The iShares Large Cap Max Buffer Jun ETF (BATS:MAXJ) seems to be an ideal investment vehicle for tech-heavy portfolios that need full-on downside protection in exchange for a capped upside. The disadvantage, of course, is the capped upside part, and if you’re expecting tech giants like the Magnificent 7 to keep rallying beyond last week’s volatility, this is probably not for you. On the other hand, if your portfolio has been tech-focused over the past year and a half – either through direct ownership or through a cap-weighted ETF with a high concentration in information technology stocks – and you’re looking for maximum downside protection without giving up all of the upside, it’s worth looking at this very new fund.

Incepted on June 28, the ETF is not even a month and a half old but already seems to have a reasonable amount of liquidity (approximately 65k daily average share volume), with an AUM of a shade under $140 million. The ETF is managed by Blackrock Fund Advisors and charges a net expense ratio of 0.50%, after a waiver of 0.03%.

How Does MAXJ Work?

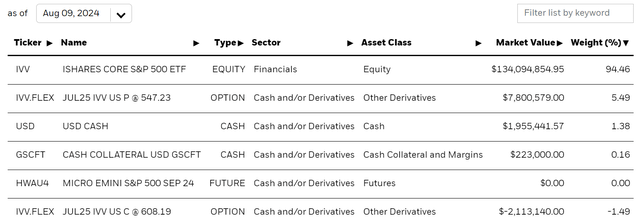

This ETF is essentially built on a base of equities held in the form of iShares’ own Core S&P 500 ETF (IVV), called the reference asset. The value of this asset is nothing more than the current market price of IVV shares, which is around $535.85 as I write this. The strategy used to provide the downside protection (which is 99.5% net of fees) and the capped upside exposure (10.64%) involves put and call options at specific strikes and of equal durations.

iShares MAXJ Web Page

In effect, the ETF is designed as a 1-year hedge that starts on July 1, 2024 and ends on June 30, 2025. During this period, the fund gives you the aforementioned upside exposure as well as the downside protection. Hypothetically, that means you can rotate all of your broad-market holdings into this fund and sleep easier at night knowing your portfolio now has adequate protection.

However, as I mentioned earlier, since it also caps your upside exposure – in this case, at the call strike of $608.19 – at just over 10%, you can consider a more measured approach. It depends on how much upside exposure you’re willing to trade off for the near-100% downside hedge (ITM puts at a $547.23 strike mean there’s intrinsic value in these puts.) Investing now means buying a 98.98% buffer on your holding through the end of the options contract, but also means a 10.06% remaining upside if IVV breaches that call strike. In other words, the money you’re not willing to lose can be put into MAXJ for complete downside protection, with a conservative bonus upside. I think that’s a fair proposition.

Why Should You Explore Such a Hedging Strategy?

This is a very important point because we’re already in a very volatile economic, political, and market environment. This past month’s multiple-whammy in the form of a disappointing CPI print, suboptimal jobs report, weak PMI, and the yen carry trade roadblock caused by the Japanese central bank’s unexpected 25 bps interest rate hike and ensuing short squeeze – they’ve all combined to reveal weaknesses in the global markets.

Those are just the ones behind us. The catalysts ahead are even more daunting: the election, an escalation of global conflict, still-high interest rates, extreme valuations in tech, AI not living up to its anticipated returns on investment, and so many more that investors are hoping and praying won’t flare up all of a sudden. The problem is, we’ve just seen such a mini-flare-up, and there’s absolutely no guarantee that the next one won’t be as bad or worse.

In such a scenario, I think it makes perfect sense to protect your investments, and one of the ways to do that and still take on a modicum of risk is to invest in hedging strategies like this – at least, until we’re over the proverbial wall of worry. In that vein, I’m not surprised that Berkshire Hathaway (BRK.A)(BRK.B) has chosen to boost its liquidity to the tune of $277 billion as of the June quarter, and I suspect we’ll see that grow further when Q3 results are announced on the day before the 2024 United States presidential election – unless the top brass at Berkshire finds a more profitable home for those funds that also carries lower risk, or there’s an option to hedge a higher-risk asset.

Why This Move Calls for Rigorous Investor Discipline

This is not going to be an easy decision to make. I get that. Every broad-market portfolio with a tech skew has seen 50% to 60% gains since the lows of October 2022. Why would you give up the chance to push that even further? After all, the market and the economy seem resilient enough, don’t they? Didn’t the market bounce back stronger after every downturn over the past two years? Indeed, isn’t the market up nearly 150% since the short-lived pandemic recession?

Fair questions, all of them, so why go into panic mode now? The point I’m trying to make here is not that you should go into panic mode, but that you should prepare for the undeniable volatility to come. Take your gains made thus far and protect them. Of course, you can definitely keep a small portion of your portfolio in high-risk, high-reward equities like the Magnificent 7 if you want a little more upside exposure. Many of these companies have shown that they can withstand multiple recessions and still come out of them with stronger revenues, greater profitability, and impressive cash flows. However, I believe very strongly that the bulk of your portfolio should either be in money-market ETFs right now to take advantage of still-high interest rates, or protected by hedging strategies like the one MAXJ offers. There’s also another alternative that I’ve suggested recently with a (VOOG)-(VOOV) pairing, but that’s only ideal if you’re bullish on the market overall.

In principle, this is a great ETF for risk-averse investors, so I’m rating MAXJ a Strong Buy even though it has a very short history. It’s a well-calculated strategy and run by a highly experienced team from Blackrock – Jennifer Hsui, Co-Head of Index Equity at Blackrock with a tenure of nearly 15 years; Greg Savage, CFA, Head of Americas Index Asset Allocation, 15 years with Blackrock; and Paul Whitehead, Co-Head of Index Equity, 27-year tenure at Blackrock.

In closing, I would just say that choosing your preferred investment vehicle should necessarily factor in the risk-on environment that many investors have gotten comfortable with over the past several years, but more so its eventual and inevitable cyclical shift to a risk-off one. The more prepared you are, like Berkshire is right now, the more resilient your portfolio will be so it can weather any kind of downturn in the near to medium term, and the better positioned it will be to take advantage of the next prolonged bull market that will eventually return. The best part about this particular strategy with MAXJ is that you’re not severely handicapping your exposure to the upside in the process. Capping, not handicapping.

Read the full article here