We previously covered e.l.f. Beauty, Inc. (NYSE:ELF) in May 2024, discussing the immense growth in its financial numbers and market share gains, thanks to its well-loved and strategically marketed/ priced beauty offerings.

Even so, despite its relative nascency in the beauty sector, the untapped international market, and the potential for massive growth, it was apparent that the stock had been overvalued then, with it offering interested investors with a minimal margin of safety, resulting in our Hold (Neutral) rating then.

Since then, ELF has charted new heights before pulling back as the wider market rotates from high growth stocks, and we enter the typical tough August month, attributed to its 1Y outperformance at +92% compared to the SPY at +24%, prior to the recent correction.

While the beauty retailer has delivered double beat FQ4’24 earnings call, its FY2025 guidance has underwhelmed, worsened by the deceleration observed in its domestic market, with it remaining to be seen if the management may continue to deliver high double-digit growth ahead.

As a result of the near-term uncertainty and the still expensive stock prices/ valuations, we are reiterating our Hold (Neutral) rating here.

ELF’s Investment Thesis Remains Rather Speculative Entering FQ1’25 Earnings Call

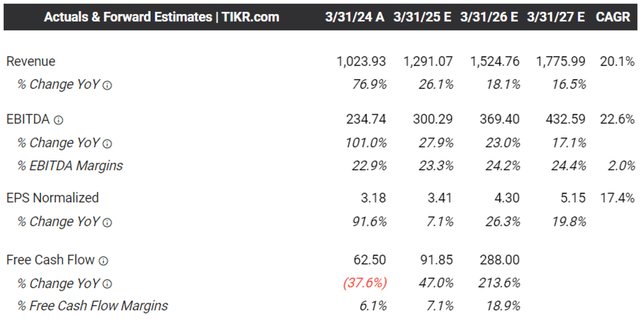

ELF recently celebrated its 20th anniversary as a company, with FY2024 also bringing forth impressive net sales of over $1B (+76.9% YoY) for the first time, while generating robust adj EBITDA margin of 22.9% (+2.7 points YoY) and adj EPS of $3.18 (+91.5% YoY).

With the company expected to report their FQ1’25 earnings results on August 8, 2024, we shall highlight a few metrics for readers to look out for, with it underscoring the health of its business and near-term prospects.

1. ELF’s Underwhelming FY2025 Guidance Implies Either Excessive Prudence Or Macro Headwinds

The Consensus Forward Estimates

Tikr Terminal

Unfortunately, ELF has offered an underwhelming FY2025 revenue guidance of $1.24B (+21.5% YoY) and adj EPS of $3.225 (+1.4% YoY) at the midpoint, with it missing the consensus estimates of $1.27B (+24.5% YoY) and $3.56 (+11.9% YoY), respectively.

It appears that the beauty retailer’s high growth trend has finally shown signs of deceleration, when compared to its 5Y top/ bottom-line growth CAGR of +30.8% and +37%, respectively, further underscoring why we believe that the above consensus forward estimates appear to be overly aggressive.

While it remains to be seen if ELF’s guidance has been on the prudent side, based on their beat and raise historical trends, and/ or if the profitable growth deceleration is a sign of worse things to come, one thing is for sure, the macroeconomic outlook remains uncertain.

The June 2024 CPI is still elevated and remains well above the Fed’s target rate of 2%, worsened by the recent market rotation from high growth stocks, with ripples being felt throughout the stock market over the past week.

ELF 5Y Stock Price

Trading View

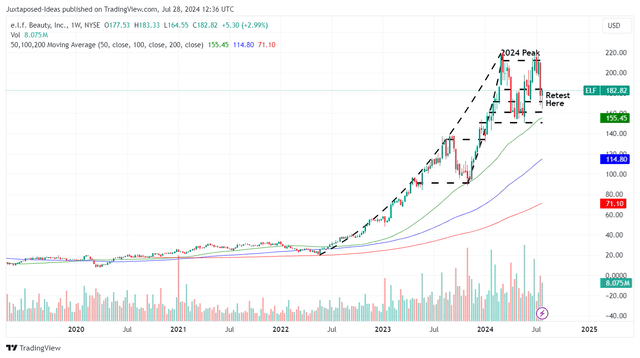

This may also be why the ELF stock has retraced as it has since the 2024 peak, with it effectively losing -16.1% or -$1.58B of its Market Capitalization since the July 2024 peak, and moderating much of the gains recorded after the impressive FY2024 earnings call in May 2024.

While the management has guided FQ1’25 performance “to be above that +20% to +22% net sales guidance range” on a YoY basis, they may have to deliver a massive beat and raise quarter to put a floor at current levels of $180s, as per their historical trend.

Barring that, we believe that the market correction may not end yet, with it potentially triggering further stock correction to the May 2024 support levels of $150s, implying a -13% downside from current levels.

