Amidst depressed sentiment, the management team of Enovix (NASDAQ:ENVX) fired on all cylinders in the first quarter of 2024.

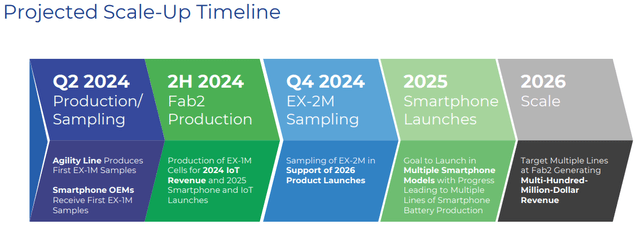

Key milestones for manufacturing have been reached and Enovix is on track to produce and deliver its first samples with the EX-1M technology in the second quarter of 2024 and for Fab2 to be ready for production in the second half of 2024.

As sampling goes out, I expect to see more commercial interest in Enovix. This was further supported by a development agreement that was signed with a top five smartphone OEM by volume.

Enovix is not stopping there, as six out of the top eight smartphone players are going to receive the EX-1M samples.

On top of these commercial developments, on the product front, Enovix has been hard at work improving its technology and product, with the next product, EX-2M, expected to sample in the fourth quarter of 2024, and the team is already working on EX-3M, which is expected to sample in 2025.

I have written extensively about Enovix on Seeking Alpha, which can be found here. I am more confident than ever about the company’s ability to deliver and in this article, I aim to share with you why that is so.

Manufacturing on track

As of the first quarter of 2024, Factory Acceptance Testing of the Gen2 Agility Line has been completed, and most of the machines are already in Malaysia, and Site Acceptance Testing is also well underway.

With that, management expects that they are on track to produce its first battery samples with the EX-1M technology in the second quarter of 2024.

Factory Acceptance Testing for the high volume Gen2 Autoline is also almost finished. Also, yields are expected to be upwards of 95% for its high volume Gen2 Autoline given they use the same process as the Agility Line.

With a huge focus on the qualification process and getting things right at an earlier stage, management has a high degree of confident in scaling the high volume Gen2 Autoline.

In the second quarter of 2024, Enovix will be sampling its first EX-1M batteries from the Agility Line to smartphone OEMs and some IoT customers.

In the second half of 2024, Fab2 will be ready for production.

By Q4’24, Enovix expects to sample the EX-2M.

By 2025, Enovix aims to launch multiple smartphones and IoT customers with the EX-1M battery.

In 2026, Enovix will be focused on scaling to multiple lines across Fab2.

Scaling up timeline (Enovix)

Commercialization showed huge progress

This quarter marks a new chapter for Enovix, and likely is one of the most significant on the commercialization front, as there were multiple material updates in the quarter.

The first major announcement on the commercialization front is that Enovix announced its first-ever development agreement with a top five smartphone OEM by volume.

This is a huge development for Enovix, essentially crushing critics that do not believe in any commercialization chances for the company. I am of the opinion that this is a great endorsement for its strategy to focus on large smartphone OEMs, and also a great endorsement in the company’s technology and management team.

I do think we will see more such development agreements being signed with Enovix through 2024 as more of the top eight smartphone OEMs sample Enovix’s products.

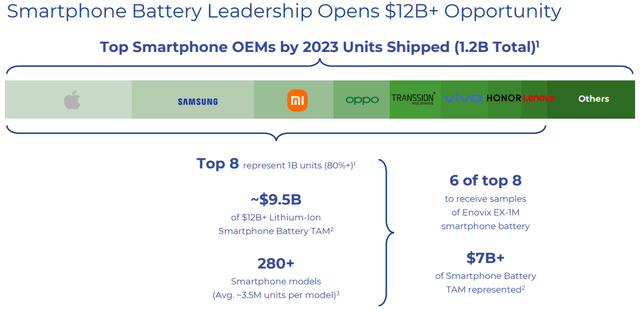

Before I talk about the second major announcement, I need to share more about the market opportunity for Enovix and where it is focused at.

This is one of the best slides that Enovix has presented in terms of its market opportunity.

As highlighted below, the smartphone battery market is about $12 billion today. 80%, or $9.5 billion, of the smartphone battery market is made up by the top eight smartphone players.

