SES AI (NYSE:SES) continues to lead the next-gen battery manufacturers towards commercialization. SES is developing a competitive advantage with its combined hardware/software battery offering and is adopting generative AI as the core of its value chain, “all in on AI” SES said in its Q2 earnings call. The adoption of AI will deliver a high-performance battery with an improved safety profile, leading to an accelerated approval process in both the Auto and UAM industries.

The value proposition of SES is enhanced by its decision to stay with liquid electrolytes, it means SES cells can be manufactured with existing Li-ion manufacturing processes and equipment. The decision removes the scaling issue faced by the competition and significantly reduces the potential capital expenditure, operating costs and learning curve experience needed by its customers.

SES might begin recording revenue in Q1 2025, and they are at least two years ahead of the competition in the Auto OEM market. SES has more manufacturing lines than the competition, has produced more battery cells, and has two B sample JDAs in operation.

This is the second of a series of articles on next-generation battery companies. In the first one on QuantumScape (QS) I said that next-gen batteries will be assessed according to three key metrics: Battery Density, Charge Time and Safety and the battery companies should be compared on their customer base, time to commercialization and price.

In this article, I will suggest that SES is ahead in all six measures.

SES a recap

In my first article on SES, I covered its history, but a recap is important to put this article in context.

SES AI began as Solid Energy, an MIT spinout intending to bring a solid-state battery to the market.

In 2015, they abandoned research into solid electrolytes and dropped the patent they had acquired from MIT; many will say SES dropped solid battery development because they had failed to develop the technology. They could be correct, but it matters little.

Since 2015, SES has focused on Li-metal anode technology with liquid electrolytes. In 2015 they moved to high solvent in salt electrolyte which remains the focus of their R&D.

In 2021, SES signed three A sample Joint Development Agreements: the first with General Motors (GM), the second with Hyundai/Kia (OTCPK:HYMTF) and the third with Honda (HMC).

The 2021 JDAs followed several key breakthroughs, they worked with existing Li-ion equipment vendors to develop a volume production line in South Korea and released their prototype cell. The 107 Ah Apollo cell had industry leading density of 417Wh/Kg and 935Wh/L.

SES went public in 2022, changing its name from Solid Energy to SES AI.

The decision to drop the development of solid electrolytes, enforced or not, brings SES an enormous competitive advantage. It means SES cells can be produced on existing lithium ion production lines, indeed its two most recent production line installations were bought from existing li-ion equipment vendors. (CEO Water Tower Research Interview May 2024)

The company name was changed to SES AI because solid state was no longer the bedrock of the company but AI is.

Detractors will say the AI monicker is a marketing tool latching onto a new trend. However, SES is a company founded on AI, its products are designed by AI and sold bundled with AI. An SES battery is sold in two parts, the physical cell and the AI that monitors its total life cycle. SES is an AI company that happens to make batteries.

Technology and focus

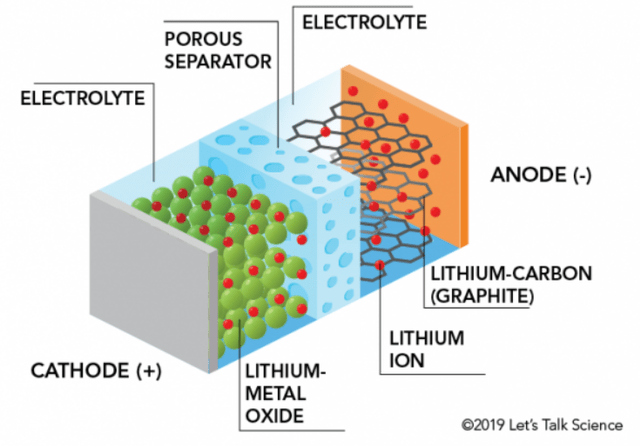

QS and SES are focused on improving battery density by moving away from graphite anodes to Lithium metal ones. The anodes offer the prospect of higher-density battery cells but have a reputation for safety issues. Both manufacturers take a different approach to designing the remainder of the cell and how they will deal with the safety aspects.

A standard lithium-ion cell looks like this, an image I shared in my article on QS.

