Given the blockbuster returns from tech darlings like Nvidia (NVDA), value investing might be out of favor.

Don’t get me wrong—I also own a lot of Nvidia and Amazon (AMZN). However, my portfolio is currently slightly tilted toward growth because combining yield and growth is the best way to optimize long-term income growth.

That’s because, according to Schwab, total return is a strong proxy for long-term income growth.

But the good news is that value investing isn’t dead – you must do it safely and responsibly.

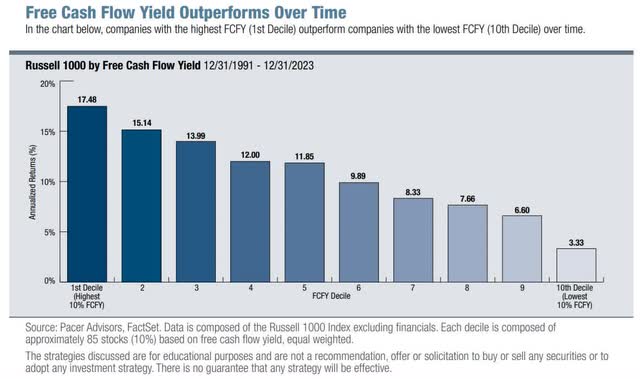

Value Still Works, But You Have To Do It Safely

Pacer Funds

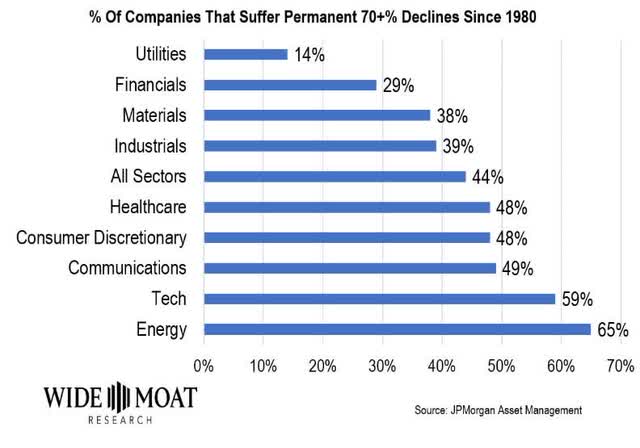

Over the last 33 years, value investing has kept working, but the trick was to avoid value traps like these.

Wide Moat Research

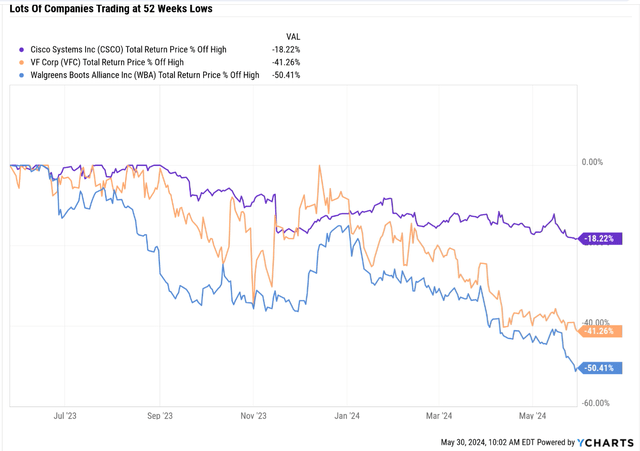

Many companies are trading at 52-week lows right now, including former dividend king V.F. Corp (VFC), former dividend aristocrat Walgreens (WBA), and tech utility Cisco (CSCO).

Ycharts

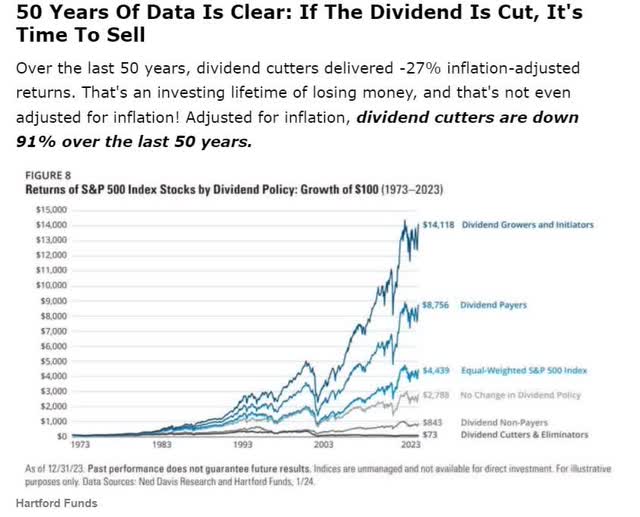

Of course, it’s not a surprise that former aristocrats who have slashed their dividends (twice in the case of VFC) due to business distress are sucking something fierce.

