MKS Instruments (NASDAQ:MKSI) is a major supplier of components and subsystems to major semiconductor equipment companies Lam Research (LRCX) and Applied Materials (AMAT), and about one-third of its revenues come from these two companies. MKSI was in the spotlight on Wednesday July 10, as Bank of America started coverage on the semiconductor equipment company with a Buy rating.

In this article, I analyze MKSI as well as two other companies in the supply chain – Ichor Holdings (ICHR) and Ultra Clean Holdings (UCTT), evaluating financial metrics and attempting to answer the question as to whether to invest in the supply chain or the major customers. This analysis is not an attempt to question the rationale of investing in a small company, and those in the supply chain usually are, but is focused on investing in the supply chain or the customer in the semiconductor industry.

Pros and Cons of Investing in Smaller Supply Chain Companies

Supply chain companies are smaller, and could offer a sizeable growth potential with more room to expand compared to larger ones. Their focus on innovative, specialized products makes them crucial to their larger customers. The synergy between these products and the design of the completed equipment system provides steady revenue and long-term contracts. MKSI, as opposed to ICHR and UCTT, serves various industries, diversifying its revenue base and reducing investment risk.

However, investing in smaller supply chain companies carries risks, with stock prices prone to significant fluctuations. Their dependency on a few large customers poses a risk if their customers experience downturn, which are commonplace in the cyclical semiconductor industry. Importantly, these smaller firms lack the resources of larger companies, making them more predisposed to market disruptions and economic downturns. This was clearly a problem for Lam Research following covid lockdowns, and I discussed it in several Seeking Alpha articles such as my June 27, 2021 article entitled “Lam Research: Robust Demand Offset By Supply Chain Disruption.”

Now that the supply chain problems are behind us, I was prompted to write this article because of a June 29, 2024 MarketWatch article entitled 11 favored semiconductor stocks expected to outperform Nvidia over the next year, which listed Ichor Holdings as one of these favored stocks. The upgrade of MKSI by BofA solidified the writing of this article.

Sales Analysis of MKSI and Other Suppliers to Applied Materials and Lam Research

MKS Instruments (MKSI), which provides process control solutions, vacuum technology, and photonics products such as pressure measurement and control instruments, gas and vapor delivery systems, and ozone generators. Its products are used in major semiconductor processing steps, such as deposition, etching, cleaning, lithography, metrology, and inspection, and the company believes it has the broadest critical subsystem provider in the wafer fabrication equipment ecosystem and addresses over 85% of the market.

There are two other major suppliers that are key to both AMAT and LRCX.

- Ichor Holdings (ICHR), which provides fluid delivery subsystems and component, such as delivery subsystems that deliver, monitor, and control precise quantities of the specialized gases by blending and dispensing the reactive liquid chemistries used in semiconductor manufacturing processes such as chemical-mechanical planarization, electroplating, and cleaning.

- Ultra Clean Holdings (UCTT), which is a leading developer and supplier of critical subsystems, components, parts, and ultra-high purity cleaning and analytical services primarily for the semiconductor industry.

Analysis of Applied Materials and Lam Research

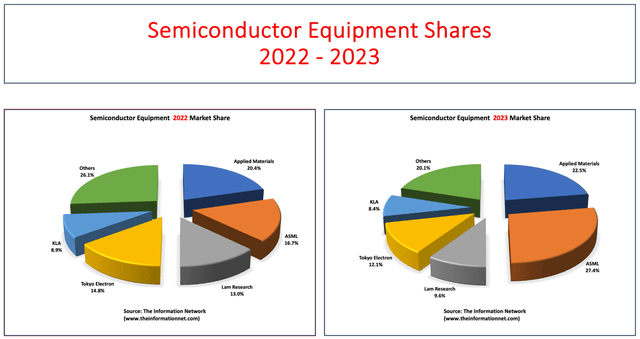

According to my analysis of the semiconductor equipment market, Applied Materials and Lam Research are among the top semiconductor equipment companies. As I first reported in my March 4, 2024 Seeking Alpha article entitled Applied Materials’ WFE Market Share Plummets 5% Below ASML In 2023, AMAT was the #2 company globally with a 22.5% share and LRCX was the #4 company with a 9.6% share. Chart 1 shows global shares for 2022 and 2023 according to The Information Network’s report entitled Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

For 2024, I see a recovery of WFE revenues, which was dropping by double digits in mid-2023 but ended down just 2% because of pull-ins of equipment purchases from 2024 into 2023, primarily by Chinese semiconductor companies. Thus, a recovery won’t happen until 2H 2024, and even then, revenue for the year will be just 1%.

