Fund Characteristics

|

P/V Ratio |

Low-60s% |

|

Cash |

3.1% |

|

# of Holdings |

22 |

All data as of June 30, 2024

Annualized Total Return

|

2Q |

YTD |

1 Year |

3 Year |

5 Year |

10 Year |

Since Inception |

|

|

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

(%) |

|

|

Global Fund |

-4.81 |

3.18 |

6.62 |

-3.28 |

2.77 |

2.43 |

4.81 |

|

FTSE Developed |

2.48 |

11.32 |

19.80 |

6.44 |

11.53 |

8.99 |

10.54 |

|

FTSE Developed Value |

-1.66 |

4.98 |

11.79 |

3.98 |

6.66 |

5.68 |

7.61 |

|

*Inception date 12/27/2012. FTSE Developed Value 10 Year and Since Inception returns are gross returns, as net returns for those periods are not available. All other performance figures above are net returns. |

We have bad news and good news. The bad news is that the Longleaf Partners Global Fund declined -4.81% in the second quarter, behind the FTSE Developed and FTSE Developed Value indices, which returned 2.48% and -1.66%, respectively. In the quarter, we didn’t have enough significant winners, and more 10%+ decliners led to disappointing relative performance. The good news is that our stock price declines were overreactions, resulting in our aggregate value per share performance outpacing stock price performance in the quarter. We own great companies that are on offense.

|

Returns reflect reinvested capital gains and dividends but not the deduction of taxes an investor would pay on distributions or share redemptions. Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by visiting Value Investors Since 1975 | Southeastern Asset Management. The prospectus expense ratio before waivers is 1.35%. The Global Fund’s expense ratio is subject to a contractual fee waiver to the extent the Fund’s normal operating expenses (excluding interest, taxes, brokerage commissions and extraordinary expenses) exceed 1.05% of average net assets per year. This agreement is in effect through at least April 30, 2025, and may not be terminated before that date without Board approval. |

It was encouraging to see large stock price moves in our favor since quarter end as of the posting of this letter. It has also been nice to see some overvalued market favorites moving in the opposite direction. We are excited about the future of the portfolio and in position to achieve our goal of double-digit returns this year and beyond.

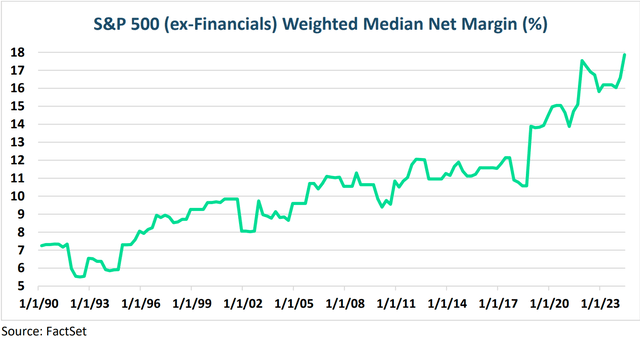

It is important to consider this chart:

There are plenty of non-US companies in the FTSE Developed Index, but we highlighted the S&P 500 above because US companies account for 52% of index earnings and a much higher percentage of the contribution to market cap and returns for the index. For years, Warren Buffett, Jeremy Grantham and others have asserted that corporate margins as defined above would struggle to permanently break out of their historical high single to low double-digit range, which had also held for many years before our chart above begins in 1990. Yet we are still several years into margins continuing to rise, which has significant valuation implications, particularly with high price-to-earnings (P/E) ratios. The focus tends to be on the high P/E ratios themselves, rather than the risk posed by elevated margins. If we analyze “normal” margins against gross domestic product (GDP), as Buffett might, or against S&P 500 revenues, as Grantham might, the current margins are unprecedented.