A simplified Battery Cell (Let’s Talk Science)

Lithium ions move from the cathode to the anode during charging and back again during discharge. Energy density is a function of how many ions the anode can store plus the mass and volume of each part of the battery. Lithium metal anodes do not need electrolyte on the anode side of the battery, reducing the cell’s total volume and mass, increasing its volumetric and gravimetric density.

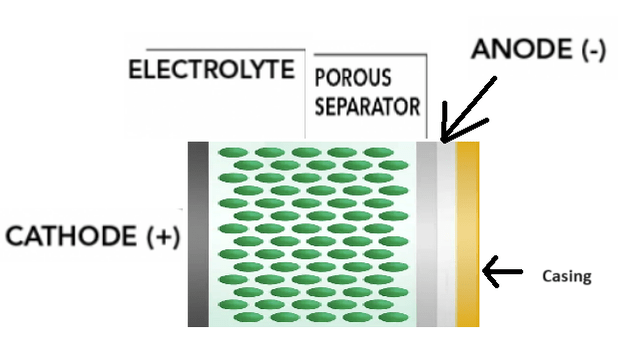

An SES cell looks like this

SES Cell (edited by author from ses website)

There is no electrolyte on the anode side of the battery. Still, unlike QS, which uses the anode as the energy collector for the battery, SES has traditional metal electricity collectors for the anode and cathode.

The electrolyte on the cathode side of the battery is one of the areas QS and SES differ, SES is using traditional, although much improved, electrolytes from li-ion batteries. This use of conventional energy collectors and electrolytes makes it possible to manufacture this battery on current high volume manufacturing lines. A significant competitive advantage for SES.

QS has moved to a hybrid pouch/prismatic cell it hopes will be suitable to all OEM manufacturers. In December 2023 SES announced it was moving to offering both pouch cells and prismatic cells. Its B sample lines will be able to produce both types of cells,

The following quotes are from the December 2023 Special Corporate Presentation by the SES CEO

So far, our focus has been on pouch cell formats. And these pouch cell formats are still the preferred form factor for our current automotive customers. And we’re doing A-Sample and B-Sample joint developments with them.

today, we are introducing an entirely new form factor for lithium-metal cells

It offers a choice to automotive customers that may want to build a prismatic lithium-metal cell. And both this pouch and prismatic lithium-metal cell have about 100 mPOWER capacity.

we are going to convert our lines so that they have dual capabilities to produce both the pouch and prismatic form factor for lithium metal, so that we can serve more automotive customers better

In short SES battery cells include liquid electrolytes and li-metal anodes, they are available in pouch or prismatic form, but for SES the physical cell is only a part of the final product.

Generative AI

SES is an AI company that makes batteries. To understand that statement we must explore what SES means by AI and how it leads the company and is a major part of its products.

SES is using AI in two ways: to discover new and improved electrolytes and to improve the safety of its batteries. Both are important, but the safety AI solution delivers a competitive advantage to SES unmatched by the competition.

AI for battery safety

SES has built a lot of battery cells, far more than the competition (Special call)

At the cell level, we have 5 lines. We have 3 A-Sample lines, and we are preparing 2 B-Sample lines. In Shanghai, we have Line 1 and that’s mostly for internal R&D. And Line 4, that’s for a B-Sample JDA. In Chungju, South Korea, Line 2 and 3 are 2 A-Sample JDAs, and we’re preparing Line 5 for a B-Sample JDA. And this last month, we broke the record and we built 1,100 mPOWER lithium-metal cells per month

As the cells are being built SES measures and records data in the special call SES announced a significant increase in the number of data points being measured and collected.

we are increasing the number of control points from less than 400 in A-Sample to over 1,400 in B-Sample. And we’re incorporating imaging tools with AI processing throughout our assembly process, such as vision, X-ray, CT and ultrasound. And all these data are used to train our Avatar and safety is quality

The data points are fed into the AI software, large numbers of cells are taken to SES bunkers (these are like bomb bunkers) where the cells are tested to destruction. During the testing, the cells are continually monitored until they blow up, burst into flames, fail, or come to any other number of deaths.

The measurements and the outcomes are the purpose of the testing and they are fed into the AI software. Machine learning is applied to this ever-growing database, searching for patterns in the changes to cell measurements that can be used to predict an outcome. The AI models developed use generative AI to predict incidents for future cells. These predictions are tested and the model continues to learn.

