Investment action

I recommended a buy rating for Moody’s (NYSE:MCO) when I wrote about it in November last year as the growth outlook remained attractive, and I did not see any major hurdles that would impair growth in the medium term. Share price performance has been great so far, up ~13% since my last update. Based on my current outlook and analysis, I recommend a hold rating. My key update to my thesis is that I am downgrading MCO from buy to hold because of the potential growth slowdown post FY24, which is likely going to drag down valuation given that its closest peer is trading at a much lower valuation despite a similar growth outlook.

Review

MCO reported another strong earnings report a couple of weeks ago. Revenue growth came in much higher than my expected growth rate of 10% in the growth years, at 21.5%, pushing revenue to a total of $1.78 billion, beating the consensus estimate of 15.5%. The growth was driven by Moody’s Investors Service [MIS], which saw growth of 34.7% y/y, and Moody’s Analytics [MA] that saw revenue growth of 8.4%. Down the P&L, EBITDA margins expanded 610 bps y/y to 50.7%, and EPS saw $3.37, which beat consensus estimate of $3.01.

As a previous bull on MCO, I was really happy to see the headline growth figure for the MIS segment. On a closer look, though, it becomes clear that financial institutions were the primary drivers of this robust expansion through their opportunistic issuance and the pull-forward of corporate leveraged loan refinancing. More specifically, management observed a substantial amount of pull forward in 1Q24, with the majority of it coming from 2H24 refinancing requirements and a small amount from later years. While this is good for the near term, it comes at a cost: lower volume for the remaining quarters and the next 12 to 24 months.

Author’s work

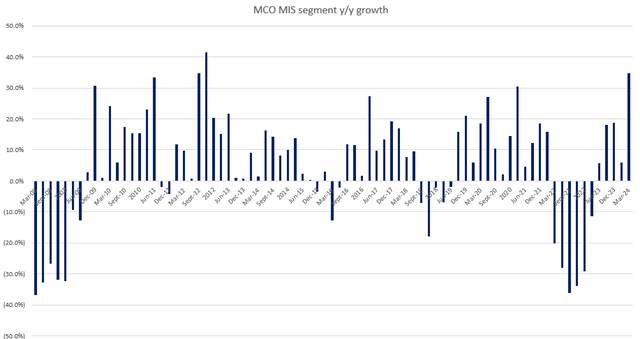

For a historical perspective, MIS has only seen a similar level of growth as it did in 1Q24 a few times, and whenever it posts a similar growth of this level, it was followed by strong deceleration in the following quarters. Notably, whenever growth decelerates to negative territory, the share price falls accordingly:

- From FY08 to FY09 the stock fell by 15 to 20%

- From 2H15 to 1H16, the stock fell >20%

- From 1Q22 to 1H23, the stock fell >20%

My belief is that MCO is going to see a similar trend in the coming quarters as growth slowdown. Remember that MIS represents a very large part of the business (74% of EBIT), hence, how this segment performs is definitely going to significantly impact the sentiments. That said, it is difficult to put out a sell rating (or short the stock) because I do see potential for MCO to continue seeing strong volume in the very near term (maybe 1 or 2 more quarters) that could potentially push MIS growth to greater heights (they demonstrated this in 2H12 before). The reason I say this is because the current uncertain macro environment (especially with the Fed flagging the potential for rates to go up) is likely going to cause a lot of companies to have the FOMO (fear of missing out) moment. As macro indicators continue to point to a strong labor market and sticky inflation, they might pull forward more debt issuance to lock in the rates today, and this benefits MCO. However, my stance is still that this comes at a cost, and I am not willing to bear the risk of growth slowing down by a lot as we go into FY25 and beyond.

Put together, the current set-up for MCO is:

- ~74% of the business profit is going to face growth headwinds over the next 12 to 24 months as a bunch of revenue is being pulled forward.

- 26% of the remaining business profits doing not too bad, but it is going to continue facing FX headwinds because of the strong USD (which should continue to stay strong because rates are likely to stay higher for longer). Nonetheless, it should still continue to grow at high single-digit

- Valuation that has rallied up to a 10-year high of 35x forward PE (more on this below)

I don’t think this is a favorable set for equity investors, and as such, I am downgrading to a hold rating.

Valuation gap vs peer is a concern

Author’s work

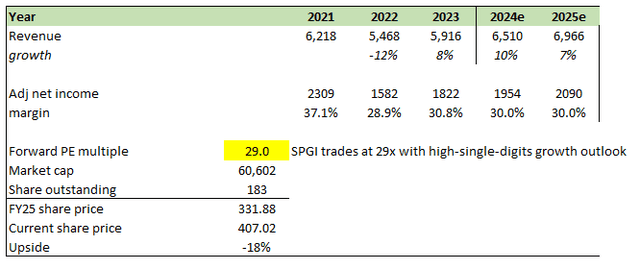

I believe MCO is going to see a higher growth rate in FY24 because of the pulled-forward situation, but this is going to result in a slowdown in FY25. MCO annual growth since subprime is around ~8 to 9%, and using that as a baseline, I expect a slowdown in FY25 (7%) to realign the 3-year average back to the historical trendline. In terms of net margin, historical average net margin has trended between 25 and 30%. Assuming that MCO manages to achieve the high end of this range because of a higher revenue base (some benefits from operating leverage), I expect MCO to generate around $2.1 billion of earnings in FY25.

The closest competitor for MCO is S&P Global (SPGI), and both of them have historically traded in line with each other, almost at a 1:1 ratio. However, the valuation gap between the two has widened to 20% (MCO trading at a premium), something that I don’t think is sustainable given that both companies are exposed to the same end market, expected to grow at similar rates, and offer similar products and services. As MCO shows a slowdown in FY25, I believe the market is going to downgrade MCO’s multiple back to SPGI levels (1:1 ratio), resulting in a potential downside of 18%.

Risk

The upside risk is that the pulled-forward impact could last longer than expected with a higher magnitude than I expected, and this could drive near-term growth to be much higher than expected too. This is also why I am not downgrading MCO to a sell rating. Given the uncertainty here, I would rather just sit out on this one.

Final thoughts

My recommendation is to downgrade MCO to a hold rating despite strong recent performance. Although the pull-forward effects have a positive impact on near-term earnings, this comes at a cost over the next 12 to 24 months, which is likely going to drag down growth. This, coupled with a high valuation relative to peer, suggests a risk-reward scenario unfavorable for investors. There’s a chance the positive impact lingers, but I believe the downside risk outweighs the upside potential at this point.

Read the full article here