Guidewire Software: Investment Thesis

Since my December 2023 article, “Guidewire Software: Time To Take Some Money Off The Table,” the Guidewire Software, Inc. (NYSE:GWRE) share price has increased by 46.44%, while the S&P 500 (SP500) has increased by 22.93%. So, I am reminded again, Mr. Market can show a lack of understanding of factors affecting the intrinsic value of a stock for long periods of time. And in the case of Guidewire Software, I am not overly surprised at Mr. Market’s lack of understanding.

Underlying earnings growth is strong, and this can be expected to continue. The balance sheet is also strong, with virtually no net debt and invested funds to provide backup. These are reasons to be really enthusiastic about this stock.

What Mr. Market appears to be missing is the other major stakeholder in this business. This other major stakeholder is receiving what amounts to preferred dividend distributions, while the common stock stakeholders are receiving no distributions out of earnings. Dividends on preferred stock are treated as a deduction from entity earnings to arrive at earnings attributable to common stockholders. And that is what should be happening with employee stock compensation, which is effectively a form of preferred distribution out of earnings to employee stakeholders in the company. Deduction of employee stock compensation is both appropriate and necessary to arrive at Guidewire Software earnings attributable to Guidewire common stock shareholders. When that adjustment is recognized, there is still a path to profitability through continuing strong growth. But the path will be longer and the earnings will be less than what, I believe, is currently perceived by Mr. Market.

I consider the share price is currently well above intrinsic value, and I maintain a Sell rating for Guidewire Software stock. Notwithstanding, the company’s 4th quarter and 2024 full-year results are due out post-market on Thursday, Sep. 5, 2024, and another strong headline result could see a further increase in the share price. Just be aware, Mr. Market is known for sudden and unexpected changes in attitude and direction.

Below I provide detailed analyses showing balance sheet strength, profit performance, and the impact on common stock shareholders of the preferred distributions to employee stakeholders through share issues, with cash outlays on repurchase of shares to offset these issues.

A Lot to Like About Guidewire Software’s Balance Sheet

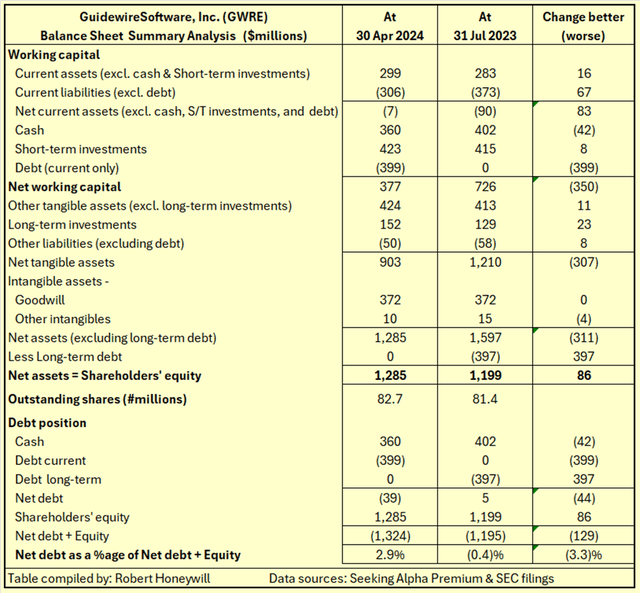

Table 1

SA Premium and SEC filings

Table 1 shows Guidewire Software has adequate working capital even if it were to repay current debt without drawing down replacement borrowings. The current debt is in relation to 1.25% Convertible Senior Notes due 2025. I cannot find anything on the intentions of the company in relation to conversion to equity, repayment in cash at maturity, or a further convertible note issue, but any of these options would likely not be an issue for the company.

