Before we start our article, we would like to thank Robert Dydo for his successful calls on Ouster. His comprehensive analysis and outstanding research played a key role in bringing Ouster to our attention, which led us to initiate coverage on this stock.

Strong Q1 Earnings, Stock Jumps 20%

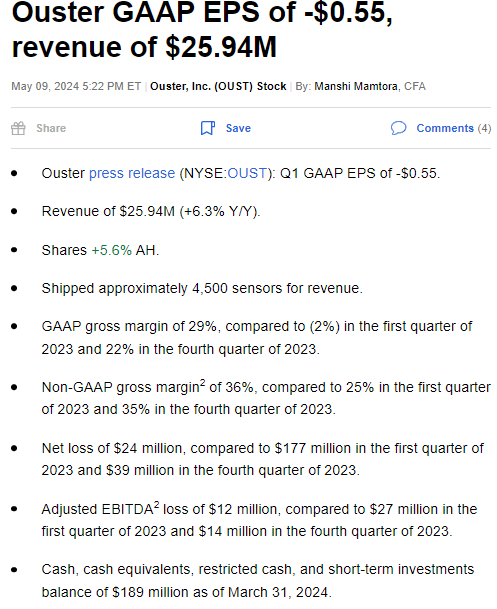

Ouster (NYSE:OUST) reported its Q1 2024 results on May 10th 2024. Earnings were very positive as revenue increased 51% to $26 million, exceeding expectations. The market liked the results, and the stock rose almost 20% the day after. Other headline results can be seen below:

Ouster Q1 Earnings (Seeking Alpha)

Ouster’s gross margin improved significantly, reaching 29% in Q1 2024, up from -2% in the same period last year. This margin expansion was due to higher revenues, as well as the cost savings from outsourcing its manufacturing to Thailand. Ouster continues to optimize its cost structure in order to reduce its cash burn, which is a key priority for the company. Keeping its operating expenses at a minimum level will provide the company the financial flexibility to invest in its growth initiatives.

The robotics segment stood out as the largest contributor to Q1 revenue growth. Lidar sensors are increasingly being adopted by robotics companies, which creates strong demand for Ouster’s vertical lidar solutions. However, the real opportunity we see for Ouster is on the software side. Ouster has started to attach software to its industry-specific sensors in order to create verticalized lidar solutions. We think that this verticalization strategy coupled with AI models can be a unique differentiator and create high margin revenue streams for the company.

With a market cap of $550 million, Ouster is a compelling small-cap investment opportunity in the growing lidar market. The company continues to capture lidar market share in industrial applications and has the potential to grow to $1 billion revenue in 5 years. We are bullish on Ouster’s software and verticalization strategy and believe the company is a great bet on the robotics and autonomy megatrends.

Lidar Demand is Growing

Lidar technology fell out of favor the for some time, causing the sector to shrink and consolidate. The complex nature of the lidar systems made it difficult to integrate into consumer products and also had cost disadvantages to other sensor technologies such as cameras. However, in the last few years, the unit prices of lidars have come down significantly, and new generation lidars are also produced in more compact sizes. Demand has also seen an uptick in the robotics and automotive sector, especially with the acceleration of AI.

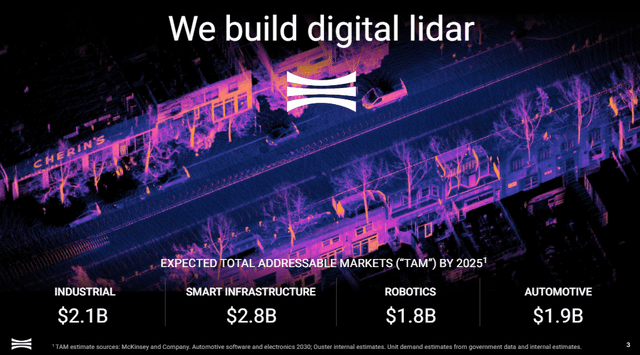

The lidar market is expected to grow at a 21% CAGR in the next few years to reach $8 billion by 2030, due to high demand for autonomous vehicles, robots, drones, industrial automation, smart farming, and many other perception-based solutions. On the other hand, Ouster estimated its TAM to be around $8.5 billion by 2025 (see below):

Ouster TAM (Ouster Investor Presentation)

There are many companies in the lidar sensor market, but the top players are Hesai (NASDAQ:HSAI), Ouster, and Luminar (NASDAQ:LAZR). Luminar is specialized in the automotive industry and ADAS systems, as the company recently announced its partnership with Volvo, which was a significant milestone for the company. Ouster is also a key player in the lidar market, offering a diverse portfolio of lidar products for various industries. We believe that Ouster’s diversified and verticalized solution portfolio is a key differentiator in the market. The increasing adaptation of lidar in different industries is an indicator of the future growth of the company.

Hesai is the market leader for lidar sensors with almost 50% market share. The Chinese company’s products are adopted by major automotive OEMs and Tier 1 suppliers globally. While Hesai currently holds the largest lidar sensor market share, the company is facing geopolitical challenges. Last January, the company was added to the list of “Chinese Military Companies Operating in the United States” by the US Department of Defense. Hesai has denied the allegations and filed a lawsuit to challenge this decision. Eventually, if not overturned, this decision will lead to potential trade restrictions for the company and create opportunities for competitors like Ouster and Luminar to gain market share.

