RYCEY Delivers Robust Profitable Growth, With Market Trends Signaling Bright Prospects

We previously covered Rolls-Royce Holdings (OTCPK:RYCEY) (OTCPK:RYCEF) in May 2024, discussing the successful reversal of its fortunes after facing extreme challenges during the COVID-19 pandemic, thanks to its highly strategic “Power by the Hour” business model and recovering air travel trends.

With the management guiding excellent growth through 2027 while reporting improving balance sheet health and growing LTSAs, we had initiated a Buy rating then.

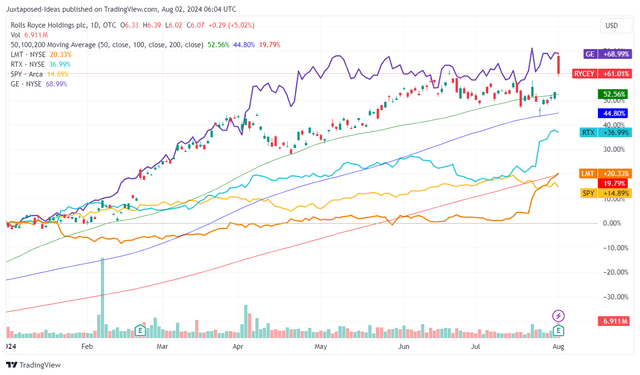

RYCEY YTD Stock Price

Trading View

Since then, RYCEY has had a very satisfying one-day rally of +10.7% at its peak after the H1’24 earnings report, with the stock’s YTD performance mirroring many of its Aerospace and Defense peers.

The YTD rallies are not surprising indeed, attributed the recovery in commercial travel and the growing orders for commercial planes/ engines, with Boeing (BA) already highlighting a projected +3% increase in airplane deliveries over the next twenty years and over 44K in new commercial airplanes by 2043.

As a result of this tailwind, the jump in RYCEY’s share prices post H1’24 earnings report has played out as expected indeed, attributed to the robust revenues of £8.18B (-3.1% sequentially/ +17.6% YoY), operating margins of 14% (+3.2 points sequentially/ +4.3 YoY), and adj EPS of 8.95 pence (+1.1% sequentially/ +82.6% YoY).

Most of the tailwinds are attributed to the robust growth observed in the Civil Aerospace segment at revenues of £4.11B (inline sequentially/ +27% YoY) and operating margins of 17.9% (+7.2 points sequentially/ +5.5 YoY), given the higher aftermarket profit from large engine long-term service agreements.

We believe that the management may continue to report robust Civil Aerospace performance as well, attributed to the growing order book at 1.77K large engines (+8.5% sequentially/ +9% YoY) and a gross book-to-bill of 2.3x in H1’24.

At the same time, with RYCEY also operating in the Defense industry, the increasingly unstable geopolitical climate with two hostilities still ongoing in Ukraine and Gaza have also triggered intensified defense spending from the US government and the European government, amongst others.

The same has been observed in Lockheed Martin’s (LMT) outsized defense multi-year backlog of $158.34B (inline QoQ/ YoY) and RTX Corporation’s (RTX) at $77B for defense contracts (inline QoQ/ +5.4% YoY) in the latest earnings calls.

This market trend has already triggered RYCEY’s robust Defense revenues of £2.21B (+2.3% sequentially/ +18% YoY) and multi-year order backlog of £8.5B (-7.6% sequentially/ -4.4% YoY), particularly in the submarine segment at +84% YoY.

Data Center Power Demand May Boost RYCEY’s Nuclear Projects

Given the generative AI hype and the resultant data center capex boom, it is unsurprising that more hyperscalers have reported higher energy consumptions with data center REITs also reporting power constraints.

Here is where RYCYE’s Power Generation Solutions and New Markets come in, attributed to their well diversified power offerings across diesel gensets, gas gensets, battery storages, and Small Modular Reactors [SMR] for new applications in data centers, building upon the conventional utility and land defense use cases.

For example, the Power Systems segment already reported a growing H1’24 order intake of £2.4B (+26.3% YoY) with a book-to-bill ratio of 1.3x, compared to 1.1x in H1’23.

At the same time, while the modular reactor remains in development and regulatory approval stage in the UK, we believe that there are immense opportunities for more use cases globally, especially in the data center market.

For reference, Chris Sharp, the chief technology officer at Digital Realty, A leading data center REIT, has highlighted that “a normal data centre needs 32 megawatts of power flowing into the building. For an AI data centre it’s 80 megawatts.”

With the US utility infrastructure aging and power interruptions increasingly common over the past few years, it is unsurprising that the CTO has predicted that future data centers are likely to come “with their own dedicated, built-in nuclear reactors.”

Equinix (EQIX), the largest data center REIT based on the market capitalization of $75B at the time of writing, has already signed a letter of intent and made a $25M prepayment to Oklo, an advanced nuclear technology company based in California, to procure up to 500 MW of nuclear energy upon operation.

