ETF Overview

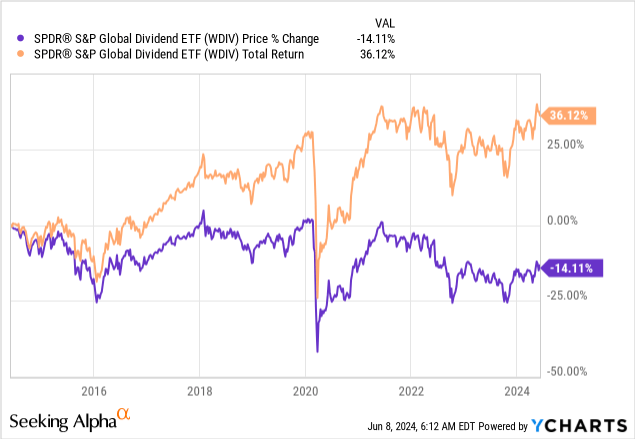

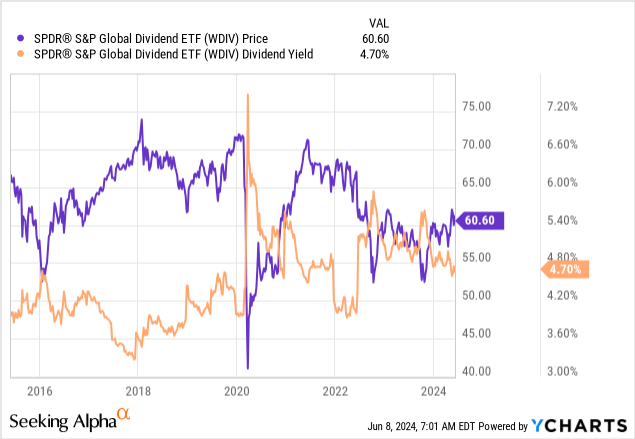

SPDR® S&P Global Dividend ETF (NYSEARCA:WDIV) has a portfolio of international dividend stocks. Dividend stocks from the U.S., Canada, and Japan made up more than half of WDIV’s portfolio. The fund currently has a dividend yield of about 4.7%, only slightly higher than the 10-year treasury rate. The fund has inferior total return than other international dividend growth funds in the past 10 years. Therefore, we think investors may want to seek other dividend funds instead.

YCharts

Fund Analysis

Portfolio construction methodology

WDIV tracks the S&P Global Dividend Aristocrats Index. To be included in this index, stocks must have been increasing their dividends or paying stable dividends for at least 10 consecutive years. The index selects top 100 qualified stocks with highest yields. It limits the weight of each stock to 3% of the index. In addition, no single country can represent more than 25% of the index and no more than 20 stocks can be included from the same country. Each sector is also capped at 25% of the index, and no more than 20 stocks can come from the same sector.

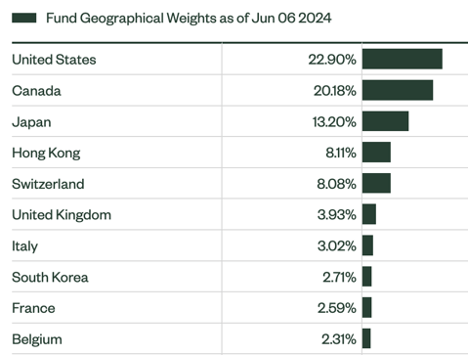

WDIV is concentrated in three countries

Despite the limit to cap each country at 25% of the portfolio, WDIV is still heavily concentrated in a few countries. Stocks from the U.S. represent about 22.9% of its total portfolio. This is followed by Canada’s 20.2% and Japan’s 13.2%. Together, stocks from these three countries represent about 56.3% of WDIV’s portfolio. We are not concerned about WDIV’s heavy concentration on these three countries as they are developed countries with stable political and economic environment.

SPDR

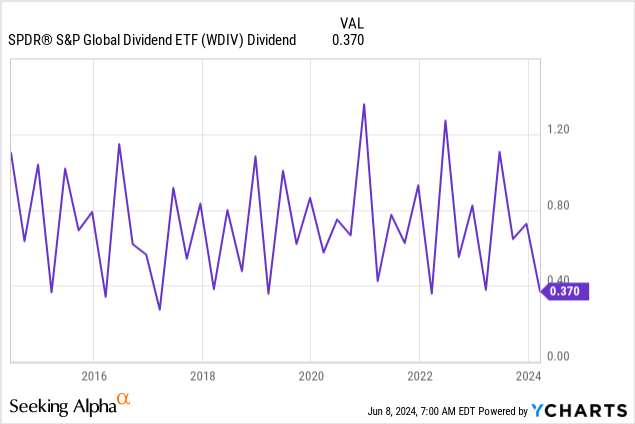

Dividend has been quite stable since its inception

WDIV’s portfolio construction methodology of focusing on stable dividend paying stocks has resulted in relatively stable dividends. As can be seen from the chart below, WDIV’s dividend paid in the past 10 years has been in the range between $0.3 ~ $1.2. The exact value varies depending on the season of the year. The discrepancies of the dividends in different years depends on many factors. One main factor is the foreign exchange rates. If we filter out this factor, WDIV’s dividend should look even more stable.

