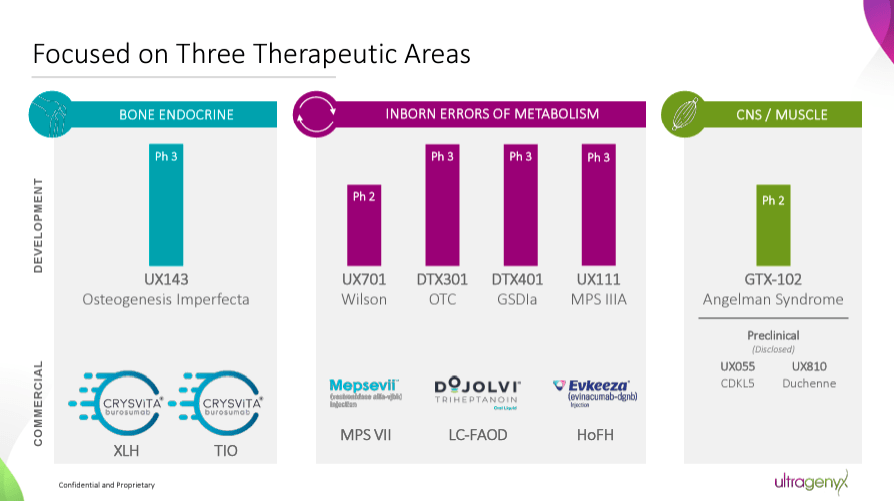

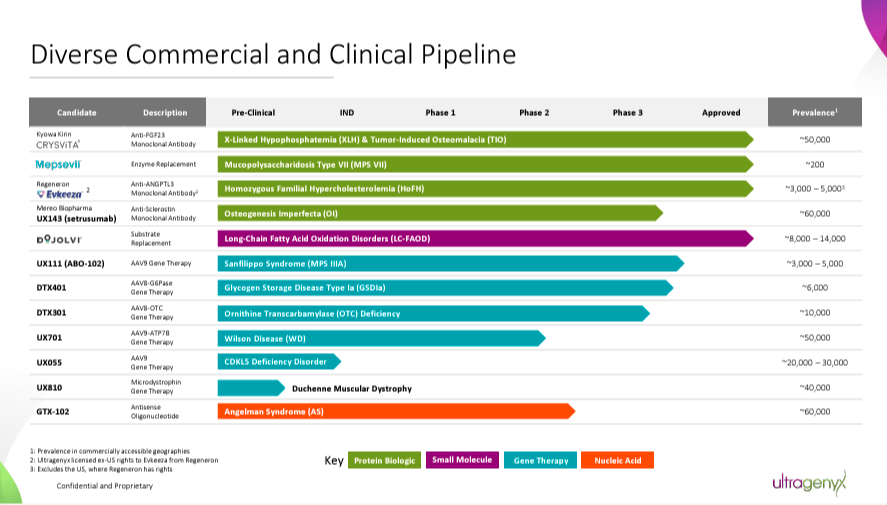

Ultragenyx Pharmaceutical Inc. (NASDAQ:RARE) develops innovative therapies for rare and ultra-rare genetic diseases. Its commercial portfolio includes Crysvita, Mepsevii, Dojolvi, and Evkeeza, which address unmet medical needs in conditions like X-linked hypophosphatemia [XLH], Mucopolysaccharidosis VII [MPS VII], long-chain fatty acid oxidation disorders [LC-FAOD], and homozygous familial hypercholesterolemia [HoFH]. Additionally, RARE’s pipeline targets severe diseases such as osteogenesis imperfecta, Angelman syndrome, Wilson disease, Sanfilippo syndrome type A, and glycogen storage disease type Ia. RARE’s stock price has increased substantially due to its positive clinical trial results and progress toward new regulatory approvals. However, despite promising revenues, RARE’s expensive multiple and ongoing unprofitability remain a concern. Hence, I believe the stock could be a good buy at a lower price, but for now, I remain neutral.