Hartford Funds

What about Cisco? There’s very little risk of a dividend cut (approximately 0.5%).

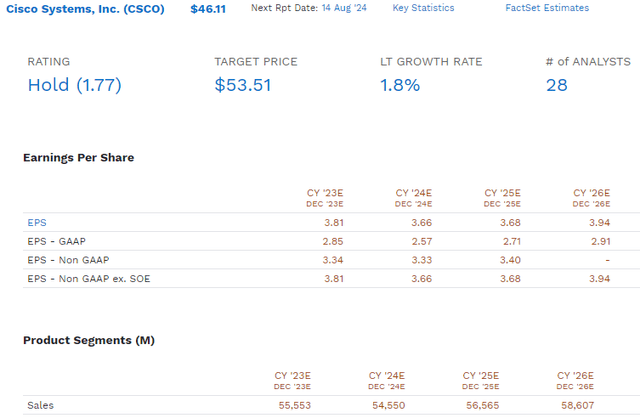

FactSet Research Terminal

However, according to the median analyst consensus, growth prospects have really deteriorated to just 2% over the long term.

If Cisco yielded a very low-risk 10% (like BTI), that would be OK, and it would almost keep up with inflation.

However, with a yield of 3.5%, that 2% growth consensus means 5% to 6% long-term returns; what you can get with bonds today is what investors should expect.

So that explains why even quality companies like Cisco, a tech utility growing 3X slower than the utility sector, are down so severely.

Dividend Aristocrat Opportunities: Dividend Legends Trading At 52-Week Lows

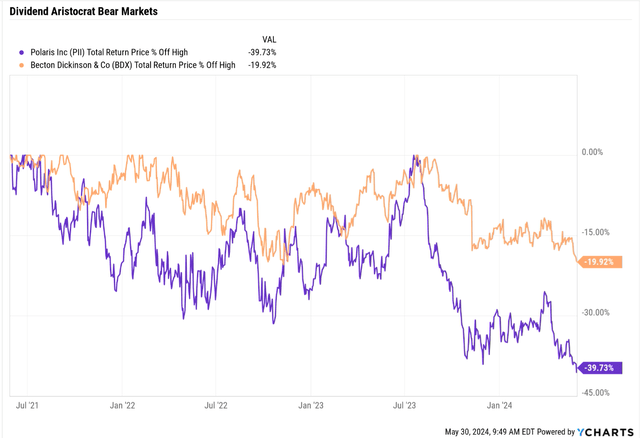

Ycharts

Several dividend aristocrats are trading at 52-week lows with nothing wrong. Their premises appear entirely intact, and they’re merely suffering from either bubble bursting or short-term negatives that don’t threaten the long-term growth outlook.

Let me show you two of my favorite “52-week low” aristocrat opportunities right now that might represent coiled spring opportunities to earn Buffett-like returns from blue-chip bargains over the next few years.

Becton, Dickinson (BDX): A Dividend King In A Bear Market

Becton, Dickinson, founded in 1897 by Maxwell Becton and Fairleigh Dickinson, is an American multinational medical technology company. They specialize in manufacturing and selling medical devices, reagents, and instruments. Known for its reliability, the company boasts an impressive 52-year streak of consecutive dividend increases.

So, what’s wrong with BDX? Is it the growth rate? Has it fallen below the historical 6% to 10% annual rate of the last 10 to 20 years?

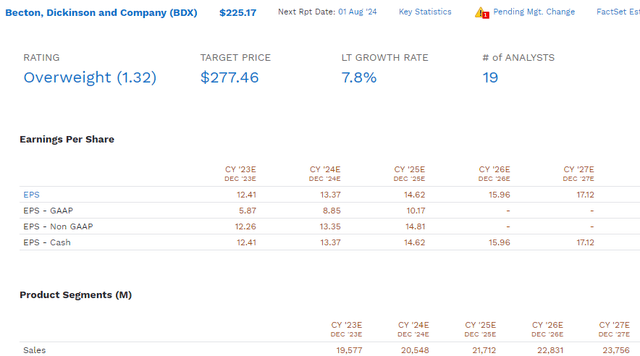

FactSet Research Terminal

No, it’s expected to grow around 8%, in line with its historical rate, and thus deliver around 10% long-term returns.