YCharts

WDIV’s stable dividend has also resulted in stable dividend yield. As can be seen from the chart below, its dividend yield has typically been in the range of 3.6% and 5% in most of the last 10 years. Its current yield is around 4.7%, only slightly higher than the current 10-year treasury rate of 4.4%.

YCharts

Total return not attractive

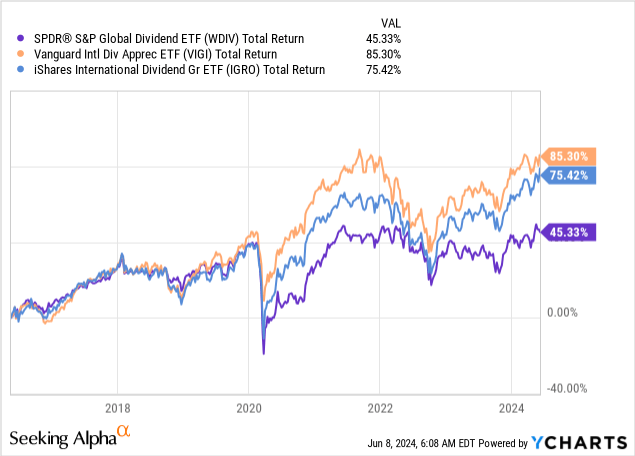

The biggest drawback of owning WDIV is its unimpressive total returns. Without counting the returns from dividends, the fund has delivered a negative price return of 14.1% since its inception in 2014. The chart below compares WDIV’s total return with two other international dividend growth funds: Vanguard International Dividend Appreciation ETF (VIGI) and iShares International Dividend Growth ETF (IGRO). As the chart below shows, WDIV’s total return (including dividend) was only 45.33% since 2015. This was much lower than VIGI’s total return of 85.3% and IGRO’’s total return of 75.4%.

YCharts

We think WDIV’s inferior return has to do with its portfolio construction methodology. As we have mentioned earlier, the fund can include stocks that are able to pay stable dividends with or without increasing their dividends in the past 10 years or more. In addition, stocks with higher yields are ranked higher in the list. These higher yield stocks typically have inferior growth outlook (therefore, lower share prices) and because of its inferior growth outlook, its earnings cannot grow rapidly over time. Hence, limiting their ability to grow their dividends in the long run. Therefore, the result is a portfolio of stocks that may be able to pay stable dividends, but with limited growth potentials. In contrast, IGRO and VIGI emphasize on owning stocks that has consistently increase its dividend in the past and/or has the potential to grow their dividends in the future. IGRO and VIGI’s emphasis on dividend growth has produced much better total returns in the long run.

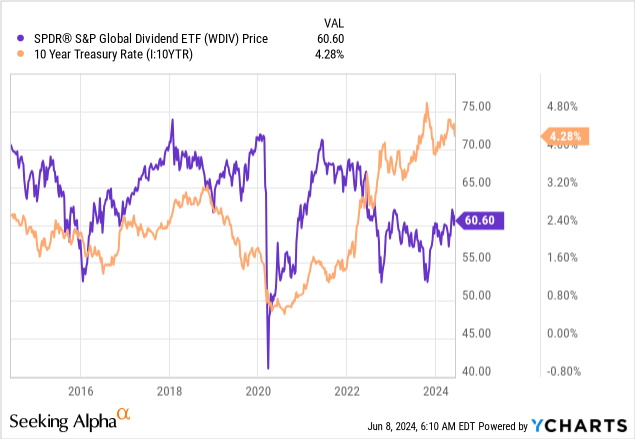

Fed fund rate can impact WDIV’s price performance

Since a vast majority of WDIV’s portfolio include international stocks outside of the U.S., its fund price can be impacted by foreign exchange rates. A strong U.S. dollar will typically compress WDIV’s fund price and vice versa. The strength of the U.S. dollar is typically influenced by the U.S. treasury rate. Here, we will use the 10-year treasury rate to illustrate this. As can be seen from the chart below, WDIV’s fund price has an inverse correlation to the treasury rate. Since the beginning of 2022, the rising treasury rate has caused WDIV’s fund price to remain quite weak. The good news is that we are likely already at the peak or near the peak of this rate hike cycle. Therefore, we may be able to see some outperformance if the Federal Reserve decides to turn dovish on its monetary policy. However, we know combating inflation is no easy task, as inflation often has a self-fulfilling prophecy. Therefore, the Federal Reserve may need to keep the rate elevated for a lengthy period. Hence, investors should keep this in mind.

YCharts

Investor Takeaway

WDIV does not offer better returns than other international dividend growth funds. Although its dividend yield of 4.7% is not bad, it is only slightly higher than the 10-year treasury rate. If we factor in foreign exchange risk, this yield is not particularly attractive either. We think investors may want to consider other dividend funds instead.

Additional Disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.

Read the full article here