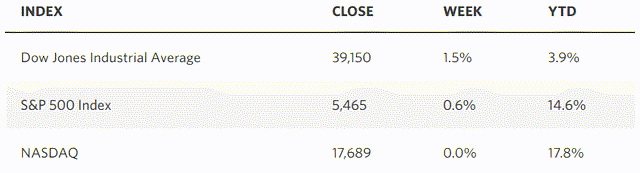

Despite outsized returns for the S&P 500 and Nasdaq Composite, the first half of 2024 was anything but easy for investors. The equally weighted S&P 500 was up a mere 4.1%, and the Russell 2000 managed a gain of just 1%. While the average stock languished, a handful of mega-cap technology names, supercharged with the euphoria over artificial intelligence (AI), propelled the major market indexes higher. These mammoth enterprises are viewed as impervious to what has concerned investors the most — interest rates that may stay higher for longer, sticky inflation, and a slowing rate of economic growth. They generate huge amounts of cash, have no borrowing needs, and still have unlimited access to capital. Their only weakness may be the law of large numbers, as their spectacular growth rates are clearly unsustainable.

Edward Jones

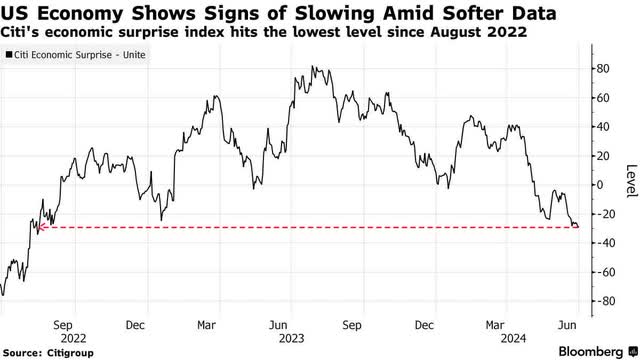

That is why I am looking for a pullback in the broad market this summer, instigated by profit taking in these market leaders, as profit and revenue growth rates decelerate. At the same time, we are likely to see a period of increased uncertainty between now and when the Fed ultimately begins to lower short-term interest rates, which could increase market volatility and hasten any pullback. I doubt Fed officials will give any indication a rate cut is coming before their September meeting. Meanwhile, signs of a softer labor market, consumer fatigue, and delays in capital investment in advance of the election are likely to raise concerns between now and the meeting on September 3 that the Fed is waiting too long to ease policy. The fears of inflation will morph into concerns about weakening rates of economic growth.

Bloomberg

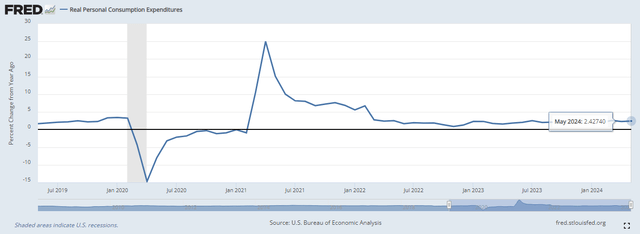

If the Fed does begin to lower rates two months from now, which is my expectation, I think concerns about economic growth will be overdone. The rate of overall consumer spending in May rebounded from April, but more importantly, the real (inflation-adjusted) rate of consumer spending growth over the past year increased 2.4%. That supports an economic growth rate in line with its long-term trend of 2%. Consumers may be far more cost conscious today than they were during the post-pandemic period when excess savings soared, but they are far from struggling based on last month’s data. Considering that consumer spending accounts for approximately 70% of our economic growth, only when real year-over-year consumption rates fall below 1% will I become concerned about the resilience of this expansion.

FRED

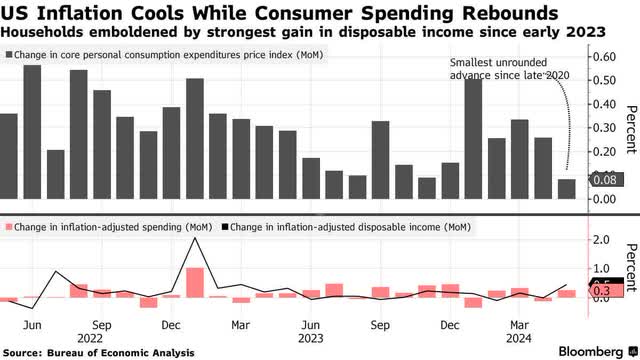

While consumer spending rebounded, the core rate of inflation resumed its disinflationary trend after three months of no progress. The core personal consumption expenditures (PCE) price index fell from 2.8% to 2.6% with an increase of 0.08% from April to May resulting in the smallest monthly increase since late 2020. If we can repeat those numbers in June, which would be a July report, I think the Fed will be prepared to begin the rate-cut cycle on September 3, easing concerns about the rate of economic growth that are bound to manifest between now and then.

