We previously covered Sea Limited (NYSE:SE) in May 2024, discussing why we had finally upgraded the stock to a Buy, particularly attributed to Shopee’s robust performance across most metrics and narrowing losses in FQ1’24, despite the launch of GoTo/TikTok Shop in early 2024.

With the management still reiterating its FY2024 guidance while maintaining a healthy balance sheet, we had believed that the stock continued to offer robust capital appreciation prospects.

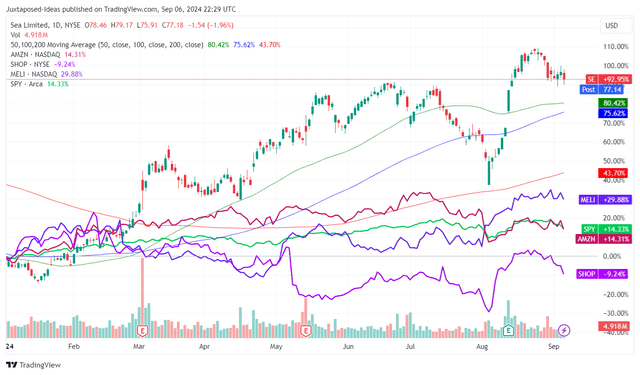

Since then, SE has already recorded a return of +9.1%, outperforming the wider market at +3.7%. Even so, we are reiterating our Buy rating, thanks to its robust FQ2’24 performance, raised FY2024 guidance, and cheap PEG ratio.

Combined with its market leading share, growing penetration in Indonesia, and excellent advertising opportunities, we believe that the diversified commerce company remains well positioned to generate robust profitable growth ahead.

SE’s Investment Thesis Remains Cheap, Thanks To Its Accelerating Top/Bottom-Line Growth Prospects

SE YTD Stock Price

Trading View

SE has had an impressive YTD rally indeed, thanks to the management’s laser focus on delivering sustainable and profitable growth since early 2023, with the same already observed in its FQ2’24 earnings call on August 13, 2024.

Despite the bottom-line miss, the well diversified commerce giant in Southeast Asia has reported robust revenues of $3.8B (+1.8% QoQ/ +22.9% YoY) and adj EBITDA of $448.5M (+11.8% QoQ/ -12% YoY).

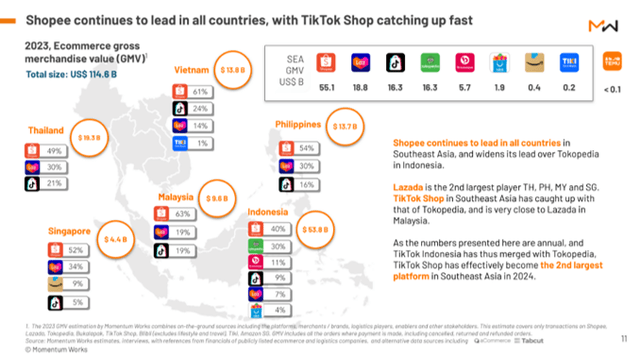

SE’s Robust Penetration In Southeast Asia

Vulcan Post

Much of SE’s top-line tailwinds are attributed to the accelerating e-commerce gross orders of 2.5B (-3.8% QoQ/ +40.3% YoY) and the growing revenues of $2.8B (+3.7% QoQ/ +33.7% YoY), attributed to its market leading e-commerce share at 48% in Southeast Asia.

Most importantly, Shopee continues to retain its leading market share in countries with high e-commerce Gross Merchandise Values such as, Indonesia at $53.8B – 40%, Thailand at $19.3B – 49%, Vietnam at $13.8B – 61%, and Philippines at $13.7B – 54%.

Perhaps part of the tailwinds may also be attributed to SE’s growing advertising revenues (number unspecified), which had contributed to the core marketplace revenue growth to $1.8B (+5.8% QoQ/ +41.4% YoY).

Readers must note that the management continues to highlight “meaningful room” to expanding its ad take rate, which is currently still “lower than the industry average we observe in more mature e-commerce markets… represents a good opportunity to improve our monetization.”

This opportunity may also be why SE has grown its R&D and marketing efforts to $1.07B (inline QoQ/ +37.8% YoY), allowing it to improve the ad bidding algorithms while achieving higher returns from ad spend.

Early results have been promising indeed, since its advertising consumer base has grown by over +20% YoY in FQ2’24, significantly aided by the introduction of Live Ads, live-streaming e-commerce, to directly compete with TikTok streaming sales.

This growth flywheel may also be why the SE management has also expected “Shopee will become adjusted EBITDA positive from the third quarter,” while also “revising up our guidance for Shopee’s 2024 full-year GMV growth to mid-20%.”

This is up from the original guidance of H2’24 and GMV growth to be in the high teens range offered in the FQ4’23 earnings call.

This development implies SE’s ability to competitively scale its well diversified offerings despite the intensified competition from other players, including Lazada (BABA), GoTo/ TikTok’s (GOTO-INDONESIA), Amazon (AMZN), and MercadoLibre (MELI).

This is impressive indeed, since it builds upon SE’s highly profitable:

- Digital Financial Services with adj EBITDA margins of 31.7% (+2 points QoQ/ -0.3 YoY), attributed to its robust digital bank performance and

- Digital Entertainment with adj EBITDA margins of 69.5% (+5.8 points QoQ/ +24.3 YoY), attributed to the growing gaming bookings at $536.8M (+4.8% QoQ/ +21.1% YoY), increasing quarterly paying users at 52.5M (+7.3% QoQ/ +21.7% YoY), and higher paying user ratio at 8.1% (-0.1 points QoQ/ +0.2 YoY).

