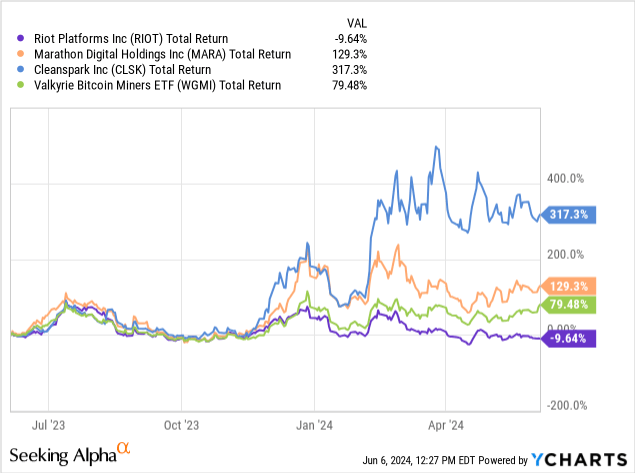

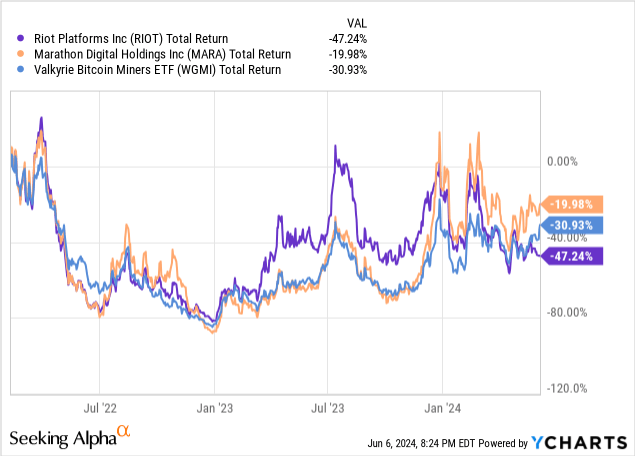

One of the Bitcoin (BTC-USD) miners that has lagged the peer group year to date and over the last 12 months is Riot Platforms (NASDAQ:RIOT). Down 12% over the last year while other mining peers have doubled and in some cases even quadrupled, RIOT has been a disappointing ticker for mining stockholders at down almost 10%:

Riot is a company that I’ve covered for Seeking Alpha in the past. I’ve previously been bullish the name last year due to the company’s mix of EH/s capacity, debt-free balance sheet, and large unencumbered BTC stack. However, in my most recent article covering the company in February, I was less enthusiastic about the name and downgraded the stock to a “hold” due to what I viewed as efficiency concerns from the underlying business. A lot has happened in the four months since that coverage.

In this update, we’ll look at the company’s recent bid to takeover smaller mining peer Bitfarms (BITF), early post-halving production figures, and revenue trends to consider as Texas enters what could be yet another hot summer.

Bitfarms Takeover Bid

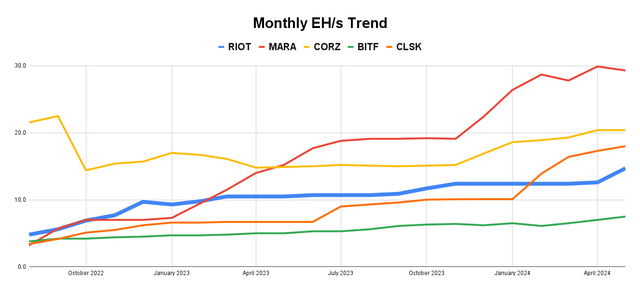

EH/s Trend (Author’s chart, company filings)

Less than two years ago, Riot Platforms was the second-largest Bitcoin miner by exahash capacity after only Core Scientific (CORZ). Marathon Digital (MARA) has impressively scaled to the top spot over the last 12 months. But today, Riot finds itself behind even CleanSpark (CLSK) which has quickly catapulted to a top tier miner. Given Riot’s nearly $1.3 billion in balance sheet liquidity between cash and Bitcoin, it’s not surprising to see the company already being active as Bitcoin mining faces consolidation.