Smartphone opportunity (Enovix)

The second major announcement on the commercialization front that Enovix announced is that six out of these top eight smartphone players are going to receive the EX-1M samples from Enovix.

To put this in context, this represents $7.5 billion of the smartphone battery total addressable market.

For reference as to how big this opportunity is, the top eight smartphone players collectively produce about 280 smartphone models, and there is an average smartphone unit volume of 3.5 million per model.

Thus, from the perspective of Enovix, three to four of these smartphone models will utilize the full capacity of one of its Gen2 lines.

The smartphone market is the largest market within consumer electronics for Enovix, but there is another $12 billion of total addressable market in the combined IoT and computing segments.

There are two things to note.

The first is that the largest smartphone OEMs also happen to be the largest customers within the IoT and computing markets, producing tablets, wearables and computers that all represents incremental market opportunity if Enovix wins the smartphone business from these largest smartphone OEMs.

The second thing is also that the smartphone requirements are the strictest and most difficult to achieve among the three markets. If Enovix is able to win the smartphone business from these largest smartphone OEMs, there is a high likelihood that its IoT and computing businesses will also go to Enovix and even have a shorter qualification period thereafter.

Product roadmap

Enovix is focused on improving its batteries and is moving very quickly in this regard.

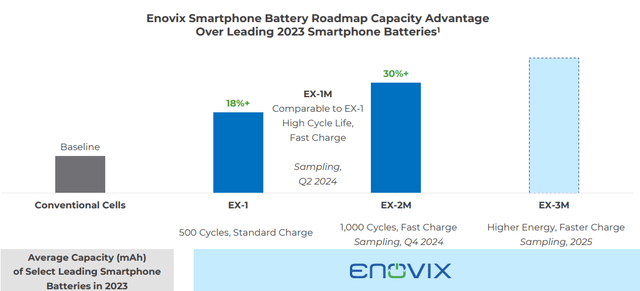

I have previously already mentioned EX-1, which is its current technology that has been sampling since last year, and EX-1M, which is differentiated from EX-1 in that it has better cycle life and fast charging characteristics.

EX-1M will be starting sampling in the second quarter of 2024, and this offering is already a level about the batteries available in the smartphone market.

The next product, EX-2M, will have further improvements to cycle life, energy density and fast charging, which is expected to sample in the fourth quarter of 2024.

The R&D team is already working on EX-3M, which will continue to have even more improvements to cycle life, energy density and fast charging, and EX-3M is expected to sample in 2025.

Product roadmap (Enovix)

The third key update from the commercialization front is that management shared that they continue to make progress with IoT customers, and the strategy here is similar to that of smartphones where it is focused on a few high-volume opportunities.

The commercial team is making progress on both EX-1M and EX-2M opportunities within the IoT space, and management expects these products to be launched in 2025 and 2026.

Smartphone OEMs are increasingly seeing the need for a battery with increased energy density for the growing number of on-device AI applications, and the number of engagements Enovix has with the top eight smartphone OEMs is telling.

Scaling up

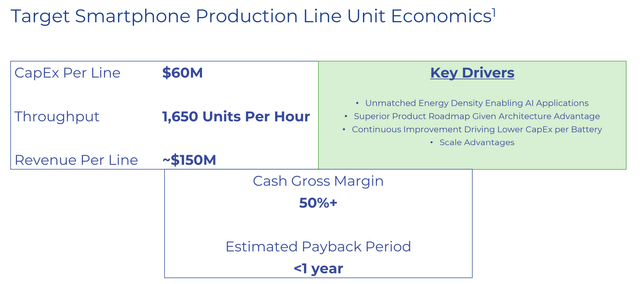

With the first line and Fab2 expected to start production by the second half of 2024, management now has a clearer view of the unit economics of its future production lines at Fab2.

From the capital expenditures perspective, management expects that $60 million in capital expenditures is needed for each line, and the target throughput for each line is 1,650 units per hour.

With that, each line is capable of generating $150 million in revenue per production line and with an expectation that the cash gross margin should be at least 50%, Enovix expects the payback of each of these lines to be just one year.

I think this gives a sense to investors as to how Enovix can scale the number of lines after the first line starts production in the second half of 2024, and that the company has an attractive unit economics as it scales the business.