These numbers demonstrate SE’s successful reversal from its FQ2’22 performance, when only its Digital Entertainment segment was profitable – subsidizing the two other segments’ ongoing cash burn, as observed in FQ2’24’s higher overall adj EBITDA margins of 11.8% compared to FQ2’22 levels of -17.4%.

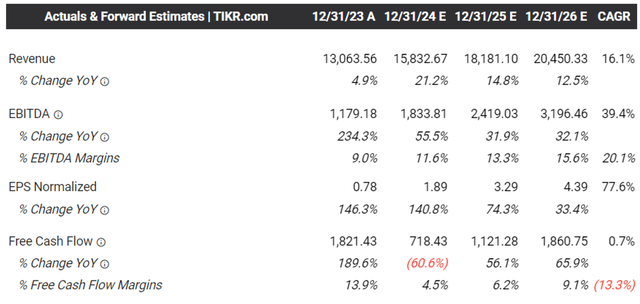

The Consensus Forward Estimates

Tikr Terminal

As a result of its highly successful bottom-line improvements and the management’s raised forward guidance, we can understand why the consensus have already raised their forward estimates, with SE expected to generate an expanded top/ bottom-line growth at a CAGR of +16.1%/ +77.6% through FY2026.

This is compared to the previous estimates of +8.6%/ +27.6% and the historical top-line growth at +69.4% between FY2017 and FY2023, respectively.

So, Is SE Stock A Buy, Sell, or Hold?

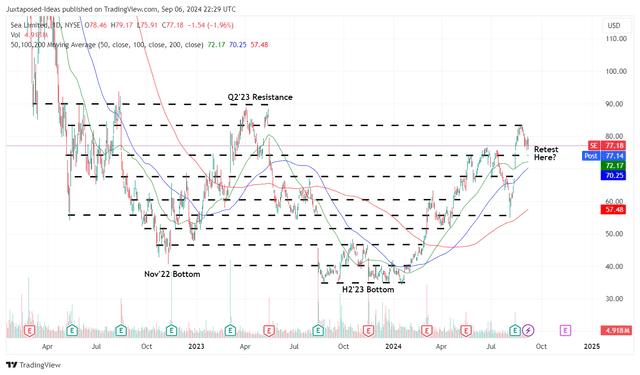

SE 2Y Stock Price

Trading View

It is unsurprising, then, that SE has already charted an impressive recovery from the January 2024 bottoms of $34s and the recent August 2024 pullback at $55s.

While the stock has failed to break out of its resistance levels of $83s, it remains well-supported at $77s while running away from its 50/ 100/ 200 day moving averages.

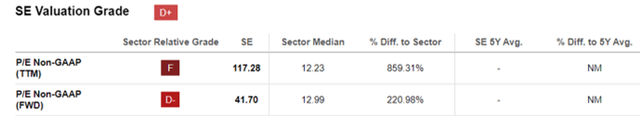

SE Valuations

Seeking Alpha

While SE may appear to be rather expensive at FWD non-GAAP P/E of 41.70x, we believe that it remains reasonably valued attributed to its relatively low non-GAAP PEG ratio of 0.53x.

This is based on the FWD non-GAAP P/E valuations of 41.70x and the projected adj EPS growth at a CAGR of +77.6% through FY2026.

Even when compared to its well diversified commerce peers, such as:

- Amazon.com, Inc. (AMZN) at 1.03x (author’s calculation, based a similar method at FWD non-GAAP P/E of 37.70x and adj EPS growth at +36.6%),

- MercadoLibre (MELI) at 1.42x (55.82x and +39.3%),

- Shopify (SHOP) at 1.91x (64.45x and +33.7%),

it is undeniable that SE’s PEG ratio is extremely cheap here, offering interested investors with an improved margin of safety.

Based on the consensus FY2026 adj EPS estimates of $4.39 and the FWD non-GAAP P/E valuations of 41.70x, we are also looking at an excellent doubling upside potential to our bull-case long-term price target of $183.00.

As a result of the highly attractive risk/ reward ratio, we are reiterating our Buy rating for the SE stock.

Risk Warning

It goes without saying that with SE’s premium P/E valuation comes with great expectations, with any earning misses and/ or underwhelming forward guidance likely to bring forth painful corrections.

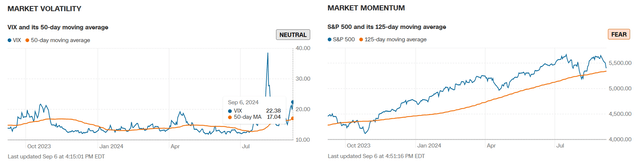

Stock Market Volatility

CNN

With the CBOE Volatility Index already exceeding October 2023 levels, the market momentum hitting fear levels, and the SPY index likely to drop below the 125-day moving averages (implying pessimistic stock market sentiments), we believe that there may be more volatility in the near term indeed.

As a result, while we remain optimistic about SE’s long-term prospects, we believe that there may be a near-term market-wide correction.

Interested investors may want to monitor its stock movement for a little longer before adding if its support levels of $77s are not breached in the near-term.

Otherwise, a further pullback to $55s is not overly bearish indeed, with those levels also nearer to our fair value estimates of $51.70, based on the FQ2’24 annualized adj EPS of $1.24 and the FWD non-GAAP P/E valuations of 41.70x.

Patience may be more prudent for now.

Read the full article here