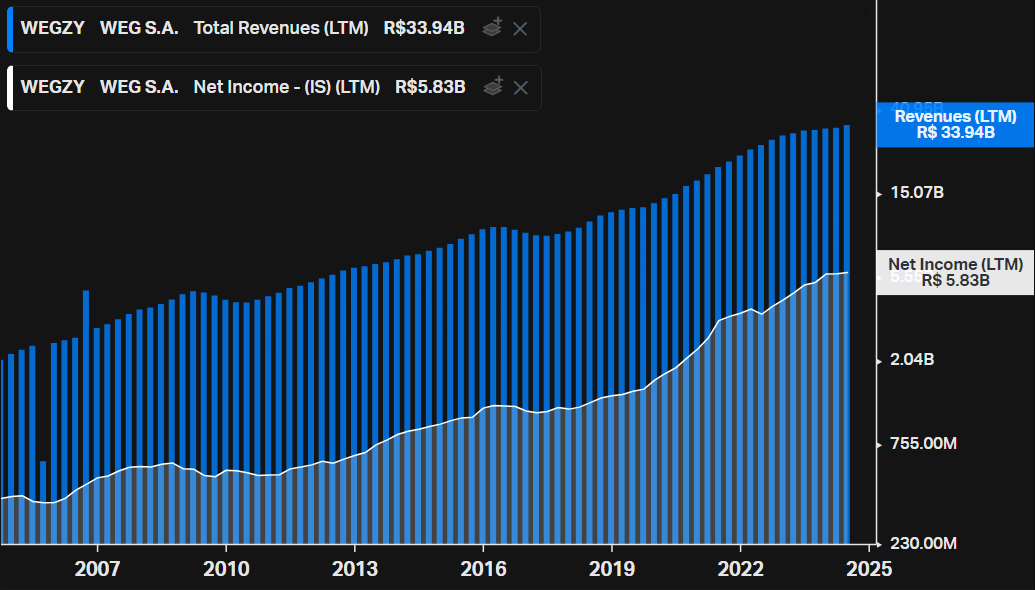

All these moats have been achieved through years of good work, which has translated into an excellent track record for Weg. Net revenue and net income have advanced consistently over the last 2 decades, and since 1996, Weg has shown a CAGR of 18% in net revenue, rising from R$372 million to R$32.5bn in 2023. In Q2 earnings the company continued to show very positive numbers and exceeded market expectations, with a highlight on the continued evolution of revenue and the expansion of the EBITDA margin.

Koyfin

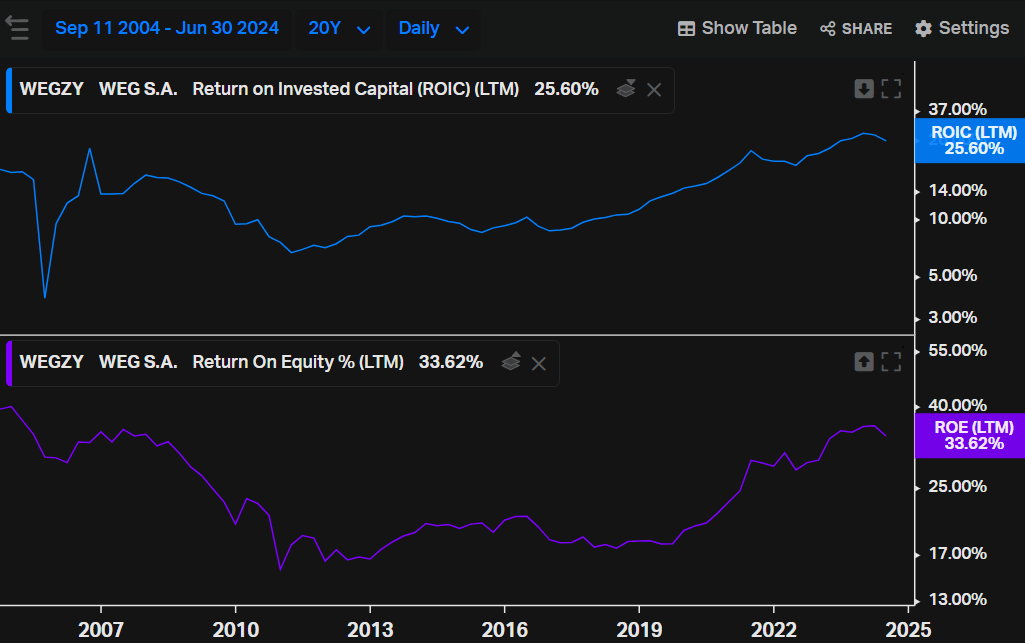

Complementing and justifying this exceptional track record are the profitability indicators. The Return on Invested Capital of over 25%, together with an ROE of over 30%, shows how Weg has consolidated itself as a compounder and manages to generate high shareholder value.

Koyfin

Weg’s Future Prospects Remain Strong

Of course, if the company manages to maintain this high ROIC for long enough, the company will continue to develop its financials in an excellent way, and will probably be able to remunerate its shareholders well. Something that makes the thesis even more comfortable in the long term is that its prospects remain excellent.