Is the dividend at risk of a cut? Nope.

| Rating | Dividend Kings Safety Score | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| BDX | 94% | 0.5% | 2.00% |

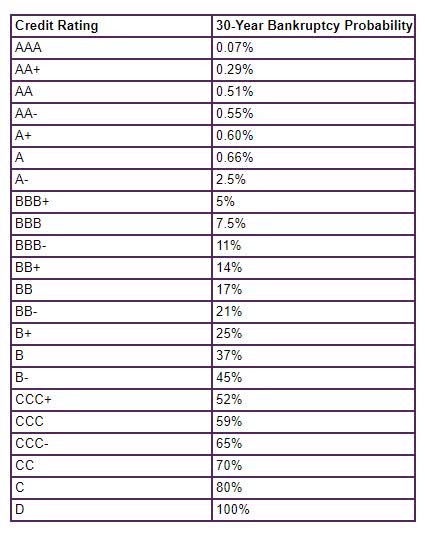

| S&P Risk Management Rating | 93% Percentile, Exceptional | BBB Stable outlook credit rating = 7.5% 30-year bankruptcy risk | 15% or Less Max Risk Cap |

(Source: DK Research Terminal)

BDX has a very low-risk dividend, and S&P considers it the top 7% of companies managing its entire risk profile.

No dividend cuts are expected in the next few years, and the risk of a cut, even in another Pandemic or GFC-level downturn, is approximately 2%.

What about valuation? Was it in some crazy bubble that resulted in a sharp correction?

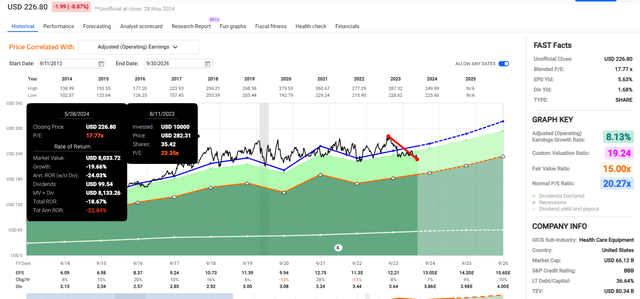

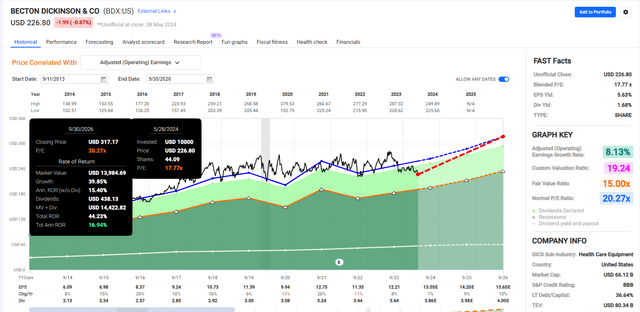

FAST Graphs, FactSet

No, BDX was about 10% overvalued before it fell into this bear market.

So, what is causing this weakness?

While Becton, Dickinson is a critical player in the medical products industry, BDX is recovering after some challenging years. They strategically utilized funds from COVID-19 to strengthen their core business. Their crucial product, Alaris, is back on the market, though its success remains to be entirely determined.

The Alaris Saga

The troubles began in early 2020 when a Class I recall (the most severe kind) for its Alaris infusion pumps due to reported multiple system errors, software glitches, and use-related issues. This forced the company to halt new shipments of the pumps used in caring for 70% of patients on infusion therapy. Talk about a major disruption to operations!

But that was just the beginning. Over the next few years, BDX had to navigate a minefield of additional recalls, cybersecurity vulnerabilities, and compatibility issues with certain syringes. The company even had to file for a new 510(k) clearance from the FDA in 2021 to get the regulatory green light for all its modifications to the Alaris system over the years.

BDX’s products are indispensable, ensuring business stability even during economic downturns. However, the acquisition of CB Bard brought some revenue fluctuations.

Management is confident that Alaris sales will bounce back by 2025, with $400 million in sales.

