The Advance Report on Monthly Sales for Retail & Food Services, corresponding to activity during the month of September 2023, was published by the Census Bureau at 8:30 AM, October 17, 2023. This report – widely considered to offer some of the best and most timely high-frequency indicators of current U.S. economic activity – provides initial data on consumer spending at U.S. retail establishments during the reference month. In this article, we will walk our readers through an in-depth analysis of this just-released data on retail sales and then discuss their implications for the U.S. economy and financial asset prices.

Summary Data And Analysis

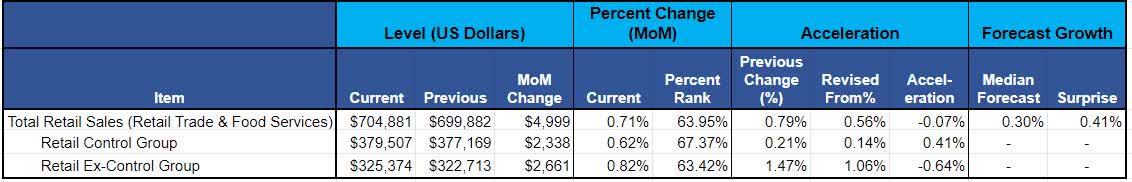

We begin our analysis of the Advance Retail Sales Report by reviewing summary information highlighted in Figure 1. We recommend that readers pay particular attention to the percent rank of Month-on-Month (MoM) growth, MoM acceleration, and the surprises relative to forecasts.

Figure 1: Change, Acceleration, Expectations, and Surprise

Retail Sales Summary (Census Bureau, Investor Acumen)

The “Advance” sample of Retail Sales (Retail Trade & Food Services), totaled $704,881 million (seasonally adjusted) during the month of September, compared to the prior month’s $699.822 million (revised up from $697.557 million), representing a Month-on-Month (MoM) growth rate of 0.71%, which ranks in the 64th percentile. This MoM growth rate represents an acceleration of -0.07% versus last month’s 0.79% (revised up from 0.56%). September growth was greater than the median forecast of 0.30%.

The Impact Of Inflation On The Value Of Retail Sales

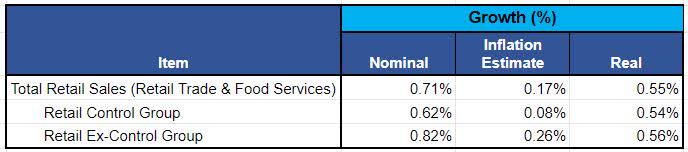

In this section, we highlight the impact of inflation on the interpretation of Retail Sales data. Price inflation impacts the quantity of goods and/or services that a given amount of money can buy. In order to track the actual quantity (as opposed to mere dollar value) of goods that retailers sell, it is necessary to adjust the nominal sales figures (reported in “current dollars”) for the impact of inflation. In Figure 2, we show Retail Sales in both “current dollars” and in “real” terms. The “real” figures represent the economic value of goods sold by retailers, after they have been adjusted for inflation in specific retail goods/services categories.

Figure 2: Real Sales in Current Dollars and Adjusted for Inflation

Inflation Adjustment (Census Bureau, Investor Acumen)

Although in nominal terms, Retail Sales decelerated slightly in current dollars Retail Sales actually accelerated by 0.51%. It should also be noted that the MoM inflation in retail prices was actually below the Fed’s overall target, in annualized terms. This should be highlighted as a positive development in this report.

For the remainder of this article, all figures will be presented in “real” (inflation-adjusted) terms. This is important because the most important indicators of economic activity in the U.S. economy, such as Real Gross Domestic Product and Real Gross Domestic Output, are accounted for in real-inflation adjusted terms.