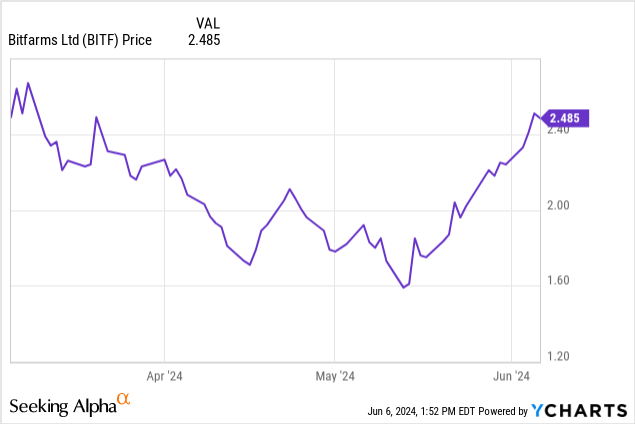

On June 5th, Riot Platforms disclosed owning 12% of the outstanding common shares in Bitfarms stock. This is after reporting 10% ownership about a week prior. Riot’s disclosure of its beneficial ownership in Bitfarms comes about a month after making a buyout offer directly to the company at $2.30 per share. Per a prior disclosure:

In particular, on April 22, 2024, Riot sent a letter to the Board that set out Riot’s non-binding proposal to acquire all of the outstanding Common Shares of the Company (the “Proposal“) for consideration of US$2.30 per Common Share, to be paid with a combination of cash and shares of Riot’s common stock (the “Purchase Price“).

The Board of Directors for Bitfarms rejected Riot’s offer and recently announced a strategic review as the company attempts to figure out a path forward with buyout sharks apparently in the water. It should be noted that Bitfarms disclosed additional unsolicited expressions of interest in the company, though no specific names of additional suitors have been made public. It also bears mentioning that Bitfarms doesn’t have an acting CEO and is being sued by its last CEO for alleged wrongful dismissal and breach of contract.

Per Riot’s June 5th disclosure, the company is seeking presence on the company’s board of directors:

Riot currently intends to requisition a special meeting of the Company’s shareholders, at which Riot intends to nominate several well-qualified and independent directors to join the Company’s board of directors (the “Board“), which follows from Riot’s serious concerns regarding the Board’s track record of poor corporate governance.

Given Riot Platforms’ increased position in BITF stock, we appear to have a hostile takeover attempt happening in real time. As of article submission, Bitfarms shares are 8% above Riot’s original buyout offer price. But at 7.5 operational EH/s for the month of May, Bitfarms’ post-halving Bitcoin production isn’t terribly far off from what Riot averaged in the month when accounting for curtailment.

From Riot’s vantage, taking over Bitfarms’ operations is a fast way to grow operations in line with tier 1 peers without having to ship or energize machines. If Bitfarms does indeed have additional suitors who are willing to pay a higher price, it works to Riot’s advantage since it’s now such a large shareholder in the company.

Post-Halving Production & Power Credit Strategy

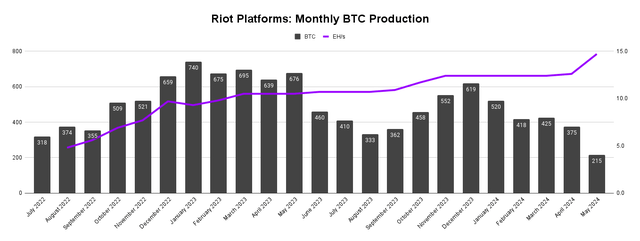

Riot Platforms has been slower to scale than other companies in the space. The latest production data from May shows a production figure that has predictably cratered following the block reward halving in late-April:

Monthly Production Figures (Author’s chart, Riot Platforms disclosures)

At just 215 BTC mined in May on 8.8 average operating EH/s, Riot’s BTC per EH/s figure in the month was 24.4. Bitfarm’s May figure was virtually the same. May is an important signal to the market because it’s our first indication of the viability of many of these companies in a post-halving environment. For Riot, May shows the fourth consecutive month of what amounts to a HODL strategy for the company, as it has kept all BTC produced.