Balance Sheet Is OK, Not Justifying The Bear Market

BDX’s debt is manageable and supported by a strong cash flow that ensures consistent dividend payments. Their large-scale production of needles and syringes gives them a competitive advantage. While their diagnostic business faces pricing pressure, CareFusion’s products have high switching costs, deterring new competitors. Bard’s diverse products and patents further protect its market position.

They have invested significantly in research, bolstering their product pipeline. Alaris is expected to reclaim much of its lost revenue by 2025, promising a brighter future for BDX.

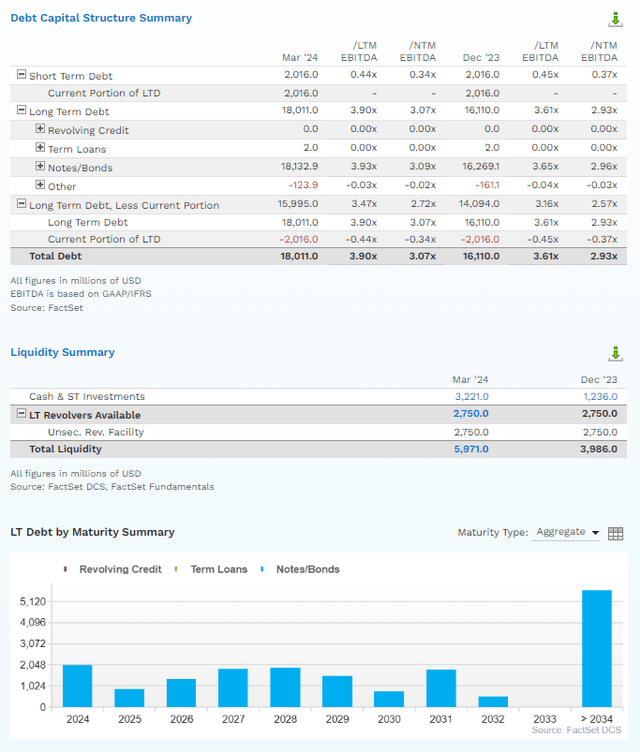

FactSet Research Terminal

BDX’s leverage ratio of almost 4X seems a bit high for medical companies. Rating agencies want to see 3X or less. However, on a net debt/EBITDA basis, 2.6X is a safe debt level.

Operating cash flow covered interest costs 8X, which the 8+ level rating agencies want to see.

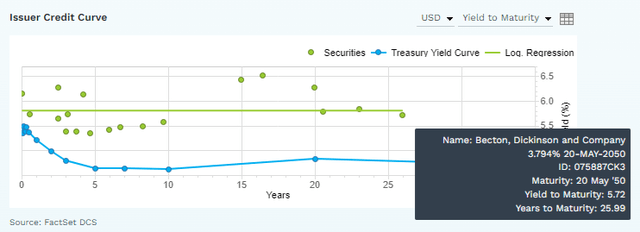

FactSet Research Terminal

The bond market isn’t worried about BDX’s long-term viability, as evidenced by its 5.7% yielding 26-year bonds.

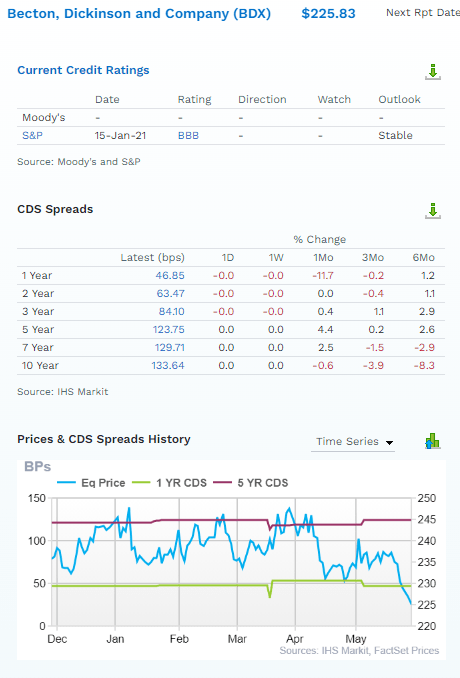

FactSet Research Terminal

Credit default swaps are the bond market’s way of estimating real-time default (bankruptcy) risk. That risk has been stable for the last six months while the price has steadily fallen.

