Odds were already looking good for those expecting looser monetary policy in the months ahead. These chances just got better following today’s monthly data on the consumer price index (“CPI”).

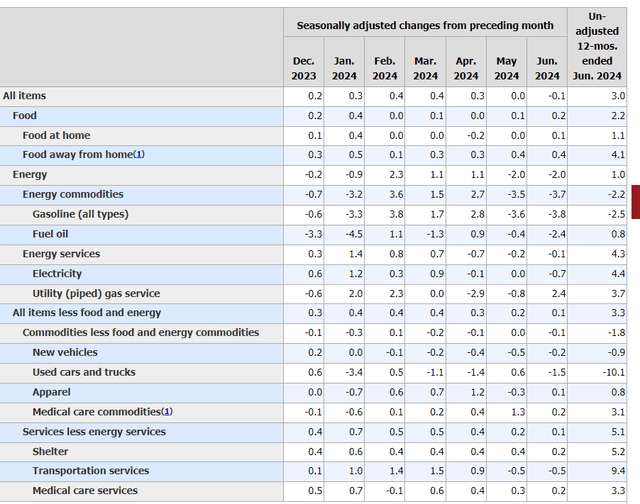

Prices surprisingly declined 0.1% on the month, according to the Labor Department’s monthly release. Forecasters were expecting a 0.1% increase following a flat reading in May. On a twelve-month basis, the index rose 3.0%, also below expectations of a 3.1% increase.

Excluding the volatile food and energy categories, core CPI also rose less than expected at 0.1% for the month and 3.3% YOY. The better-than-expected readings continue a trend first seen in the May data released last month.

Equity markets have torn through the record books recently. On Wednesday, the S&P 500 (SP500) topped 5,600 for the first time after closing at its sixth straight record close, with all 11 sectors of the index advancing. Notable gains were logged once again by the most popular names. Nvidia (NVDA) stock, for example, climbed 2.7%. Likewise, shares in Tesla (TSLA) also climbed higher for the 11th consecutive day.

Pre-market trading was initially marked by more muted trading in the three indexes. The positive data, however, turned indexes higher in the morning hours, with the Dow Jones Industrial Average (DJI) and the Nasdaq Composite (NDX), which closed at its 27th record of 2024 on Wednesday, each up about 80 points. The S&P was also higher but more flattish. In the bond markets, 10-year Treasuries (US10Y) fell further to 4.198% after closing at 4.28% on Wednesday.

Falling prices, especially in some core categories, are a welcome relief for consumers. However, prices remain sticky in the most substantive categories, such as shelter. For interest-rate observers, today’s report will almost certainly have no impact on the rate direction at this month’s Federal Open Market Committee (“FOMC”) meeting. But it may further solidify the case for a rate cut in September. Here are some more insights into where prices rose and fell in June, as well as the implications for Federal Reserve (“Fed”) policy.

Where Prices Rose In June

Housing inflation has been the most stubborn component of the overall index. This didn’t change in June as the line item rose 0.2%, marking the fifth consecutive month of increase following a 0.4% increase in May. The increase in housing was fueled by an increase in both rent and owners’ equivalent rent, each of which rose 0.3%. These increases highlight the ongoing stickiness in housing inflation despite overall decreases elsewhere.

BLS – Summary of CPI By Individual Category

Medical care also remained elevated in June. Medical care commodities rose another 0.2% in June, as did medical care services, which also rose 0.2%. A 0.1% increase in hospital services contributed to this increase.

The rate of increase in the medical care index was slowed by a flat reading on the prices of prescription drugs, following a 2.1% increase in the month prior. A recent report from GoodRx Holdings (GDRX) showed that prescription drug prices have increased by 40% over the last decade, forcing many to give up their prescriptions. Any relief in pricing in this area, as seen in today’s CPI report, will serve as a welcome step in breaking this trend.

Elsewhere, prices ticked higher in apparel, which increased 0.1% on the month, as well as in the personal care, education, and recreational indexes.