Analysis Of Annualized Growth Of Key Components Of Retail Sales Over Various Time Periods

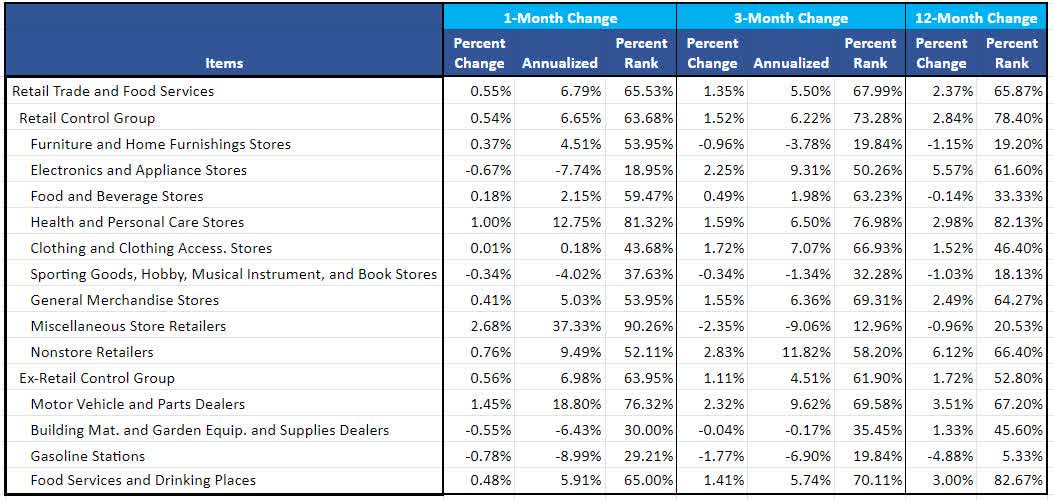

In this section, we break down Retail Sales into key components, scrutinizing their annualized growth rates over various time frames (1m, 3m, 6m and 12m). The purpose of this analysis is two-fold. Our first purpose is to identify which components of retail sales are growing at a faster or slower rate than the overall aggregates. Our second purpose is to determine whether, and to what extent, growth rates are accelerating or decelerating over various time frames.

Figure 3: Real Annualized Growth Rates of Key Components

Real Annualized Change in Retail Sales (Census Bureau, Investor Acumen)

During the latest 1-month period, the real growth rate of sales overall Retail Trade & Food Services was moderately above the historical median (65.93 percentile). This rate of growth was similar to that exhibited over the most recent 3-month and 12-month period. Drilling down further into the growth rate data, we find rather extraordinary breadth in the growth figures, with both the Control Group and Ex-Control Group categories exhibiting growth rates that were very similarly above-average in historical terms.

The September data do not exhibit any significant divergences in growth between categories, nor over time, that might provide signals regarding potential acceleration or deceleration going forward.

Key Drivers Of Change And Acceleration: Decomposition Analysis

In this section, the analysis is focused on identifying which components of retail sales are driving the MoM growth (contraction) and MoM acceleration (deceleration) in the overall Retail Sales figures. We develop this analysis in three steps. First, we analyze the contributions of the Control Group and the Ex-Control Group to the reported overall MoM growth and acceleration of Retail Sales. Second, we focus exclusively on the Control Group and break down the component contributions to its reported MoM growth. Third, perform the same analysis for the Ex-Control Group.

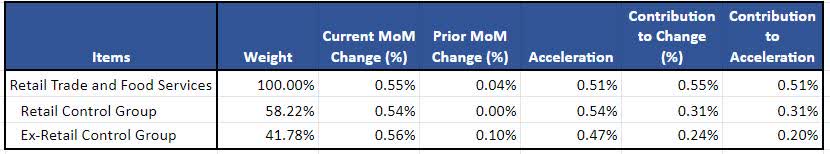

Contributions To Change And Acceleration From Control Group & Ex-Control Group

In this subsection we focus on the contributions of the Control Group and Ex-Control Group to the MoM growth and MoM acceleration of Retail Sales.

Figure 4: Control Group & Ex-Control Group Contributions to MoM Retail Sales Growth

Contributions to Real Retail Sales (Census Bureau, Investor Acumen)

Both the Retail Control Group and the Ex-Retail Control Group accelerated in real terms with the Retail Control Group contributing slightly more to both the total change and the total acceleration of Retail Sales.