Rare Diseases: Business Overview

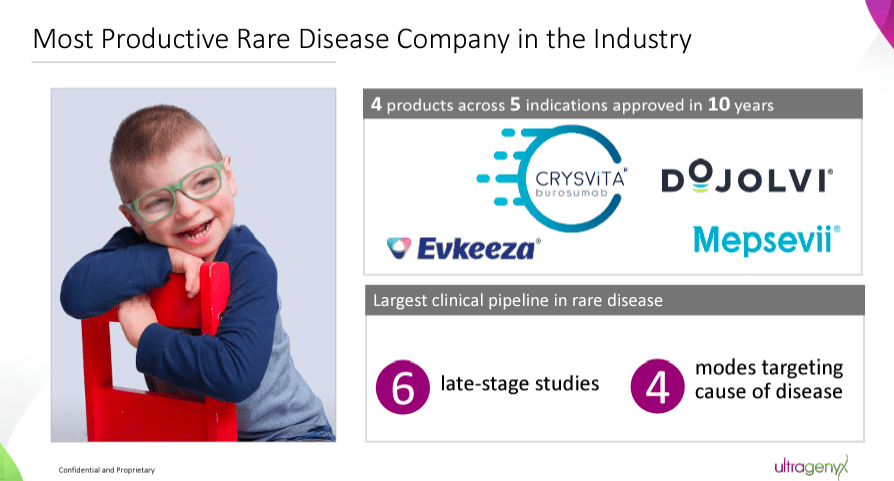

Ultragenyx Pharmaceutical is a commercial biopharmaceutical company founded in 2010 and headquartered in Novato, California. RARE focuses on unmet medical needs in rare and ultra-rare genetic conditions characterized by severe symptoms and low prevalence rates. Despite its focus on rare and ultra-rare diseases, the company’s revenue potential is notable. Rare disease research often requires high costs and involves significant risks. However, the positive aspect is that unmet medical needs are less competitive and favorable for rapidly capturing a large market share. Moreover, these diseases typically benefit from favorable regulatory incentives, potential premium pricing, and global market access that can be aggregated across regions.

Source: Corporate Presentation. August 2024.

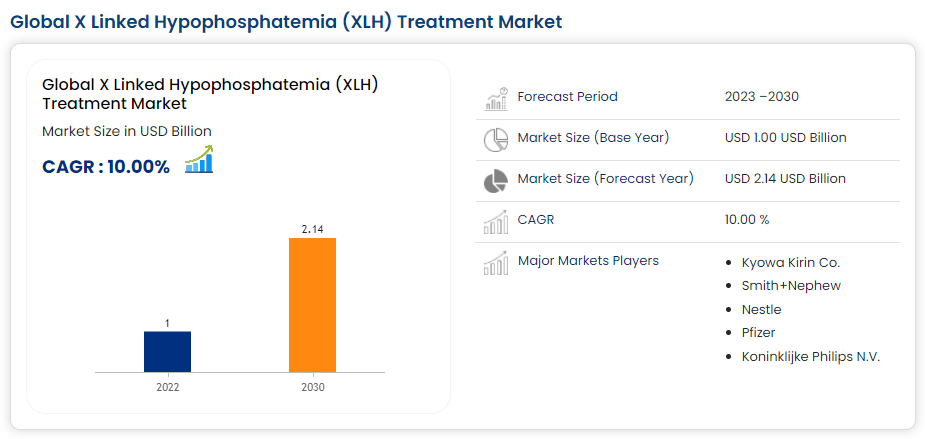

Currently, the company’s commercial portfolio includes burosumab, known as Crysvita. This monoclonal antibody targets fibroblast growth factor 23 [FGF23] to treat X-linked hypophosphatemia [XLH]. XLH is a rare genetic disease marked by low phosphate in the blood due to phosphate loss in the urine, resulting in soft bones and deformities. The prevalence of XLH is 1 in 20,000 to 1 in 25,000 individuals. Yet, despite its relatively rare prevalence, its market is projected to reach $2.1 billion worldwide by 2030.

Source: Data Bridge.

Another product is vestronidase alfa, known as Mepsevii, an enzyme replacement therapy [ERT] for Mucopolysaccharidosis VII [MPS VII]. MPS VII, or Sly syndrome, is an inherited disorder characterized by a deficiency of the enzyme β-glucuronidase. This deficiency leads to the accumulation of glycosaminoglycans in various organs, causing developmental delay, organ enlargement, skeletal anomalies, and respiratory problems. This disease is extremely rare, with an estimated prevalence of 0.24 per 100,000 live births. The market for MPS VII is projected to reach $934.7 million by 2034.

Additionally, the portfolio includes triheptanoin, marketed as Dojolvi. This triglyceride is a caloric source, treating long-chain fatty acid oxidation disorders [LC-FAOD]. LC-FAOD is a group of metabolic disorders that impair the ability to convert long-chain fatty acids into energy, leading to cardiomyopathy and liver impairment. The prevalence of these disorders is approximately 1 in 9,300 to 1 in 30,000 live births. This rare disease still represents a relatively sizeable market size, estimated at roughly $533.7 million.

Source: Corporate Presentation. August 2024.