Ouster’s Software Opportunity

Ouster is originally a lidar sensor company, but has a strategic focus on software to create additional value from its sensors and enhance its value proposition. The company wants to build a software platform with industry-specific perception models, mapping tools, and developer kits. We think that this software platform has the potential to differentiate Ouster even more from competitors and create competitive advantages based on proprietary software capabilities.

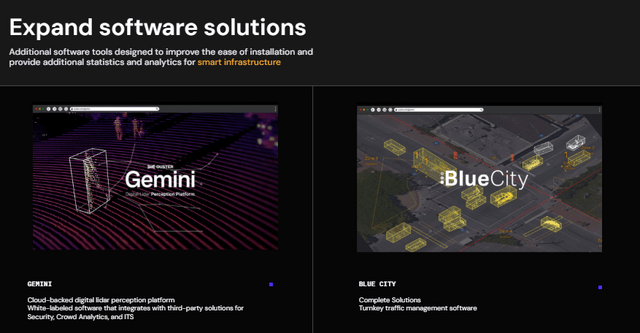

Ouster currently has two software platforms that complement its lidar hardware offerings:

- Gemini: A SaaS platform for users to process Lidar information for real-time analytics and insights.

- Bluecity: A software suite to enable smart infrastructure solutions based on lidar, such as traffic monitoring and urban transportation planning.

Ouster Software solutions (Ouster Q1 Earnings Presentation)

Gemini and Bluecity are revenue generating products that are both driving lidar sensor sales in their end-markets, and the company is planning to target new industries using the same model. The end goal of this strategy is to diversify the lidar product portfolio across industries using software and generate a higher margin revenue stream for the company.

Ouster also works on AI perception models that leverages data from lidar sensors, in order to provide more intelligent perception and mapping capabilities. From the Q1 call:

Angus Pacala (CEO):

Turning to our strategic business priorities for 2024, first up is expanding software and installed base growth. In the first quarter, Ouster has trained a new deep learning perception model that advances our ambition to be a world leader in lidar-powered perception solutions. With improved operating performance, our Gemini and Blue City customers now benefit from further improvements to object detection at longer distances and multiple object tracking accuracy.

Overall, Ouster’s strategic decision to diversify its product portfolio and target vertical markets beyond the crowded automotive lidar space appears to be a great move. Given the dominance of Chinese suppliers like Hesai in the mainstream lidar sensor space, it is unlikely that any US or European company can effectively compete on cost and scale. By focusing on high-value verticals such as robotics and smart cities and leveraging AI integrated software capabilities, Ouster can differentiate its offerings and avoid direct competition with the cost-advantaged Chinese suppliers.

$1B Revenue Potential in 5 Years

Ouster delivered $26 million revenue in Q1, which indicates a growth of 51% YoY. The company has now an annualized revenue run rate of $100 million. Ouster’s management team remains bullish for the Q2 quarter, forecasting 40% revenue YoY growth at the midpoint. As per the earnings call, Ouster is seeing strong demand for its high-end lidar products in its industries, and the company is optimistic about the overall potential of the market.

For the long term, the company is guiding between 30% – 50% revenue growth and a gross margin expansion of 35% – 40%. Considering the company’s growth trajectory and the vast market opportunities in robotics, autonomous vehicles, and smart infrastructure, we believe the company has a potential to reach $1 billion revenue within the next five years (if the company grows on its higher range)

Ouster Long-term growth framework (Ouster Q1 Earnings Presentation)

Valuation – Potential for higher multiples

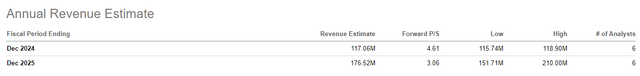

Ouster’s current market cap is around $550 million. The estimated revenue for 2024 is $117 million, and the company trades at a forward P/S ratio of 4.6 (see below):

Ouster Revenue estimates (Seeking Alpha)

We think that this valuation does not reflect Ouster’s long-term growth potential, considering its industry verticalization and software expansion strategies. With the company forecasting a sustained 30% to 50% annual revenue growth rate, Ouster should be valued as a high-growth industrial tech company rather than a low-margin semiconductor player. We believe that the market will recognize this dislocation eventually, which could trigger a significant re-rating of the company.

Risks

There are few risks that could impact the company’s performance:

- China Competition: Chinese companies such as Hesai dominate the lidar market. Any entry by the China suppliers in to Ouster’s target verticals could intensify competition and put pressure on Ouster’s prices and margins.

- Disruption by alternate technologies: Technological advancements in alternative sensing technologies, such as cameras, could potentially threaten Ouster’s business.

Conclusion

Our view is that Ouster’s valuation does not reflect its long-term growth potential. The company has many strengths, including strong revenue growth, margin expansion, and a focus on industry verticalization. Also, its software expansion strategy is a game-changer as it can help transform the company in to a high-tech industrial firm. Our analysis indicates that the company has the potential to grow to $1 billion revenue in five years and achieve 50%+ gross margins. We believe these prospects can drive the valuation of the company higher in the long term.

We are bullish on Ouster and rate the company as a Buy.

Read the full article here