Control Group: Analysis Of Component Contributions

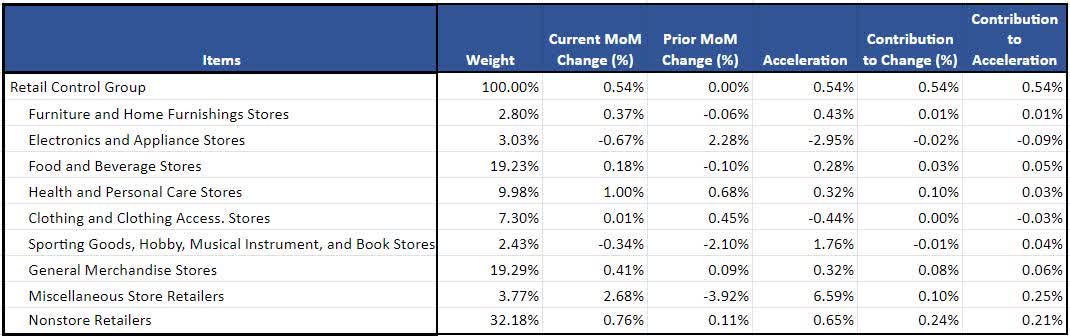

In this subsection, we focus the component contributions to the MoM Change and MoM Acceleration of the Control Group.

The Retail Sales Control Group excludes spending on automobiles, gasoline, building materials, and food services. By removing these volatile and/or otherwise unrepresentative components, the Control Group typically provides a better indication of underlying trends and tendencies in consumer spending.

Figure 5: Control Group: Contributions of Components to Change and Acceleration

Contributions to Real Retail Control Group (Census Bureau, Investor Acumen)

Essentially all of the contribution to acceleration can be attributed to two items: Miscellaneous Store Retailers and Nonstore Retailers. The largest contributor to deceleration was Electronics and Appliance Stores.

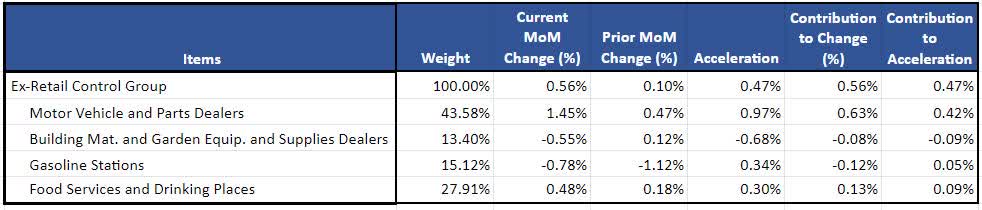

Ex-Control Group: Analysis Of Component Contributions

In this subsection, we focus the component contributions to the MoM Change and MoM Acceleration of the Control Group.

The Ex-Control Group consists of sales by retail vendors in four major categories: Motor Vehicles and Parts, Building Materials & Gardening Equipment, Gasoline Stations and Food Services & Drinks. Monthly growth in these categories often tend to be volatile and/or otherwise unrepresentative of overall trends and tendencies in consumer spending. Therefore, monthly Ex–Control Group sales growth numbers need to be analyzed in an appropriate context. However, taken as a group, it is important to note that the overall incidence of Ex-Control Group sales is important, representing 41.78% of total Retail Sales for this month.

Figure 6: Ex-Control Group: Contributions of Components to Change and Acceleration

Contributions to Real Ex-Retail Control Group (Census Bureau, Investor Acumen)

It was notable that, during this month, the growth and acceleration in the Ex-Control Group was dominated by Motor Vehicles and Parts Dealers accounting for nearly all the contribution to both change and acceleration.

Implications For The US Economy

Retail Sales is one of the most important indicators of current economic activity in the U.S. Our detailed analysis of the data for the month of September indicates that overall Real Retail Sales grew at an above-average pace, continuing the above-average real growth trends exhibited during the past 3-month and 12-month periods. Notably, Real Growth in the Control Group recovered in September after slowing down in August, making it uncertain whether there is any significant change in underlying trends and tendencies in consumer spending.

