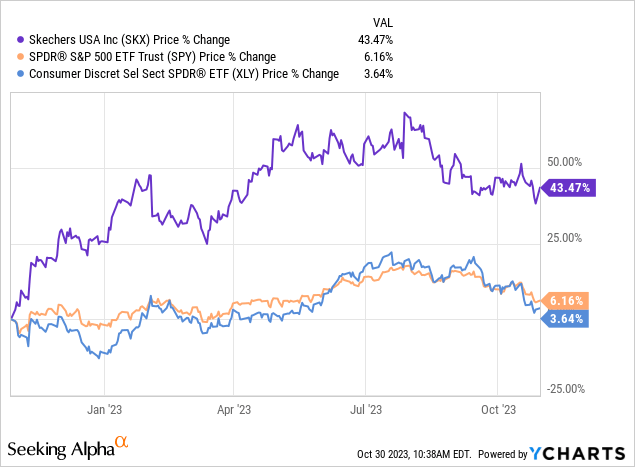

Skechers U.S.A., Inc. (NYSE:SKX) designs, develops, markets, and distributes footwear for men, women, and children worldwide. Year-to-date the firm’s stock has performed exceptionally well, gaining as much as 43%, significantly outperforming both the broader market and the consumer discretionary sector.

In today’s article, we are going to take a look at the company’s latest earnings and discuss whether the stock could be an attractive investment at the current price levels, in the current macroeconomic environment.

Q3 results

Sales

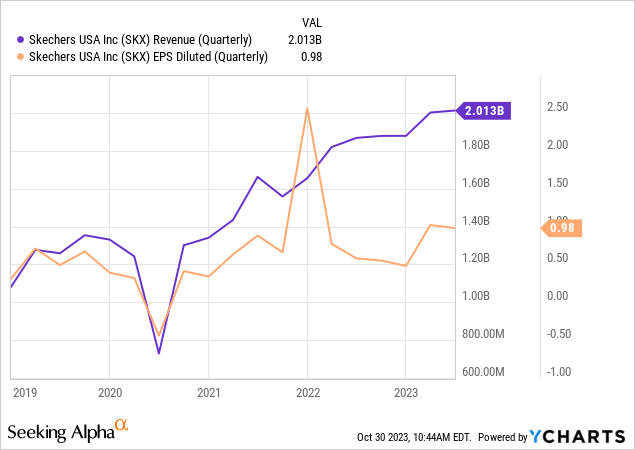

In our opinion, there is a lot to like about the latest quarterly results. First of all, SKX has not only managed to achieve record quarterly sales topping $2 billion, but they have also delivered diluted EPS of $0.93, representing a more than 69% increase year-over-year. The following chart depicts how the revenue and diluted EPS figures have developed over the past five years.

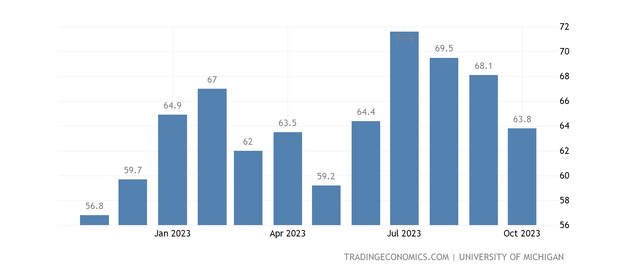

The steady growth of revenue is a strong indication for us that the demand for SKX’s products remains robust despite the uncertain macroeconomic environment. While consumer confidence in the United States has been quite volatile throughout the year, which is normally unfavorable for firms selling non-essential, discretionary products, SKX has managed to overcome this headwind. We believe this may be a sign of superior brand loyalty, giving the company an edge over its competitors.

U.S. Consumer confidence (tradingeconomics.com)

The recent partnerships with athletes have been highlighted by management as one of the key drivers for increased attention.

We introduced a collaboration with entertainment legend Snoop Dogg, and we launched Skechers Football boots with Harry Kane, one of the leading strikers in the world and captain of England’s national team. Both ambassadors and their products generated significant media and consumer attention for the brand. And, this week, we announced the signing of two-time NBA All-Star Julius Randle and rising star Terance Mann – both of whom are competing in our Skechers Basketball footwear this week.