Valuation: Becton, Dickson Is Irrationally Priced

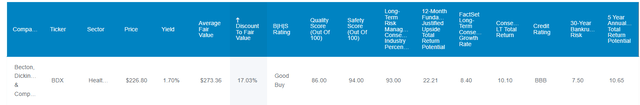

Dividend Kings Zen Research Terminal

BDX is 17% historically undervalued and a potentially good buy for anyone comfortable with its risk profile. It’s not a particularly fast-growing dividend king, but that steep discount offers a 22% 12-month fundamentally justified return potential.

In other words, if BDX grows as expected in the next year, returning to the 10-year average historical fair value would generate a 22% return.

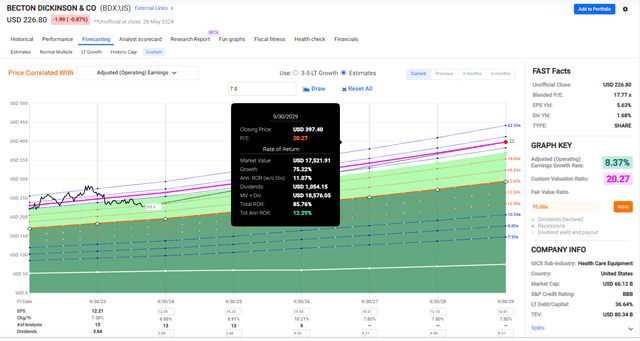

3-Year Consensus Fair Value Justified Total Return Potential: 44% or 17% annually.

FAST Graphs, FactSet

BDX’s current fundamentals justify modest market outperformance and a very healthy 17% annual return potential over the next three years.

5-Year Consensus Fair Value Justified Total Return Potential: 85% or 12% annually.

FAST Graphs, FactSet

Over the next five years, 8% growth could drive 85% or 12% annually.

Risks To Consider: Why BDX Isn’t For Everyone

Here are the risks potential investors in BDX need to keep in mind.

Geopolitical Events: Adverse geopolitical events or trade disruptions could significantly impact BDX’s financial performance, especially since 43% of its business comes from international markets.

Regulatory Changes: Increased regulatory focus on using certain chemicals, like ethylene oxide, could affect BDX’s operations and profitability.

Production Risks:

Supply Chain Interruptions: Interruptions in BDX’s supply chain, manufacturing, or sterilization processes could lead to delays and increased costs.

Technological Advances: Rapid innovation by competitors in high-growth areas, such as molecular diagnostics and pharmacy automation, could erode BDX’s market share and margins.

Financial and Corporate Risks:

Debt Management: While BDX’s strategic debt issuance demonstrates financial agility, it poses a risk if not managed effectively.

Operational Challenges: The effectiveness of BDX’s cash flow management strategies might not yield the anticipated improvements, potentially affecting the company’s ability to invest in growth opportunities or return capital to shareholders.

Legal and Regulatory Risks:

Ongoing Investigations: Regulatory and legal risks, including ongoing investigations and enforcement practices, could adversely affect BDX’s business.

Product Approvals: Delays receiving regulatory approvals for new products or expansions, such as the 510(k) clearance challenges for the Alaris system, could slow down revenue growth and margin improvement.

Tech and Innovation Risks:

Innovation Pressure: Continuous innovation is necessary to maintain BDX’s competitive edge. Failure to introduce new products or technological advancements could impact BDX’s market position.

Ability to Sell Risks:

Market Competition: The medical technology industry is highly competitive. New product introductions and technological advancements by rivals could impact BDX’s market share and margins.

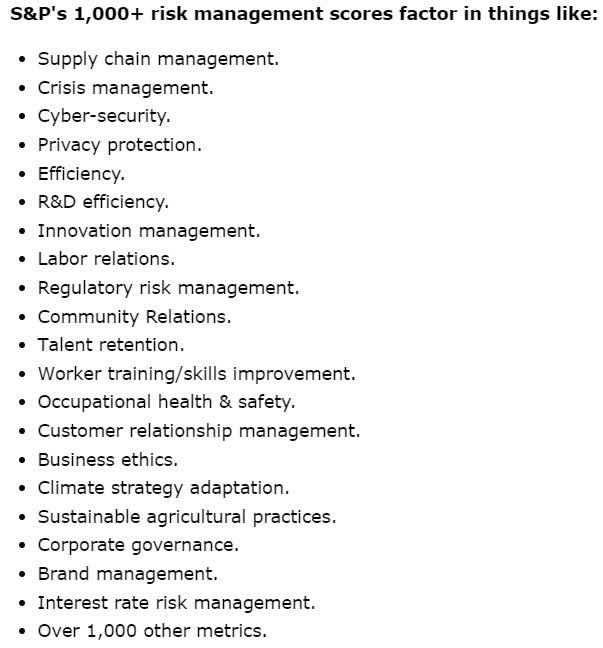

How Good Is BDX At Managing These Risks?

