All financial numbers in this article are in Canadian dollars unless noted otherwise.

Introduction

It’s time to talk about the TC Energy Corporation (NYSE:TRP), one of North America’s largest midstream companies with a 7.4% yield.

My most recent article on this company was written on April 6, 2023, when I highlighted the company’s impressive dividend track record, a rating downgrade, and plans to grow the business more consistently.

This is a part of my takeaway back then (emphasis added):

TC Energy is a fascinating company and a major part of the North American energy infrastructure. It services major basins, export facilities, and non-fossil fuel energy demand while maintaining a dividend yield of 6.8%. The dividend has been hiked for 23 consecutive years, providing reliable income for its many investors.

Unfortunately, due to the company’s substantial investment needs, it has had to seek external funding, resulting in a significant accumulation of debt on its balance sheet in recent years. Unfortunately, this trend is projected to continue in the foreseeable future, and as a consequence, the company’s credit rating has been downgraded.

As the company just released its 3Q23 earnings, it’s time to take another look at this giant, as I’ve started to like its yield. In fact, the company hasn’t been this cheap since before the Great Financial Crisis.

While a big part of this is due to elevated borrowing costs in a situation of higher borrowing needs, the risk/reward for income investors has gotten quite good.

So, using just-released earnings, I’ll use this article to explain why TRP has turned into a more attractive high-yield opportunity in the midstream industry.

Also, note that TRP does not issue a K-1 form. It’s a “normal” Canadian C-Corp.

So, let’s get to the details!

A Strong 3Q23 Performance & Spin-Off

After having analyzed more than a dozen midstream companies in the past few months, I can conclude three things.

- Most midstream companies are now free cash flow positive, allowing them to pay dividends without having to borrow money.

- Despite the economic weakness, pipeline demand is high, and business is booming.

- Companies with elevated leverage are suffering from the impact of high rates on borrowing costs, hurting the bottom line.

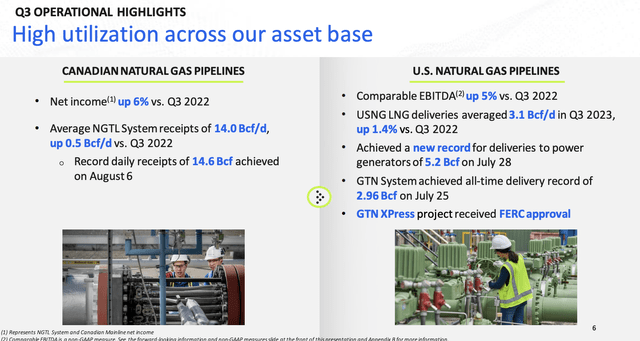

When it comes to TRP, the company is benefiting from very strong demand.

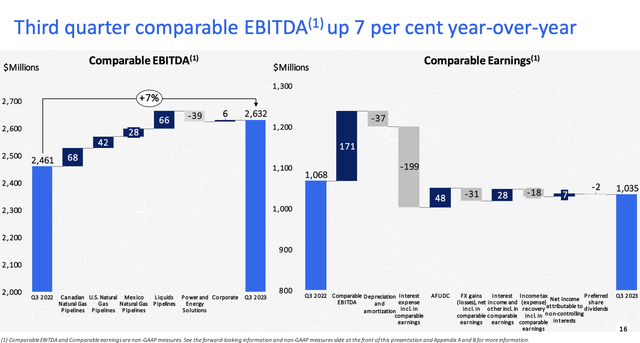

During the third quarter, TC Energy delivered a robust performance, leading to a 7% year-over-year increase in comparable EBITDA.

TC Energy Corporation

This performance was primarily driven by higher flow-through costs and increased NGTL rate-based earnings in the Canadian Natural Gas rate-regulated pipelines business, additional assets placed into service in the Mexico Natural Gas Pipelines business, higher long-haul contracted volume, and increased volumes.

TC Energy Corporation

The company has placed around $5 billion in assets into service so far in the year, including a significant portion of the West Path project.

It also saw $5.3 billion in cash proceeds, largely due to the sale of a minority equity interest in Columbia Gas and Columbia Gulf, but more on that later in this article.

This positions the company to reach its asset sales goal and limit annual net capital expenditures.

