Telesat Corporation (NASDAQ:TSAT) is worthy of a strong buy recommendation. The company’s shares are undervalued, and the Canadian government partially funds its upcoming satellite launches. Despite the clear execution risks of the company’s plans, there is beautiful upside potential to TSAT’s stock price.

Based on the context of Telesat’s business today, I find it hard to rate the company as anything but a buy, as it is reaching all of its operational milestones. I think the best is yet to come for this transformative company.

Company Overview

Telesat Corporation is a global satellite operator based in Ottawa, Canada. Founded in 1969 as a commercial spin-off of Canada’s Communications Research Centre, Telesat launched its first satellite, Anik A1, in 1972, making Canada the first to have its domestic geostationary communications satellite.

Telesat has since expanded globally and developed new satellite technologies, culminating in the upcoming Telesat Lightspeed broadband low Earth orbit [LEO] constellation. It launched a test satellite with SpaceX in July and inked a deal for SpaceX to launch its constellation starting in 2026. Telesat guided that Lightspeed will have 156 satellites in orbit by Q2 2028.

Lightspeed will mirror SpaceX’s Starlink operational model and capabilities – but there’s a twist. The Lightspeed constellation will provide space-based internet services primarily to government and enterprise customers. This competitive positioning will help give it a first-mover advantage in tailoring to these segments.

Telesat Corporation generates income by renting out satellite bandwidth to broadcasters, ISPs, and governments, focusing on long-term agreements. Some factors driving demand for its services include high-speed internet access in remote and underserved areas and secure communication channels for corporations and government agencies.

Telesat operates in a single operating segment, providing satellite-based services. In 2022, revenue was $759 million, with 47% from broadcast services, 51% from enterprise services, and 2% from consulting and other services.

Thesis

What I love about this project is that Lightspeed is already fully funded. This is through Telesat’s existing cash balance of $1.8 billion and $2 billion in committed funding from the Canadian government.

Part of why it’s fully funded is due to some thrifty cost-cutting by its management team. Telesat originally planned for 298 satellites but reduced this to 198 satellites last year. It also saved $2 billion on CAPEX by awarding Canadian space technology company MDA a contract to make these satellites. Telesat stated the MDA contract has fully funded the first 156 satellites. Once the initial constellation is operational, the remaining 42 satellites will be paid for from cash flow.

What this means for us as investors is that there’s minimal risk of shareholder dilution via the company increasing shares outstanding, which gives us more of a reason to buy now. This is a somewhat unusual situation for companies launching massive projects like this. Telesat’s share count has remained relatively stable at 155 million.

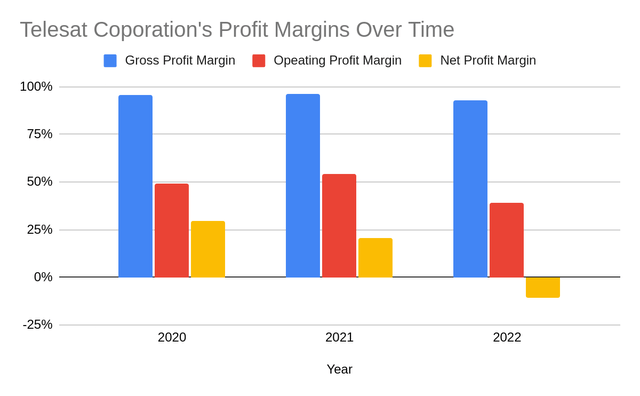

Telesat also has sufficient capital and inflows while it scales its customer base. The company expects to generate significant cash flow from its existing satellite fleet operations. It has high margins on its legacy business.

