Deutsche Bank Aktiengesellschaft (NYSE:DB) has reported a muted performance in Q2 2024, impacted by legacy issues related to the Postbank acquisition in 2010. Beyond that, its operating outlook is challenging due to the prospects of lower rates ahead and a potential decline in credit quality, making its risk-return profile quite challenging right now.

As I’ve covered in previous articles, Deutsche Bank has not been one of my preferred European banks despite its low valuation compared to peers, as I see this largely justified by the bank’s fundamental issues. While operating performance has improved recently, first supported by strong volumes in the capital markets and more recently by rising rates, there remains work to be done for the bank to have a respectable profitability level over the long term.

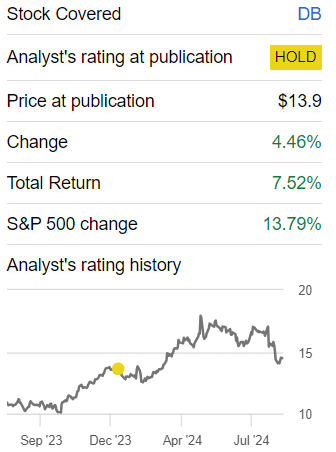

Moreover, as the tailwind of higher rates was near its end, I was leaning bearish a few months ago on Deutsche Bank. Not surprisingly, its shares have underperformed the market since my last article, being up by only about 7.5% vs. close to 14% for the overall U.S. market during the same time frame.

Article performance (Seeking Alpha)

As Deutsche Bank has recently announced its quarterly earnings, I think it’s now a good time to analyze its most recent financial performance and update its investment case. Let’s see if it now offers more value to investors or not within the European banking sector.

Q2 2024 Earnings Analysis

Deutsche Bank has reported a positive operating performance over the past few quarters, and the first semester of this year was no exception. Its revenues amounted to €15.4 billion in H1 2024, representing an annual increase of 2% YoY and progressing well toward its annual target of about €30 billion.

This positive top-line performance was mainly supported by the bank’s investment banking division, which reported revenue growth of 9.8% YoY, while other segments had a softer performance. Within investment banking, revenue growth came mainly from commissions and fee income, while net interest income was not a major driver of revenue growth over the past couple of quarters.

This clearly shows that the rate tailwind is almost gone. Higher rates had a very positive impact in 2022/23, but more recently the cost of deposits has increased and net interest income (NII) growth has been much softer across the sector in recent quarters.

Considering that the European Central Bank has already made one rate cut and more cuts are expected ahead, the bank’s NII will likely drop over the coming quarters. NII should become a headwind for revenue growth in the near future. While I think Deutsche Bank is likely to meet its revenue guidance for 2024, I see market estimates for 2025 as somewhat optimistic. The current consensus expects revenue growth of 3.76% YoY in 2025, which may be difficult to achieve considering the rate outlook.

This means the Street may be expecting higher revenues coming from the bank’s capital market activities, which were somewhat muted during 2022/23, but these revenues are quite cyclical. It’s difficult to forecast how they will develop in the coming quarters. Thus, I think there is a strong probability that revenue estimates for 2025 will be revised downwards in the coming months.

Moreover, Deutsche Bank’s strategy has been to shift its business away from capital markets activities into more predictable revenue streams, including private and corporate banking, or asset management, which are more related to rates than investment banking.

Regarding costs, its adjusted costs amounted to €10.1 billion in H1 2024, a decline of 2% YoY, which is a good outcome considering the inflationary environment and wage pressure, which was offset by efficiency measures across its business. Its cost-to-income ratio was 69% in the semester, excluding some extraordinary effects, which is still a relatively high ratio and shows that Deutsche Bank needs to continue to push for cost-cutting and efficiency improvements over the coming years.

Indeed, its cost-to-income ratio target is about 62.5% by 2025. Thus, Deutsche Bank understands is efficiency is not among the best and needs improvement. This task is not easy given that revenue should be under pressure in the coming months and the bank’s cost base is to a large extent quite sticky. This means Deutsche Bank may fail to achieve its efficiency target, an expectation that is supported by its cost-cutting track record, which is not particularly impressive.