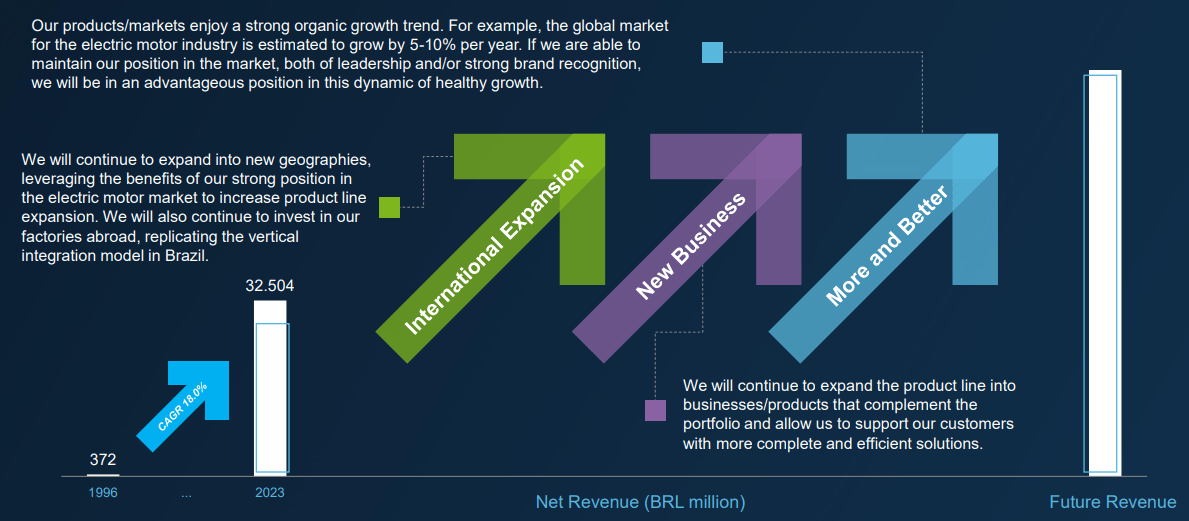

Its main market of electric motors and equipment for the energy sector should continue to show strong organic growth. For example, renewable energy is a secular trend, according to Kings Research, the wind power market size is expected to grow at a CAGR of 13% until 2031. According to Weg, the global electric motor market is expected to grow by between 5% and 10%.

But overall it’s hard to say what a sustainable revenue CAGR will be for Weg over the coming decades. Over the years, the company has proved to be very innovative, creating a series of products that now account for a good part of its revenue and that didn’t even exist a few years ago. Not only that but there is still international expansion as an avenue for growth, since although diversified, around 47% is still Brazilian revenue.

Weg Investor Presentation

Even with this difficulty in forecasting, management, and history show us that the benefit of the doubt is valid, so a good guess would be that maintaining revenue growth close to low double-digit is feasible and fits into sustainable growth. For the close of 2024, market estimates suggest that Weg will advance its revenue by almost 15%, while EBIT growth is estimated at ~13.4%.

Weg’s Valuation Doesn’t Make Much Sense

One of the things you learn in the financial market (perhaps in the hard way) is that most of the time, good and well-run companies give you surprises and good news, while bad companies give you negative surprises.

More than half of 2023 revenue was obtained through products that the company released in the last 5 years. This is a very important factor since the market ends up paying for growth that it doesn’t know exactly what it is, which ends up translating into confidence in management that capital allocation will be as efficient as in the past and somehow this growth will keep coming.

It’s undeniable that a company with such a good track record in terms of management and capital allocation (with an ROIC of over 35%) should be traded at a premium over more “mediocre” companies in the market. But to what extent does this premium still allow for an attractive return for the shareholders?