It’s worth mentioning that RARE also has Evinacumab, commercially known as Evkeeza. This is a monoclonal antibody that inhibits angiopoietin-like protein 3 [ANGPTL3]. When Evinacumab inhibits that protein, it addresses homozygous familial hypercholesterolemia [HoFH]. HoFH is a genetic condition marked by high levels of low-density lipoprotein cholesterol [LDL-C] from birth, which increases the risk of cardiovascular disease, heart attacks, and strokes. This condition is rare, with a prevalence of approximately 1 in 160,000 to 1 in 300,000 individuals. However, this condition’s market size is tiny, estimated at just $76.4 million, so I wouldn’t consider it a significant value driver.

Product Pipeline: Genetic Root Causes

Therefore, RARE’s pipeline mostly targets genetic root causes to restore healthy gene function. While its main value drivers are Crysvita, Mepsevii, and Dojolvi, it also has promising investigational programs. For instance, UX143 is a Phase 3 drug for osteogenesis imperfecta [OI]. It also has GTX-102, a Phase 2 candidate for Angelman syndrome [AS]. RARE’s gene therapies deliver functional gene copies, such as UX701, a Phase 2 candidate for Wilson disease [WD]. UX111 is a Phase 3 candidate for Sanfilippo syndrome type A [MPS IIIA], and DTX401 is a Phase 3 drug for glycogen storage disease type Ia [GSDIa].

Late-stage programs are also progressing well, with positive data from pivotal studies. RARE has announced encouraging results for drug candidates such as UX111, GTX-102, DTX401, and UX143. These outcomes, particularly those from Phase 3 trials, underscore the potential of RARE’s therapies. The company has agreed with the FDA on the settings for regulatory submissions.

Source: Corporate Presentation. August 2024.

During RARE’s latest earnings call, management highlighted that its products exceeded expectations and revised its 2024 revenue projections upward. Moreover, in July 2024, RARE completed GTX-102’s Phase 2 trial and met with the FDA to design its Phase 3 trial. RARE is also preparing UX111’s Biologics License Application [BLA] for MPS IIIA. The FDA agreed that cerebrospinal fluid heparan sulfate [CSF HS] can be a surrogate endpoint. Surrogate markers are valuable in rare diseases where traditional endpoints take years to observe and treatments are unavailable. Thus, RARE should be able to use this marker to prove its therapy’s efficacy, improving the odds of an expedited approval of UX111.

RARE is also working on DTX401’s BLA for GSDIa. This rare genetic disease makes maintaining normal blood sugar levels difficult. Therefore, GSDIa patients often need cornstarch for supplemental glucose to avoid severe hypoglycemia. Fortunately, DTX401 showed positive Phase 3 data. Patients noted a significant reduction in daily cornstarch intake, suggesting DTX401 stabilized glucose levels more effectively than current therapies. The FDA granted DTX401 orphan drug designation, regenerative medicine advanced therapy [RMAT] designation, and Fast Track designation. Additionally, the European Medicines Agency (EMA) granted DTX401 PRIME designation. This corroborates DTX401’s relatively favorable regulatory environment and also showcases how promising its potential is for GSDIa. In theory, RARE should be able to expedite DTX401’s review process through these designations.

Expensive Price Tag: Valuation Analysis

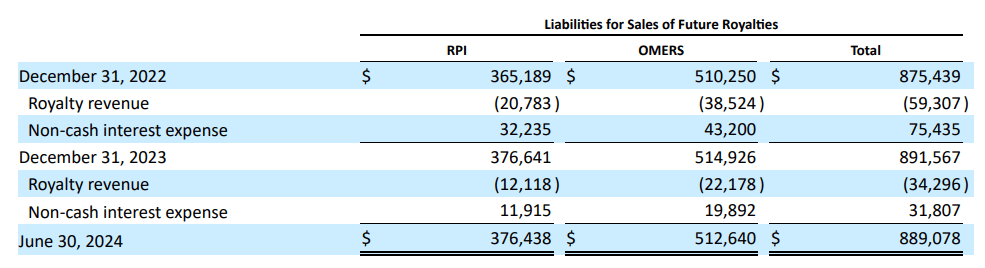

From a valuation perspective, RARE trades at a $4.9 billion market cap, making it a mid-sized biotech in the sector. This is especially notable since it’s focused on rare diseases. Moreover, its balance sheet holds $480.7 million in cash and equivalents and $283.1 million in current marketable securities. This amounts to $763.8 million in available short-term liquidity against no financial debt. However, RARE does have $889.1 million in liabilities for future royalties. Since the company will have to fulfill these liabilities over time, they will undoubtedly be a net revenue headwind for its foreseeable future.

