Oracle (NYSE:ORCL) is another beneficiary of the recent AI boom, as its stock performance over the past year can attest.

ORCL 5Y Price History (Seeking Alpha)

Eventually, I decided I wanted to see the story behind the stock, so I finally took a look. I’m convinced that Oracle has all the right ingredients for success: a moat, a growth story, and a decent price to get in on it. That’s why I think it’s a Buy.

Oracle’s Moat

Oracle offers a wide scope of products for its customers, the central one being its cloud business. It accounts for a majority of their revenues.

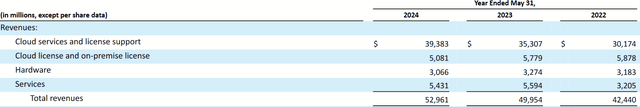

Income Statement (FY 2024 Form 10K)

More recently, their cloud business has shown tremendous value in training large language models. In the FY 2024 earnings call, CEO Safra Catz spoke to their advantage here:

In other words, the world’s largest cloud companies and the world’s most successful and accomplished AI companies choose to use Oracle cloud services and data centers…so why are they working with Oracle, because Oracle’s Gen 2 cloud infrastructure is different. OCI’s area network moves data much faster. And when you charge by the minute, faster also means less expensive. OCI trains large language models several times faster and at a fraction of the cost of other clouds.

This is the nucleus of their moat. When a company wins on both price and results, that gives it a clear lead, and when one considers how many other contenders there are in the cloud space, that’s no small feat. Oracle doesn’t dominate everything that we might call “cloud,” but it is leading where I think demand is its strongest for the foreseeable future.

There’s more to this than OCI’s advantages in running LLMs. They also offer significant scope in their product, both how their cloud service is structured for customers, as well as adjacent products, such as hardware support and non-cloud software services.

Thus, there isn’t just an advantage of price and results in the essential product; they are also very adaptable to the specific needs of their customers.

The quote above mentions their deal with OpenAI, which some might see as the clincher that proves their advantage, but I think what really seals it is the announcement they later made in July about Palantir (PLTR):

“Oracle’s powerful and flexible cloud infrastructure, combined with Palantir’s decision acceleration platforms, helps customers rapidly scale AI capabilities across its operations,” said Rand Waldron, vice president, Oracle. “This will enable customers to get the most value out of their data, while meeting their sovereignty and security standards.”

In my view (and I covered them before), Palantir leads the way in data analysis and is among the best-positioned to eat the fruits of AI. They will definitely want the best cloud services, especially considering the US government and its allies are some of its main customers, and so multiple nations’ safety and security are on the line. This partnership is a significant vote of confidence for Oracle.

Growth Outlook

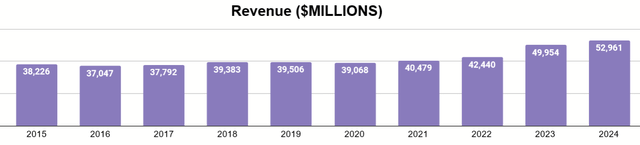

If we look at Oracle historically, it was already a steady grower. Below I’ll show annual data with fiscal years ending in May.

Author’s display of 10K data

Revenue grew at a CAGR of approximately 3.7% per year. Much of that owes to the more recent spikes as they’ve matured. This is largely driven by their cloud business. To quote their earnings release:

Fiscal year 2024 total revenues were up 6% in USD and constant currency to $53.0 billion. Cloud services and license support revenues were up 12% in USD and up 11% in constant currency to $39.4 billion. Cloud license and on-premise license revenues were down 12% in USD and constant currency to $5.1 billion.

Most of their growth projections are in how this business will contribute to overall revenue, and it will likely get progressively faster. To quote Catz yet again:

Throughout fiscal year 2025, I expect continued strong cloud demand to push Oracle sales and RPO even higher and result in double-digit revenue growth this fiscal year. I also expect that each successive quarter should grow faster than the previous quarter as OCI capacity increases to meet demand. We believe our momentum, our current momentum will continue as our pipeline is growing even faster than bookings and our win rates are going higher as well.

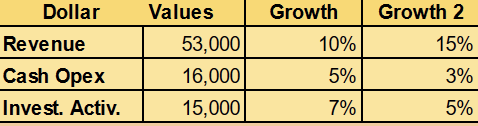

To map this growth potential out a bit more intuitively, I’ve put out a couple of projections, with rough amounts of current revenues and typical cash spent on operating expenses, capex, and M&A.

Author’s calculation

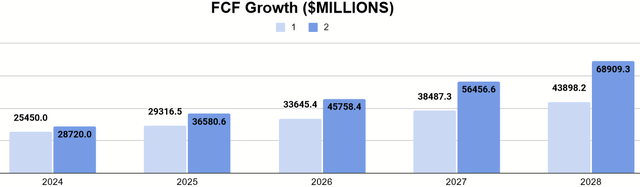

The first column will be a slower growth of free cash flow, while the second will be a faster rate.

Display of author’s calculation

Between the two, the company could very well generate over $40 billion in a few years, if this level of growth persists. Considering the depth of their moat, I think it is likely that they will.