2. Watch ELF’s International & Skin Care Growth Prospects

ELF has long iterated their next growth opportunities in the international market, with it only comprising 15% of its FY2024 sales compared to the wider aesthetic market at over 70%.

Much of the management’s strategy lies in its value proposition, based on the average price point of $6.50 for its products compared to $9.50 for legacy mass cosmetics brands and over $20 for prestige brands. This is on top of its sustained expansion into skin care segment, significantly aided by the recent Naturium acquisition worth $355M.

For now, the international market growth remains robust at +25.7% QoQ/ +115% YoY in FQ4’24, attributed to the accelerating gains in Canada and the UK, with it also driving ELF’s overall sales.

Even so, readers must note that the management’s underwhelming FY2025 guidance implies a slower international roll out, worsened by the slower domestic growth at +17.2% QoQ/ +64.8% YoY in the latest quarter, compared to the year before at +27.8%/ +75.5%, respectively.

While these numbers remain robust, it remains to be seen if ELF’s partnership with Sephora in Mexico from Q3’24 onwards may well balance the decelerating growth observed in the domestic market.

As a result, readers may want to monitor the management’s FQ2’25 guidance offered in the upcoming earnings call.

3. ELF remains Inherently Expensive Here

ELF Valuations

Tikr Terminal

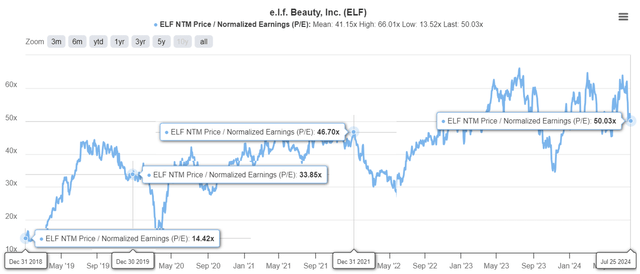

Readers must note that ELF’s elevated P/E valuations come with great expectations, with it only linked to its ability to consistently deliver future double-digit growth.

Even so, based on the chart above, it is undeniable that the stock has gotten overly expensive compared to its historical levels, especially given the potential growth deceleration.

At the same time, when comparing to its beauty/ personal care peers, such as:

- Ulta Beauty (ULTA) at FWD P/E valuations of 14.14x with the projected adj EPS growth at a CAGR of +6.1%,

- L’Oréal S.A. (OTCPK:LRLCF) at 29.67x/ +8.3%, and

- Estée Lauder (EL) at 27.47x/ +14.6%,

it is undeniable that ELF is still expensive at 50.03x/ +17.4%, respectively.

While we applaud the robust performance metrics reported by the management across its financial numbers, unit sales, digital initiative/ channel expansion, membership growth, and retail partnership (amongst others), there remains a minimal margin of safety despite the recent correction.

So, Is ELF Stock A Buy, Sell, or Hold?

ELF 2Y Stock Price

Trading View

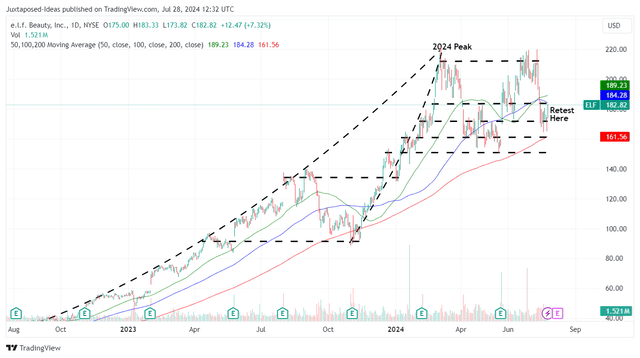

For now, ELF has already retraced dramatically over the past few weeks, while being well supported at its previous support ranges of $170s to $180s.

For context, we had offered a fair value estimate of $120.80 in our last article, based on the management’s FY2024 adj EPS guidance of $2.85 and the 5Y P/E mean of 42.41x (nearer to its mature peers’ P/E).

Despite the pullback, it is apparent that ELF remains expensive compared to our updated fair value estimates of $136.70, based on the management’s FY2025 adj EPS guidance of $3.225 at the midpoint and the same 5Y P/E.

With a minimal margin of safety to our reiterated long-term price target of $182.70, based on the stable consensus FY2026 adj EPS estimates of $4.31, we believe that current levels do not appear attractive for those looking to buy the dip.

With ELF’s FY2025 likely to bring forth a more challenging YoY comparison, we maintain our belief that the market’s exuberance surrounding its future execution may moderate from henceforth, as observed in the stock’s double top pattern observed thus far.

As a result of the potential capital losses, we prefer to maintain our Hold (Neutral) rating here.

Read the full article here