O’Reilly Automotive, Inc. (NASDAQ:ORLY), the automotive part retailer, showed a stable performance in Q1 with a slight EPS miss, but a slower EPS guidance for 2024 than markets anticipated. Barclays has recently also weighed on the potential weakness with decreased financial estimates for O’Reilly for the year.

My previous article, “O’Reilly Automotive: Looking At Mexico And Canada For Future Growth,” focused on O’Reilly’s long-term financial success, but also the company’s slower new domestic store growth in the United States, and O’Reilly’s potential better expansion into the other mentioned markets for continued long-term growth. I initiated the stock at Hold as the exceptional financial profile has been priced in.

Since the article was published on the 24th of February, O’Reilly has returned -4% compared to S&P 500’s (SP500) return of 9%. Further weakness in the stock may now create an attractive buying opportunity for the long term as some industry weakness is forecasted.

My Rating History on ORLY (Seeking Alpha)

Solid Q1 Report Negatively Surprised Wall Street

O’Reilly’s Q1 financials showed a solid 7.2% revenue growth to $3.98 billion, led by continued store expansion and a 3.4% growth in comparable sales. The operating margin saw a very slight 0.4 percentage point decrease to 18.9%, driven by higher SG&A. The revenues were in line with Wall Street analysts’ estimates, but the $9.20 EPS missed by $0.11.

Interestingly, while the 2024 EPS guidance was raised to $41.35-41.85 from $41.05-41.55 with the Q4 report and the rest of the guidance was reaffirmed, the guidance disappointed the consensus estimate of a $42.49 EPS. As a result, the stock ended up falling nearly -8% at one point to the Q1 report but ended the day at a more moderate decline of -4%.

The company opened 36 new stores domestically during Q1, and one new store in Mexico. For 2024, net new openings of 190-200 are expected showing good continued network expansion. While the Q1 and 2024 guided profitability surprised markets negatively, I believe that the Q1 report was overall solid.

Forecasted Industry Softness

Industry softness is expected to affect O’Reilly’s Q2 and 2024 results, now weighing on the stock as well after the Q1 report – Barclays’ analyst Seth Sigman recently lowered financial expectations for O’Reilly’s upcoming quarters, dropping forecasted Q2 comparable sales to just 2% and the 2024 EPS estimate into $40.70, below O’Reilly’s current guidance range.

AutoZone (AZO) had an unusually slow 0.9% same-store sales growth in constant currency in the latest quarter ending at the start of May, and Advanced Auto Parts’ (AAP) comparable sales declined by -0.2% in Q1 – the weaker performance has been seen across the whole industry. Slowing inflation also plays a part in the companies starting to show weaker comparable growth.

In O’Reilly’s Q1 earnings call, the company communicates experienced industry weakness to have continued into April as adverse weather and macroeconomic conditions have weighed on consumer spending in auto shops. AutoZone echoed a similar tone in the company’s latest earnings call, also noting lower tax refunds’ effect on spending – macroeconomic conditions could continue to pressure the industry’s sales into a weaker level in the short term, as Barclays recently noted.

Advanced Auto Parts expects a 0-1% comparable sales growth in 2024 and O’Reilly’s a range of 3-5%, both expecting quite a similar performance throughout the year as was reported in Q1, with very slight guided mid-point improvements assuming that the economic environment doesn’t deteriorate demand during the rest of 2024.

Continued short-term weakness for O’Reilly could create a better buying opportunity – the stock hasn’t enjoyed the recent industry weakness, and the weakness is highly likely only a temporary hiccup as O’Reilly leads the industry in latest reported comparable sales.

ORLY’s Weakness May Create a Buying Opportunity

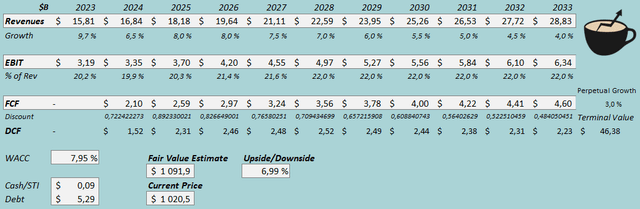

I updated my discounted cash flow [DCF] model to consider the slight short-term weakness. I now estimate a 2024 revenue growth of 6.5% instead of 7.5% previously, but similar growth afterward at a total CAGR of 6.2% from 2023 to 2033, and 3.0% perpetual growth afterward.

For the EBIT margin, I estimate a slight deleverage into 19.9% in 2024 due to weaker expected comparable sales. Afterward, I estimate operating leverage to expand the margin into 22.0% eventually, slightly lower than my previous 22.5% eventual EBIT margin estimate. The company continues to have healthy cash flows, although higher guided capex worsens free cash flow in 2024.

DCF Model (Author’s Calculation)

The estimates put O’Reilly’s fair value estimated at $1091.9, 7% above the stock price at the time of writing. While the upside isn’t enough to create a very attractive short- to midterm opportunity, the valuation is starting to get more attractive -if O’Reilly’s stock takes a further hit from temporary weakness, a good buying opportunity may emerge. The fair value estimate is nearly the same as the $1096.9 estimate previously in February.

CAPM

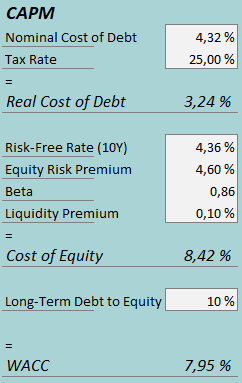

A weighted average cost of capital of 7.95% is used in the discounted cash flow (“DCF”) model. The WACC used is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, O’Reilly had $57 million in interest expenses, making the company’s interest rate 4.32% with the current amount of interest-bearing debt. I continue estimating a long-term debt-to-equity ratio of 10%.

To estimate the cost of equity, I use the 10-year bond yield of 4.36% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s estimate for the US, updated on the 5th of January. I again estimate the beta at 0.86. With a liquidity premium of 0.1%, the cost of equity stands at 8.42% and the WACC at 7.95%.

Takeaway

O’Reilly reported a solid Q1 report, but the EPS in the quarter and in the 2024 guidance both missed Wall Street expectations. The industry has seen adverse effects from weather, tax refunds, and the overall macroeconomic sentiment, creating a weaker outlook for the rest of 2024 as well. The stock has reacted negatively to the temporary weakness, and as O’Reilly’s continues to perform well against the industry, further weakness could provide a buying opportunity as the long-term investment case stands the same.

My DCF model estimates a very slight undervaluation, and as such, I remain with a Hold rating for O’Reilly Automotive, Inc. Continued stock weakness could now create a better buying opportunity soon, though.

Read the full article here