Although the performance of what we do own lacked a unified theme this quarter, we had multiple companies impacted by European geopolitical concerns: Eurofins, Delivery Hero, Entain, Exor, Accor, Vivendi, and Glanbia. Notably, our aggregate value per share in this group outperformed the aggregate price per share performance in the quarter because these companies are far more “global” than they appear. We also own several companies listed in the US that had short-term challenges the market overreacted to: Mattel, MGM and Bio-Rad all continue to adjust to post-COVID normalcy in a way that is frustrating to the market, whereas IAC, Warner Bros. Discovery and Live Nation had non-value-per-share-impacting drama from external forces. We also had positive developments at Millicom, Prosus and FedEx, as we detail below.

While the FTSE Developed is trading at roughly 20 times potentially peak free cash flow (FCF), our individual investments are trading closer to 10 times FCF on margins that can improve. This positions our investments for growth even in tougher economic times, especially on a relative basis. If the FTSE Developed ex-financials margin reverts to 15% (still above long-term normalized levels) and trades at its long-run average P/E multiple in the mid-teens (similar to non-mega-cap-growth-stocks globally today), this would imply a decline of over 20% in the next year. Conversely, if our portfolio’s earnings power (which we believe is underpinned by many things within our investees’ control) materializes into 2025 and trades at a low-teens multiple (assuming a discount to the market multiple because these are boring value stocks, but this could prove conservative), this would be an increase above our inflation plus 10% target. This exercise underscores the importance of stock picking for long-term success and the margin of safety in the portfolio today.

After doing both videos and letters for over two years, we have decided to go back to letters only. There was not enough differentiation in content between the two formats. Plus, we express ourselves better in writing. Another factor in our decision is that in- person visits have become more accepted again as the COVID era has waned, further reducing the need for videos. We will continue with our P/V Podcasts and look forward to sharing more content in that format.

Contribution To Return As Of June 30, 2024

|

2Q Top Five |

|||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) |

|

Millicom (TIGO) |

20 |

0.91 |

5.9 |

|

Prosus (OTCPK:PROSY)(OTCPK:PROSF) |

14 |

0.65 |

5.9 |

|

FedEx (FDX) |

4 |

0.31 |

6.9 |

|

CNX Resources (CNX) |

2 |

0.16 |

6.0 |

|

Richemont |

2 |

0.09 |

4.9 |

|

2Q Bottom Five |

|||

|

Company Name |

Total Return (%) |

Contribution to Return (%) |

Portfolio Weight (%) |

|

Bio-Rad (BIO) |

-21 |

-1.00 |

4.0 |

|

Eurofins (OTCPK:ERFSF) |

-18 |

-0.83 |

4.5 |

|

Delivery Hero (DHERO) |

-17 |

-0.76 |

3.5 |

|

Mattel (MAT) |

-18 |

-0.68 |

3.3 |

|

Entain (OTCPK:GMVHF)(OTCPK:GMVHY) |

-21 |

-0.64 |

2.6 |

Millicom – Latin American wireless and cable company Millicom was the top contributor for the quarter. This quarter saw significant FCF growth due to operational improvements driven by Iliad’s growing influence at the company, as mentioned in previous letters. Organic revenues rose approximately 4%, while total costs decreased by about 3.5%, leading to a more than 20% increase in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) and a rise in the stock price. However, the quarter ended with Iliad proposing to buy the entire company for $24 per share, around the current market price but well below our value. The bid seems aimed at managing regulatory thresholds for acquiring over 33% of a Luxembourg company, even if the initial tender offer is rejected. We continue to monitor developments actively, while remaining confident in the company’s continued strong performance and intrinsic value.

Prosus – Global consumer internet group Prosus contributed for the quarter. Nearly 80% of Prosus’s net asset value (NAV) comes from its stake in Tencent, which saw improved trends in gaming and advertising. Profits grew much faster than revenue due to a shift towards higher-margin revenue streams. Tencent continued its significant share repurchases aiming to buyback HK$100 billion worth of shares this fiscal year. Additionally, Prosus achieved profitability in its consolidated e-commerce portfolio while maintaining strong top-line growth, marking an important milestone that demonstrates management’s focus on profitable growth rather than growth at any cost. Most importantly, capital allocation has shifted towards shareholder returns, with Prosus buying back 22% of its float over the last two years, resulting in material NAV per share accretion.