Source: RARE’s latest 10-Q report.

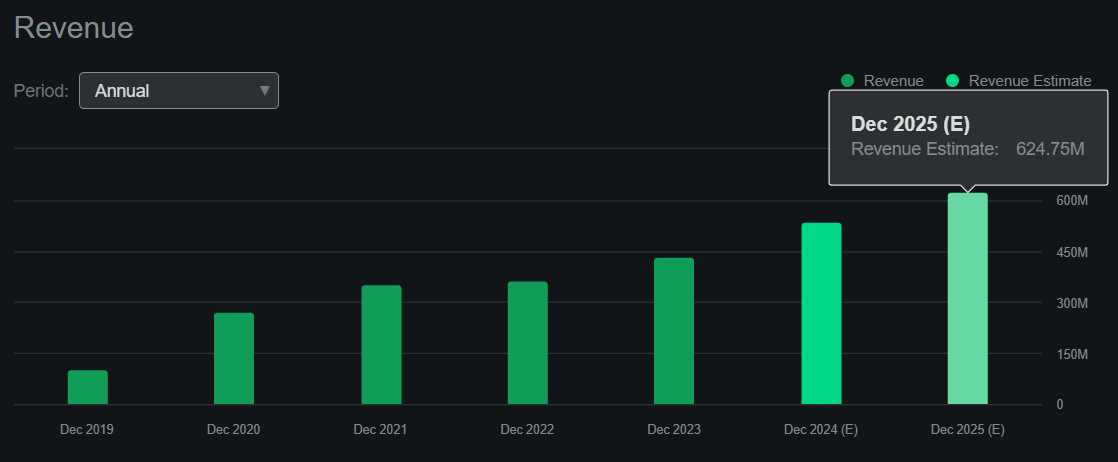

Fortunately, according to Seeking Alpha’s dashboard, RARE is projected to generate about $624.8 million in revenues by 2025, so those royalty liabilities seem manageable by comparison. Also, these liabilities are mostly tied to Crysvita’s revenues, so theoretically, they wouldn’t affect the rest of its IP.

Nevertheless, its book value stands at $432.4 million, indicating a P/B multiple of 11.3. This is expensive on its own and significantly higher than the sector median P/B of 2.5. Likewise, if 2025’s forecasted revenues materialize, it would imply a forward P/S ratio of 7.8, which is again considerably higher than the sector median forward P/S of 3.8. So, I think RARE is undoubtedly already pricing in much of its promising future prospects, and this tapers my optimism on the stock.

Source: Seeking Alpha.

Furthermore, I estimate the company’s latest quarterly cash burn was $81.5 million by adding its CFO and net CAPEX. This suggests a cash runway of 2.3 years, but that’s if we exclude the non-current portion of its marketable securities worth $110.7 million. If I include those, RARE’s cash runway is approximately 2.7 years. This is a healthy cash runway and shows the company has enough resources for the foreseeable future. However, it also indicates that the company isn’t yet self-sustainable despite its relatively impressive revenue potential.

This and its expensive valuation nudge me to adopt a neutral stance on RARE. I’m bullish on its underlying IP, but at this point, I think the stock price is already too high to warrant a “buy” rating. Hence, I deem RARE a “hold,” but it could be a good buy on dips.

Caveats: Risk Analysis

The main risk to RARE’s outlook at this juncture is its relatively high valuation. These concerns can translate into sustained headwinds for the stock price and could exacerbate downside reactions to potential bad news. Moreover, despite promising revenues, the company’s ongoing cash burn warrants caution. Ultimately, investors need to see a company capable of accumulating shareholder value once its IP is proven and monetized. Unfortunately, RARE continues to accumulate losses instead. These factors can’t be ignored and justify my neutral stance on RARE.

Source: TradingView.

As for its upside potential, I believe RARE’s promising multiple phase 3 drug candidates are quickly progressing toward potential regulatory approval. If this materializes, it would likely help its stock price. Yet, RARE’s valuation remains expensive and seems unable to translate revenues into profits, so I believe the pros and cons cancel each other out. Nonetheless, if the stock price declines substantially, RARE could prove a fine long-term addition to your investment portfolio.

Wait For Dips: Conclusion

Overall, RARE is a biotech company focused on rare diseases. It has a diverse portfolio of approved and late-stage drugs and ample resources to fund its research for the foreseeable future. Unfortunately, much of this positive outlook is already priced into the stock. Moreover, despite its promising revenues, I am concerned about RARE’s mounting losses. Hence, I think RARE could make sense at a lower stock price, but for now, I lean neutral on the stock.

Read the full article here