Naturally, these collaborations have also contributed to the higher marketing expenses.

Selling expenses increased $27.4 million, or 18.2%, and as a percentage of sales increased 80 basis points to 8.8%. The increase was due to higher brand demand creation expenditures.

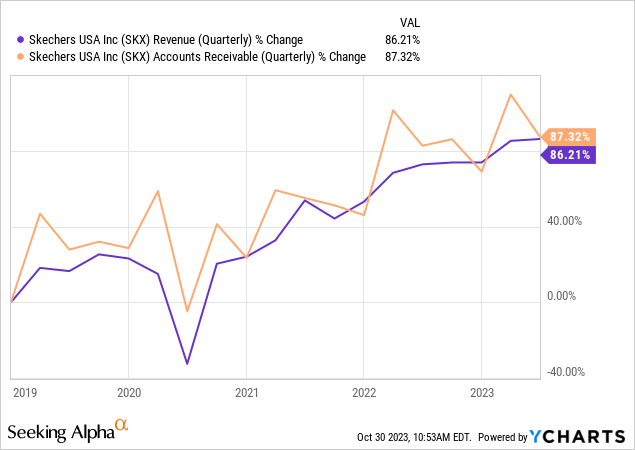

When talking about sales, we also normally like to examine how the accounts receivable have developed simultaneously. If accounts receivable grow at a faster pace than sales, it may be a warning sign that demand is artificially inflated and sales are pulled forward from future periods by changing revenue recognition policies or selling more on credit.

The following chart however shows that this is not the case for SKX. The firm’s revenues and accounts receivable have been growing consistently with each other over the past years.

Last, but not least, we need to highlight that the growth has been coming not only from a single geographic region, but it has been observed globally.

All regions grew, including the Americas, with growth of 7% in the United States due to continued strength in our Direct-to-Consumer channel, and Asia Pacific with growth of 18% in China.

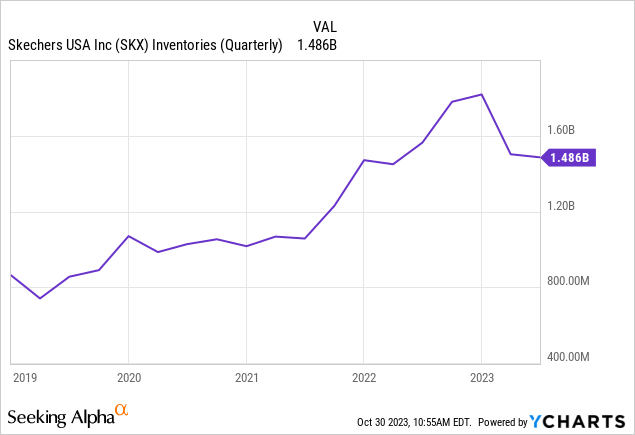

Inventories

Another important line item to highlight is the inventory. Inventory levels have substantially decreased – by as much as $436 million year-to-date. Normally we pay close attention to inventory levels because excessive inventory levels could be creating downward pressure on the profitability of the firm when the time of inventory reduction comes. Obsolete inventory may need to be sold at steep discounts, for example, leading to margin compressions.

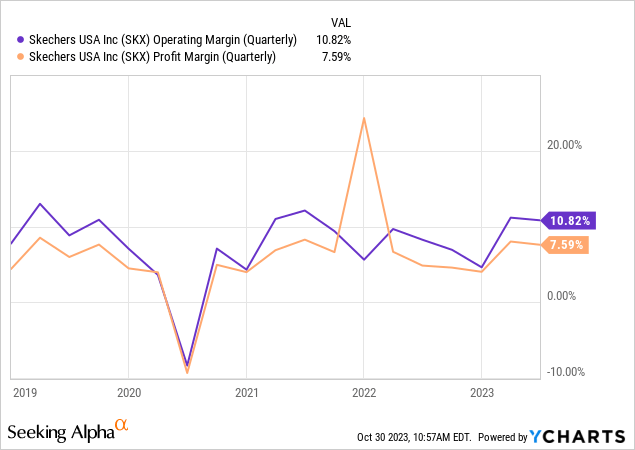

The charts above show that SKX has managed to reduce its inventory levels without having a significant negative impact on profitability.

