Investment summary

My recommendation for Carlsberg (CABGY) is a buy rating. There is a strong growth outlook in the key regions for CABGY, especially in China and India, that should continue to drive organic growth. There are also visible catalysts in Europe that should drive volume recovery—specifically, warmer weather and an upcoming sports event. As earnings grow, I expect CABGY to trade back to its historical average forward PE multiple of 19x.

Business Overview

CABGY produces, markets, and sells beer and soft drinks. Within its portfolio, there are multiple brands, of which some of the most renowned brands are: Carlsberg, 1664, Danish Royal Stout, etc. You can find the entire list here. Segment-wise, CABGY reports in 3 big regions: Western Europe, Central & Eastern Europe, and Asia. Western Europe is the largest with DKK37.3 billion in revenue, followed by Asia with DKK23.3 billion in revenue, and lastly, Central & Eastern Europe with DKK12.96 billion in revenue (all revenue figures for FY23). CABGY’s competitive moat is its branding and scale. Take, for instance, its core brand, Carlsberg. The years of marketing and brand investments made in the brand have made it one of the most popular beers in Europe, and this is something that is hard to displace given the strong consumer mind share. Its massive scale, with DKK73.6 billion in revenue, allows it to continue investing heavily in its brand and distribution, which smaller players are unlikely to be able to match.

1Q24 results update

Released on April 30th, CABGY saw robust organic sales growth of 6.4%, beating consensus by 140 bps. Driving the growth was volume growth of 2% and pricing (revenue per hl) growth of 4%. By region, Western Europe organic volumes were flattish at 0.2%, supported by strong pricing growth of 5% driving organic revenue growth, but offset by weak volumes in France, Switzerland, and Norway. In Central & Eastern Europe and India, organic volume grew by 2.2%, driven by premium beer and energy drinks. Pricing was also positive, driven by price increases from last year and during the quarter and a positive category mix. This led to organic revenue growth of 7.2% in 1Q24. In Asia, organic volumes grew by 3.1%, driven by strong growth in the China, Laos, and Malaysia markets. Volumes in Vietnam were flat despite industry volume declining by mid-single-digit, suggesting market share gains. Overall, Asia organic revenues grew by 7.6%.

Strong growth outlook in key regions

In Europe, CABGY should benefit from warmer weather and sports events in the coming quarters, driving positive volume growth (a recovery from the weak volume seen in 1Q24). For weather, a warm weather definitely is in favor for CABGY as it means more drinking occasions (out of home especially), and this should benefit CABGY. This occurs just before two big sporting events, the Paris Olympics and the European Championships, which I believe will boost consumption of alcoholic beverages. An increase in sales and marketing spending is in the works, with a focus on summertime activations in Western Europe timed to coincide with major sporting events. This shows that management is paying close attention to the market and making smart investments in this area. Some of these include promoting Tourtel Twist as the official AFB partner of the Olympic Games in Paris, as well as additional activations during the Tour de France and the European Football Championship.

In China, CABGY showed really strong execution, as evident from the 5% volume growth during the Lunar New Year despite a tough Chinese beer market. I expect more growth from China as management continues to execute its big-city strategy with more directed marketing efforts. As of FY23, CABY has already entered into 91 big cities, ~10x since it started its strategy in 2016/17, a very impressive track record that makes me believe they can continue expanding. CABGY should also benefit from an underlying mix shift impact, given that big cities are growing faster and have a stronger skew towards premium beer products.

In an estimated flat Chinese beer market, our business delivered 5% volume growth, thanks to a well-executed Chinese New Year.

If we look at the first quarter, you are right, it would say, it was a well-executed Chinese New Year with the 5% volumes. When we look at it, big cities and premium grew faster than average and of course that’s key. 1Q24 earnings transcript

In India, which accounts for around 18% of sales, the growth momentum remains very strong. For reference, India grew volumes by low teens in 1Q24, more than double the market’s growth, and combined with pricing growth (due to mix and price increases), this led to overall India sales growth of around 20%. In fact, growth could have been better if not for the unfavorable weather conditions in north India; as such, on a like-for-like basis, India’s growth could have been >20%. Given the strong momentum, I expect growth to continue sustaining itself at a similar pace, with the potential for margin to expand if CABY resolves the ongoing dispute with its partner (resolution of the dispute will unlock the capacity constraint that CABGY is facing today).

Guidance seems conservative

Management reiterated their guidance for organic EBIT to grow between 1 and 5%. A more subdued macro environment in China and unfavorable summer weather in Europe are likely to be the factors at the bottom of the guidance range, while more positive summer trading conditions and an improved operating environment in China are likely to be the factors at the top. With the many positive growth catalysts ahead, I believe management is once again being conservative with its guidance. If we look at guidance history, they tend to under-guide and over-deliver. In FY23, they initially guided for -5 to 5% growth but reported 5.2%; in FY22, they initially guided for 0-7% but reported 12.2% growth; in FY21, they initially guided for 3–10% but reported 12.5% growth. I believe the current guide will follow the same pattern, with the possibility for guidance upgrades in the coming months as CABGY executes well in China and European volume recovers on the back of good summer weather and sporting events.

Valuation

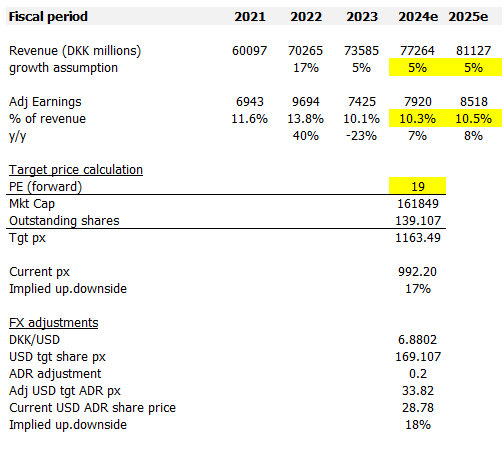

Redfox Capital Ideas

I model CABGY using a forward PE approach, and using my assumptions, I believe CABGY is worth ~DKK1,163. I expect CABGY to be able to at least sustain its current mid-single-digit growth (5%) in the near term, supported by volume recovery in Europe and momentum in China and India. Earnings should scale back to historical levels of low teens as CABY experiences volume growth, but this is partially offset by the required investments to capture this demand. As such, I only modeled for minimal margin expansion. My earnings growth expectation is higher than CABGY’s historical average adj earnings y/y growth of mid-single-digits; as such, I expect CABGY to trade at least in line with its historical average forward PE of 19x.

Risk

Hotter than expected weather in Europe and unexpected disruptions in the upcoming Paris Olympics are going to hurt CABGY Europe’s volume recovery narrative. Management may make a mistake in execution in China and India, causing the growth momentum to come to a halt.

Conclusion

My view for CABGY is a buy rating due to its strong growth momentum in key regions, particularly China and India. These markets, along with a potential European volume recovery fueled by warmer weather and sporting events, position CABGY for continued organic sales growth. I also believe management guidance is conservative, as their historical track record suggests they tend to over-deliver. However, hotter weather in Europe or execution missteps in China and India could hinder growth.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here