Investment thesis

STAAR Surgical’s (NASDAQ:STAA) EVO lens is the leading product with a growing market share in the corrective eye surgery market, given its superiority versus existing procedures. Despite challenges from the current macroeconomic environment, the company is achieving solid growth and strong profitability. With a healthy balance sheet, boasting $235 million in cash and no debt, STAAR is well-positioned to invest aggressively in future growth, particularly in the US market. I anticipate 21% growth in each of the next two years, leading to revenue and FCF of $500 million and $70 million respectively for 2026. Based on these estimates, my price target of $46 implies substantial upside potential, offering an attractive risk-reward profile for investors. I therefore maintain a Buy rating on STAA shares.

Financial highlights and my expectations looking ahead

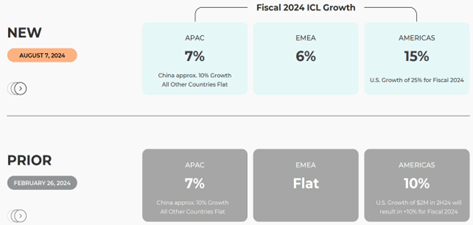

Improved outlook for growth following strong adoption in the US market

Q2 Investor presentation

The company reported a 7% year-over-year increase in Global ICL Sales Growth for Q2. Growth was particularly strong in the Americas, where sales grew 14% year over year, and EMEA, which saw corresponding growth of 10%. The outperformance in the quarter led management to raise full-year guidance by $5 million, as described above.

Sales in the US market grew 25% year over year to $5.5 million, as the company’s Highway 93 go-to-market program begins to bear fruit. The US market presents a significant opportunity, with management projecting potential annual sales of $140 million if market share increases from the current 3% to around 20%, similar to its share in other large markets. I anticipate growth in the US will accelerate to above 30% over the next two years. Commenting on the optimistic outlook for the US market, its CEO stated:

And if I were to use an analogy, I think for the US business we crawled. We’re starting to walk. We might start to jog by the end of the year and we’ll be running in 2025.

Uptick in China sales

Sales in China continue to represent a significant portion of overall revenue. Year over year sales growth in China for H1 2024 has been close to 6%. Management’s guidance of a 10% increase for the full year, indicates an anticipated acceleration in growth during the second half of 2024. Despite a highly competitive environment, STAAR is successfully gaining market share in the country. Growth has mainly benefited from the company managing to add a second distributor for its products in the market. Stimulus programs from the Chinese government should also benefit sales later this year. I anticipate that growth in the mid-teens exiting Q4 will be sustained throughout 2025 and 2026.

Ongoing investments to propel growth

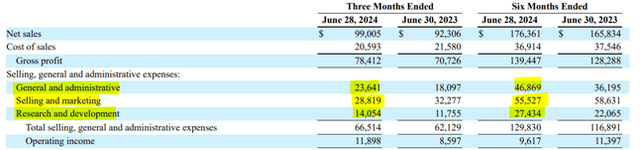

Q2 Financial report

As the company’s gross margins continue to rise towards 80%, operating expenses continue to increase, which has capped adjusted EBITDA margins at close to 12%. Although Sales and Marketing expenses have seen a reduction year over year as management has decided to narrow the focus of its marketing activities, R&D and G&A expenses have significantly increased, as shown above. However, I expect expense growth to moderate over the next two years, which could lead to adjusted EBITDA margins approaching 20% by 2026.

Valuation

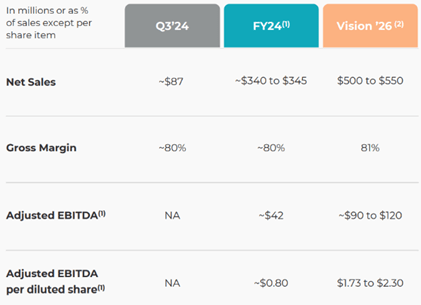

Q2 Investor presentation

The CEO reaffirmed his commitment to achieving the targets disclosed to investors during the company’s Investor Day last September, stating:

The initiatives I’ve covered today are starting to translate into better growth, laying the foundation for future sales acceleration into 2025 and towards our $500 million plus Vision 2026 sales target.

According to my expectations which I laid out previously, I anticipate this year’s revenue to be at the high end of guidance, and overall revenue growth of 21% in both 2025 and 2026. This would result in 2026 revenue reaching $500 million, aligning with the lower end of management’s targets, which are shown in the image above. I expect adjusted EBITDA to be approximately $95 million, which should translate to FCF of close to $70, after deducting capex which is running at about $25 million annually.

Given STAAR’s net cash position of $235 million, at the current share of $32, it has an enterprise value of $1.33 billion. Based on my estimate for FCF in 2026, shares are valued at an EV/2026 FCF multiple of 19. Direct-to-Consumer healthcare companies like DexCom (DXCM) and Masimo (MASI) which are growing at double-digit growth rates, typically trade at FCF multiples above 30. Assuming STAA shares are valued in line with these companies, a 30 times multiple on my FCF estimate for 2026 would imply an enterprise value of $2.1 billion and a share price of $46. This represents an upside of 44% within the next 24 months, which I consider to be very attractive. Besides, given that the company remains an attractive acquisition target, according to recent media reports, I believe significant downside risk is mitigated, thereby presenting investors with an attractive risk-reward.

Risks to consider

Competition

STAAR’s offering competes with more affordable alternatives in the market such as LASIK and SMILE. Though it continues to outpace the growth of these competing products, if competitors persist in lowering their prices, these options may become more appealing to consumers, despite EVO’s advantages in other areas.

Lack of traction in the US market

Achieving its 2026 growth and profitability targets hinges significantly on the success of its products in the US market. If the company fails to gain traction in the US despite its substantial investments, it could adversely affect its future outlook and reduce returns for investors.

Macroeconomic weakness

Corrective eye surgery is considered a discretionary expense, so in a challenging economic climate, consumers may delay these procedures, potentially impacting the company’s sales.

Conclusion

STAAR’s EVO lens stands out as a leading product in the corrective eye surgery market, as it continues to grow its market share despite macroeconomic challenges. With a promising outlook for strong growth and an attractive valuation, I believe an investment in STAA shares offers significant upside potential, making it a compelling investment opportunity with a favorable risk-reward profile.

Read the full article here