Today’s retail sales report indicates that the U.S. consumer has remained remarkably strong despite numerous headwinds. This report strengthens the impression that consumer spending, and the overall U.S. economy, is still running quite “hot,” despite the Fed’s attempts to engineer a slowdown.

Implications For Financial Markets

The effects that retail sales data can have on financial markets are complex, and a number of factors must be taken into account. One major factor to consider is what expectations were prior to the report. A second factor to consider is whether the overall economy is perceived to be running “hot” or “cold.” A third set of factors is non-fundamental, such as technical conditions, sentiment and positioning. Keeping all of this in mind, let us separately consider how today’s retail sales numbers could potentially impact fixed income and equity markets.

Fixed income markets (interest rates, bond prices & bond yields). The first thing we will consider is that, overall, the retail sales data were significantly stronger than expected. Many were expecting a softer retail sales report this month due to soft credit card spending data published by several banks. However, no slowdown in consumer spending was reflected in the Census Bureau’s retail sales data. All things equal, “hotter-than-expected” data typically leads to lower bond prices and higher bond yields. A second factor to consider is that the retail sales data this month tends to indicate above-trend growth in consumer spending. Such an environment is typically supportive of lower bond prices and rising bond yields. The final set of factors we will consider is non-fundamental: in our view, prior to the release of the retail sales report, technical conditions, sentiment and positioning were generally neutral after a recent rally off of multi-year lows (multi-year highs in yields) in Treasury markets.

Taking all of the above factors into account, we would expect Treasury yields to rise significantly in the wake of this report. In particular, markets may begin to price in a higher probability of further rate hikes by the U.S. Fed. The U.S. Fed wants to be seeing below-average growth rather than above-average growth in economic activity generally and retail sales specifically. Under current macroeconomic conditions, above-average real growth in retail sales places significant upwards pressure on inflation, a fact which will tend to unnerve bond market participants.

Common equity markets. Equity markets tend to react differently than bond markets to retail sales data. First, positive surprises in retail sales data and/or above-average growth in retail sales tend to be supportive of improving expectations for growth in corporate revenues and profits. All else equal (which it never is), the sort of above-average growth that we saw in September would ordinarily tend to be supportive of rising equity prices.

Second, in contrast to the aforementioned consideration, to the extent that above-average retail sales growth is considered to be indicative of economic conditions that are “too hot,” equity prices may tend to fall if it is widely perceived that such conditions will result in higher wage and/or materials costs and/or higher interest rates. As indicated in the section on implications for bond markets, all else being equal, equity prices might be expected to fall due to the perception that growth in retail sales is “too hot.”

Third, in examining non-fundamental factors such as technical conditions, it is our view that after a strong rally off of recent lows, short-term sentiment and positioning were generally neutral heading into today’s retail sales report.

Taking all of these factors into consideration, we believe equity prices may tend to react negatively to this report. The surprisingly “hot” retail sales report will tend to heighten fears that both the Fed and interest rate markets will produce a tightening of monetary conditions, rising interest costs and increasing discount rates – all of which are negative factors in the pricing of common equities.

Concluding Thoughts

Retail sales is one of the most important indicators of economic activity in the U.S. economy. Sound macroeconomic analysis of indicators such as this enables astute investors to boost their performance and minimize risk in their investment portfolios.

Today, as part of our investment discipline, our team will be evaluating whether the most recent retail sales data – in combination with other fundamental and non-fundamental factors – warrant any changes (tactical or strategic) in our portfolio holdings.

Today’s surprisingly strong retail sales data reinforces our current cautious position towards equities. The report indicates the need for the U.S. Fed to continue to apply a tight monetary policy stance and to maintain a hawkish tone in their market communications. In the intermediate term, we believe that a “higher for longer” interest rate environment raises the risk of a severe economic slowdown or recession.

Read the full article here