The Information Network

Chart 1

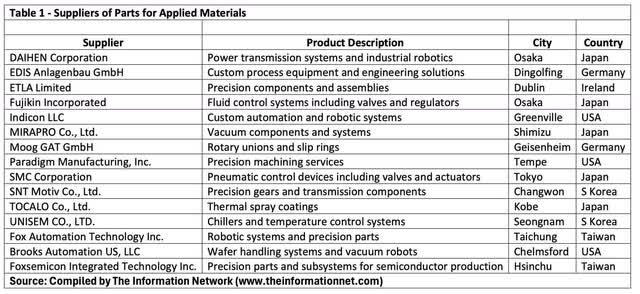

Investors need to realize that these equipment companies assemble their semiconductor systems made by a large number of third-party companies. Table 1 are winners of Applied Materials’ Supplier Excellence Award for 2023. Lam Research has its own supplier list but the variety of parts and international location of suppliers is similar.

Applied Materials, The Information Network

Sales Analysis of Suppliers to Applied Materials and Lam Research

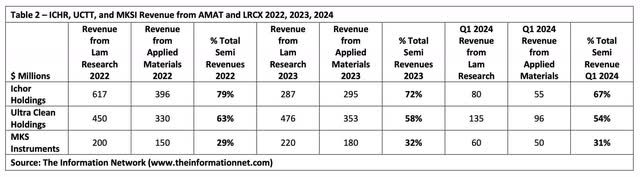

In Table 2, I list revenues for MKSI, ICHR, and UCTT from sales of components to AMAT and LRCX for 2022, 2023, and 1Q 2024. The table shows relatively consistent revenue from MKSI during this period. But it also indicates significant shifts in the percentage of total revenues for ICHR and UCTT between 2022, 2023, and Q1 2024.

For Ichor, revenues from Lam decreased 47% YoY between 2022 and 2023, from $617 million in 2022 to $287 million in 2023, but Applied Materials’ revenue dropped 25% YoY. This drop is attributed to a significant decrease in Ichor’s total revenues, which dropped 37% YoY from $1,280 in 2022 to $811 in 2023. As noted in Chart 1, Lam’s market share decreased from 13.0% to 9.6%, as its revenue dropped 24.2% in 2023.

Over the period of this analysis sales to LRCX and AMAT declined slightly. These suppliers are impacted by orders for products from their customers, who in turn are impacted by the state of the semiconductor industry. In Q1 2024, for example, Ichor was impacted by slowing in build rates for EUV gas delivery associated with order delays in leading-edge logic.

The Information Network

Investor Takeaway

I’ve often been asked by readers whether to invest in MKSI, ICHR, and UCTT, large suppliers of subsystems and parts to Applied Materials and Lam Research or to instead invest in these major equipment companies, which assemble parts not only from these three companies but from a large variety of suppliers into a finished system and sell them to semiconductor manufacturers.

