Introduction

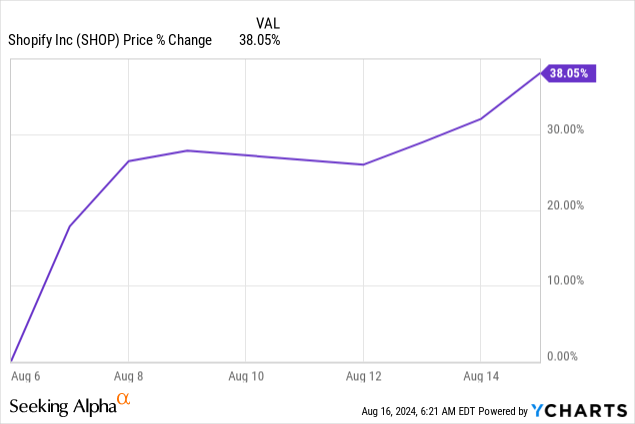

Last week, Shopify (NYSE:SHOP) (TSX:SHOP:CA) announced its Q2 2024 results and the market reacted very enthusiastically and the stock shot up 26%. Since then, the run kept going, and the stock is now up 38%.

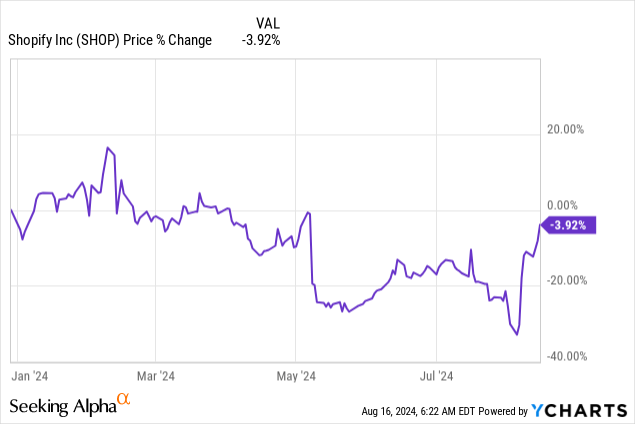

Of course, if you zoom out, you see that the stock had dropped a lot recently. Probably, the reason was that investors saw weaker consumer demand and were afraid it would impact Shopify. So, despite the big jump now, the stock is still down about 4% year-to-date.

High-growth investing, never a dull moment, ha-ha.

So, what made the market react so enthusiastically? Let’s find out.

The Numbers

Let’s start with revenue. That came in at $2.05 billion, beating the estimates by $40 million, a beat by 2%. Not bad at all. Revenue surged by 21.3% year-over-year. If you adjust for the sale of Deliverr, revenue growth comes in at a strong 25%, which shows the company’s real strength better.

For an e-commerce company like Shopify, GMV or Gross Merchandise Volume, the dollar amount of everything sold on the platform will always be a KPI (key performance indicator). GMV was up 22% to $67.2 billion during the second quarter, substantially beating the consensus estimate of $65.7 billion.

The MRR or Monthly Recurring Revenue increased 25% to $169 million, again beating the consensus, by $10 million. The main driver was the one you want to hear as an investor: the growth in merchants, up 30% globally. Shopify Plus contributed $52 million to the MRR, or 31% of MRR. Great to see that.

Shopify’s gross profit increased by 25% to $1.0 billion, resulting in a gross margin of 51.1%, up from 49.3% a year ago. Of course, this was partly caused by selling Deliverr, the logistics business. But the change in pricing plans also pushed up gross margins and operating expenses were down. On the other hand, Shop Pay grew substantially and that pushed down gross margins.

Talking about that, GPV (Gross Payments Volume), grew to $41.1 billion, representing 61% of Shopify’s GMV processed through Shopify Payments, versus $31.7 billion, or 58% last year. That’s 30% growth. There’s also Shop Pay, which grew 45% year over year, to $16 billion in GPV, representing 39% of the total GPV.

