As new catalysts impact financial markets, some investors are likely looking for stocks that act as a potential hedge against crucial risk factors. Events in Israel over the past week are a significant risk factor that can impact financial markets if escalation continues. Crude oil has risen by around 4% in value as the Middle Eastern production stability outlook for the essential commodity is questioned. Of course, oil will be a critical commodity in any Middle Eastern-centric issue; however, I believe that natural gas will likely face more related volatility, specifically liquified natural gas.

The LNG market has boomed over the past two years due to the Russia-Ukraine war, causing Europe to dramatically lower its imports from Russia while increasing its LNG imports from the US, Qatar, and others. European natural gas prices were extremely high in 2022 but have fallen by around 80% as LNG imports soar to recoup lost Russian sources. The primary company to benefit from that trend is Cheniere Energy (NYSE:LNG), the largest US exporter of LNG, with most resources flowing into Europe.

In the past, I was bearish on Cheniere because the stock appeared to have downside risk due to falling LNG prices in Europe. Europe’s natural gas and LNG prices have continued to slide since then, causing its quarterly EPS to decline from over $20 per share in Q1 to just ~$5.60 in Q2. As contracts continue to roll, its Q3 profits may be even lower due to lower LNG prices today, potentially making Cheniere Energy overvalued. That said, the stock rocketed up by around 8% in value over the past week in response to the geopolitical crisis. Accordingly, I believe it is a critical time to take a closer look at Cheniere’s exposures and the global LNG market to determine if its outlook has improved or is merely reacting to fear and hype.

A Closer Look at Europe’s LNG Demand

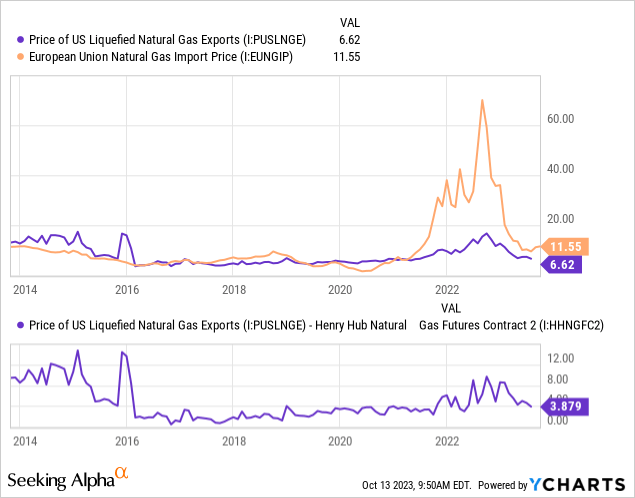

The natural gas price in Europe primarily drives the US price of LNG because most US LNG flows to Europe today. Europe’s LNG demand was extremely high in 2022 as it raced to secure new sources of its primary power source, leading to an extreme increase in its natural gas prices. US LNG prices also rose dramatically, up to $9 over the base price of natural gas. However, since its supplies have normalized, the spread between LNG and natural gas has normalized and is now back at ~$3.80, roughly its typical historical level. See below:

Europe’s natural gas price has moderated tremendously from last year’s level as fears of a shortage have declined. Warm winter weather last year and slower economic growth in Europe benefited the market by pushing demand lower. Europe’s natural gas price is currently €51/MWH, roughly $16/MMBTU. While Europe’s natural gas price is much lower than it was, being briefly over €300/MWH, it has doubled since summer when it was just ~ €25/MWH. Crucially, Europe’s natural gas price soared by 40% this week due to concerns regarding Middle Eastern natural gas supplies, as Europe is more dependent on the Middle East today after losing Russian sources.

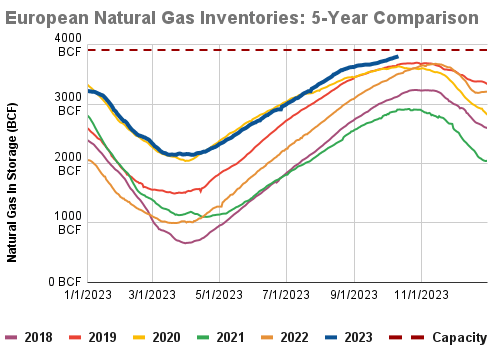

Still, Europe’s natural gas storage level is extremely high today, pushing up against its capacity level. Europe has more natural gas today than at any point over the past five years and is significantly above the average seasonal level. See below:

Europe Natural Gas Storage (Celsius Energy)

Europe is going into withdrawal season in a robust position. European weather forecasts also predict another year of warmer weather, potentially lowering demand throughout the season. So, aside from geopolitical risks to Europe’s natural gas supply, the continent’s demand for US LNG should not be exceptionally high today. One bullish factor not particularly geopolitical is the increasing demand for LNG from Asian and Southeastern Asian countries actively looking to move away from coal. As Asian demand continues to grow, while Europe may not see a return in Russian gas flows any time soon, there is reason to believe US LNG export prices will remain elevated, or at least not decline significantly. Additionally, two major Chevron LNG plants may soon go on strike amid an increase in global labor issues, potentially limiting some future LNG supply worldwide.

That said, multiple geopolitical pressures could increase US LNG export prices. For one, the undersea gas pipeline between Finland and Estonia is believed to have been deliberately sabotaged, with NATO planning to “respond” if a culprit is found. This potential attack occurred one year after the initial Nord Stream 1 sabotage and soon after Finland joined NATO. Further, the second-largest European LNG provider is Qatar, which recently signed long-term LNG export contracts with European countries. Those deals quickly became scrutinized because Qatar is widely seen as a sponsor, or a haven, of Hamas leaders.

