Performance

| Note: This document contains excerpts from the Investor Letter that was published to current and prospective LPs. In order to comply with all applicable regulation, certain performance data and portfolio data has been omitted. Please sign up for our quarterly letter on our website to receive complete updates inclusive of performance data. |

The fourth quarter of 2024 saw high levels of volatility in the market. The short-lived enthusiasm following the US elections was followed by pessimism after hot inflation numbers caused the Federal Reserve to adjust their interest rate cut projections for 2025 downward.

We typically play company and industry specific growth or turnaround stories that are overlooked by the market. Many of our investments worked out as expected, with a total of 10 companies contributing more than 1% to our performance. This contrasts with 3 companies that detracted more than 1% from our performance. Our 3 detractors remain in our portfolio as we believe our original thesis on those companies remains unchanged.

|

Top Contributors |

Performance* |

Top Detractors |

Performance* |

|

|

A-Mark Precious Metals (AMRK) |

48.1% |

Valaris (VAL) |

-28.3% |

|

|

Marex Group (MRX) |

57.8% |

X-Fab Silicon Foundries (OTCPK:XFABF) |

-15.8% |

|

|

Remitly Global (RELY) |

64.7% |

St Joe (JOE) |

-16.8% |

|

|

flatexDEGIRO (OTCPK:FNNTF) |

39.5% |

|||

|

Hoegh Autoliners (OTCPK:HOEGF) |

49.6% |

| * Performance approximated using closing price at 2024/12/31, or the average sales price if a position is fully sold, divided by the average acquisition price, adjusted for dividends. |

Portfolio

Night Watch manages a global value strategy that differentiates on the following points:

Catalyst – We predominantly buy value companies with an identifiable catalyst for a rerating. Catalysts can include industry tailwinds or company specific catalysts (e.g., CEO changes, earnings inflection, refinancing).

Inside Ownership – We aim to find companies where management has considerable ownership in the company. We consider this alignment of interest to be an important determinant of share price performance.

Unique Names – To differentiate from a long list of other value strategies, we seek unique portfolio holdings that have little overlap with a typical wealth management portfolio. We thus aim to provide our LPs with diversification from their other investments in addition to strong performance.

The portfolio as of December 31 st, 2024 is as follows:

|

Theme |

Weight |

Positions |

Insider Ownership |

Catalyst |

|

Housing |

12.3% |

4 |

1/4 |

2/4 |

|

Consumer |

16.1% |

5 |

5/5 |

4/5 |

|

Aerospace |

9.1% |

3 |

2/3 |

3/3 |

|

Counter-Cyclicals |

11.9% |

2 |

2/2 |

2/2 |

|

Energy |

10.3% |

3 |

1/3 |

3/3 |

|

US Onshoring/ Fiscal Stimulus |

8.1% |

2 |

1/2 |

2/2 |

|

Emerging Markets |

10.8% |

4 |

2/4 |

2/4 |

|

Europe – Quality names for value price |

23.8% |

6 |

5/6 |

6/6 |

|

Event Driven/ Other |

4.5% |

|||

|

Funding Shorts |

-3.0% |

|||

|

Cash |

-3.9% |

|||

|

Total |

100% |

29 |

19/29 |

24/29 |

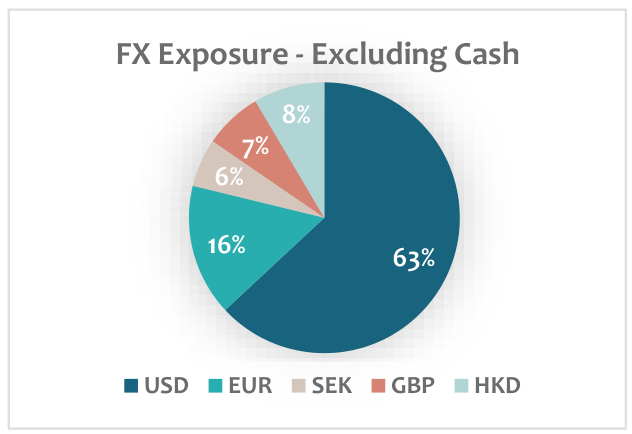

FX Exposure – Excluding Cash

Largest positions:

- Allfunds

- Valaris

- Marex

- Distribution Solutions Group

- X-FAB Silicon Foundries

Strategy Update

At the beginning of 2024 we identified 5 ‘themes’ to which we wanted exposure given the strong tailwinds. We would like to update you on those themes, as well as discuss 3 other themes that we started investing in throughout the year.

Energy

Our offshore energy exposure was the largest detractor of the strategy’s performance in 2024. Our thesis is based on the fact that we are seeing a move from oil & gas production from Western countries – often constrained by environmental regulation and punitive taxation – to regions such as Brazil and Western Africa, which happen to be offshore. There have been no new orders of offshore equipment since 2014 and the resulting supply / demand mismatch should bring in excess profits for this sector in the years ahead.