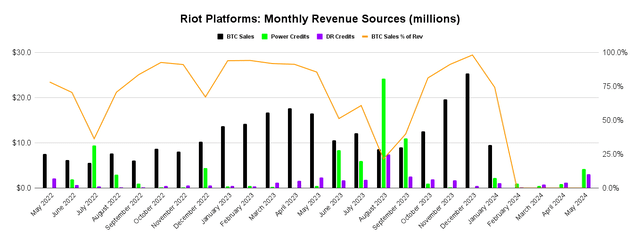

Between June and September 2023, Riot Platforms reported $63.1 million in total power credits. This was against $40.3 million in BTC sales at an average price of just under $28k. As of article submission, the price of BTC is near $71k. Thus, even with the reduced block reward following the halving, the price of Bitcoin is more than double what it was last year when Riot Platforms found energy credits to be the better strategy.

Monthly Revenue Sources (Author’s chart, Riot Platforms disclosures)

Yet despite what is few as terrific gains in the price of BTC over the last year, we can already observe Riot’s willingness to curtail as May 2024 resulted in $7.3 million in energy credits – a 160% increase over May 2023. And again, May was the fourth consecutive month that Riot didn’t sell any of its BTC production. Acquisitions aside, Riot’s revenue path over the next four months boils down to something that is largely out of the company’s control:

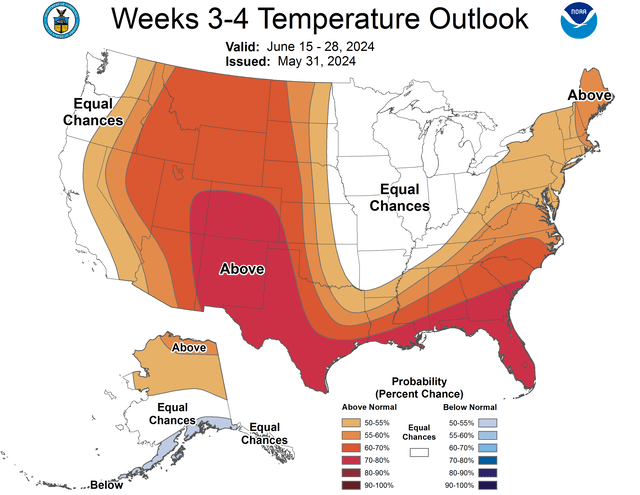

June Temperatures (NOAA)

June and July have both been previously forecasted to be hotter than average months for the state of Texas, with August and September being closer to normal. A more time sensitive update from NOAA (graph above) shows a high probability of above normal temperatures for nearly the entire state. While the company endured negative press because of its energy credits last year, RIOT’s stock responded very well to the strategy:

Risks

As I see it, the worst case scenario for Riot Platforms from an unapologetic business standpoint would be Bitcoin’s price declines and Texas simultaneously has a moderate to cool summer. If these things were to happen together, Riot’s power credit revenue would likely disappoint and the reality of operating mining machines in a post-halving world would impact the company’s bottom line. I would say that each of these factors are out of the control of the company.

Summary

From where I sit, Riot Platforms is an interesting trade idea, but probably not a great long term investment. Between now and likely the end of September, Riot should be able to benefit from power credit optionality. If it’s hot and Bitcoin’s price returns are lackluster, Riot can instead go the energy route for monetizing power. This is not something that every public miner is able to do, so it gives Riot Platforms and advantage in the event Bitcoin’s summer month price languishes. Alternatively, if Bitcoin’s price rockets higher, and it’s more economical to keep the machines running, Riot will benefit from its pivot to a HODL strategy and its Bitfarms equity will likely appreciate. There’s admittedly a lot of “ifs” and guesses here, but that’s the nature of the speculation game.

Read the full article here