Where Prices Fell In June

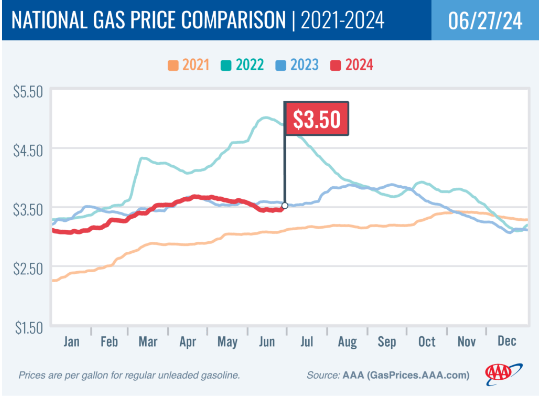

While overall energy prices are up YOY, falling gasoline prices have provided some relief over the last two months. In May, the index declined by 3.6% for the month, and in June, it fell by another 3.8%. These declines occurred despite an increase in summer travel in the U.S. Gas prices did spike before the Independence Day holiday as oil prices surpassed the $80 per barrel mark. This is likely to be reflected in the July CPI reading.

AAA – Chart of National Gas Prices From 2021 Through Present

In the longer term, oil prices may decrease due to weakening global demand and increased supply. A report released today by the International Energy Agency (“IEA”) reduced its forecast for oil demand next year to 980,000 barrels per day, down from the previous estimate of 1 million barrels. Although the forecast for the current year was increased, the demand growth is expected to be driven primarily by developing nations. According to the agency, these updates reflect both market normalization and the increased adoption of electric vehicles.

In addition to falling prices at the pump, travelers also benefitted from a continued decline in airline fees, as well as in the rental of cars and trucks and motor vehicle insurance. Fares to fly dropped another 5% after declining 3.6% in May. The decreases in motor vehicle insurance are notable given the outsized increases in prior periods. While the index is still up more than 6x the topline index, the recent declines could be viewed as a welcome reprieve.

Used vehicle prices also resumed their decline after a one-off month of increasing 0.6% in May. In June, prices declined 1.5%, bringing their twelve-month decline to 10.1%.

Fed Policy Implications

The June CPI report follows Fed Chair Jerome Powell’s two days of congressional testimony earlier this week. During his testimony, Powell struck a more dovish tone. In his remarks, he noted that inflation was not the only risk, referencing the cooling labor market and its implications for the broader economy.

The commentary on the labor market is notable. In prior speeches, policymakers have blamed a tight labor market for inflationary pressures. And Powell has previously stated that some softening of labor market conditions would be necessary to support reduced inflationary pressures. Moderating job growth, as seen in June, and the upward trend in unemployment are clear signs of softening that Powell was likely looking for.

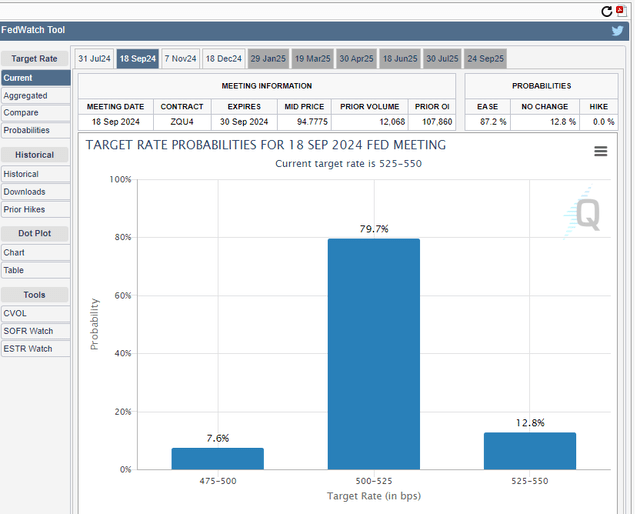

While no movement on rates is just about a foregone conclusion at this month’s FOMC meeting, the chances are significantly better in September. In prior coverage on both the monthly payroll and CPI reports, I’ve consistently predicted that the Fed would likely lower rates at least once this year beginning in September. Today’s CPI release reaffirms my views regarding timing.

According to the CME’s FedWatch Tool, observers saw a 70% chance of a rate cut in September before the release of today’s report. Those odds jumped to the 80% mark following the release. The jump is for good reason, considering the positive trends seen in the June CPI report.

CME FedWatch Tool – Target Rate Probabilities For September FOMC Meeting

Final Takeaway Of June CPI Report

Fed Chair Jerome Powell has emphasized, on more than one occasion, the need for greater confidence in declining inflation. Today’s June CPI data fits the bill of the positive trends required to bolster this confidence. Last week’s labor report, which showed a rise in unemployment and moderating job gains, also supports this outlook. Combined, these factors could suggest a favorable scenario for a potential rate reduction as early as September.

Read the full article here