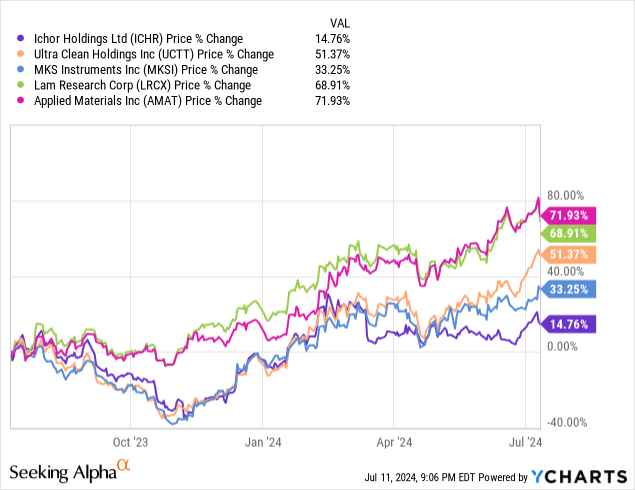

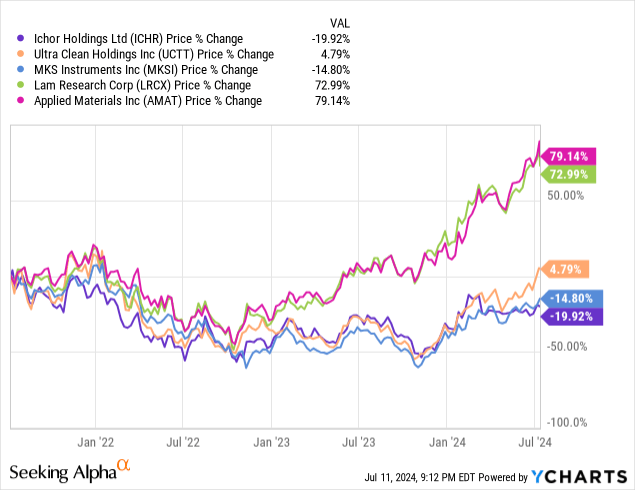

In Chart 2, I show share prices of these five companies for a 1-Year period, with clearly LRCX and AMAT exhibiting stronger growth than MKSI and UCTT, and well ahead of ICHR with mid-single digit performance. MKSI’s share price has grown just 33.25% compared to 71.93% for AMAT and 68.91% for LRCX.

YCharts

Chart 2

Over a 3-year period, the differences are even more striking, as shown in Chart 3. MKSI’s share price has decreased 14.80% while AMAT increased 79.14% and LRCX increased 72.99%.

YCharts

Chart 3

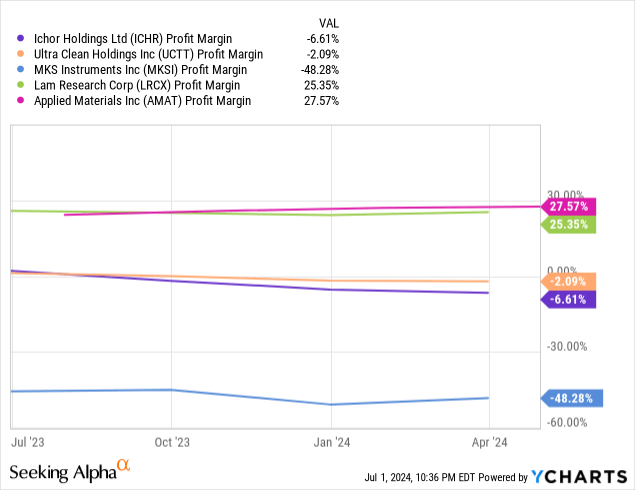

In Chart 4, I show Profit Margin for the five companies. Again, the differences between supply chain companies and major equipment suppliers is extraordinary. All three parts suppliers exhibit negative profit margins for the 1-year period while LRCX and AMAT have double digit margins.

YCharts

Chart 4

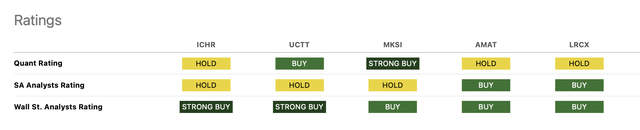

In Chart 5, I compare ratings of the five companies by Quant, SA Analysts, and Wall St. Analysts. Seeking Alpha’s rating is a Strong Buy. I disagree. I rate MKSI a Hold, reinforced by the upgrade by BofA.

With respect to the other companies, I rate LRCX and UCTT also a Hold, and ICHR and AMAT a Sell.

Seeking Alpha

Chart 5

Read the full article here