Return to shareholders

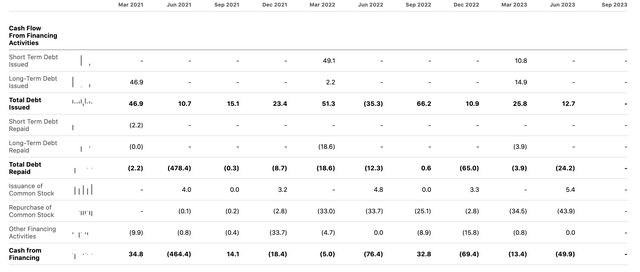

While the company does not pay dividends, they have not forgotten about their shareholders in Q3. The firm has spent as much as $40 million to buy back shares, which brings the total amount to $100 million year-to-date. More than $325 million are still remaining from the currently authorized share buyback program. While this amount may not look stellar at first glance, for a company with a market cap of around $7 billion, it is indeed a meaningful amount.

During the third quarter, the Company repurchased approximately 805,486 shares of its Class A common stock at a cost of $40.0 million. Year-to-date 2023, the Company has repurchased nearly 2.1 million shares of its Class A common stock at a cost of $100.0 million. At September 30, 2023, approximately $325.7 million remained available under the Company’s share repurchase program.

CF from financing (Seeking Alpha)

All in all, we are impressed with the firm’s top- and bottom-line results, as well as with their commitment to returning value to their shareholders.

Valuation

In light of the most recent financial results, there is one more question that needs to be answered. Is it worth investing in SKX right now?

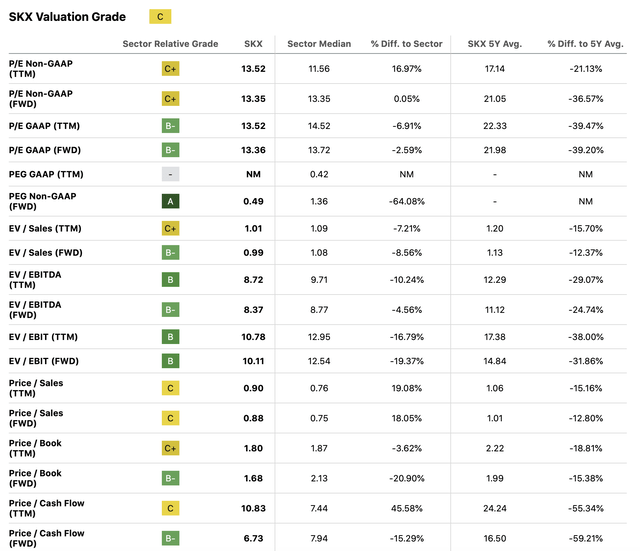

To discuss this question, we are going to be looking at the relative valuation of the firm, using traditional price multiples to assess how the firm’s current valuation compares to its peers.

First of all, let us compare SKX’s price multiples with the consumer discretionary sector median and its own 5YR historic averages. Currently, the stock is trading significantly below its own historic averages, however, compared to the sector median it has higher P/E, P/S, and P/CF figures.

Valuation (Seeking Alpha)

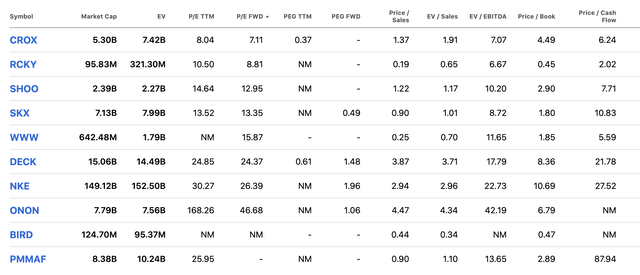

To make a more representative comparison, the following table summarizes the set of valuation metrics for the firms in the footwear industry.

Comparison (Seeking Alpha)

While SKX is also not the most attractively priced firm in the industry, we believe that the current multiples are justified in light of the demonstrated ability to keep demand high, reduce inventory, and at the same maintain attractive profitability.

For these reasons, we assign SKX’s stock a “buy” rating.

Read the full article here