S&P

S&P rates BDX as 64% optimal risk management, in the top 10% of global companies.

| S&P LT Risk Management Score | Rating |

| 0% to 9% | Very Poor |

| 10% to 19% | Poor |

| 20% to 29% | Suboptimal |

| 30% to 59% | Acceptable |

| 60% to 69% | Good |

| 70% to 79% | Very Good |

| 80+% | Exceptional |

| BDX | 64% optimal |

| Global Percentile | 90% (top 10% of global companies) |

(Source: S&P)

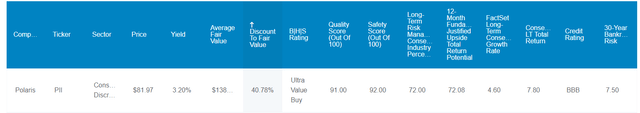

Polaris (PII): Suffering From The Curse Of The Pandemic Boom

Polaris Inc. is a global leader in power sports, offering a wide range of high-quality vehicles, including off-road vehicles, motorcycles, snowmobiles, and boats. With a strong focus on innovation and customer satisfaction, Polaris aims to provide thrilling outdoor experiences through its robust product lineup.

Despite recent financial challenges, the company remains committed to maintaining its market leadership by investing in research and development, optimizing dealer inventory, and enhancing operational efficiencies. Polaris continues to uphold its reputation for delivering top-notch products and exceptional customer service, ensuring that every adventure is unforgettable.

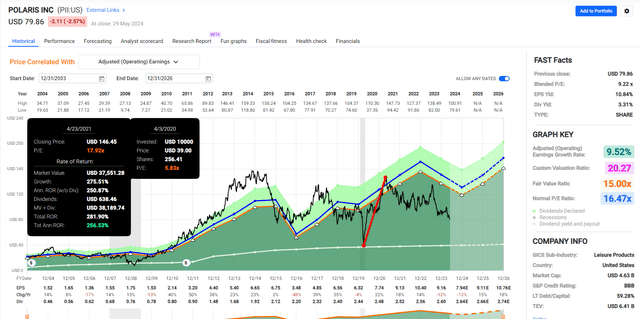

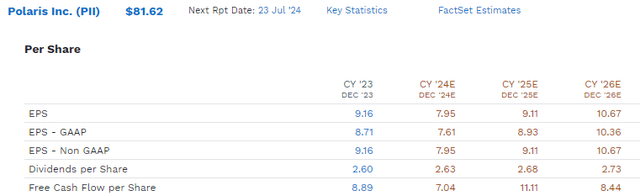

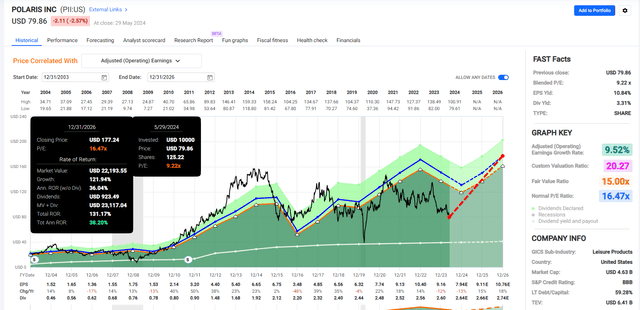

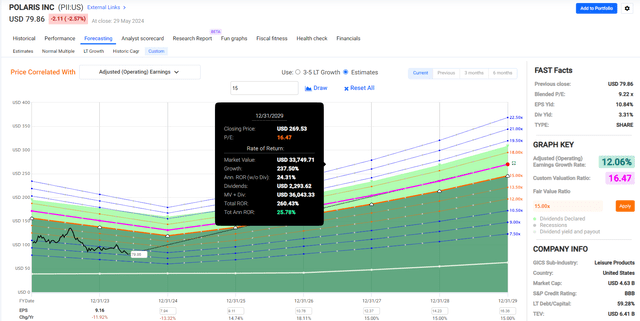

FAST Graphs, FactSet

Polaris fell off a cliff in the Pandemic crash because it had acquired Boat Holdings in an all-cash transaction valued at $805 million in 2018.