We initially became interested in offshore energy after Valaris (VAL) emerged from bankruptcy in 2021. At the time, day rates for floating rigs were around $200k / day, compared to operating expenses per rig around the same amount. A tightening market has since pushed up day rates to around $500k. A rig has gone from operating at break-even, to being able to earn $100m per year. Valaris allows us to buy the industry’s most modern fleet for less than $150m per rig, providing really attractive returns once every rig has been put to work.

However, H2 of 2024 saw a pause in the market’s recovery. The rapid increase in demand has tightened other parts of the offshore supply chain. There are temporary shortages in subsea equipment and FPSOs (the floating platform that you need for the production of oil). 2025 projects are therefore being pushed into 2026 and offshore energy companies such as Valaris sold off – hard. While we failed to predict this pause, we believe the thesis remains unchanged. Our call on offshore oil remains a high conviction bet.

Countercyclical Basket

As a long-biased strategy, we prefer to own various countercyclical companies to lower the risk of our portfolio. At the beginning of the year, we identified a pawn store operator and a wholesaler / retailer of precious metals called A-Mark Precious Metals (AMRK) as interesting long-term opportunities that simultaneously provided a hedging function to our portfolio. We have exited our position in AMRK during the year. We believed that economic uncertainty and higher precious metals prices would spark renewed consumer demand for physical gold and silver coins. This demand did not materialize and we therefore saw no immediate catalyst in AMRK.

We added Marex (MRX) as a new counter-cyclical name during the year. Marex is the largest non-bank futures commission merchant (i.e., a broker in futures, mainly commodities). Apart from the long-term growth in traded futures, Marex benefits in times of volatility, when trading activity goes up. Marex has shown organic growth at a >15% CAGR since 2020, earns a >25% ROE, has additional growth from M&A and still trades at ~10x 2025 P/E, even after a 60% run up since our original purchase.

Aerospace

Going into 2024, the outlook for airplane production looked rosy, with both Boeing and Airbus being booked out until 2030. We intended to benefit by buying suppliers to those companies. This all changed after a safety incident in a Boeing plane used by Air Alaska in January, which forced Boeing to slow production. Boeing’s production was subsequently impacted by a union strike, while Airbus also never managed to achieve their targeted production.

Because Boeing did not want to disrupt their supply chain again, having experienced the difficulty in ramping up their supply chain after the pandemic, they continued ordering at their usual production rate, building large inventories in the process. This supported earnings of our 2 investments: Montana Aerospace (AERO SW) and Astronics (ATRO), allowing us to exit both positions at material profits.

If demand for airplanes is strong, but OEMs fail to supply the market, you want to own the airplanes instead of the supply chain. The increasing scarcity of airplanes should push up the value of airplanes. The logical play is to own lessors of airplanes such as Air Lease (AL) and Aercap (AER), on which we made trading profits during the year.

During H2 we pivoted out of the aerospace supply chain, into United Airlines (UAL). We’re cognizant of the poor track record that airlines have in generating returns for their shareholders. At the same time, we saw clear catalysts for an improving US airline market: Southwest and American Airlines were struggling to make money and decided against further growing their fleet. A Jet Blue Chapter 11 filing will allow them to cancel their airplane lease obligations and would see further capacity disappear from the US. As a best-in-class airline, UAL now has a chance to reach their target of 14% EBIT Margins (versus 9% in 2024), which would lower the ~6x P/E we paid to something closer to 3x. UAL has moved up by roughly 6% since our acquisition price at $60 and we are happy to hold our shares as long as the tightened supply provides a tailwind.

Consumer Basket

The US consumer has been in a 2-year affordability crisis. As a result, there are many quality consumer businesses available at very attractive prices. However, we don’t currently see a reason why US consumer spending should rebound from its current depressed level. We will therefore limit ourselves to companies with company-specific growth drivers. An example is Remitly (RELY) which we acquired around $13 after the stock sold off excessively on an earnings miss in Q1, despite the 30% growth on the back of market share gains. Valuation is very attractive when considering that marketing expenses are a discretionary reinvestment into the business.

US Housing

We have been very modest in building out housing related exposure during the year, given the worsening outlook for US housing. We did increase our exposure to Senior Living Facilities, given the favorable supply / demand dynamics. Our long-term holding in St Joe (JOE) detracted from our performance in Q4, despite steady growth. We are actively engaging with the company to figure out a way for the stock market to reward them for the significant value creation of the last 5 years.

New Theme: Europe – Quality at a value price

Most value strategies end up owning low quality businesses which tend to only perform well if you time the cycle well. Fortunately, extreme bearishness on the European economy now allows us to buy European quality businesses for value prices. Don’t get us wrong, we are more negative than anyone on the anti-capitalist direction that Europe has decided to take. But we believe Europe has still produced many successful companies over the last decades. In addition, European skilled labor is extremely competitive given the weak euro, and exporters who predominantly have labor as an input cost will be well positioned.

Our largest exposure is through XFAB (XFAB FP) and Melexis (OTCPK:MLXSF), as discussed in our Q3 letter. We have been a little early in calling the end of the destocking cycle in automotive semiconductors, but we believe the setup for 2025 is strong.