Just so you know, Shopify Payments is Shopify’s built-in payment solution that allows merchants to accept payments directly on their stores. Shop Pay, on the other hand, is an accelerated checkout for customers, which allows them to save their payment and shipping details for faster purchases in the future across all Shopify stores. I have used Shop Pay myself and I love it. It’s maybe even simpler than Amazon’s ordering and payment process.

The company raked in $0.26 in EPS, beating the $0.20 consensus and up 85% year-over-year. This is on a non-GAAP basis, but for Shopify, non-GAAP shows the company’s earnings power better, as GAAP numbers include the company’s investments in other companies, like Affirm and Global-e and if the stock prices of these companies move up or down, that has to be reflected in GAAP EPS, while it’s just paper gains or losses. That’s why non-GAAP numbers are the way to look at Shopify’s EPS.

Merchant Solutions was up 19% to $1.5 billion. The biggest drivers were higher GMV and GPV.

Subscription Solutions revenue increased 27% year over year to $563 million, driven by the addition of more merchants and the introduction of higher subscription plans.

Free cash flow came in at $333 million, not comparable to the $97 million a year ago. It represents a free cash flow margin of 16%.

I also liked hearing about Shopify’s operating leverage. While revenue was up 25% (excluding Deliverr), operating expenses were up just 5%. That’s outstanding operating leverage.

Shopify’s balance sheet remains very strong, with $4.1 billion of net cash.

Shopify doesn’t really give guidance, but it said it expects revenue to grow at a low-to-mid-twenties percentage. Gross margins should improve by 0.5% and free cash flow in Q3 should be around 18% again, and in double digits for the rest of the year.

More insight

The company proudly shared a milestone achievement. Since it launched its Shopify POS (point-of-sale), it has seen more than $100 billion in GMV.

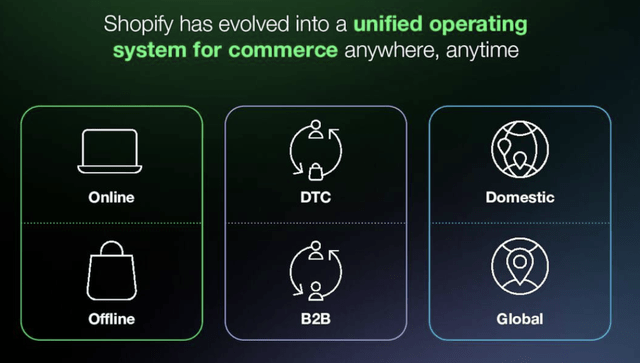

Harley Finkelstein emphasized on the call that Shopify has evolved into a unified commerce platform, with features across online, offline, B2B, and international markets.

Shopify Q2 2024 earnings slides

The recent release of Markets simplifies cross-border selling, enabling merchants to expand effortlessly into new markets. This is how you should see Markets.

Shopify Q2 2024 earnings slides

Shopify’s point-of-sale solution also saw robust growth, with offline GMV increasing by 27% year-over-year.

B2B is newer, but it’s gaining traction fast, with a 140% increase in B2B GMV, showing the value for larger enterprises. President Finkelstein on the Q2 2024 earnings call (the source for all of the following quotes):

This is something that many large brands have been searching for, and is yet another example of the work we are doing to drive our leadership position in unified commerce.

Shopify tries to start from first principles, by making everything as simple as possible and by becoming a platform. President Harley Finkelstein on the conference call:

We believe that the mark of great software is that as it scales and grows, each new feature is built as if it were there from the very beginning. Everything works together harmoniously, crafted in consistent style and quality. This is a key value proposition for Shopify and something that as we have evolved from an online store to a comprehensive unified operating system for commerce anywhere.

Finkelstein also commented on Shop Pay:

For merchants, Shop Pay is more than just a digital wallet. It offers comprehensive order tracking via the Shop app and allows buyers to earn Shop Cash redeemable for purchases within the app. This builds greater customer engagement and unlocks additional opportunities to reach customers.

