Impressive Price Performance: Will it Continue?

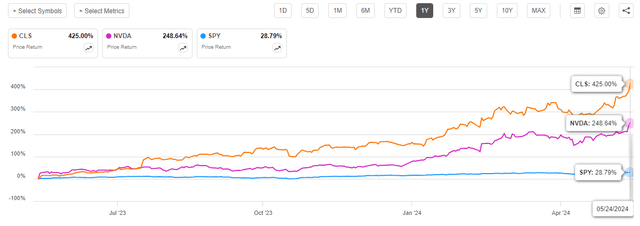

Over the past year, Celestica’s (NYSE:CLS) stock price surged more than 400%. Most of that rapid rise was thanks to the fast revenue growth and the company’s AI compute programs it was delivering to the hyperscalers. Share price has not only outperformed the S&P 500 but also Nvidia by nearly 150%.

CLS price performance (Seeking Alpha)

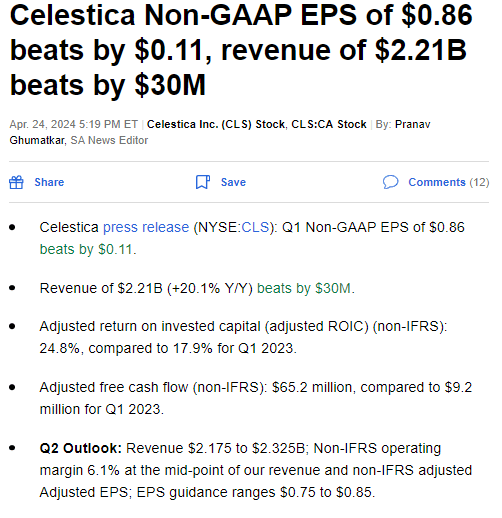

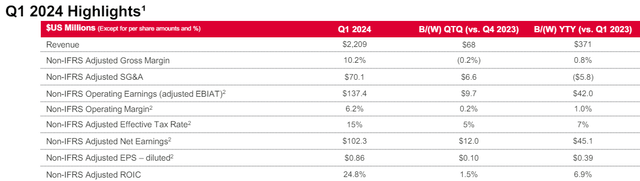

The company reported a strong Q1 quarter with both top and bottom-line beats. Revenue was $2.21 billion (+20% YoY), beating consensus by $30 million and non-GAAP EPS was $0.86, a $0.11 beat. The market reacted very positive to the results, and the stock has been up by 30% since its Q1 earnings. See below the Q1 results:

2024 Q1 Earnings (Seeking Alpha)

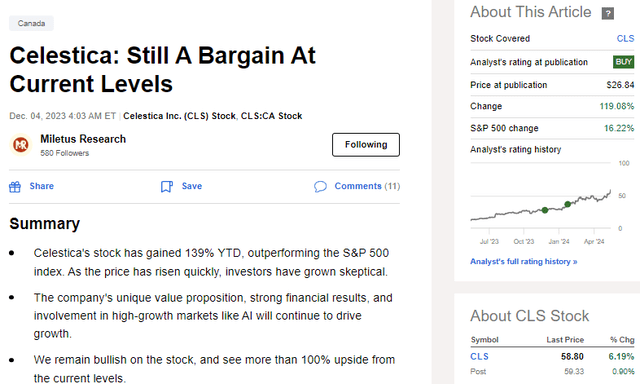

We have issued two multiple bullish calls on Celestica since 2023. See below our initiation when price was $26.

December Article (Seeking Alpha)

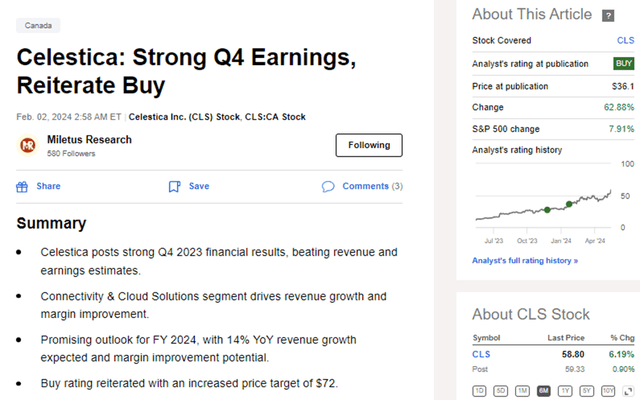

And then in February we reiterated our buy rating when the price was $36 (see below).