Our other large holding is Allfunds (ALLFG NA), Europe’s most dominant fund distribution platform. Despite having historically grown revenue at 21% per year, 2022 and 2023 saw slower growth, causing a rerating from >40x P/E in 2021 to <12x 2025 P/E. Allfunds has seen acquisition interest at prices 50-70% above today’s price, but a deal has not materialized. Growth for the company also re-accelerated in Q2 2024, but the market has yet to catch on.

New Theme: Emerging Markets

In early 2024 we acquired 2 positions that traded in Hong Kong: Ping An (PNGAY, 2318 HK) and Dream International (OTCPK:DRMMF, 1126 HK). Both companies lacked an immediate catalyst which is something we try to limit to <20% of our portfolio. However, at valuations of 3x and 4x P/E, and with dividend yields of 14% and 8%, respectively, we saw sufficient upside in those 2 companies, which have historically been shareholder friendly.

Our outlook on China changed when in September of this year, there were clear indications that China intends to stimulate its economy, as well as stop its stock market from being the global embarrassment it has been for the last years. Our main concern with the Chinese market has been their frequent disregard for shareholders. With the government now actively stimulating share repurchases, it is clear that boosting the stock market has become a national priority. For the last 2 years, the Japanese Stock Exchange has encouraged Japanese companies to pass shareholder friendly reforms, something which has benefited Japanese share prices tremendously. China seems to have taken a look at their neighbor and decided they want that for themselves. We have expanded on our Chinese holdings, in particular through various names that should benefit from higher Chinese consumer spending.

In addition, we have started accumulating a position in Brazil, which is arguably one of the cheapest markets at the moment. We look forward to updating you on this position in the near future.

New Theme: Fiscal Stimulus / Reshoring

During the aftermath of the Covid pandemic, US industrials were seeing rapid growth backed by elevated fiscal spending, as well as the reshoring of activities which for the past decades had shifted towards Asia. Low energy prices combined with tariffs started moving this activity back to the USA. Unfortunately, industrial activity has since gone into decline caused by a slowing economy and a prolonged destocking cycle, with the ISM Purchasing Manager Index going under 50 – indicating contraction – since November 2022.

We believe the long-term trend still exists and might come back alive under President Trump. Our preferred exposure is through Distribution Solutions Group (DSGR), a rollup of value-add distributors where we co- invest alongside CEO Bryan King who owns 77% of the company through his family office LKCM.

Conclusion

We believe we are well positioned to benefit from various long-term investment trends, as well as from some stock specific investment opportunities. We look forward to updating you after Q1.

On behalf of the Night Watch team,

Roderick van Zuylen, Chief Investment Officer

Eileen Ke, Chief Operating Officer

|

Important Disclosures This document was prepared by Night Watch Investment Management, LLC (“NWIM”) on December 6th, 2023, based on information available as of December 6th, 2023, and is subject to amendment. The information and opinions contained in this document (including information obtained from third-party sources) are for background purposes only and do not purport to be full or complete, and do not in any way constitute personalized investment advice or an investment recommendation on the part of NWIM. No representation, warranty, or undertaking, express or implied, is given as to the accuracy or completeness of the information or opinions contained in this document, and no liability is accepted as to the accuracy or completeness of any such information or opinions. All investments involve the risk of a loss of capital. NWIM believes that its proprietary investment program, research and risk-management techniques moderate this risk through the careful selection of portfolio investments. However, no guarantee or representation is made that NWIM’s investment program will be successful, and investment results may vary substantially over time. Past performance is not a guide to future performance. This publication makes no recommendations whatsoever regarding buying, selling, or holding any specific security, class of securities, or securities of a class of issuers. You are required to conduct your own due diligence, analyses, draw your own conclusions, and make your own investment decisions. Commentary is provided without reference to any investment strategy or product offered by NWIM. NWIM or entities managed by NWIM may be invested in any of the industries or securities mentioned. They may trade in and out of those positions without providing any updates. Certain information contained in this document constitute “forward- looking statements,” which can be identified by the use of certain terminology, such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” or “believe” or the negatives thereof, or other variations thereon or comparable terminology. Any projections or other estimates in this document, including estimates of returns or performance, are “forward- looking statements” and are based upon certain assumptions that may change. Due to various risks and uncertainties, actual events or results, or the actual performance of any investment vehicle, portfolio or product described herein may differ materially from those reflected or contemplated in the forward-looking statements. Actual events are difficult to project and often depend upon factors that are beyond the control of NWIM. TO THE FULL EXTENT PERMITTED BY LAW NEITHER, NWIM NOR ANY OF ITS AFFILIATES, NOR ANY OTHER PERSON OR COMPANY, ACCEPTS ANY LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT, OR CONSEQUENTIAL LOSS ARISING FROM, OR IN CONNECTION WITH, ANY USE OF THIS PUBLICATION OR THE INFORMATION CONTAINED HEREIN. NWIM AND ITS AFFILIATES EXPRESSLY DISCLAIM ANY GUARANTEES, INCLUDING, BUT NOT LIMITED TO, FUTURE PERFORMANCE OR RETURNS. Copyright 2025 Night Watch Investment Management, LLC. All rights reserved. Copyright © Night Watch Investment Management, LLC – All rights reserved. 2024 Q4 Update |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here