Of course, AI had to be a theme, right? And what I heard really made me smile with contentment. This is how Shopify applies AI:

Our tools and our AI models are crafted not just to operate but to excel leveraging emerging technologies to enhance our feedback loops. These tools provide sharper, more iterative feedback, enable more precise analysis, and deliver quicker signals, letting us identify patterns faster than ever, so we can swiftly adapt and respond.

Harley Finkelstein further explained that after testing a new AI-driven digital platform in the first quarter and seeing strong growth, Shopify increased efforts in the second quarter, leading to a 51% rise in merchant acquisition while staying within the company’s financial objectives.

He also mentioned that over 50% of new merchants in the second quarter came from outside core English-speaking markets. Meanwhile, Shopify reduced efforts in other, less efficient areas to focus on testing and finding new high-return opportunities.

What I also found remarkable was this comment:

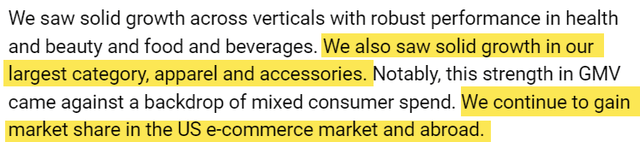

Shopify Q2 2024 earnings call

Does that mean that there is a tectonic shift happening in apparel retail? While brands like NIKE (NKE) and Lululemon (LULU) are suffering, Shopify’s apparel is doing very well and continues to win market share. Noteworthy!

An analyst asked if Shopify also saw the weaker consumer. This was CFO Jeff Hoffmeister’s answer:

I do know that there are a lot of people out there talking about softening consumer spend, and we hear that, too. I think from us, the key point is we are working with our merchants to help them be very successful in this environment. We didn’t see any significant deterioration or improvement throughout the quarter.

That is strong. Yes, there are pressures, but we are immune, that’s more or less what this means. Another testament to Shopify’s strength. Harley Finkelstein thought he knew why:

Keep in mind, we have a very diverse set of verticals and merchants across geos and merchant types. You think about like we have scrubs from FIGS, we have pet products from BarkBox, and razors from Flamingo. We have Nestle and Heinz and Mattel and Staples. So the wonderful part of our business model is it’s not relying on one particular type of merchant and one particular geography. We have merchants coming to us for B2B and merchants that doing direct-to-consumer.

Shopify also made three small acquisitions in this quarter. CFO Jeff Hoffmeister explains:

Since our last earnings call, we made three small acquisitions. The first acquisition added some enhancements to allow Plus merchants to do easier customizations of the checkout process. The second gives mid-market and enterprise merchants greater visibility into their inventory across our multiple stores and channels. The third brings a team that will enhance our abilities to get early-stage merchants on platform and ramp the success of their businesses.

All three of these acquisitions were small in terms of dollar amount and immaterial to our financials, but are important additions to enhancing our merchant efforts. Moreover, these acquisitions bring us some great founders who were specifically drawn here by the quality of our existing team.

Is Shopify A Buy Now?

For companies that grow fast, there is a rule that has been used for a while already, the rule of 40. Revenue growth is combined with profitability margins and if the number is above 40, you have high quality. I would even add another class: above 50 is top-notch.

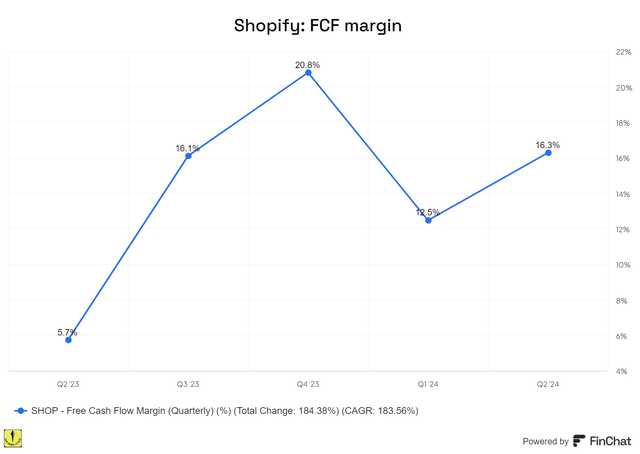

FinChat.io

As you can see, with 16.3%, Shopify passes the Rule of 40.