The more cells SES produces and tests and the more measurements they take, the better the predictive ability of SES becomes. In the special call SES said they had predicted 23 out of 25 cell incidents an improvement from the 60% detection 12 months earlier. The model will get better as more information is fed into it and the increase to 1,400 measurement points during manufacturing will continue to improve the prediction rate of the AI model.

Data collection goes beyond manufacturing into the vehicle where the battery is deployed. Each cell is monitored for its entire life. The CEO said in the Water Tower Research interview (May 2024) that the OEMs they are working with already have the infrastructure to collect this data from the car.

The outcome of this testing and AI prediction has two direct impacts: firstly, car manufacturers will be aware of an individual cell problem in a car before an event occurs. This is an enormous cost savings for the OEMs, at present batteries are produced in batches, if one battery cell fails on one car the entire fleet with that batch of batteries must be recalled after an incident. In the future, it may just be one car recalled before an incident. This could save the OEM millions of dollars. Secondly, resale values of cars, the software will give a remaining lifetime and health/safety profile of a cars battery. It will likely replace the mileage used to work out the value of a used ICE vehicle.

This month SES announced that their 100Ah cell was the first high density cell to pass the Chinese safety standard GB38031-2020, a global standard test required by all of SES’s OEM partners. The GB38031 is an abuse test, what happens when the battery is overcharged, undercharged and subject to short circuit. It was an outstanding achievement, but SES will have known in advance that the chosen cells would pass as they would have been able to look at all their measurements before sending them.

Electrolyte discovery

SES are very transparent regarding the performance of their batteries, indeed, they challenged their competitors to release similar data at the special call. One area they appear to be behind the competition is life cycle. Currently SES quote 500 cycles at 95% (water tower interview), QS and SLDP quote 1,000 cycles. 500 cycles is roughly equivalent to 150,000 driving miles so it is enough for most auto applications. Still, a car buyer will prefer a longer cycle cell over a shorter one. For SES life cycle is a function of the electrolyte and SES is using AI to help improve its electrolyte.

Prometheus is the AI molecule development tool being developed by SES, they are attempting to increase the number of known electrolyte molecules from 100 to 100,000,000,000. (CEO Water Tower interview) The first hundred were discovered and tested by scientists in labs. The new ones will be found using Prometheus AI. When a promising molecule is identified, it will be sent to another AI tool that will virtually manufacture and test the molecules before passing on successful candidates for physical testing.

In the interview the CEO said he expects life cycles to go from 500 to 800 in the B sample and then 1,000 in the C sample before hitting the longer term goal of 1,500.

Electrolyte changes are easy for manufacturers building SES cells to deal with, using traditional li ion manufacturing lines the cell is made and the electrolyte is injected into the finished cell, another advantage of staying with existing manufacturing technology.

Performance of SES cells

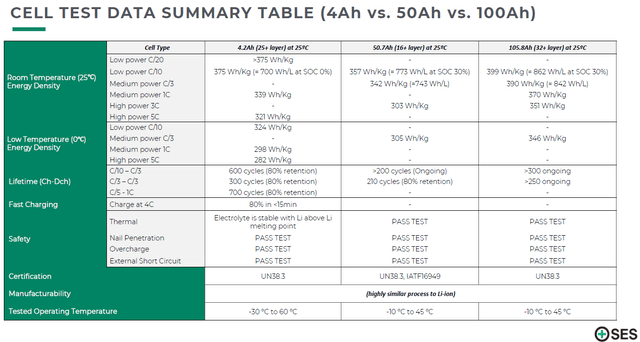

The following table is taken from the November release of the 100Ah Li-Metal Cell Data report.

Cell Performance (SES website)

The competition does not release such detail, it shows the excellent density figures and the poor cycle data, 300 was the best at the time but we know it is now at 500. The testing was performed by an external lab and the UN38.3 certificate is included in the document.

The density figures of 399Wh/Kg and 862Wh/L are particularly good, at least on par with what has been achieved by the competition.

Commercial progress

SES leads the charge versus its immediate start-up competition and legacy battery makers.

In November 2023 SES was the first next-gen battery company to enter B sampling with a JDA announced with an unnamed auto OEM. In April 2024 SES announced that Hyundai/Kia was moving to B sample testing after successfully completing the A sample tests. SES will build a large capacity Li ion line in South Korea later this year to provide the cells for B Samples to Hyundai. (worth noting this line is being bought from an existing li ion vendor and no scale up testing is needed).

