I’m confident that Amazon (NASDAQ:AMZN) is Wall Street’s best deep-value hyper-growth opportunity.

I’m also confident that it could potentially join Meta (META) and Alphabet (GOOG) (GOOGL) in paying a dividend. Maybe not a high yield, but potentially a rapidly and steadily growing dividend.

Meta popped 25% when they announced a dividend. Alphabet popped 16%. Like those tech giants, Amazon is about 2X to 3X undervalued relative to its historical norms. It’s also growing about 50% to 100% faster.

How strong is my conviction in Amazon’s future growth potential, excellent valuation, and a possible dividend? I just increased my position by 50% to 1,000 shares. That’s because, while I can’t tell you whether Amazon’s dividend is coming next quarter or next year, I’m 80% confident that it’s coming relatively soon, and investors who buy today will be thrilled they did in five-plus years.

So, let me share the three reasons you should buy Amazon before the likely coming dividend pop.

Reason One: Amazon Is The Best Deep Value Hyper-Growth Deal On Wall Street

Wait for a fat pitch and then swing for the fences.” – Warren Buffett

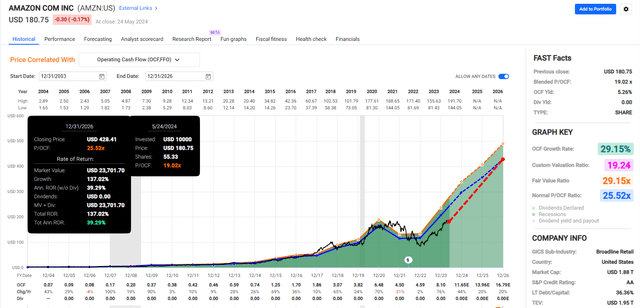

FAST Graphs, FactSet

FAST Graphs, FactSet

We’ve already seen that Amazon’s valuation is very low compared to its historical 25.5X cash flow. However, its free cash flow proliferates, offering exceptional return potential in the next few years.

Amazon Growth Consensus Forecast

| Year | Sales | Free Cash Flow | EBITDA | EBIT (Operating Income) | Net Income |

| 2023 | $574,785 | $36,658 | $109,538 | $36,852 | $30,425 |

| 2024 | $638,776 | $62,608 | $136,848 | $61,764 | $48,618 |

| 2025 | $710,140 | $76,348 | $157,314 | $77,012 | $62,584 |

| 2026 | $785,929 | $104,744 | $181,735 | $97,992 | $79,586 |

| 2027 | $860,354 | $127,536 | $210,185 | $116,594 | $95,778 |

| 2028 | $924,758 | $149,486 | $241,558 | $136,897 | $112,630 |

| 2029 | $1,008,330 | $176,399 | $276,364 | $163,368 | $135,349 |

| Annualized Growth 2024-2029 | 9.8% | 41.9% | 18.4% | 28.2% | 28.2% |

| Cumulative 2024-2029 | $4,928,287 | $697,121 | $1,204,004 | $653,627 | $534,545 |

(Source: FactSet Research Terminal)

Amazon’s free cash flow is expected to grow by 42% annually through 2029 to a staggering $176 billion and reach $1 trillion in sales by the end of the decade.

Apple (AAPL) holds the record for the most free cash flow any company generates annually. Apple generated approximately $111.44 billion in free cash flow in 2022

Amazon is expected to surpass that record by 2027.

Thanks to incredible margin growth, it’s expected to generate almost $700 billion in free cash flow over the next five years.

Amazon Margin Consensus Forecast

| Year | FCF Margin | EBITDA Margin | EBIT (Operating) Margin | Net Margin |

| 2023 | 6.4% | 19.1% | 6.4% | 5.3% |

| 2024 | 9.8% | 21.4% | 9.7% | 7.6% |

| 2025 | 10.8% | 22.2% | 10.8% | 8.8% |

| 2026 | 13.3% | 23.1% | 12.5% | 10.1% |

| 2027 | 14.8% | 24.4% | 13.6% | 11.1% |

| 2028 | 16.2% | 26.1% | 14.8% | 12.2% |

| 2029 | 17.5% | 27.4% | 16.2% | 13.4% |

| Annualized Growth | 18.3% | 6.2% | 16.7% | 16.8% |

(Source: FactSet Research Terminal)

Most companies would love to see 18% annual growth. That’s the consensus growth rate of Amazon’s free cash flow margin.

That’s courtesy of AWS and advertising, the fastest-growing parts of its business empire.