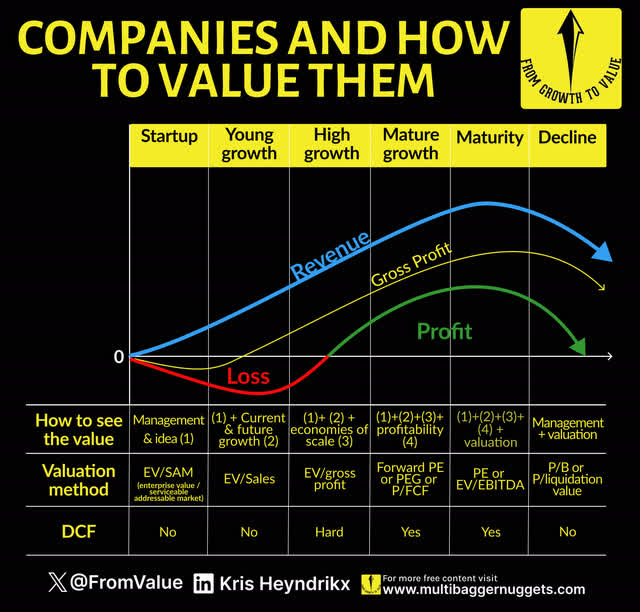

To continue, it’s very important to look at this graph.

Made by the author

Because of its profitability, I think Shopify is now between high growth and mature growth. So, let’s first look at EV/Gross Profit.

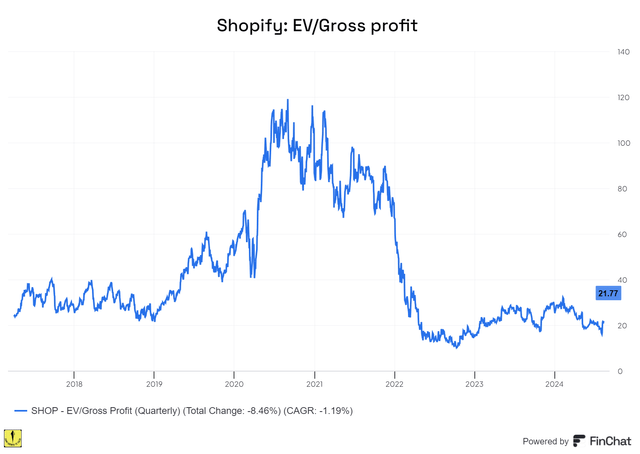

FinChat.io

At 21.77 times gross profit, Shopify is not cheap, but it’s cheaper than most of the period I have owned it (represented in the chart). Just for reference, when I made it the first Potential Multibagger in early May 2017, at a split-adjusted $7.74, it traded at 29 times EV/gross profit.

Of course, you should not only look on a relative basis but also on an absolute basis, and then I think this is not cheap, but fair for a company growing at this speed and expected to continue to grow so fast for many more years.

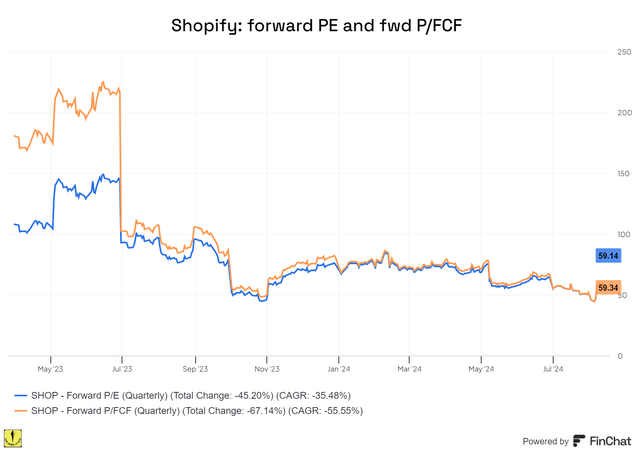

FinChat.io

With a forward P/FCF of 59 and a forward PE of 59, again, Shopify doesn’t look cheap. But let’s look forward.