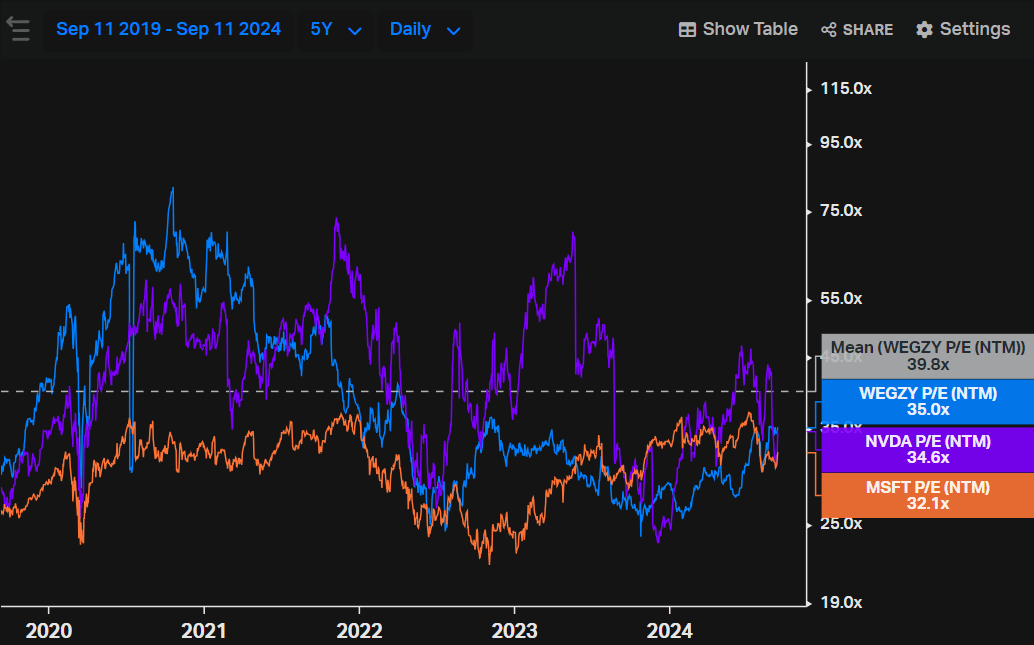

Even though Microsoft and Nvidia are not Weg’s peers, I decided to add them to the chart. Coincidentally, all three are trading at just above 30x earnings for the next 12 months, but not only that, of the three, the one with the most stretched valuation by this indicator is Weg, at 35.2x. Even though this seems a bit absurd, this level is not far off its historical average, such as the 39.8x average of the last 5 years or the 32x of the last 10 years.

Koyfin

As already mentioned, for the year 2024, the market estimates growth for Weg’s revenue and EBIT of 15% and 13.4%, respectively. It’s interesting to note that for Microsoft’s FY, these figures are 15.7% and 22%, respectively, maintaining an expectation of growth above double digits for 2025. For Nvidia, for this year (FY 2025) the figures are 106% and 123% respectively

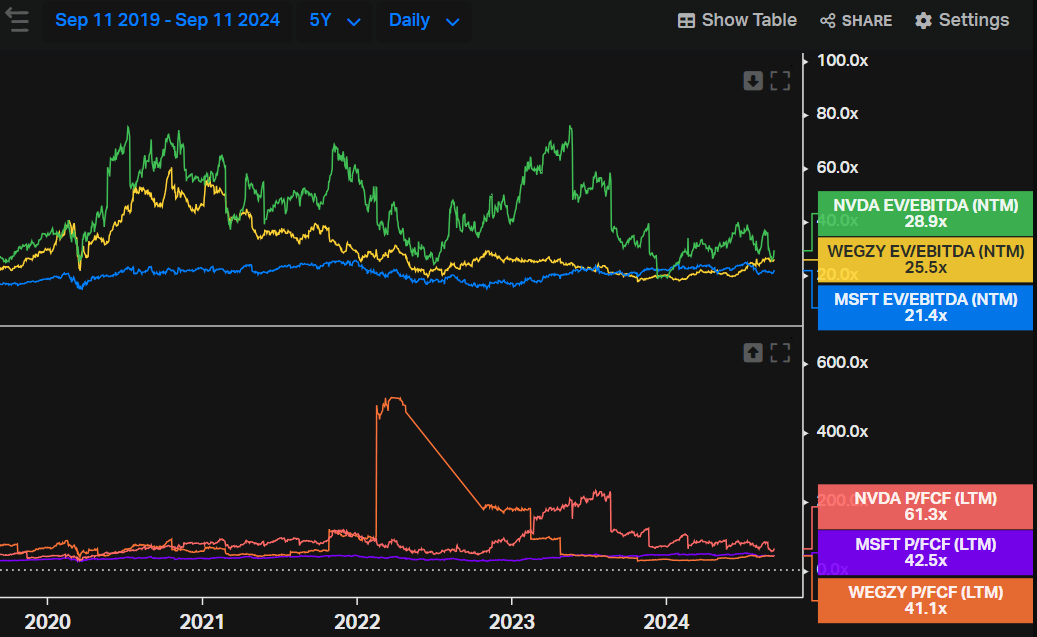

The comparison here is not so fair, since Weg is from the industrial sector, it’s a Brazilian company, as well as other differences. But it is quite striking that a company that still has part of its revenue dependent on Brazil (even though the exchange rate risk is not so high); is a listed company in Brazil; and has a projected growth “only” slightly higher than the low double-digit, is trading at a more expensive level than Nvidia and Microsoft, which also undeniably have good prospects and very well-established competitive advantages. With other indicators such as price-to-free-cash-flow or ev-to-ebitda-NTM, this comparison doesn’t change that much either.

Koyfin

Considering the median of its sector, Weg continues to stand out for having too high a valuation, receiving a D grade or worse relative to its sector in all valuation indicators.

To sum up this section, buying Weg at these prices means paying (dearly) for a quality premium, but taking along some optionalities for growth and new avenues for growth that, if management maintains efficient capital allocation, are likely to materialize.

The Bottom Line

There is no doubt that Weg stands out as one of the best companies on the Brazilian stock exchange. But price matters, so paying a premium as high as the one currently embedded in Weg stocks doesn’t seem to be attractive to investors.

My hold rating is exclusively for the low attractiveness of this valuation, and depending on the continuation of the distortion, it could even turn into a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here