This development is not overly ambitious as well, with the US Nuclear Regulatory Commission [NCR] already certifying the country’s first SMR in early 2023, capable of generating 50 MW in energy.

Combined with other developments in the SMR market and the data center capex boom/ power constraint issues, we believe that the demand for clean and consistent energy sources will continue to grow and in turn, accelerating the development/ adoption of RYCEY’S SMR technology in the intermediate future.

Risk Assessment

For now, while we are optimistic about RYCEY’s Defense and New Market segment prospects, we must highlight a few items for consideration.

One, while tensions remain elevated in Ukraine/ Gaza and it remaining to be seen when geopolitical issues may moderate from these heights, we expect RYCEY’s defense revenues to be lumpy depending on contract award and budget approval.

As a result, readers may want to temper their near-term expectations on a QoQ/ YoY basis.

Two, we must highlight that RYCEY’s New Market segment remains nascent with minimal revenues and negative profit margins in H1’24, with any top/ bottom-line contribution only likely by the second half of the decade.

In addition, there has been numerous pushbacks from environmentalists along with the risks of radioactive wastes, implying that the coveted regulatory approval may be fraught with challenges.

As a result, interested investors may want to focus on the commercial/ defense aerospace/ Power management segments, prior to monetization of its SMR opportunities.

Reinstated Dividends & Shareholder Returns

For now, the RYCEY management’s confidence of generating increasingly rich Free Cash Flow is also observed in the raised FY2024 underlying operating profit guidance of £2.2B at the midpoint (+38.3% YoY) and Free Cash Flow guidance of £2.15B (+67.9% YoY).

This is compared to the original midpoint guidance of £1.85B (+16.3% YoY) and £1.8B (+40.6% YoY) offered in the FY2023 earnings call, respectively.

This development has also triggered RYCEY’s reinstated FY2024 dividends with a payout ratio of 30% in underlying profit after tax, implying that the company has finally returned “to an investment grade credit rating.”

While the payout ratio may not be as rich as the estimated number of 66.1% in FY2018, based on the underlying profit after tax at £331M and the dividend paid out at £219M then, we believe that long-term shareholders will more than welcome the reinstated payouts after the last paid out in 2019.

This is especially since RYCEY’s balance sheet has improved drastically to a lower debt level of £3.54B (-12.1% sequentially/ -10.6% YoY/ -41.1% from the peak debt levels of £6.02B in December 2021).

Combined with the increasingly rich cash/ equivalents of £4.31B (+14% sequentially/ +50.6% YoY) and lower net debt-to-EBITDA ratio of 0.3x (0.8x in FY2023), it is unsurprising that the management has decided to reward investors by reinstating dividend payouts.

So, Is RYCEY Stock A Buy, Sell, or Hold?

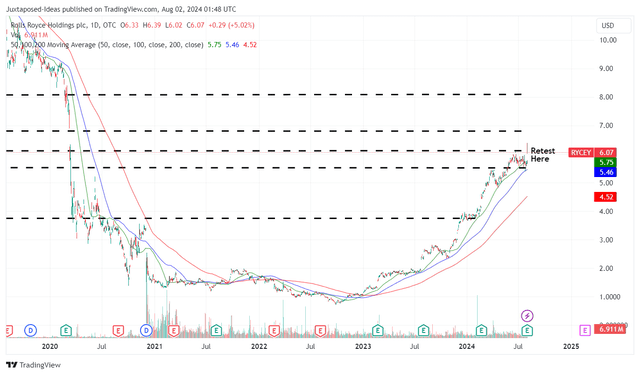

RYCEY 5Y Stock Price

Trading View

For now, RYCEY has charted new heights, albeit moderated by profit taking after the robust H1’24 earnings call and raised FY2024 guidance.

For context, we had offered a fair value estimate of $5.00 in our last article, based on the FY2023 adj EPS of $0.18 (based on the exchange rates at the time of writing) and the FWD P/E valuations of 27.64x.

Based on RYCEY’s raised FY2024 adj EPS guidance of $0.22 (based on the exchange rates at time of writing) and stable FWD P/E valuations over the past three years, we are looking at an updated fair value estimate of $6.10.

This implies that the stock remains reasonably priced at current levels, with there remaining an excellent upside potential of 23.5% to our reiterated long-term price target of $7.50, based on the stable consensus FY2026 adj EPS estimates of $0.27.

Based on RYCEY’s reinstated FY2024 dividends with a payout ratio of 30% in underlying profit after tax, we are looking at approximate payouts of $0.06 per share, implying a decent 1% yield based on the stock prices at the time of writing.

While minimal, the payouts already allow long-term shareholders to DRIP and accumulate additional shares on a quarterly basis.

At the same time, as the company’s Free Cash Flow generation further grows and balance sheet improves, we may see the management raise the ratio to be “in the middle of the 30% to 40% payout range” while commencing on share repurchases.

As a result of still attractive total return prospects through capital appreciation and dividend payouts, we are reiterating our Buy rating for the RYCEY stock here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here