SES had A sample JDAs with Hyundai, GM and Honda (10Q Q2 2024 P12). Hyundai was the second company to go to a B sample so the first must have been Honda or GM. The Honda A sample JDA concluded in 2023 and the GM one will conclude in 2024. From this, I assume that Honda was the first OEM to go to B sample testing. It is only because the dates match up, I have no proof of this.

In 2023 Total worldwide car sales were around 77 million, Hyundai/Kia had 9%, Honda 5% and GM 8% of the worldwide car market. It suggests that SES is currently being B sample tested for 14% of the market or around 12 million cars a year. With a probable cell cost per car around $5,000 SES is aiming for annual revenue of $60 billion.

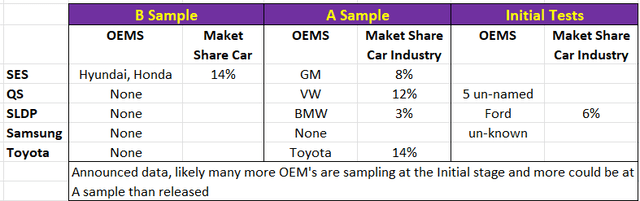

This is far ahead of the rest of the market, a quick breakdown of the state of play is in this table

Sample tests (Author collected)

SES is expecting C sample testing to begin next year and start of production (SOP) in 2026. (Q2 2024 earnings)

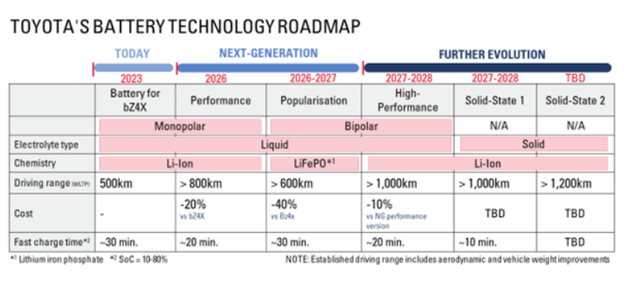

If we compare this to the competition. SLDP has sent A samples to BMW but expects to produce A2 and A3 samples. QS has sent A samples to VW and 5 other auto OEM’s but has not finalized its cell chemistry yet or its scaled production process. Samsung set up its first pilot line for Solid state batteries in 2023 and sent prototype cells to OEMs earlier this year, Toyota set out its roadmap for battery development in a recent press release.

Toyota Battery roadmap (Toyota website)

Considering all the competition, SES would appear to be 2-3 years ahead in the race to commercialize a next-generation battery.

UAM production

In August SES announced the conversion of its A sample line in South Korea to UAM production was complete and the line had passed its field acceptance test. It is the only line dedicated to next-gen battery production for the UAM market. The AI safety product integrated into this line will be important for UAM manufacturers. UAM is a large market $38 million (Q2 shareholder letter P2) SES have not being specific about which drone manufacturers they are working with, in the linked share holder letter they said they had signed agreements with “a few” and expect to sign “a few more” in 2024. The CEO was more forthcoming when interviewed by Water Tower Research, at the end of the interview the CEO was asked what investors should look out for to monitor how things were going. The CEO said, amongst other things, “revenue from UAM cell sales in early 2025”.

It is impossible to estimate the size of this revenue; it could be small sales to industrial drone makers or large volumes to military swarm drone manufacturers. Both were mentioned in the letter to shareholders.

SES finances

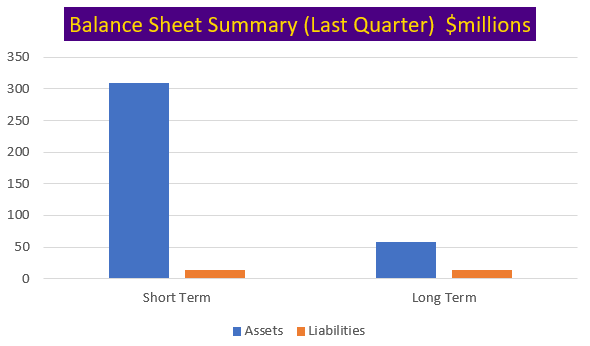

Although SES does not have a balance sheet the size of QS (equity $1.2 Billion) or SLDP (equity $456 million). It is in excellent financial shape and has equity of $330 million with zero debt.

