I believe inflation is definitely returning, despite Powell’s statements at Jackson Hole about him being confident that the return to 2% inflation is well underway.

It’s been long known that inflation is a monetary phenomenon. If you create more money, you will eventually have more price inflation than if you did not create more money. This is just about more money chasing the same (or sometimes fewer) number of goods: the price of goods must go up. The problem with the fiat system is that money creation is linked to debt, and debt compounds exponentially due to compound interest. Fiat money creation therefore undergoes the same exponential growth. It shouldn’t be too hard to make the connection that the more the US debt compounds, the more inflation there will be.

The problem with where we are now is that interest rate changes will likely become inflationary, no matter which way they go. Higher rates exacerbate the interest burden from shorter maturity debt. This leads to more money creation to service the debt. Lower rates are also inflationary: it’s just the classic expansionary monetary policy which lowers borrowing costs and stimulates the economy. In short, the high level of fiscal deficits is now starting to dominate the reality around inflation. Put differently, the Fed will start to lose control over inflation because the interest rate lever no longer works. Thus, it will be forced to abandon the 2% inflation target.

Now, please understand that I don’t mean the sitting Chairman will come out and announce that 2% is no longer the official target. This would be an awful method because it would signal that the Fed has completely lost control of the situation.

What I mean is that we will stay well over 2% inflation and other things like unemployment will take center stage as monetary policy objectives. The Fed after all has a Dual Mandate. If price stability is ever brought up, it will likely be in the context of lessening the volatility of prices rather than keeping price growth at 2% (i.e., as long as inflation variance is low then this fits the bill for price stability, the actual level of inflation will be uncontrollable). The focus will just shift to keeping rates lower for longer so hiring and job creation can improve.

This would constitute a “soft abandonment” of the target, but it will become clearer to markets as month after month of higher than 2% inflation comes out, and the Fed does nothing to address it.

In terms of the markets, this could be bullish for stocks in the short term. Income investments like REITs and MLPs have done particularly well this year anticipating rate cuts. Tech has outperformed, but this is largely based on the hype behind AI. Rate cuts are good for stocks.

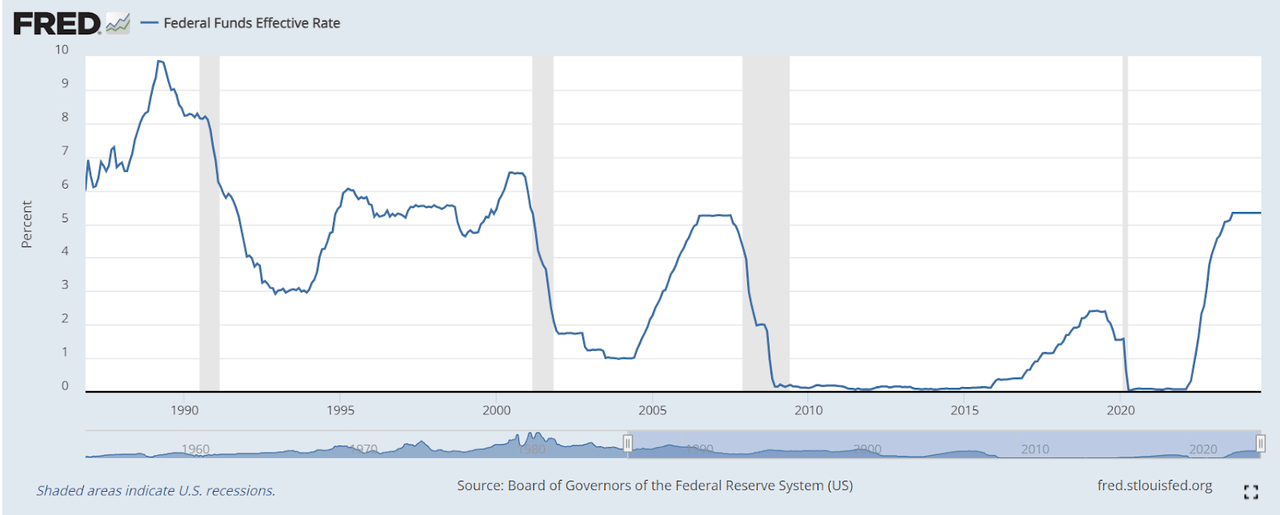

The other side of the argument is that recessions tend to occur after easing starts. Notice that the rate cuts tend to precede the recession (shown in gray vertical bars).

Fed Easing Before Recessions – Fed Funds Rate (FRED)

Indeed, the timing of all this, when combined with the position of the yield curve, warrants some caution about the short-term direction of where things are going.

When considering things from a longer time frame, I can hardly see much upside left in equities. Once the realities of persistently higher inflation sets in, long-term yields will need to move up to adjust for the increased inflation expectation. The result of this would be multiples compression in equities because equity free cash flow yields will need to trade at a risk premium to risk-free yields of longer durations. Real returns are set to be lower.

What do I like here? Mainly hard money alternatives to fiat: precious metals and bitcoin. I believe there will be value in trading the swings and opening volatility positions via SPX or SPY options and VIX derivatives. Lastly, betting on a steepening yield curve seems smart here.

Read the full article here