Smartphone production line economics (Enovix)

Extending cash runway through cost reductions

Enovix announced cost reductions of $35 million, primarily within operating expense.

These are expected to materialize from Q4’24 into 2025 as more R&D activity moves from Fab-1 to Enovix’s lower cost sites in Malaysia, Korea, and India.

With these cost reduction measures and capital expenditures starting to trail off after the final vendor payments after the completion of FAT and SAT at Fab-2, the company expects to have sufficient cash on hand to last through 2026.

So, the question is whether Enovix will need to raise capital?

Management shared some insights on the call that with qualifications coming in and customers expressing interest to purchase Enovix batteries, there are two groups of potential sources of capital where the company can attract for the capital expenditures needed for subsequent production lines.

The first group are the customers who are increasingly offering Enovix financial support to enable the company to get to the next phase in terms of scaling up.

The second group are governments and sovereign wealth funds looking to provide Enovix with the capital, likely from Malaysia.

Lastly, management asserted and confirmed that at the current stock levels, they do not view raising equity as an option.

With the steps taken to improve the cost structure mentioned above, this also helped to lengthen the runway for Enovix such that it will not have any near-term need to raise capital.

My focus on the earnings is not necessarily the financials, given the main thesis lies on Fab-2.

For Q1’24, Enovix reported $5.3 million revenues, ahead of the $3.5 million to $4.5 million guidance, due to strength in IoT battery shipments from Routejade.

Q1’24 adjusted EBITDA loss of $26 million was in line with $24 million to $31 million guidance.

For Q2’24, Enovix’s guidance for revenue was between $3 million to $4 million and adjusted EBITDA loss of between $26 million to $32million and adjusted EPS loss between negative $0.22 to negative $0.28.

Valuation

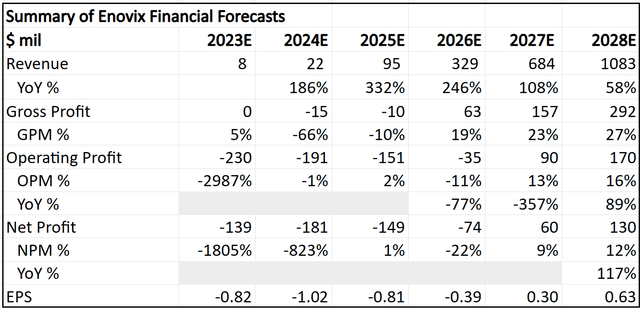

Needless to say, the financials of Enovix will change from time to time as more information on the progress on manufacturing, commercialization and margins appear.

I think on the spectrum of very optimistic to very pessimistic, my financials are on the conservative end because I think there are many risks and uncertainties along the way.

I assumed a 4% dilution each year or cumulative dilution of 20%, although management has guided that there will likely not be any equity capital raise in the near-term.

In addition, while if one line and four lines are fully operational, Enovix should be able to generate $150 million and $600 million in revenues respectively, I embedded some conservatism there. Management expects to be able to ramp these four lines in 2026, but I pushed this back to 2027, and I also assume in 2025, the first line does not fully ramp up to capacity.

Summary of 5-year financials of Enovix (Author generated)

My intrinsic value for Enovix is adjusted upwards to $15.60.

My 1-year and 3-year price targets are adjusted upwards to $17.80 and $23.80 respectively, based on the 2028 financials discounted back to 2024 and 2026 respectively.

Conclusion

While there is multiple good news to celebrate after this earnings report, Enovix still has lots of execution to get right before it becomes a leading battery company.

For now, the company has managed to build a product that is superior to others available in the market, build a factory that is capable to building samples first, and then at scale, and attract the largest smartphone players interest in sampling these batteries.

The next step would, of course, be that Enovix needs to convert actual wins for its first line and subsequent lines.

With this demand, it will be easier for Enovix to attract capital from customers or governments. With this additional capital for the next few lines, the demand for Enovix will continue to grow.

Of course, the company needs to be able to manufacture these leading batteries at scale and do so in an economically attractive manner.

I started investing in Enovix when the new management team came in, and after watching the management team execute on their promises for the past year, I am increasingly confident in their abilities to scale Enovix into the leading battery player it is capable of becoming.

Read the full article here