Author supplied

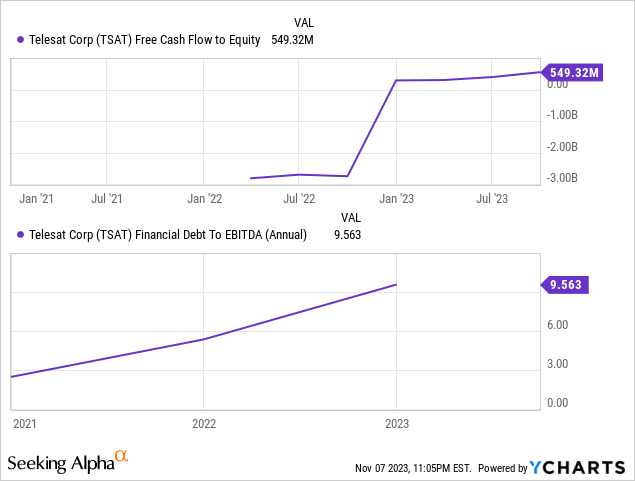

A small but important concern of mine is its debt situation, which has ballooned since the company was made public. Telesat’s long-term debt is $3.3 billion with a 5% average interest rate. However, they’ve reduced their debt by 28% since 2020, buying back $587 million in bonds this year.

As an investor, a rule of thumb I use is that I’d much rather a company take on debt than issue shares, and I think the reverse is true for management. Issuing shares offloads investors more risk, while debt primarily puts that risk on the company’s shoulders.

Its debt is, therefore, a significant financial risk, but its interest expense is manageable relative to EBITDA generation.

The company’s results from the previous quarter were also solid, with revenue of $175 million and adjusted EBITDA of $133 million. Its adjusted EBITDA margin remained strong at 75.9%, slightly down from 76.0% in Q3 2022. They also reported a strong order backlog of approximately $1.5 billion, which gives visibility for the next three to five years, strengthening my bullish stance. Management’s outlook over the short term is also positive. It posted a revenue guidance of $690M – $710M and adjusted EBITDA guidance of $500M – $515M.

This thesis is further strengthened by the company meeting its operational milestones, which suggests that preparations for the launch are going as expected. The company successfully launched its LEO-3 demonstration satellite in July 2023, which has completed in-orbit testing. Meanwhile, Telesat and MDA teams are making substantial progress in moving the Lightspeed program forward, including ordering long lead-time components for its satellites.

Then there’s management’s highly confident assessment of the company. In their most recent earnings call, the CEO stated: “We remain hugely bullish about Telesat Lightspeed and look forward to sharing more detailed information with investors about our business plan and expectations.”

So, this suggests that Telesat’s prospects are attractive and likely to pan out as expected based on the evidence and situation today.

Valuation

Telesat’s fair price and valuation are key reasons I’m bullish on the stock.

With a current stock price of $11.39 at the time of writing, Telesat has a market capitalization of $568.09 million and an enterprise value of $1.27 billion. Looking at trailing financials, the company generated revenue of $745 million over the past 12 months and EBITDA of $851 million, representing EV/Revenue of 1.7x and EV/EBITDA of 1.5x.

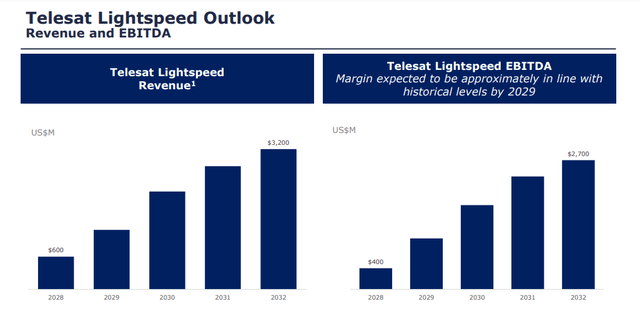

Looking ahead, management has guided to $1.1 billion in EBITDA from the Lightspeed satellite constellation at maturity in 2029. EBITDA is projected to be greater once more satellites are launched, and more customers are onboarded and monetized.

Telesat investor presentation

This projection is built on forecasts for its total addressable market, revenue, and earnings. Revenue is expected to grow steadily from $600 million in 2028 to $3,200 million in 2032. EBITDA is projected to increase, starting at $400 million in 2028 and reaching $2,700 million by 2032.