It broadened and diversified Polaris’ range of powersports offerings into the $8 billion U.S. pontoon boat market, one of the fastest growing segments.

Polaris expected the acquisition to be immediately accretive to its earnings, with around $100 million in future tax benefits driving additional cash flow accretion.

However, it also leveraged the balance sheet, meaning PII was exposed to some unexpected economic crisis, like the one in early 2020.

However, $5 trillion in government stimulus and $4 trillion in Fed money printing sparked a boom in durable goods since most people were still locked out of experiences like concerts, movies, or travel.

EPS boomed by 65%, but then all that stimulus ran into the pandemic, disrupting supply chains.

Why Is Polaris In A Bear Market?

Polaris has experienced a significant decline in its stock price, falling by approximately 40% in the past few years. This downturn can be attributed to several key factors:

Economic and Market Conditions: The company has faced headwinds due to high financing rates and cautious consumer behavior, particularly in the big-ticket discretionary goods segment. This has led to declining sales across various segments, including off-road, on-road, and marine products. For instance, in the first quarter of 2024, Polaris reported a 20% decline in total sales, with significant drops in off-road (16%), on-road (14%), and marine (53%) segments.

Operational Challenges and Increased Costs: Polaris has encountered operational inefficiencies and increased costs, which have pressured its profit margins. The company has had to elevate promotional activities to move inventory, further impacting its pricing and profitability. Additionally, manufacturing inefficiencies and higher finance interest have contributed to lower net income and profit margins. For example, in Q1 2024, Polaris’ net income plunged by 97% year-over-year, and its profit margin shrank to 0.2% from 5.2% in the same period the previous year.

Despite these challenges, Polaris remains focused on strategic initiatives to regain its market position, including significant investments in research and development and efforts to optimize dealer inventory levels. The company also leverages its strong brand reputation and innovative product offerings to drive future growth and profitability.

Polaris’ Balance Sheet Can Support The Dividend Streak Even In A Higher For Longer World

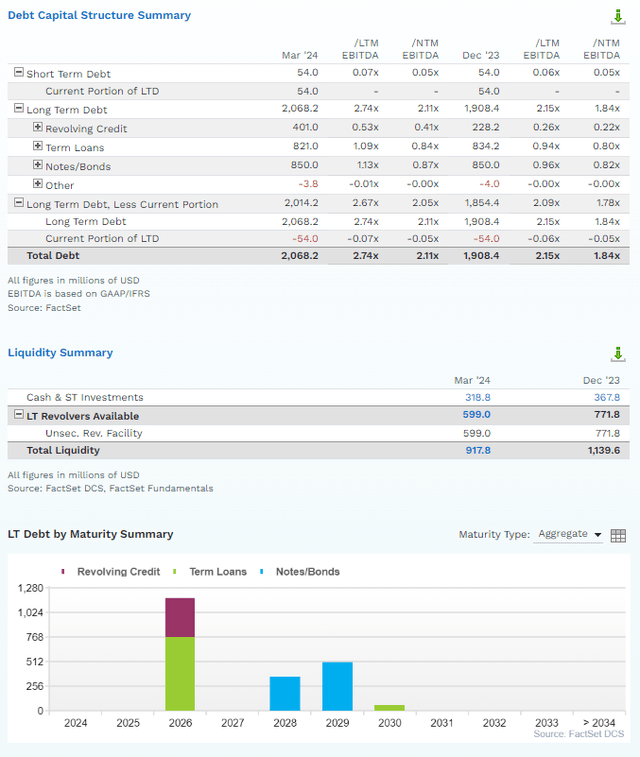

FactSet Research Terminal

PII’s leverage ratio is below the 3X level, which S&P considers safe for this industry, and deleveraging is continuing rapidly. That’s why the dividend growth has been so anemic for several years. PII correctly prioritizes de-leveraging while maintaining a growth streak when EPS is temporarily declining.

FactSet Research Terminal

Dividends have always been well covered by free cash flow, so S&P rates PII a stable BBB, the same as BDX.

S&P

Polaris Is Expected To Recover And Soar To New Heights

FAST Graphs, FactSet

Polaris is expected to recover its earnings in 2025 as margins expand, and interest rates fall, boosting sales in an economy expected to continue growing at 2%.

PII is very attractively valued at a forward PE of 9 and 12.5X EV/FCF compared to its historical 16.5X multiple.

Within a few years, PII offers a 130% return potential or almost 40% per year.