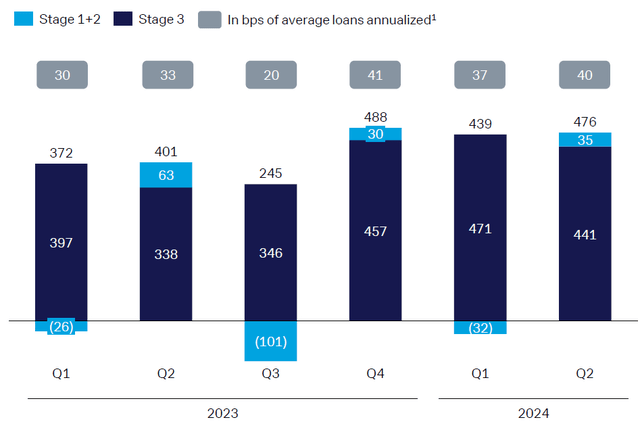

Regarding asset quality, its provisions for loan losses were somewhat higher than expected, driven mainly by the bank’s exposure to commercial real estate (CRE). In Q2 2024, its provisions amounted to €476 million, up by 19% YoY and 8% QoQ, representing a cost of risk ratio of 40 basis points (bps). While historically, one of Deutsche Bank’s positive factors for its investment case was its sound credit profile, this has changed in recent quarters as defaults in the CRE increased, especially in the U.S. related to offices.

Loan loss provisions (Deutsche Bank)

As shown in the previous graph, Deutsche Bank’s cost of risk ratio has been around 40 bps over the past three quarters. This is above its long-term trend, but according to Street estimates its cost of risk ratio should be stable in the coming quarters and be about 36 bps in 2024. This means its quarterly provisions for loan losses should remain between €400-500 million in the upcoming quarters. However, I think the risk is more biased to the upside as economic conditions aren’t improving in Europe. Higher credit losses may occur if the European and the U.S. economies enter into a recession in the coming months.

In the U.S., the bank expects some moderation of loan loss provisions in the second half, even though its office exposure should continue to be problematic. Taking this background into account, the bank revised its guidance for its cost of risk in 2024 to be above 30 bps, reflecting worse credit quality than Deutsche Bank was expecting some months ago.

Regarding its bottom-line, its reported results were significantly impacted by a litigation provision booked in Q2 related to its Postbank acquisition in 2010. That was when some shareholders sued Deutsche Bank for what they considered to be a low share price when it acquired Postbank. Some months ago, a German court indicated that these claims may be valid, leading the bank to book a legal provision of about €1.3 billion in Q2.

While this is a one-off effect, it had a great impact on the bank’s reported profit, which amounted to only €0.1 million in Q2 2024. Excluding this effect, its adjusted net profit was around €1.4 billion and its return on tangible equity (RoTE) ratio, a key measure of profitability in the banking sector, was 7.8%. This is a below-average profitability level compared to other European banks. It is a key reason why Deutsche Bank trades discounted to its book value, a profile that is justified by structural issues and is difficult to turn around in the near term.

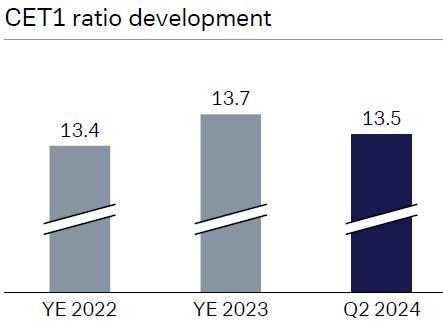

Regarding its capital position, despite the bank’s efforts to optimize its balance sheet and reduce risk-weighted assets, during Q2 its capital ratio was hit by the litigation provision related to its Postbank acquisition. Its CET1 ratio declined by 20 bps in the quarter, to 13.5% at the end of June, which is an acceptable ratio even though it’s lower than compared to the average of its peers.

CET1 ratio (Deutsche Bank)

This capital position is a strong support for its dividend, which was €0.45 per share related to 2023 earnings, and is expected to increase to €0.66 per share in 2024, representing an increase of 47% YoY. At its current share price, Deutsche Bank is currently offering a forward dividend yield of close to 5%, which is interesting for income-oriented investors.

Regarding its valuation, Deutsche Bank is currently trading at only 0.41x book value. This is slightly above its historical average over the past five years, but is at a significant discount to some of its peers, such as Citigroup (C) or Barclays (BCS), which are trading at about 0.6x book value. However, Deutsche Bank has a serious profitability issue. Using an absolute valuation model, based on the Gordon Growth Model, I see Deutsche Bank’s justified price-to-book value being in the 0.4-0.5x range. Thus, its shares appear to be fairly valued right now.

Conclusion

Deutsche Bank has reported a muted quarter, as its operating performance can be considered positive, but legacy issues led to a much weaker reported performance. The outlook for lower rates ahead is now a headwind and credit quality can also be problematic for earnings growth over the coming quarters, thus Deutsche Bank’s risk-return profile does not appear to be very attractive for long-term investors.

Read the full article here