February Article (Seeking Alpha)

Celestica’s Q1 earnings were another great success, showcasing its ability to capitalize on the massive AI opportunity. We believe that the strong quarterly performances, expanding margins and the fast-growing AI custom compute market indicates that Celestica’s price momentum will continue throughout the year. Although the stock has achieved significant gains since last year, we remain confident in the stock’s potential, and raise our price target from $72 to $84, which means a 43% upside at the current levels.

The AI Run: Tapping into the AI Custom Compute Market

Nvidia’s impressive results have shown us that AI is real, and the opportunity is big. However, capitalizing on the AI opportunity requires a strategic positioning in the market as well as some very key capabilities. Celestica’s strategic decision to focus on the AI custom compute market was a great move, and has enabled the company to become a key beneficiary of the booming AI market. As the hyperscalers continue their AI build-outs, the demand for custom compute solutions has skyrocketed. Celestica is very well positioned to meet this demand, as it has built specialized hardware systems for many years and has deep expertise in custom silicon solutions. This unique competency has enabled the company to become a key provider of AI custom compute solutions among hyperscalers. The company started with a single hyper-scaler and has now secured similar program wins with other hyperscalers too(as per the management commentary in the Q1 call).

We don’t think this is coincidental and believe the company has unique attributes that set it apart from its peers in the market:

- Business agility: The company foresaw the AI need and was quick to pivot its offerings to the rapidly evolving AI compute market.

- Specialized custom-silicon expertise: The company has advanced engineering expertise in building custom-silicon solutions for data centers, a key capability for building and supporting custom AI hardware platforms.

- Global scale: The company has global capacity to scale manufacturing and operations. It uses its global manufacturing and distribution network to serve the hyper-scaler needs. This is a key capability that is not easy to replicate from a competitive standpoint.

- Platform lifecycle services: Celestica doesn’t only manufacture components but provides full lifecycle services, including design, supply chain, testing, validation, certification, support and disposal. This lifecycle approach makes the company’s services very high-value and hard to replace.

Our observation is that AI deployments are very complicated and require significant engineering expertise across the data center stack. Not many suppliers have the necessary skills to deal with such complexity. However, Celestica believes that this complexity is to its advantage, and thinks that it creates a competitive edge over its peers. From the Q1 call:

Daniel Chan (Analyst)

Thanks, that’s helpful. When you talk to your cloud customers and you look at the AI data center architecture, do you get the sense that the mix of your products within an AI data center could be higher than what was done for a traditional data center?

Mandeep Chawla (CFO)

Dan, as you know not all hyperscalers are created equal and there are some hyperscalers that lean towards more complex, challenging product deployments, and that really works out well for us. The reason that you’re seeing the amount of growth that we’re showing in HPS is because those are the solutions that really fit the demand requirements of certain hyperscalers. And so, as we see this shift towards more AI type of data centers, it implies more complex product, which is, what we want to see.

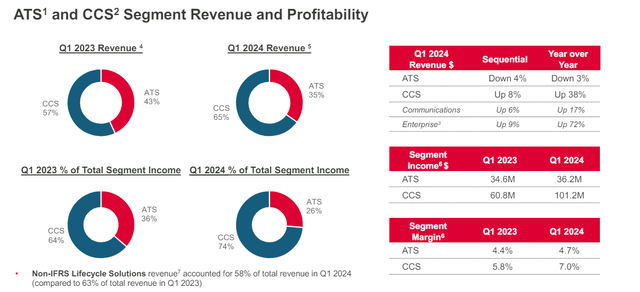

CCS Segment Continues to Drive Revenue Growth

The EMS market, overall, is still in a downturn due to the weakness in most of the end-markets. Celestica is the only EMS company that is growing its business. The driver of its revenue growth is its hyper-scaler focused CCS segment, which is growing at 38% YoY and now accounts for 65% of the overall business (up from 57% last year). Additionally, the operating margin for CCS is at a record high level of 7% (vs 4.7% of ATS).