AWS revenue grew by 17% year-over-year in the first quarter of 2024, up from 13% in the previous quarter. AWS had an operating margin of 37.6% in the first quarter of 2024, which is the highest since at least 2014.

Amazon’s advertising revenue grew 24% yearly in the first quarter of 2024. While specific operating margins for the advertising segment are not explicitly broken out, the business is highly profitable, with margins likely exceeding 50%.

Why are analysts confident that Amazon will continue growing at such fast rates when it’s already generating $3 billion monthly in free cash flow?

Reason Two: $1 Trillion Reasons I Believe Amazon’s Hyper-Growth Forecasts Are Accurate

| Year | Amazon R&D (Millions) | Amazon Capex (Millions) | Total Growth Spending (Millions) |

| 2024 | $87,166 | $62,478 | $149,644 |

| 2025 | $97,433 | $68,367 | $165,800 |

| 2026 | $107,210 | $65,861 | $173,071 |

| 2027 | $108,552 | $73,063 | $181,615 |

| 2028 | $118,013 | $72,638 | $190,651 |

| 2029 | $127,446 | $75,651 | $203,097 |

| Total | $645,820 | $418,058 | $1,063,878 |

| Annual Growth Rate | 7.9% | 3.9% | 6.3% |

| Source: YCharts | TTM Cash Return On Invested Capital | 18.55% | |

| Annual Cash Flow From Future Growth Spending Alone (2024 to 2029) | $197,349 | ||

| Source: FAST Graphs | 20-Year Average Price/Free Cash Flow | 49.18 | |

| Market Value Of Future Cash Flow Just From Growth Spending Through 2029 | $9,705,642 | ||

| Current Free Cash Flow | $62,608 | ||

| Historical Value Of Current Free Cash Flow | $3,079,061 | ||

| Free Cash Flow Value of Company | $12,784,703 | ||

| Source: FAST Graphs | Current Market Cap | $1.88 Trillion |

Amazon is spending $150 billion on growth this year, and that growth spending is growing at 6% annually, a rate that would double growth spending in the next 12 years.

Over the next five years, Amazon is expected to spend more than $1 trillion on growth. The planned cumulative U.S. federal spending on R&D and new infrastructure from FY 2024 through FY 2029 is roughly $1.775 trillion.

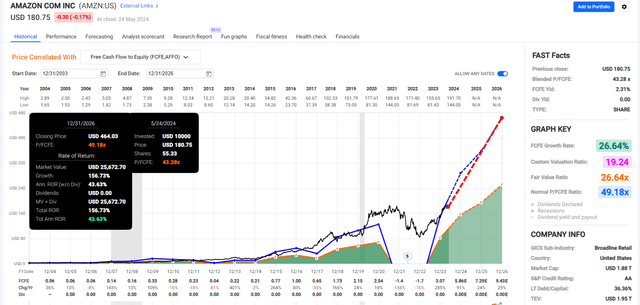

Amazon’s free cash flow return on invested capital is 18%, which has recently been rising.

Ycharts

Revenues rising faster than growth spending, 11% vs. 6%, are driving margin expansion, which is expected to continue for the foreseeable future.

Reason Three: Amazon Is Likely To Become A Dividend Growth Stock Soon

As I predicted, Meta and Alphabet eventually became dividend growth stocks because they were minting so much cash that they couldn’t avoid it.

Amazon’s cash pile is expected to become absurd without significant cash returns.

Remember that free cash flow is money left over after running the business and investing in future growth.

Returning free cash flow to shareholders through dividends does not affect a company’s growth. The company spends on growth first and pays dividends only after it has invested in all prudent growth opportunities.

$500 Billion In Net Cash By 2029 Is The Consensus

FactSet Research Terminal

Currently, Amazon isn’t buying back significant stock and doesn’t pay dividends. However, remember that Apple began paying dividends and the largest cash return program in history at $250 billion in net cash.

Meta, Alphabet, Microsoft (MSFT), and Nvidia (NVDA) have been putting more pressure on Amazon to join the big tech dividend club.

By 2025, AMZN is expected to have almost $100 billion in net cash. Today, Alphabet’s $108 billion net cash pile is the largest on earth (among non-financial companies).

By 2026, Amazon’s $159 billion in net cash is expected to be the largest on earth. And grow to $494 billion in 2029 as its nominal cash pile rises to $704 billion.

These numbers are ludicrous. No management team can justify such a monstrous cash pile that, by 2031, could reach $1 trillion in net cash.

$20 billion in net interest income from that cash pile.