Valuation

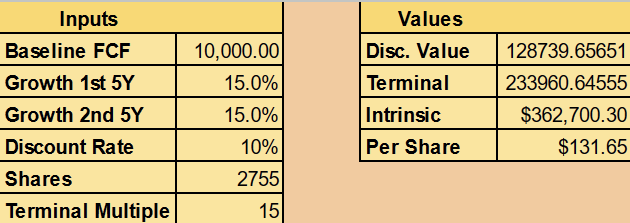

Instead of looking at a very broad picture, though, I want something more specific and to do so with more conservative assumptions than the chart shows. I’m going to use a Discounted Cash Flow model with the following assumptions:

- $10 billion as baseline FCF

- 15% CAGR over the next decade

- Terminal multiple of 15

Average FCF over the last decade was about $11.5B. If we adjust for outflows from M&A, we get $6.7B, so I think 10 is a reasonable basis of the cash this business can currently generate.

With double-digit revenue growth of a leading cloud product, it’s reasonable to assume that double-digit FCF growth of 15% is also attainable (particularly as FCF would grow at a faster rate). I think this is sustainable and would push annual FCF to $40B by the tenth year. Again, it’s possible that could be achieved sooner.

Lastly, a terminal multiple of 15 seems about as low as such a beloved tech with rising FCF like that would go.

Price/Cash Flow 5Y History (Seeking Alpha)

Moreover, it’s consistent with the multiple since Oracle became a grower.

Author’s calculation of intrinsic value

Priced for a 10% discount rate (typical return of a broad market index), that suggests a fair value of ORCL should be at market cap of about $360B, at least $131 per share. This is close to where the market currently stands.

While this doesn’t point to obvious undervaluation, it does point to growth at a reasonable price, as additional upside could be realized upon better-than-expected results.

Other Factors

There are some things that may complicate this projection (upsides and risks) that I believe will need to be monitored over time, so I wanted to go over those.

Debt

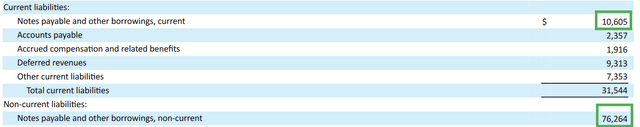

FY 2024 Form 10K

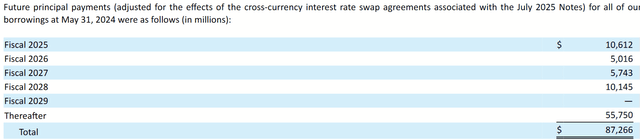

As of the latest 10K, Oracle has over $86B in debt.

FY 2024 Form 10K

The majority of this is due more than five years out. The senior notes that account for nearly all of it enjoy low interest (mostly 5% or less) and have maturities staggered through the 20s, the 30s, and into the 40s. Yet, the principal that is due soon is comparable to current levels of FCF, and any problem for the company that potentially makes repaying or refinancing this difficult deserves our remaining alert.

Cash To Shareholders

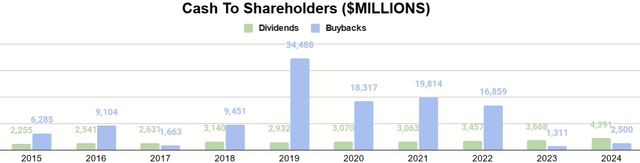

Author’s display of 10K data

One should bear in mind that part of the value here is in how FCF is used for dividends and buybacks. Total dividends have increased over the past decade, but until FY 2022, buybacks tended to be the primary way that cash was returned to shareholders.

This declined sharply in FY 2023, with their $28.2B acquisition of Cerner competing against that. As Oracle sees tremendous growth opportunity now that it did not see a decade ago, I suspect buybacks will become a lower priority, as capex is stepped up to increase their cloud capacity (as they have guided), while more M&A occurs for similar purposes or to broaden their product scope.

Still, the company has a record of being quite hungry for its own shares, as shown from 2019 to 2022 especially. If the price of ORCL continues to go up faster, it’s possible a buyback campaign could be value-deletive for long-term holders.

I suspect that the dividend, meanwhile, will continue to receive incremental increases as FCF grows.

Future Competition

While Oracle does have a lead in cloud service for LLM training, much of this is a question of capacity, as was mentioned in the earnings call. If competitors wished to raise enough capital, they could potentially build out their own capacity to catch up with Oracle.

In their latest 10K (pg. 16), they actually name other tech contenders whose products compete with theirs. These include Alphabet (GOOG), Microsoft (MSFT), and Cisco (CSCO). Companies are often hesitant to name their competitors in their disclosures, so it may be a sign of how seriously Oracle takes them. Several of their competitors possess vast financial resources and could commit to rivaling capacity if they choose.

Conclusion

Oracle has a compelling story in the current AI craze, and while many other companies have had their valuations pumped up to entire lifetimes’ worth of their earnings, ORCL stands out as priced within reason, with room to enjoy pleasant surprises along the way.

It’s not set in stone. Management’s guidance is largely focused on the next year or two, and this is a rapidly evolving technology. Long-term investors can get a good price today, but I also believe this requires owners to do their homework and keep up with their business, particularly as it remains to be seen what their full plans with debt, buybacks, dividends, and M&A will be and how that affects total returns.

Even so, when a business is in the lead with a cloud product like this, it’s hard to think they can’t weather most storms, and that’s why I think it’s a solid Buy.

Read the full article here