SES Balance Sheet (Author Database)

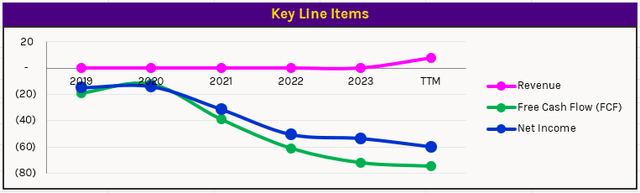

Cash usage is very similar to SLDP, although SLDP is recording more revenue ($20 m TTM). QS net income is approaching minus $500 million TTM.

SES Line Items (Author Database)

Cash usage in 2023 was $56 million, and capex was $16 million. Guidance was given in Q4 2023 for 2024 cash usage to be closer to $100 million and capex $25 million. The increase in spend was attributed to the ramp towards commercial operations.

We will have to watch cash usage closely, Q2 2024 came in at $22 million and full year cash use guidance was raised to $110 million. At the end of Q2, SES reported $295 million in liquidity and guided to a cash runway into 2027.

If the UAM sales begin as expected and prove successful, then it is reasonable to assume that SES has the cash to get to full commercial production if it continues to share capex costs with JDA customers.

Risks

It was noticeable at the Q2 earnings call that SES has very little analyst coverage. SimplyWall has no analyst forecasts for SES share price and SeekingAlpha has three with a hold rating. Being uncovered offers the potential of higher rewards but means less due diligence is being performed.

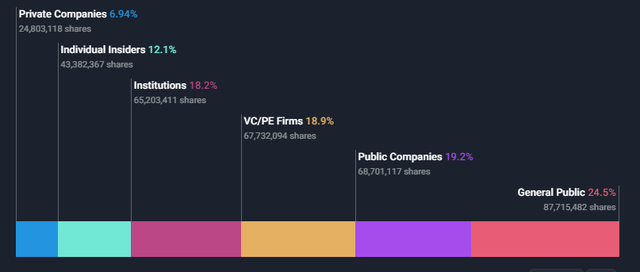

SES Shareholder Breakdown (Simplywall.st)

SES has a spread of ownership, the CEO is the largest single shareholder with 11.6%. The CEO and the rest of the shareholders look well aligned which may account for the near zero dilution in the last 12 months.

SES is a small company, its market cap of $360 million is only just above micro-cap levels and its share price of $1.07 has been hovering around the minimum listing requirement of $1 in recent weeks. SES is developing a new technology that has not yet reached commercial operations. Any investment should be considered very high risk, it faces competition from better funded startups, legacy battery makers and large Auto OEMs like Toyota horizontally integrating into its space.

The risks are clear and for once quite straightforward. It is the technology, if it does not deliver the performance expected at B sample it will not get to C sample, if the C sample does not deliver as expected the product will never be commercialized. If the tech works as expected and the competition does not deliver an unexpected step up in performance then SES could have revenue in the tens of billions of dollars suggesting significant upside for the share price.

2025 will be a pivotal year, revenue should begin with UAM companies, and the auto OEMs should move toward C sampling. 2026 should see the result of C sampling and at that point we will know the outcome for certain.

Conclusion

I am very positive about the progress SES has made and would like to reiterate my Buy rating.

The developments in AI are excellent and will give any commercial product they bring to market a significant competitive advantage. SES has discussed licensing the AI as an additional revenue stream but that idea has not yet been fleshed out.

The progress of the hardware is industry leading; two B sample JDAs with major auto OEMs is head and shoulders above the competition and puts SES years closer to commercialization than the rest.

The UAM market may be about to deliver revenue in the short term and they have converted an A sample line to produce cells specifically for this market. The high density and AI improved safety will be of great value in the drone market and may deliver significant revenue much earlier than initially expected.

I cannot give SES a Strong-Buy rating because of the time remaining to commercialization, revenue and profitability. The auto product is still at least three years from commercialization and I do not have the necessary information to assess the size of sales to the UAM market. I will review my position when we hear more about UAM sales and again when we hear about the success or failure of the B samples. Although I am not prepared to add the company to my Strong-Buy portfolio yet, my main vehicle for wealth creation, I think SES is on the right road and hope to upgrade it soon.

Read the full article here