Of course, there are also direct pressures created by conflict. Israel had to half its Tamar gas field, reducing LNG supplies going toward Egypt, indirectly creating slight pressure on the European market. The conflict also occurs relative to the Suez Canal, through which much of Europe’s LNG comes. Accordingly, a potential escalation that causes the inclusion of other Middle Eastern countries would undoubtedly threaten a significant portion of Europe’s LNG supplies.

These issues are not isolated to East Europe and the Middle East but include Central Asia. While the issue has not made as much headlines, Azerbaijan recently launched an offensive into contested territories from Armenia. Azerbaijan is a critical Russian-alternative natural gas producer for Europe, causing some to call on the EU to cut imports from the country as it had with Russia. However, that is generally unlikely, as Armenia is arguably tied to Iran and Russia, while Azerbaijan is close to Turkey. Regardless, I believe any conflict in this key gas-producing region will influence natural gas prices, mainly because it is the region between Russia and the Middle East.

As the situation is today, I would not state that Europe’s demand for US LNG will rise due to renewed conflict in gas-producing areas. That said, investors must be aware that that may occur, potentially pushing natural gas and LNG prices in Europe back into 2022 levels. Further, from a broader perspective, we can see clearly that Europe’s dependence on natural gas from virtually all eastward directions is unstable. Key reasons include higher geopolitical instability in East Europe, central Asia, and the Middle East. Further, as seen in pipeline attacks, natural gas lines are a massive target in these conflicts; thus, Europe will likely look to expand its US LNG imports to ensure energy stability.

What is Cheniere Worth Today?

The core issue in valuing Cheniere is accounting for the “binary option” in the European natural gas market. The East Asia natural gas market, to which the company currently sells around a fifth of its product, is expected to see steady demand growth for LNG over the coming years. Historically, Cheniere sells more gas to Asia than Europe, so this trend secures the company’s long-term potential, given Asia’s LNG projects are completed. However, should Middle Eastern, Central Asian, and Eastern European conflicts continue to grow, a significant portion of Europe’s “post-Russia” natural gas resources could be under fire.

In my view, without geopolitical risk escalation, we will most likely see US LNG export prices continue to compress toward the breakeven level for Cheniere. Historically, the company has had positive profits and operating cash-flows when the US LNG export price is above around $8/MMBTU, or around ~$4 to $5 above the Henry Hub spot price. Of course, Cheniere’s derivatives and long-term contracts can skew that factor a bit, but I believe that the company’s Q3 income will likely be near or below zero due to compression in commodity prices, with LNG export price being at ~$6.60/MMBTU or ~$3.80 above spot.

Cheniere’s current Q3 EPS outlook is $2.57, with its EPS expected to be around that $2.50-$3.00 range over the coming years, giving it an annualized profit outlook of ~$11 per year. Importantly, its EPS outlook remains around that level through 2033. While I believe its Q3 EPS may be a bit lower than the consensus estimate, I think that is a reasonable long-term outlook given it should earn a consistent EPS in light of growing Asian demand. That target gives the company a year-ahead “P/E” ratio of ~15.9X, a very high figure for a cyclically exposed energy company. Considering the firm is also working on various capital-intensive projects and is prone to commodity price risk, I believe its “fair value” “P/E” is closer to 9X, in line with the energy sector.

Thus, without an improvement in its fundamentals, I believe the stock is overvalued by around 75%, meaning it would need to decline by ~44% to reach its fair value, given no improvement in its EPS outlook. The company’s income is not expected to ever increase beyond its current level, so there is essentially no good reason to buy the stock today unless one firmly believes that geopolitical pressures will permanently increase US LNG export prices.

The Bottom Line

It is challenging to value Cheniere because it will likely go down one of two distinct paths and is unlikely to fall anywhere between that range. If European natural gas supplies from its eastern regions remain unthreatened, Cheniere should lose value as its “P/E” ratio falls toward the energy sectors. This could push the stock lower by over 50% and mirrors my bearish outlook from earlier this year.

However, Cheniere would be undervalued if the global LNG market fell under pressure due to the many geopolitical catalysts facing natural gas-producing areas today. Following the height of the 2022 run-up in LNG prices, Cheniere earned a quarterly EPS of ~$17.50 (the average of the recent two peak quarters), or ~$70 annualized. That occurred while European natural gas import prices soared as it raced to restore power supplies. If such a high EPS level were sustained due to prolonged war anywhere between Russia and Qatar, then Cheniere would likely be worth upwards of ~$350 or more, or 5X that annual EPS target.

In my view, in one to two years from today, Cheniere will likely be trading either around that $300+ range or lower, around $100, depending on what happens next in the LNG market. Personally, not being privy to all of the many geopolitical issues across central Eurasia, I have no strong bias on the potential for continued escalations. However, I believe the outcome is likely binary, meaning the stock LNG should move dramatically from its current value in either direction.

Investors looking to hedge against this risk, which would be bearish for most other stocks, may find hedge potential in LNG. Personally, I do not consider that to be profiting from bad news, as US investment into Cheniere is likely critical for securing Europe’s energy market stability. More speculative investors could find value in a straddle option trade on the stock LNG, betting it will move dramatically in either direction. LNG’s implied volatility is currently 30%, which, though not low, is lower than my expected volatility of ~50%+ in either direction. The critical issue with that trade is that it would need to be done on long-term options at least six months out, which are likely not liquid enough for more prominent positions. Still, personally, I would not buy or sell LNG today. Still, I expect it to face significant volatility, with upside potential depending primarily on geopolitical events amongst natural gas producers and transit lanes.

Read the full article here