5-Year Consensus Total Return Potential 265% or 26% Annually

FAST Graphs, FactSet

Polaris offers a Buffett-like 26% annual return potential for anyone comfortable with its risk profile.

Risk Profile: Why Polaris Isn’t Right For Everyone

Like any company, Polaris faces several risks that could impact its operations and financial performance. Understanding these risks is crucial for stakeholders to appreciate the challenges and opportunities that lie ahead.

Key Risks Facing Polaris

Economic Sensitivity: Polaris’ product lineup, which includes motorcycles, snowmobiles, and ATVs, consists of big-ticket discretionary items. During periods of economic downturn, consumer confidence and spending on such items can decline significantly, affecting sales and profitability. High financing rates further exacerbate this issue, making it harder for consumers to purchase these products.

Operational Challenges: The company has faced inefficiencies in its manufacturing processes, leading to increased operational costs and margin pressure. Despite efforts to improve, these challenges have persisted, impacting overall profitability. For instance, in Q1 2024, Polaris reported a 97% drop in net income year-over-year, highlighting the severity of these operational issues.

Competitive Landscape: Polaris operates in a highly competitive market with formidable players like Harley-Davidson, BRP, and Honda. These competitors are rapidly innovating and applying price pressure, which can erode Polaris’ market share and margins. New entrants like CF Moto also add to the competitive intensity, making it crucial for Polaris to innovate and maintain its market leadership.

Inventory and Promotional Activities: High inventory levels have forced Polaris to increase promotional activities, which can erode profit margins. Dealers have reported inventory levels 50% above target, necessitating heightened promotions to move products. This situation underscores the need for better inventory management and strategic promotional planning.

Weather Dependency: Sales of certain products, particularly snowmobiles, depend highly on weather conditions. Variability in snowfall can lead to significant fluctuations in sales volumes, adding an element of unpredictability to the company’s revenue streams.

Financial Leverage: Polaris’ acquisition of Boat Holdings in 2018 leveraged its balance sheet, increasing its debt levels. While the company has made strides in managing its debt, financial leverage remains a concern, especially in a volatile economic environment, especially if rates remain higher for longer or we enter a recession.

Supply Chain and Inflation: Ongoing supply chain disruptions and inflationary pressures on commodity prices, labor, and logistics can impact Polaris’ cost structure and profitability. The company must navigate these challenges to maintain operational efficiency and cost competitiveness.

Despite these risks, Polaris remains committed to its strategic initiatives, including significant investments in research and development, optimizing dealer inventory, and enhancing operational efficiencies.

By addressing these challenges head on, Polaris aims to continue delivering top-notch products and exceptional customer experiences, ensuring its leadership position in the power sports industry.

Long-Term Risk Management Assessment

| Rating | Dividend Kings Safety Score | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| PII | 92% | 0.5% | 2.00% |

| S&P Risk Rating | 67% Percentile, Good | BBB Stable outlook credit rating = 7.5% 30-year bankruptcy risk | 20% or Less Max Risk Cap |

S&P considers PII’s risk management to be 40% optimal and in the top 33% of companies around the globe.

| S&P LT Risk Management Score | Rating |

| 0% to 9% | Very Poor |

| 10% to 19% | Poor |

| 20% to 29% | Suboptimal |

| 30% to 59% | Acceptable |

| 60% to 69% | Good |

| 70% to 79% | Very Good |

| 80+% | Exceptional |

| PII | 40% |

| Global Percentile | 67% |

(Source: S&P)

Bottom Line: These 2 Dividend Aristocrats Are Potentially Worth Buying Now

Value investors need to recognize when a company is cheap for a reason and when significant declines are opportunities to be “greedy when others are fearful.”

Becton, Dickson, and Polaris are examples of solid dividend aristocrats and kings priced irrationally and thus generate potentially attractive long-term investing opportunities.

Dividend Kings Zen Research Terminal

I find PII’s better valuation, an impressive 40% historical discount, and the 72% potential upside in the next year alone to be the better opportunity.

However, the point is that even in a market near record highs, with Wall Street darlings like Nvidia putting up seven-day 20% rallies, there are plenty of attractive dividend growth opportunities.

Even the venerable aristocrats offer plenty of opportunities to buy at 52-week lows and steep discounts of up to 40%.

And I’m not talking about dumpster fire value traps, but world-class quality companies that have been around for over 130 years and could survive and thrive for another 130 years.

Read the full article here