Rising to $40 billion by 2031 if that growth rate continues without buybacks

The point is that Amazon is likely to start buying back stock and potentially paying dividends, if not this year, then next year as its net cash pile approaches $100 billion. If and when Amazon starts paying a dividend (most likely 0.25% to 0.5% starting yield, = about 20 to 40 cents per year) I want to own 1,000 shares of one of the greatest growth engines in history.

Risks To Consider: Why Amazon Isn’t Right For Everyone

Amazon is a huge company growing fast and trading at a significant historical discount, but it also has some significant risks. Before you buy shares, you should know about these risks. Remember, no stock is risk free, no company is right for everyone, and no company is a true bond alternative.

Profit Margin Risk

Amazon’s 31% free cash flow growth rate consensus forecast is predicated on impressive margin expansion. This requires that revenue grows faster than expenses. While this is highly likely, given that AWS and Advertising are the fastest and most profitable parts of the empire, if growth rates in those businesses come in less than expected, margin expansion and the company’s overall growth rate will come in below the current 25% to 31% expectations.

Competition

Amazon is the leader in online shopping but faces considerable competition. Other big retailers, such as Walmart (WMT) and Target (TGT), are improving their online stores and now offer their own subscription Prime alternatives.

Tech giants like Microsoft and Alphabet compete with Amazon in cloud computing. They are investing massive amounts (up to $110 billion) into AI and are currently ahead of Amazon in this important field.

Regulation (Largest Risk, In My Opinion)

Amazon is so giant that the government is paying more attention to it. As it becomes the largest company by revenue in a few years and achieves record profits and free cash flow, calls for breaking it up might increase.

It faces rules and investigations about data privacy, how it treats workers and fair competition. More regulations could make it more expensive for Amazon to run its business and make it harder for it to innovate.

In summary, while Amazon’s growth is exciting, there are important risks. Its high price, low profits, competition, and possible new regulations mean it might not be the best choice for every investor. Diversifying your investments is important to manage the risks of owning a stock like Amazon.

Amazon’s 87% quality and 81% safety scores give it an Ultra Sleep Well At Night (Ultra SWAN) rating and a 20% or Less Max risk cap recommendation.

Dividend Might Take Years To Arrive

While I’m confident Amazon will start paying a dividend in 2024 or 2025, so far, there is no estimate from analysts. They might indeed pile up $500 billion in net cash.

If Berkshire can stockpile $200 billion and earn $10 billion in net interest, why can’t Amazon stock pile $500 billion and earn $20 billion per year in interest?

Quantitative Measures Of Amazon’s Risk Profile

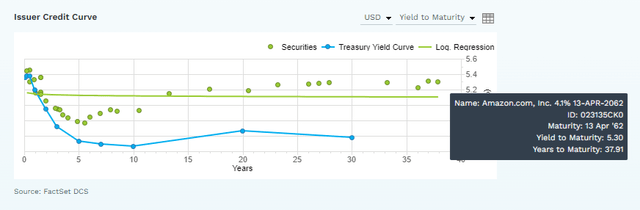

FactSet Research Terminal

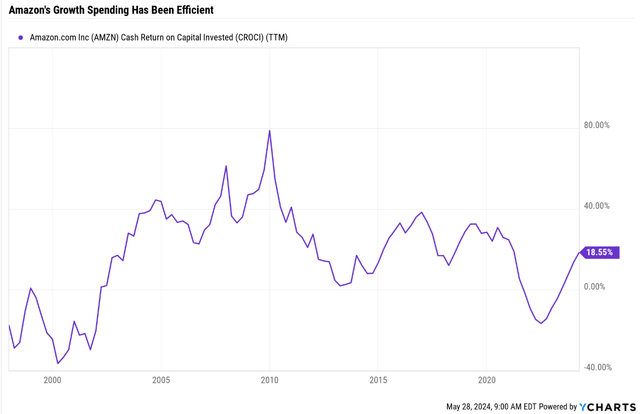

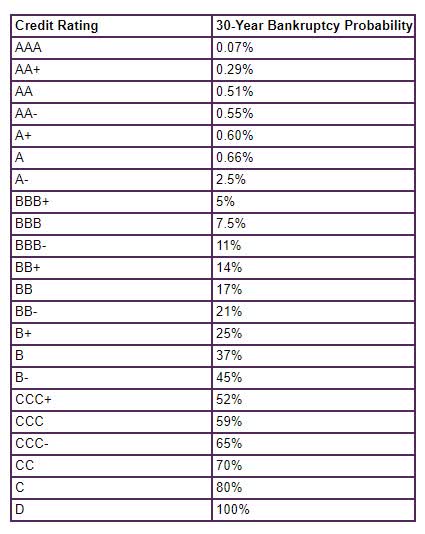

S&P estimates a 0.51% risk of Amazon bankrupting over the next 30 years.