FedEx – Global logistics company FedEx contributed for the quarter. Late in the quarter, FedEx reported strong fiscal year results, highlighting a year of strong cost management in a challenging revenue environment. Earnings per share (EPS) increased by 19%, and reduced capital expenditures narrowed the gap between EPS and FCF per share. With the increase in FCF, the company has become a significant share repurchaser, which is a welcome change. The company also announced a strategic review of their Freight segment. Our appraisal has long accounted for the underappreciated value in FedEx’s less-than-truckload operations. A potential spin-off or sale could unlock substantial value, as comparable companies like Old Dominion trade at significantly higher multiples on revenue, cash flow, and earnings than those applied to FedEx Freight by the market and our appraisal today.

Bio-Rad – Life sciences company Bio-Rad was the top detractor in the quarter. The company was one of our new investments last year, and so far, we have been early on our expectations for their life sciences business to return to more normal pre-COVID growth trends. We still believe that growth tailwinds are delayed, not derailed, and there have been no new material threats to Bio-Rad’s competitive position since we established our position last year. We are encouraged by the company’s use of a strong balance sheet to repurchase shares opportunistically. Current margins are below peer levels, suggesting potential for improvement, thereby further increasing FCF per share. The market also continues to undervalue their multi-billion-dollar stake in Sartorius. We anticipate Bio-Rad will return to solid growth. Many of its peers are valued as if this growth is already occurring, even in this tough industry environment. While we can’t predict the exact timing, we believe this recovery will happen sooner than the market expects.

Eurofins – The global leader in laboratory testing and services Eurofins detracted for the quarter. The company had a relatively quiet quarter until the final week of June when the share price fell over 20% following a short report by Muddy Waters. Eurofins has since issued a rebuttal. Our pre-investment analysis had already examined the key issues raised in the report, reaffirming Eurofins as one of our top investments. While frustrated by the timing, Eurofins must wait until it reports its first-half results in late July to respond with tangible actions. However, the company and its controlling shareholder/CEO have indicated they may consider significant share purchases if current prices persist. Despite the short-term setback, our long-term outlook on Eurofins remains positive. The short report may ultimately prove beneficial, as Eurofins is now looking to find a finite solution for one of the core issues raised, the historic related party transactions, all over a decade ago, that left the founder and controlling shareholder as a significant landlord for the group. They are also revisiting capital allocation priorities, which may result in larger near-term returns to shareholders.

Delivery Hero – German-listed food delivery business Delivery Hero was also a top detractor. Despite reporting inline results and upgrading its revenue guidance, the stock underperformed due to competition concerns in Korea, its largest market, and the potential entry of China’s largest food delivery platform into the Middle Eastern market, starting with Saudi Arabia, a crucial and profitable market for Delivery Hero. However, there were several positive developments. The company struck a deal to sell its Taiwan business to Uber for $950 million, nearly three times the enterprise value (EV) to gross merchandise value (GMV) multiple at which Delivery Hero was trading. In other words, Delivery Hero is selling 3% of their GMV for 8% of the group’s EV. This accretive transaction will help reduce financial leverage, although the market is not pricing it in until the deal closes next year after the competition review. Additionally, we are excited about board renewal activity. A credible activist shareholder took a meaningful stake and joined the board, and Prosus, another investment of ours that owns 30% of Delivery Hero, is also engaging more with the management team. We see significant opportunities for improved returns through revenue optimization, cost efficiencies, and portfolio rationalization, and we expect the renewed board to pursue these initiatives with urgency.

Portfolio Activity

We made no new investments or exits this quarter. However, we did make some adjustments, trimming and adding to positions where we believe we could enhance the portfolio both qualitatively and quantitatively. We’ve also seen some promising companies enter our watchlist, further strengthening our outlook. We look forward to discussing these opportunities with you as the year progresses.