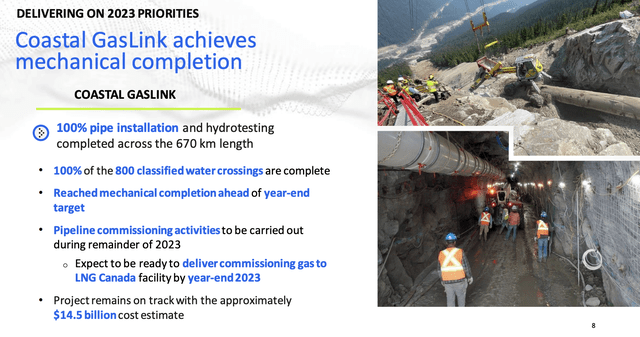

The company also achieved a significant milestone with the mechanical completion of the Coastal GasLink project ahead of schedule.

This is a pivotal step in bringing Canadian natural gas to global markets.

TC Energy Corporation

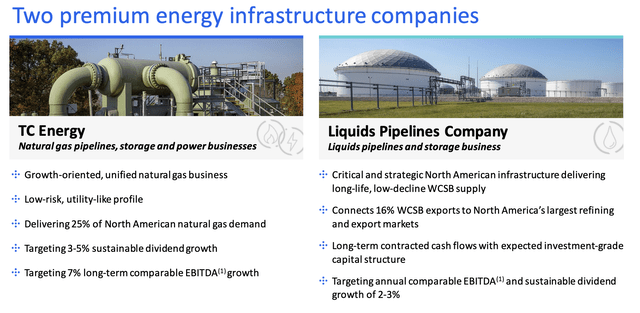

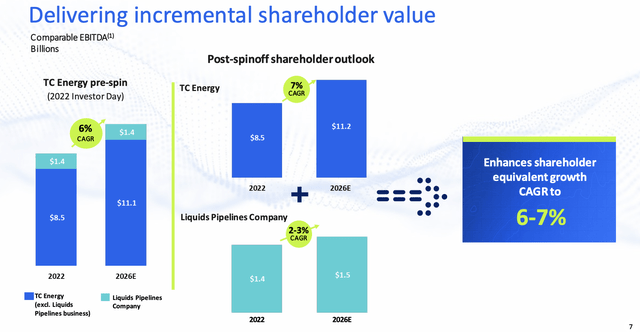

With that in mind, the company plans to spin off its Liquids pipeline business into a standalone entity named South Bow. The move aims to maximize the commercial potential of this corridor, serving the U.S. Gulf Coast and Midwest.

I’m very excited about this deal, as it would create two unique companies, each with a focus on value-adding operations with different risk profiles and growth opportunities.

TC Energy Corporation

The company believes that this separation could add at least 100 basis points to annual EBITDA growth.

TC Energy Corporation

In the second half of next year, the separation is expected to be finalized, leading to 3-5% annual dividend growth for TC Energy shareholders and between 2-3% annual dividend growth for South Bow shareholders.

As South Bow will focus on infrastructure, it will have a higher yield.

Also, given the strong demand picture for fossil fuels and the growing importance of Canada’s WCSB operations, I have to emphasize again how excited I am that the spin-off is progressing nicely.

TC Energy’s Dividend & Financial Stability

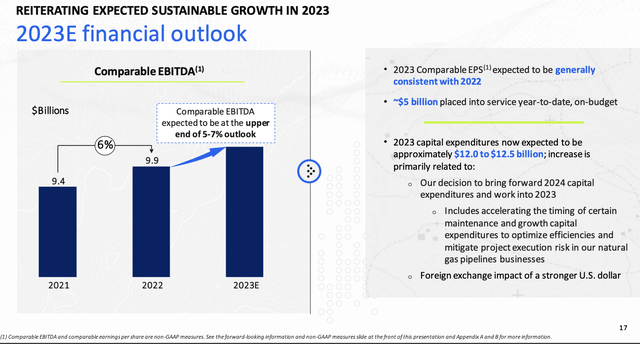

Thanks to a strong third quarter, TC Energy now anticipates that its 2023 comparable EBITDA will be at the upper end of the 5% to 7% outlook compared to 2022.

Comparable earnings per common share are expected to remain generally consistent with 2022, which is due to factors like higher interest expenses.