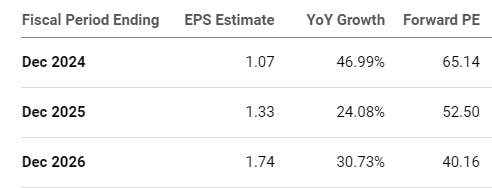

Seeking Alpha

The 2024 PEG is 1.39, which is considered fair. The 2025 PEG ratio, at 2.19 looks rather expensive, the 2026 at 1.30 fair again.

However, it remains very challenging to value Shopify. The company is priced for its long-term growth. And it keeps delivering on that promise. But of course, the future is inherently uncertain and that’s why it’s always riskier to own a growth stock. But it can also be more rewarding. I’ve been a Shopify shareholder since early 2017, and I have been rewarded nicely for it.

To me, Shopify is more or less reasonably valued right now. It’s not a screaming buy, but it’s also not egregiously overvalued. A good company at a fair price, where have I heard that phrase before?

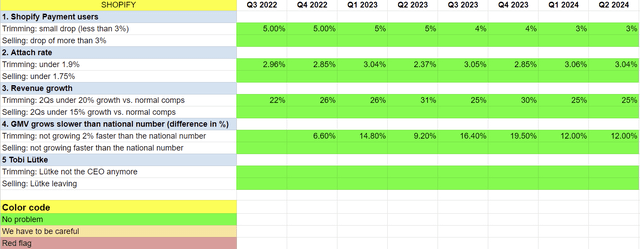

The Selling Rules

For my paid subscribers, I have Selling Rules for some the stocks I picked. They are very company-specific and represent the risks that I want to avoid. Of course, these can change over time.

The first one is about Shopify Payment users. I want the percentage of users to go up. With 3 basis points more Shopify Payments, that was no problem.

I also look at the attach rate.

In general, attach rate is the extra product you sell with a product. For example, if a bike shop sells 50 bikes in a month and can sell 5 helmets with those bikes, the attach rate is 10%.

Shopify calls its merchant solutions revenue the attach rate. It’s calculated as merchant solutions revenue divided by GMV. GMV means gross merchandise volume or the dollar amount of everything sold on a platform. In Q3, Shopify’s attach rate was 2.14%, the highest ever. Dropping under 2% would be a yellow flag, under 1.9%, I would trim, under 1.75%, I would sell.

Revenue growth is simple. I normalize the revenue growth to exclude the sale of Deliverr.

I also look at the national number for e-commerce growth. You can simply google that, and I look at the difference with Shopify’s growth. This quarter, Shopify grew 12% faster.

Tobi Lütke, founder and CEO, is a crucial lynchpin in the machine for me. There’s key-man risk and that’s why I also want to add that to the risks.

Shopify had no problem at all passing the Selling Rules. All green.

Made by the author

Conclusion

Shopify chalked another great quarter. 2022 was a tough year for most tech companies, and Shopify was no exception, with a cratering stock price and several management shuffles. But it seems like that threw Shopify back to its basics and first-principle thinking. Since Deliverr was sold just 9 months after it had been bought, Shopify has focused on what it’s best at: serving its merchants, and through them, the customers of those merchants. And the improvements are noticeable. The focus is totally back, and it’s great to see that.

CFO Jeff Hoffmeister gets the last word, as he summarized it very well, and I couldn’t have written my conclusion better:

In closing, we are showing quarter after quarter that we are executing against the plans that we have laid out and that our business model is incredibly compelling with plenty of runway ahead.

In the meantime, keep growing!

Read the full article here