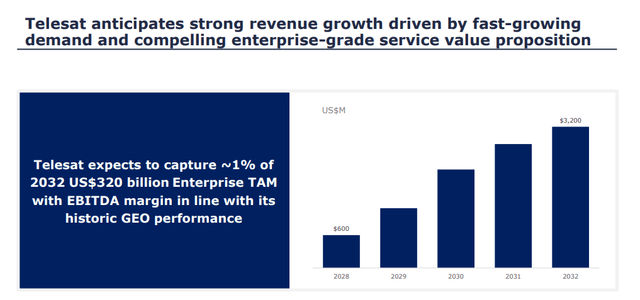

Telesat investor presentation

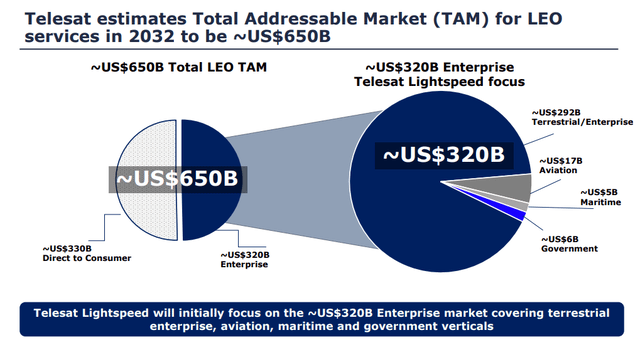

Telesat Lightspeed’s initial focus will be on the $320 billion enterprise market, which includes terrestrial enterprise, aviation, maritime, and government verticals, with specific allocations of $292 billion for terrestrial/enterprise, $17 billion for aviation, $5 billion for maritime, and $6 billion for government services.

Telesat investor presentation

I think it’s reasonable to assume the market is pricing in the operational risks of successfully launching and operating Lightspeed, and therefore, these multiples discount those complex risks. I also think it’s safe to assume that once Lightspeed is operational, much of the risk of the project will be gone, and therefore, its future earnings potential will trade at higher EBITDA multiples. This valuation will also assume that shares outstanding remain constant, which seems inevitable for the foreseeable future, as well as a 10 percent discount rate.

We’ll go with the $1.1 billion EBITDA to make a conservative calculation on the present fair value of its shares. Using this midway point will also discount some of the project’s considerable risks and uncertainties.

My formula is:

- 2027 Projected Lightspeed EBITDA = $1.1 billion

- Future EBITDA multiple * $1.1 billion EBITDA = implied future Enterprise Value

- With 155 million shares outstanding:

- Implied future Enterprise Value / 155 million shares = future stock price

- Discount rate: 10% annually for 5 years

- Present Value = Future Value / (1 + Discount Rate) ^ Years

- Future stock price / (1 + 0.10)^5 = present value per share

I will assume that Telesat’s EBITDA multiple will at least double once Starlink is operational as a base case. When we plug these new EBITDA multiples into the formula above, we can derive the stock’s present fair value per share.

| 3x EBITDA Multiple | 4x EBITDA Multiple | 5x EBITDA Multiple |

| $21 future stock price | $28 future stock price | $35 future stock price |

| $14 present fair value per share | $19 present fair value per share | $23 present fair value per share |

The average of these present values is approximately $18.67, which means Telesat has an implied upside of 63.91%.

I feel these multiples are realistic. However, they are not meant to be taken as strict guidance but rather pointing to its general trajectory as a back-of-the-envelope approximation.

Risks

While Telesat is progressing on Lightspeed, the LEO constellation faces execution risks typical of large satellite projects, including potential delays and cost overruns. Competition from players like Starlink is increasing in the enterprise broadband market.

Telesat also faces revenue headwinds in 2023/2024 from contract renewals like Bell Canada. This resulted in some pressure on its top-line revenue, which dipped 2.8% quarter-over-quarter. This is of particular concern given the fixed-cost nature of the business.

Aside from the clear execution risks, if Lightspeed encounters delays or if competition erodes revenue more than expected, the stock could face pressure over the next 12-18 months.

However, the long-term case still seems constructive, given the transformative nature of Lightspeed.

Takeaway

Telesat Corporation presents a compelling buy opportunity. Its Lightspeed project is fully funded, operational milestones are consistently met, and the risk of shareholder dilution is minimal. Despite carrying considerable debt, the company’s financials are strong, with high EBITDA margins and a significant order backlog providing visibility into its future performance.

With the Lightspeed constellation projected to generate substantial annual EBITDA upon full deployment by the end of 2027 and the stock currently undervalued, the investment thesis supports a strong buy rating.

Read the full article here