TC Energy Corporation

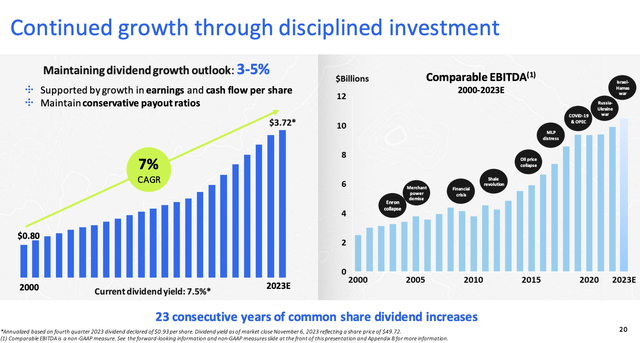

With that said, the company has a track record of consistent EBITDA growth.

This has supported solid dividend growth.

The company aims to continue growing its business in line with its 3% to 5% dividend growth rate, ensuring the sustainability of its dividend through all economic cycles.

- The company has grown its dividend every single year since 2000, with an average annual dividend growth rate of 7%.

- EBITDA growth has accelerated since the start of the shale revolution and remained strong through recessions like the 2015 manufacturing/commodity recession, the pandemic, and current economic struggles.

TC Energy Corporation

TC Energy currently pays a $0.93 per share per quarter dividend, which translates to a yield of 7.4%.

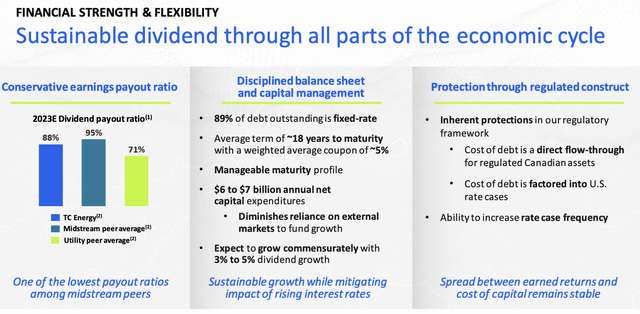

This dividend is protected by a sub-90% earnings payout ratio (non-GAAP), which is below the midstream average.

TC Energy Corporation

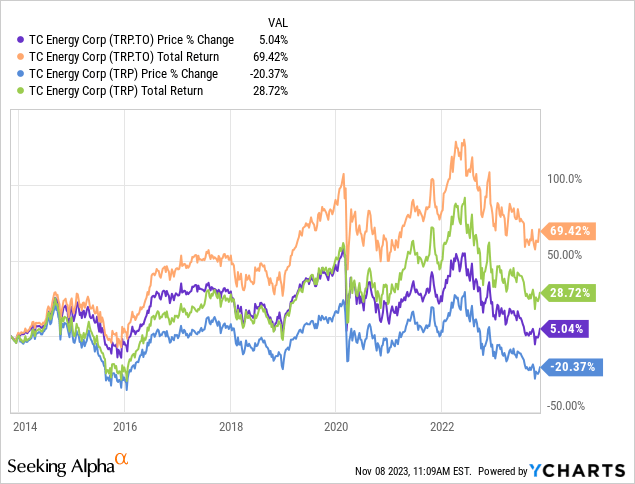

Having said that, despite consistent dividend and EBITDA growth, TRP’s stock price has been a mess.

- Over the past ten years, Toronto-listed TRP shares have returned close to 70%, including dividends. Excluding dividends, that number drops to 5%.

- NY-listed TRP shares (this includes currency fluctuations) have returned 29% since the end of 2013.

- None of these numbers are impressive.

One big issue is financial stability. As I noted in the intro, the company has been subject to a lower credit rating.

However, as you may have seen in the slide above, the company’s balance sheet isn’t poor at all. It’s also working on further improving financial health.

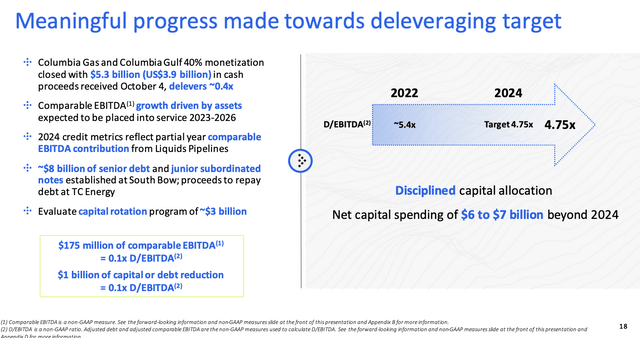

The company has a clear commitment to deleveraging and is working towards achieving a target debt-to-EBITDA ratio of 4.75x by the end of 2024.