Outlook

Despite disappointing short-term absolute returns in the quarter, the businesses we own made progress on the metrics that matter most. We are positioned well for the rest of this year. The positive stock price moves for our holdings since quarter end are good, early signs on this front. The valuation gap between the broader market and our portfolio is at a uniquely high level, reinforcing our confidence. Our holdings consist of competitively entrenched businesses with robust balance sheets and proactive management teams focused on growing and recognizing value per share. The Fund ended the quarter with a price-to-value ratio in the low-60s%, and we are confident that our portfolio is well positioned for future absolute returns and relative outperformance across various market conditions. Thank you for your continued support and investment.

|

Before investing in any Longleaf Partners Fund, you should carefully consider the Fund’s investment objectives, risks, charges, and expenses. For a current Prospectus and Summary Prospectus, which contain this and other important information, visit Longleaf Partners Fund. Please read the Prospectus and Summary Prospectus carefully before investing. Risks The Longleaf Partners Global Fund is subject to stock market risk, meaning stocks in the Fund may fluctuate in response to developments at individual companies or due to general market and economic conditions. Also, because the Fund generally invests in 15 to 25 companies, share value could fluctuate more than if a greater number of securities were held. Investing in non-US securities may entail risk due to non-US economic and political developments, exposure to non-US currencies, and different accounting and financial standards. These risks may be higher when investing in emerging markets. The FTSE Developed Index is a market-capitalization weighted index representing the performance of large and mid-cap companies in Developed markets. The index is derived from the FTSE Global Equity Index Series (GEIS) which covers 98% of the world’s investable market capitalization. The FTSE Developed Value Index measures the performance of the investable securities in the developed large and mid-cap value segment of the market, which includes companies that are considered more value oriented relative to the overall market. The S&P 500 Index is an index of 500 stocks chosen for market size, liquidity and industry grouping, among other factors. The S&P is designed to be a leading indicator of U.S. equities and is meant to reflect the risk/return characteristics of the large cap universe. Indexes are unmanaged, do not reflect the deduction of fees or expenses and cannot be invested in directly. P/V (“price to value”) is a calculation that compares the prices of the stocks in a portfolio to Southeastern’s appraisal of their intrinsic values. The ratio represents a single data point about a holding and should not be construed as something more. P/V does not guarantee future results, and we caution investors not to give this calculation undue weight. Price / Earnings (P/E) is the ratio of a company’s share price compared to its earnings per share. Gross Domestic Product (GDP) is the final value of the goods and services produced within the geographic boundaries of a country during a specified period of time. EBITDA is a company’s earnings before interest, taxes, depreciation and amortization. Net Asset Value (NAV) is a statement of the value of a company’s assets minus the value of its liabilities. “Margin of Safety” is a reference to the difference between a stock’s market price and Southeastern’s calculated appraisal value. It is not a guarantee of investment performance or returns. Free Cash Flow (FCF) is a measure of a company’s ability to generate the cash flow necessary to maintain operations. Generally, it is calculated as operating cash flow minus capital expenditures. Enterprise value (EV) is a company’s market capitalization plus debt, minority interest and preferred shares, and less total cash and cash equivalents. Gross Merchandise Value (GMV) is the total amount of sales a company makes over a specified period of time. As of June 30, 2024, the top ten holdings for the Longleaf Partners Global Fund: FedEx, 6.9%; CNX Resources, 6.0%; EXOR, 6.0%; Millicom, 5.9%, Prosus, 5.9%, Affiliated Managers Group, 5.6%; IAC, 5.1%; Kellanova, 5.1%, Fidelity National Information Services, 4.9% and Richemont, 4.9%. Fund holdings are subject to change and holdings discussions are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Funds distributed by ALPS Distributors, Inc. LLP001530 Expires 10/31/2024 |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here