The following segment was excerpted from this fund letter.

MercadoLibre (NASDAQ:MELI)

Another prime example of how alternative payment systems can boost a company’s core offering is MercadoLibre, Latin America’s largest online retailer, which we added to the portfolio during the quarter.

Since we last wrote about the company four years ago, its management has done a great deal to further differentiate its offerings from those of rivals in a highly competitive industry, leading to market-share gains across the region. In the same way that the company built its own fulfillment infrastructure to improve the customer experience in areas where third-party delivery services were lacking, it has built its own payments and credit infrastructure to otter better shopping experiences to its customers and reduce barriers that have otherwise discouraged e-commerce adoption.

MercadoLibre started its payments business, Mercado Pago, in 2003, only four years after launching its namesake e-commerce platform. It has since become the leading private payment provider in the region, accounting for 13% of all retail sales in Latin America, both online and offline, more than any single card issuer or private form of payment other than cash. Nearly three quarters of its payments now take place outside of MercadoLibre’s online site. Mercado Pago comprises more than half of the company’s total earnings and cash flow, which has helped to fund investments elsewhere—especially in logistics—that have served to reinforce its lead in e-commerce.

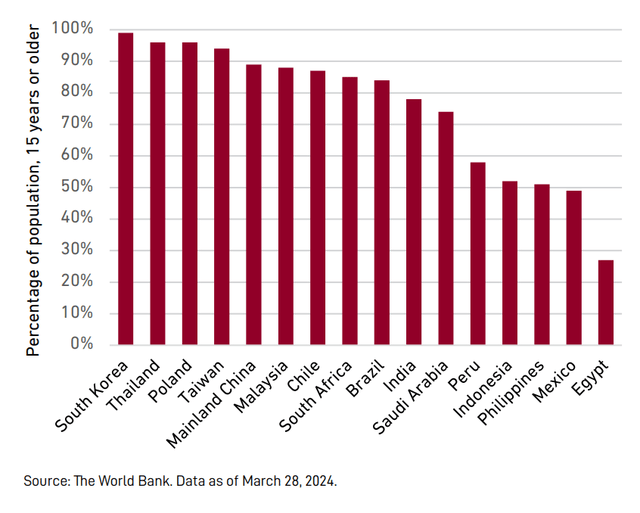

Banking Penetration

Percentage of population with bank or mobile-money accounts in select emerging markets, through 2022

Mercado Pago has been especially important to MercadoLibre’s success in Mexico, the region’s second-largest economy and MercadoLibre’s third-largest market, accounting for more than 20% of its sales. With the largest unbanked population in Latin America, many online shoppers have had to pay cash on delivery, a sometimes cumbersome process that Mercado Pago was able to help resolve. For more than half of MercadoLibre’s users, Mercado Pago was the first digital payment method available to them. In addition, more than half of the credit offered by Mercado Pago went to customers getting their first access to credit ever; half of them were women, who have been particularly underserved by banks.

This access to digital payments and credit has strengthened the competitive position of MercadoLibre’s e-commerce business, allowing it to capture more than 20% market share in Mexico, ahead of well-resourced rivals Amazon.com (AMZN) and Walmart de México (WMT) and despite the entry of Asian competitors such as Alibaba’s (BABA) AliExpress, Sea’s (SE) Shopee, and PDD Holdings’ (PDD) Temu. In Brazil, MercadoLibre’s largest market, its share has risen to just under 40%, approaching the more than 50% share in its first market of Argentina.

As its credit business grows, MercadoLibre will have to decide how to fund that growth more efficiently, while managing risks to its balance sheet. Banks will also fight back. On the other hand, regulators are likely aware of the lack of competition in the financial sector. When Mexico’s antitrust commission expressed concern about MercadoLibre and Amazon.com’s (AMZN) dominance of the online retail market, it chose to focus its recommendations on more transparency for merchants and on bundled services such as Amazon Prime’s streaming videos, not Mercado Pago—likely in recognition of the even more dominant role of banks in the financial system.

Regulations on lending practices are another inherent concern. There is a fine line between financial inclusion and usury, and where that line lies isn’t always clear, especially in a region that typically faces high inflation rates. Companies that step over these lines risk both exacerbating social problems and inviting regulators to put a collar on their businesses. Mercado Pago’s scale allows it to manage both of those risks better than its peers.

For one thing, Mercado Pago’s mainstream reach across its largest markets gives it a customer base that is far broader than those of the payday lenders or peer-to-peer lenders in the US and China that saw their industries largely wiped out by regulation. By covering a wide swath of the population, Mercado Pago has more representative data on borrowers than traditional banks. For its credit-risk managers, this provides invaluable information to navigate through often deep credit cycles, giving them a higher chance of catching concerning changes in behavior before they snowball and trap the most vulnerable customers in debt.

MercadoLibre and FEMSA have built valuable businesses for themselves in payments, ones that also address a pressing need for many customers of their retail businesses. There is still much work to do in promoting financial inclusion in Latin America compared to many other emerging markets (see chart above). That also means there is a continuing opportunity for MercadoLibre, FEMSA, and other companies to lower financial barriers for customers while at the same time differentiating themselves from their competitors and boosting their own businesses.

|

The portfolio is actively managed; therefore, holdings shown may not be current. Portfolio holdings should not be considered recommendations to buy or sell any security. It should not be assumed that investment in the security identified has been or will be profitable. To request a complete list of holdings for the past year, please contact Harding Loevner. A complete list of holdings at March 31, 2024, is available on page 9 of this report. Harding Loevner’s Quality, Growth, and Value rankings are proprietary measures determined using objective data. Quality rankings are based on the stability, trend, and level of profitability, as well as balance sheet strength. Growth rankings are based on historical growth of earnings, sales, and assets, as well as expected changes in earnings and profitability. Value rankings are based on several valuation measures, including price ratios. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here