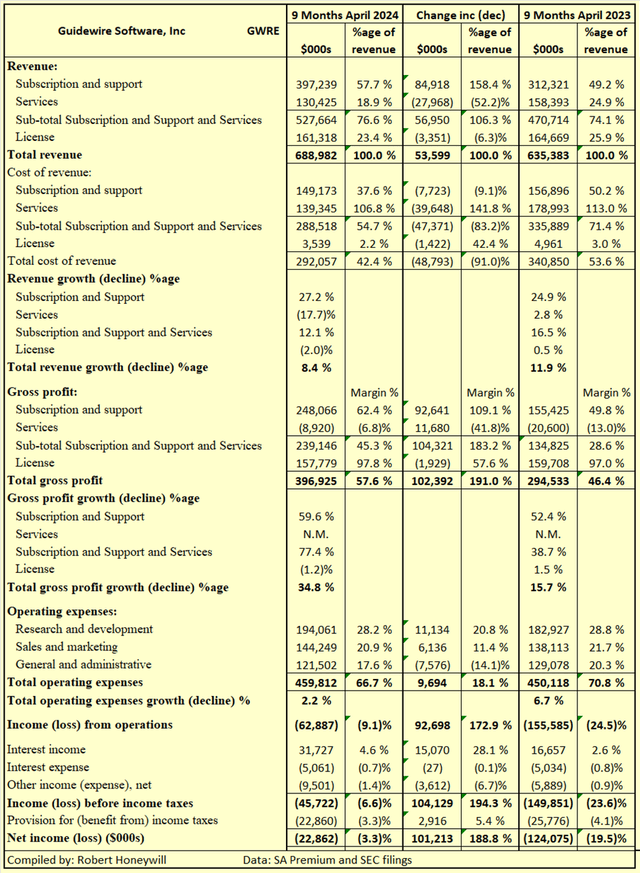

Table 2.1 Guidewire Software GAAP results 9 months 2024 and 2023

SA Premium and SEC filings

The improvement in results for the 9 months ended 2024 compared to the corresponding period for the prior year is impressive. Of the three segments, cloud-based Subscription and Support is the growth driver and high margin. The License segment is stable and has the highest margin. Passing on low-margin service revenue to partners has resulted in a decline in revenue for this segment, but an even greater reduction in costs, reducing operating loss period on period. It is quite remarkable that incremental revenue of $53.6 million was achieved with a decrement of $48.8 million in Cost of revenue, resulting in incremental GAAP gross profit of $102.4 million. Operating expenses include Research and Development, Sales and Marketing, and General and Administrative. These are all large cost centers totaling $459.8 million compared to a total of $292.1 million for Cost of revenue for 9 months ended Apr. 30, 2024.

These costs appear well controlled and are also benefiting from revenue growth, falling to 66.7% of revenue in 2024 compared to 70.8% of revenue in 2023. Income from operations improved by $92.7 million, with Loss from operations decreasing from $155.6 million in 2023 to $62.9 million in 2024. GAAP Net loss improved by $101.2 million from $124.1 million loss in 2023 to $22.9 million loss in 2024. It would not surprise to see the company report a positive full-year GAAP result at its earnings release post-market on Thursday, Sep. 5.

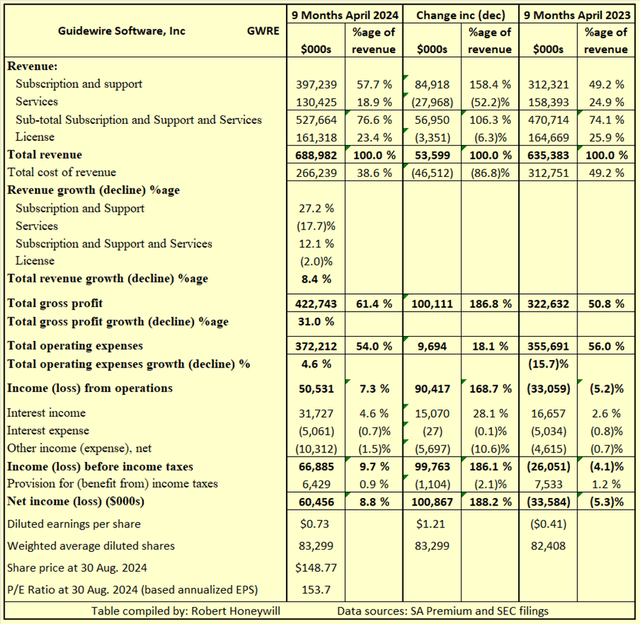

Table 2.2 Guidewire Software non-GAAP results 9 months 2024 and 2023

SA Premium and SEC filings

Table 2.2 shows the company’s results adjusted for non-GAAP items, the major one of which is stock-based compensation. The non-GAAP P/E ratio is very high at 153.7, but this can be expected to decrease in succeeding periods due to the high earnings growth potential of the company.