TC Energy Corporation

The company is expected to achieve this while maintaining a big investment pipeline (pun intended).

As I briefly mentioned, year-to-date, TC Energy has placed approximately $5 billion worth of projects into service, including capacity projects in the natural gas and liquids pipeline businesses and Bruce Power’s Unit 6 MCR program.

Total capital expenditures for 2023 are expected to be in the range of $12.0 to $12.5 billion.

In 2024, TC Energy expects to place approximately $7 billion worth of projects into service, including the Coastal GasLink, GTN Express, and the south section of the Villaras pipeline in Mexico.

Looking ahead to 2025, the company anticipates placing $9 billion in assets into service.

On October 4, TC Energy completed the sale of a 40 percent minority equity interest in its Columbia Gas and Columbia Gulf systems, generating cash proceeds of $5.3 billion. These funds will be used to reduce the year-end 2023 debt to EBITDA metric by over 0.4 points.

Adding to that, and with regard to the threat of rising rates, the company boasts a long-term debt portfolio in which a significant portion, around 89%, consists of fixed-rate debt.

This fixed-rate debt comes with an average maturity of 18 years and a weighted average pre-tax coupon of just over 5%.

This financial structure provides a considerable degree of insulation from the impact of interest rate fluctuations.

TRP has a BBB+ rating, which is one step below the A-range.

TRP Stock Valuation

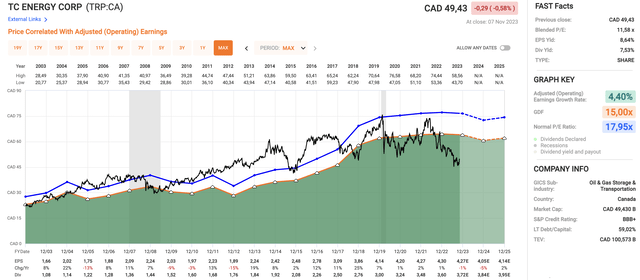

TC Energy is very cheap.

Although I would make the case that it’s cheap for a reason (elevated debt), I do not think TRP shares should be this cheap.

Using the data in the chart below:

- TRP is trading at a blended P/E ratio of 11.6x.

- This is cheaper than at any major bottom. During COVID, the company traded at 12.1x earnings per share. In 2015, the valuation fell to roughly 17x earnings per share. During the Great Financial Crisis, the valuation fell to 13x EPS.

- The normalized P/E ratio going back to 2022 is 18.0x.

- This year, EPS growth is expected to be negative 1%, which is in line with the company’s comments.

- EPS is expected to rebound by 2% in 2025 after declining by 5% in 2024.

- These numbers aren’t great, and they do not include the spin-off in 2H24.

- TRP is still attractively valued, as I would make the case that it could rise to $60 (in Toronto) without being overvalued. A return to its 18x valuation would suggest a move to $70.

FAST Graphs

Hence, I would make the case that TRP is about 20% to 25% undervalued.

When adding its juicy yield and management plans to lower debt and unlock more shareholder value, I really like the risk/reward.

Depending on what the pipeline spin-off could look like (I’ll keep you up to date), I may buy it as a higher-yielding component of my portfolio.

Takeaway

TC Energy Corporation presents an intriguing opportunity for investors, characterized by a substantial 7.4% dividend yield and a history of 23 consecutive years of dividend increases.

However, it faces challenges, notably accumulating debt due to substantial investment needs, leading to a recent credit rating downgrade.

Despite this, the company’s strong 3Q23 performance, marked by a 7% YoY increase in comparable EBITDA and a strategic spin-off plan for its liquids pipeline business as South Bow, signal positive prospects. This separation is expected to boost annual EBITDA growth and result in 3-5% dividend growth for TRP shareholders.

TRP’s financial stability efforts and commitment to deleveraging are noteworthy, with a target debt-to-EBITDA ratio of 4.75x by the end of 2024. Moreover, its predominantly fixed-rate debt portfolio provides insulation from interest rate fluctuations.

Valuation-wise, TRP appears undervalued, offering potential for growth, especially with the spin-off in the pipeline. The combination of a compelling yield, debt reduction plans, and undervaluation makes TRP a promising opportunity for investors.

The only reason I’m not giving the stock a Strong Buy rating is the fact that some peers have lower debt levels. As I expect inflation to remain elevated on a prolonged basis, it may take a while for TRP’s stock price to recover.

Read the full article here