S&P

The bond market, via credit-default swaps, estimates the risk at 1.62%, a risk associated with A-rated companies.

FactSet Research Terminal

Long-Term Risk Management: How Well Does S&P Think Amazon Manages Its Risks?

S&P

According to S&P, Amazon Ranks 55th Global Percentile For Long-Term Risk Management

| S&P LT Risk Management Score | Rating |

| 0% to 9% | Very Poor |

| 10% to 19% | Poor |

| 20% to 29% | Suboptimal |

| 30% to 59% (Amazon, 30%) | Acceptable |

| 60% to 69% | Good |

| 70% to 79% | Very Good |

| 80+% | Exceptional |

(Source: S&P)

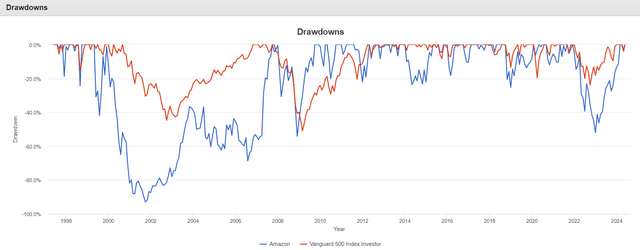

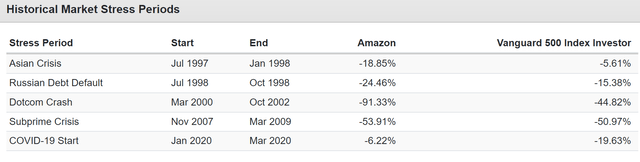

And, of course, Ultra SWAN quality has nothing to do with volatility.

Portfolio Visualizer Premium

On the way to a 241X return since its IPO, Amazon has had some truly stunning bear markets.

Portfolio Visualizer Premium

Portfolio Visualizer Premium

DK S&P Valuation Tool

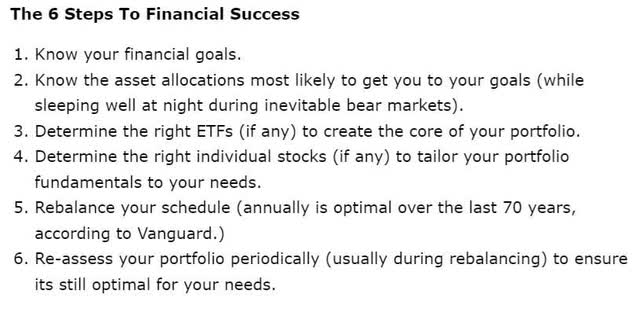

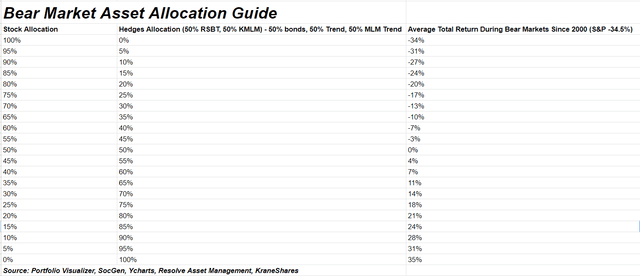

Understanding your optimal portfolio design is critical for surviving bear markets without panic selling and locking in losses unnecessarily.

DK S&P Valuation Tool

Bottom Line: Amazon Is A Buffett-Style “Fat Pitch” And May Experience A Dividend Pop

According to Howard Marks and John Templeton, you can never be more than 80% confident about any company. I call this the Marks/Templeton certainty limit on Wall Street because fundamentals can always change. However, having studied Amazon for over eight years and seeing it execute on its growth flywheel with skill and adaptability, I’m 80% confident that it has a bright future, strong return potential and will relatively soon start paying a dividend.

Amazon is one of my “fantastic four” stocks I plan to hold forever, or until I die, whichever comes first. Now, with 1,000 shares of this incredible wealth compounder, I look forward to reaping the dividend profit in the coming years as Amazon transforms into the ultimate capital return machine.

If Amazon grows anywhere close to the rates currently expected by analysts, its buybacks and dividends will put Apple to shame. When they do announce the dividend, which I consider just a matter of time unless their free cash flow implodes, I wouldn’t be surprised to see a 15% to 30% pop that day, on par with what Meta and Alphabet experienced, if not a bit larger due to superior valuation and faster growth rates.

Read the full article here