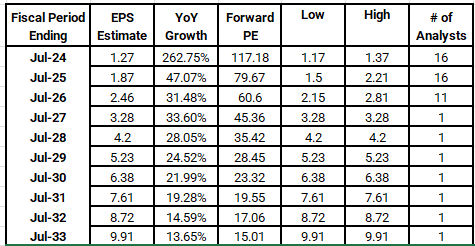

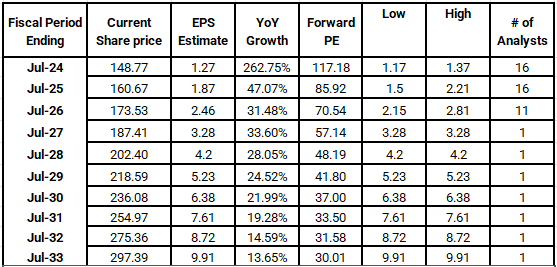

Figure 1 below shows analysts’ non-GAAP EPS estimates from SA Premium. It also projects P/E ratios out to Jul. 2033 based on analysts’ consensus EPS and the current share price of $148.77. While Figure 1 shows the P/E Ratio coming down to a fairly normal level of 15.01 by 2033, the share price would need to remain unchanged at the current $148.77 for that to be achieved.

Figure 1

SA Premium

Figure 2

SA Premium and author

Figure 2 shows the same data as in Figure 1, except the share price is increased at 8% per year, to provide a return on the investment. In this case, the P/E ratio remains high, and possibly an unacceptably high 30.01 at July 2033.

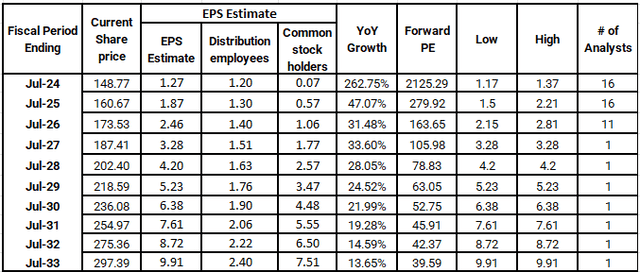

Figure 3

SA Premium and author

In Figure 3, I show the impact on forward P/E ratios of the distribution of a share of earnings to employees by way of stock compensation. The company is repurchasing on average around $100 million per year by value of shares to offset shares issued for stock compensation. This cash outflow is not being considered in arriving at non-GAAP earnings and EPS. It is certainly reducing shareholders’ equity and accordingly is reducing funds available for distribution to shareholders. I have increased the distribution to employees by 8% per year in line with the assumed increase of 8% per year in share price.

Based on the assumptions in Figure 3, the P/E ratio in July 2033 would still be at a high of 39.59. To reduce that to a more reasonable ~20.0 would require a reduction in share price growth assumptions from 8% to under 1.5% per year through July 2033. That is not a very attractive proposition.

Summary and Conclusions

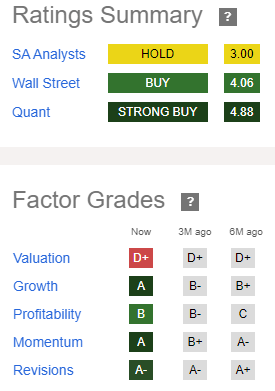

Guidewire Software, with its explosive growth in revenue and even faster growth in earnings, certainly excites the imagination. It is understandable why there is strong sentiment towards the company. SA Quant measures both sentiment and fundamentals and has the stock as a Strong Buy as per Figure 4 below.

Figure 4

SA Premium

SA Quant recognizes valuation is stretched, but also recognizes sentiment measured across the other four factor grades remains a strong driver of the share price. From the viewpoint of fundamentals, I believe valuation is more than stretched. There is an old truism, no matter how good a stock, you can still pay too much for the shares. At $148.77, I believe the share price is too much, and hence the Sell rating. But Mr. Market’s enthusiasm might not die quickly, so future share price direction remains highly uncertain.

Read the full article here