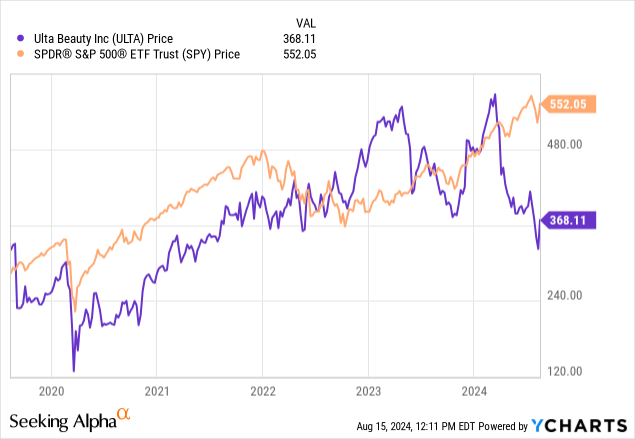

Ulta Beauty (NASDAQ:ULTA) stock has been falling over the past year by over 30%. Recession fears have pushed down stocks selling discretionary goods. Competition is heating up with more price promotions to attract customers, which investors fear may be hurting margins, and growth has slowed down.

I have followed ULTA for a while now, and it has been quite a ride for investors. The main story is that ULTA’s growth has slowed down, and investors are uncertain about whether they can “re-accelerate” their growth trajectory. I argued in my original bull thesis that ULTA still has a lot of potential, and a lot of room to grow the business going forward: Ulta Beauty Stock: Time To Re-Accelerate

My Previous Coverage (Ahoy Alpha, 2024)

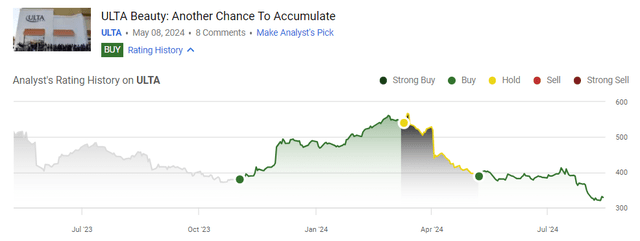

Since then, ULTA stock performance has shifted between outperforming the index, and underperforming. ULTA surged early on in 2024 stretching into overvalued territory, but then recently became undervalued again according to my latest article “Another Chance to Accumulate” dropping well under my roughly $400 margin of safety buying price.

This week, it was revealed that the legendary Berkshire Hathaway (BRK.A BRK.B) company has invested in ULTA, which has generated excitement among investors. While this is only a relatively small investment for Berkshire’s standards, it does suggest that ULTA has passed the bar for Berkshire to be considered a good investment and passing their rigorous analyses. I would like to think that Warren Buffett has read my Seeking Alpha articles, but I won’t kid myself. Similarly to Berkshire Hathaway, I still rate the company as a “buy“.

Stretched Consumer Budgets and Retail Sales

Discretionary stocks have dropped because many institutions reported that consumers budgets are stretched, and retailers are therefore competing on price. Because of those fears many retailers and discretionary goods companies have declined recently. However, this fear was somewhat overblown and retail sales surprised on the positive side today. While people are not spending at record levels, most consumers continue to spend on affordable luxuries and things are not as bad as people expected.

Domestic Competition with Sephora

ULTA’s main competitor is Sephora, owned by the French luxury good conglomerate LVMH (OTCPK:LVMHF). Compared to Sephora, ULTA is positioned as the more affordable option. This position could now be positive for ULTA as consumer are substituting more expensive cosmetics from big multinational brands for cheaper and more affordable luxury options. As shown below, consumers get more value for money at ULTA versus Sephora.

ULTA vs. Sephora Shopping Hauls (Laura Lee, 2023)

Generally, the distinction between “discretionary” and “staples” may therefore not be as binary as some make it out to be; affordable luxuries like small cosmetics may remain popular. I believe ULTA is selling products that are in between these two categories, as well as selling them at different price points. On the other hand, Sephora is clearly more expensive on average with some skin care creams being sold for over $100 per unit, and consumers may cut back on these expensive cosmetics and skin care brands. Importantly, that might not mean less consumption overall, but a substitution effect where consumer “trade down” to cheaper stores and brands that could benefit ULTA.

Moreover, there is the “lipstick effect”, where cosmetics respond differently during recessions compared to other discretionary goods such as cars or home improvement. Evolutionary psychology suggests that women may put more effort into attracting successful mates during uncertain (economic) times, to achieve safety. This could mean more cosmetics sales during recessionary periods, even though cosmetics are often labeled as “discretionary goods”.