Bloomberg

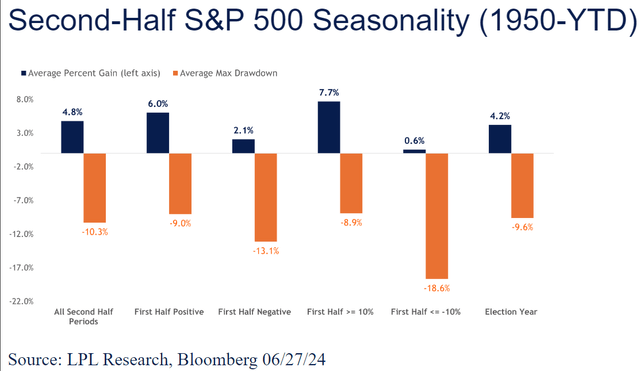

On the quantitative front, our solid first-half performance, no matter how derived, bodes well for the second half of this year. Over the past 75 years, when the S&P 500 has posted a return of better than 10% during the first six months, the remainder of the year has realized the highest average return (7.7%) in combination with the smallest average drawdown (-8.9%). That is a favorable mix for the soft landing narrative.

Bloomberg

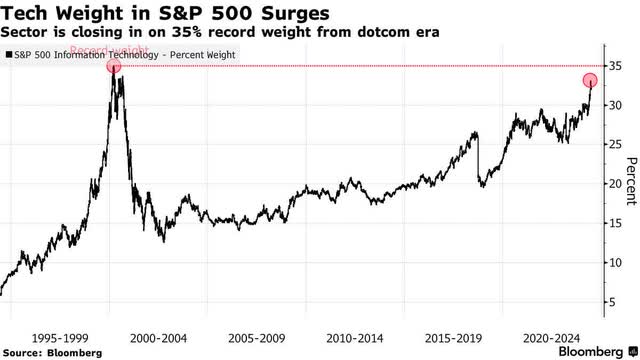

If we do realize a drawdown, which I think is normal and overdue to refresh the uptrend, I can’t find a more logical place for its epicenter than the technology sector. If not based on valuations alone, the sector weighting has become so excessive that a rebalance seems inevitable. Although the difference between today and when we last saw a similar dominance is that today’s technology companies have fortress like fundamentals that should support premium valuations over the longer term.

Bloomberg

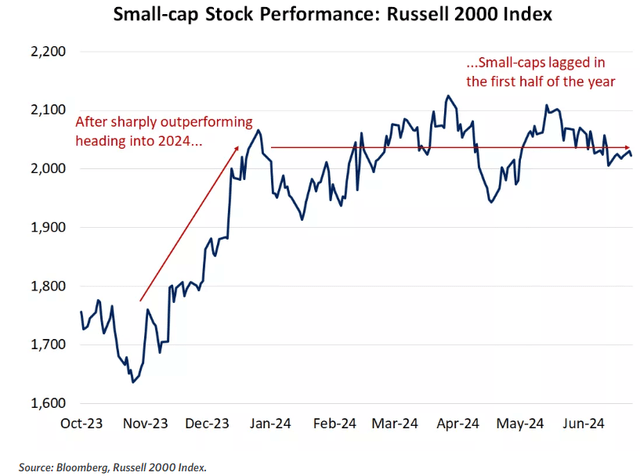

I still expect the primary beneficiary of monetary policy easing and a soft landing to be small-cap stocks, which have suffered on two fronts. The first and more obvious has been higher borrowing costs, which a rate-cut cycle should start to remedy. The second is fears of slower growth if not a recession, which pundits have been forecasted for nearly two years. If we can pull off this soft landing, small caps should have an explosive quarter or two, as they did in the fourth quarter of last year. Valuations for those companies that are earning net income are extraordinarily cheap compared to their large-cap peers.

Edward Jones

Read the full article here