Segment Performance (Celestica)

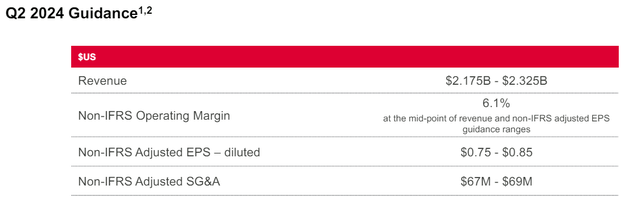

The revenue momentum for the company looks very strong as the company raised its full-year 2024 revenue guidance from $8.5 billion to $9.1 billion million, 15% increase YoY. However, we believe that the company is still being conservative on its outlook and will exceed its 2024 guidance easily. The signals that we are getting from the company’s management team is very encouraging. Also, the overall dynamics of the AI custom-compute market looks very positive. On top of it, when looking at the capex projections, the hardware demand from hyperscalers continues to be very strong. Another positive is that the company expects the ATS business to stabilize in the second half of the year. All these factors make us believe that the company can sustain its double-digit revenue growth during the next several years.

CCS Drives Margin Expansion and Shareholder Value

The company continues to show margin improvements on a quarterly basis. In Q1, non-GAAP gross margin was 10.2%, up 80 basis points YoY. Non-GAAP operating margin was 6.2%, up 100 basis points YoY and above guidance. The high margin CCS segment’s was again the main driver of the operating margin improvement. Adjusted EPS came at $0.86, a 120% increase YoY, also driven by the operating margin expansion. For the free cash flow, the company reported $65 million, which was above expectations.

Q1 2024 Highlights (Celestica)

Looking forward, the company now expects operating margin of 6.1% for 2024, vs previous guidance of 5.5%-6%. EPS is expected to be $3.3 which is a 20% raise from the previous outlook. Free cash flow guidance has also been raised from $200 million to $250 million for the year. All in all very positive operating metric improvements during the quarter.

Q2 Guidance (Celestica)

As the high-margin CCS segment continues to grow, we expect the operating margins to expand further. Our projections indicate that Celestica’s operating margin could easily reach 6.5% by the end of 2024.

Valuation Still Attractive

We think that Celestica’s operating margins have great expansion potential and can drive its stock value much higher. A one percentage point increase in operating margin can have an exponential effect on the stock. This is because margin improvements directly translate to higher earnings, which expands valuation multiples.

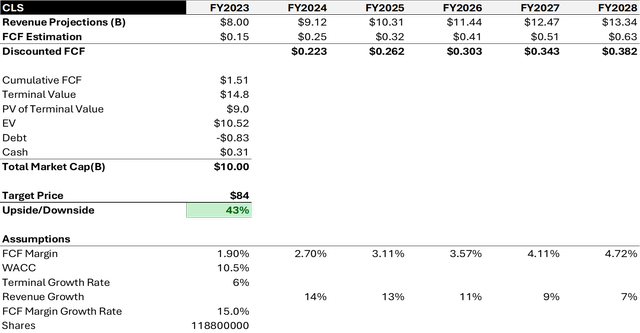

After the Q1 results and the revised 2024 outlook, we have updated our DCF valuation. The company now expects 2024 free cash flow to be $250 million instead of $200 million, so we have updated this figure in our model. Additionally, we adjusted the FY 2024 revenue growth rate to 14% in line with the company’s 2024 guidance and moderated it down to 7% for the next four years. Our model assumes a 15% annual FCF margin increase, consistent with the company’s FCF growth trajectory. For the WACC, we kept it at 10.5% and the terminal growth rate we took 6%.

DCF Model (Author)

Based on our updated DCF model, we calculate a fair value of $84 per share for Celestica, implying a 43% upside from the current price levels. We maintain our buy rating and raise our price target from $72 to $84.

Risks

Our updated risks:

Fast commoditization of AI compute services: Besides the macro risks due to its global footprint, the biggest risk we see for Celestica is the commoditization of its high-margin AI custom-compute engineering services. Celestica is currently the only ECM company that can provide high-end complex AI platform solutions. Other ECMs are trying to build similar capabilities, so it’s worth to monitor the competitive landscape.

AI bubble to burst: Another risk that is argues by investors is that the AI boom might collapse suddenly, very similar to internet boom. The internet boom, which began in the mid-1990s, lasted for five years and busted in the early 2000s. We think that the AI run has just started, and if we draw similarities to the internet boom, it should continue at least another three to four years.

Conclusion:

The strong Q1 results have strengthened our positive outlook for Celestica. The company delivered 20%+ revenue growth, expanded its margins, and raised its outlook for FY 2024, which is all very promising. The company is showing great execution with a strategic focus on the booming AI custom compute market. Also, the overall market risks look relatively low.

As a result, we believe that Celestica is one of the best AI investments in the current market. Based on our updated DCF valuation, we assign a fair value of $84 per share, implying more than 43% upside.

Read the full article here