Future Growth Opportunities

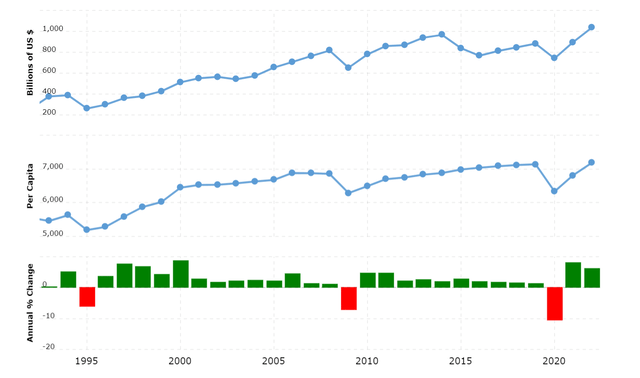

Mexico Consumer Spending (World Bank, 2024)

ULTA is expanding internationally into Mexico which is a developing economy and consumer spending has been rising over the past decades.

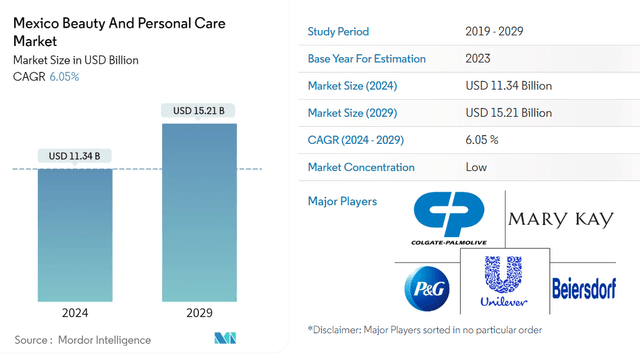

The Mexican beauty market is valued at over $10B with still has low levels of market concentration and it is projected to grow with a 6% CAGR.

Mexican Beauty Market (Mordor Intelligence, 2024)

The Mexican expansion will contribute to growth from next year onwards. How large can this become? We expect a relatively small contribution to total revenue at the moment for FY2025, but it has considerable potential long-term as ULTA could expand further into Mexico and Latin America more generally.

ULTA in store services (ULTA, 2024)

Another possible driver of growth are the in-store services that ULTA offers. Service revenues are only a small part currently, but this is a differentiating factor that they could build out to something more substantial in the long-run. ULTA offers a variety of in-store services, such as cutting hair and doing personalized make-overs. This is a great opportunity to build a relationship with their customers and improve customer loyalty. These services also attract more people to the physical store and can thereby help to drive same-store-sales growth. These services are a flywheel because they improve the in-store experience, build customer loyalty, and fit with their products. While playing the e-commerce game with low prices is perhaps not their strong suit, focusing on growing and improving these in-store services, in my opinion, are.

Market Share Developments

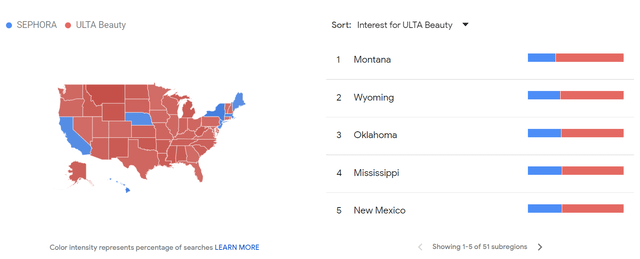

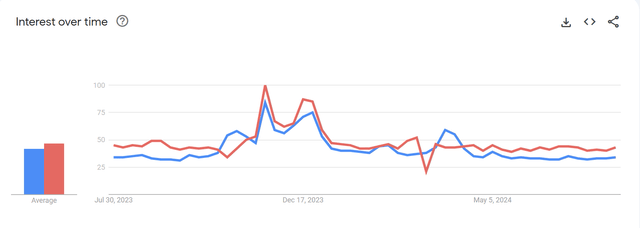

Google trends indicate that ULTA generates more web traffic in the USA than Sephora does, but this is an unreliable indicator of sales. It seems to me that ULTA is more popular in rural areas, while Sephora is more popular in the big cities. Moreover, search traffic for ULTA has increased compared to Sephora.

Search Traffic (Google, 2024) Search Traffic (Google, 2024)

Conclusions

ULTA is playing defense in the USA to guard its market leading position against Sephora’s recent expansions there, but ULTA is still doing well overall; affordable luxury and in-store experiences are a winning combination for ULTA. Importantly, ULTA needs to get back to significant growth and expand more aggressively internationally. They risk waiting too long with their expansions until new markers are already captured by Sephora, and their strategy is somewhat reacting to what Sephora is doing. ULTA needs to focus on its own business and expand as quickly as possible.

Using some alternative data sources, we were able to provide interesting insights for investors. It seems to me that ULTA is doing well and gaining market share because of their value-for-money proposition compared to Sephora, which is a more higher-end retailer. A recent investment by Berkshire Hathaway in another interesting development for ULTA beauty and gives investors more confidence in the business.

ULTA has several promising opportunities to increase growth, specifically focusing on its expansion into Mexico starting next year and leveraging its service offerings. While ULTA is focused on its omnichannel retailing, I believe that the in-store experience is the most important thing for them to focus on. While omnichannel retailing is a basic requirement for retailers nowadays, these in-store services are a differentiating factor that can become a larger contributor to revenue and help to increase store traffic.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here