Axcelis Technologies (NASDAQ:ACLS) is the second largest ion implantation equipment supplier in the world. The company’s products are an integral part of the fabrication process of semiconductor wafers. While ACLS has managed to grow its revenue by 23% in 2023 during the industry downturn, it is increasingly relying on China’s market. With multiple Chinese competitors entering the space and with the Chinese government determination for self-sufficiency, I believe ACLS is very likely to gradually lose market share in China. Therefore, I am giving ACLS stock a “hold” rating.

ACLS’ business

ACLS is a pure play WFE supplier with a focus on ion implanter. Ion implantation is a critical step in the fabrication process of chips. ACLS’ annual report has a detailed explanation of the process of ion implantation. In simple terms, an ion implanter injects dopants such as arsenic, boron or phosphorus into a wafer in order to change the material characteristics of the silicon or silicon carbide. The ionized dopants then have an electrical charge state, which allows them “to be accelerated, focused and filtered with electric and magnetic fields”.

There are three types of ion implanters, high current, high energy and medium current, each targeted at a specific range of applications, primarily defined by dose and energy. ACLS offers a portfolio of products across a complete line of high energy, high current, and medium current implanters for all application requirements.

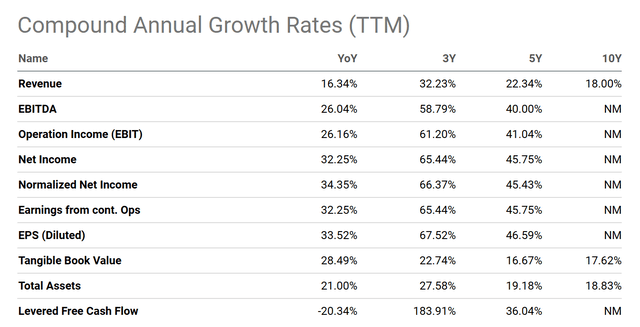

As the second largest player in the ion implanter market, ACLS has been growing its revenue at an impressive rate over the past 3, 5 and 10 years.

SeekingAlpha

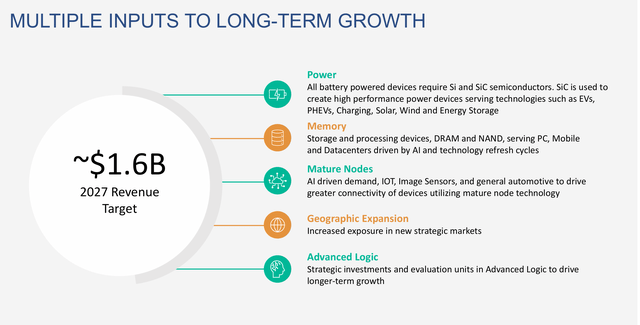

During the most recent investor day event, management has explained the drivers for ACLS’ growth story. Specifically, management has listed 5 drivers for ACLS’ growth. They are power, memory, mature nodes, geographic expansion, and advanced logic.

ACLS investor relations

Increasing reliance on China

While there is no doubt that ACLS has been a fast-grower in the past 5 years, what’s concerning to me is ACLS’ increasing dependence on China. During the Q4 2018 earnings call, ACLS’ management stated that only a little more than 20% of ACLS’ system shipment came from China. However, for FY 2023, China has accounted for 46% of ACLS’s system shipment, as explained by ACLS’ management during the Q4 2023 earnings call. In FY 2024, ACLS’ management expect China to represent 40-60% of its revenue.

There are two major factors for ACLS’ increasing reliance on China. First of all, it is widely reported that China has been the leader in terms of wafer fab expansion in the past few years, with another 18 new fabs expected to begin production in 2024. Secondly, China also is leading the world in terms of SiC adoption. The SiC Device process requires significant investment in ion implanters. However, China’s domestic companies have been slow in developing their own ion implanters. Therefore, Applied Materials (AMAT) and Axcelis were basically immune from domestic competition and enjoyed the rapid growth in China for the past few years in the domestic ion implanter market.

Growing risk of domestic competition

Despite management’s confidence in ACLS’ competitive strength in China, there are clear signs that AMAT and ACLS are very likely to face serious challenges in the coming years as domestic competitors are catching up with the technology. For some reason, ACLS listed only one competitor in China, which is the CETC Electronics Equipment Group. CETC is a powerful SOE, and it was reported back in 2021, that “a subsidiary of China Electronic Technology Group Corporation (CETC) has developed full series of homegrown ion implanters for chipmakers and the ion implanters are all made in China and can provide a one-stop service for global chipmakers”.

There are at least two other domestic competitors that ACLS didn’t mention in its annual report. The first is Kingstone Semiconductor, which is a subsidiary of the public listed company Wanye Corporation. According to Wanye’s annual report, Kingstone has shipped 8 ion planters during the first quarter of 2024 to repeating customers. Since 2020, Kingstone has accepted orders of RMB 1.7 billion from domestic customers including logic, memory, power and CIS.

Another emerging competitor is Xysemitech, which is partially owned by the publicly listed Hwatsing Technology. There is very limited information on Xysemitech. In fact, the company doesn’t even have an official website. In September 2023, Hwatsing Technology acknowledged that Xysemitech’s self-developed ion implanters were being qualified by one of the top foundries in China.

All three domestic competitors have claimed that their ion implanters can cover the 28-nanometer manufacturing process. Although it looks like it will take them a while to prove the reliability of their products, it is almost guaranteed that after 2024, the domestic competition will heat up and ACLS is very likely to lose market share to domestic competitors.

Financial projections and valuation

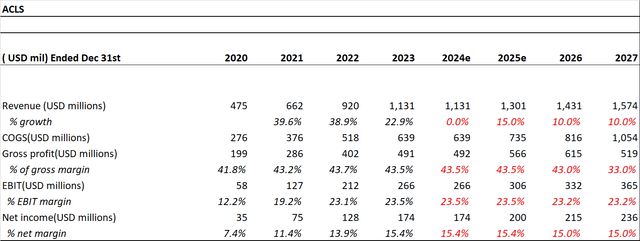

In my model, I have assumed that ACLS’s revenue will be flat in 2024 and further grow in 2025, as guided by management. However, I am assuming that ACLS will not achieve its 2027 target of $1.7 billion from ACLS’ investor day due to increased competition in China. I’m also assuming ACLS’ margin will shrink a little big as a result of increased competition.

author’s estimate

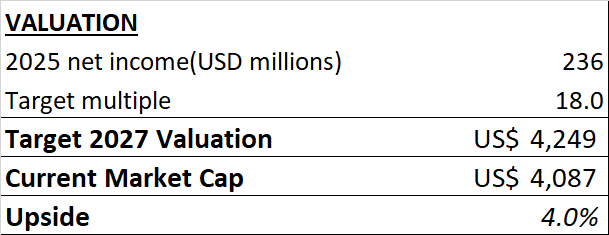

On the valuation side, I applied an 18 times TTM P/E multiple, which is the same as ACLS’ current multiple.

SeekingAlpha

Based on my assumptions, ACLS appears to be fairly valued at this price.

Conclusion

As the second largest player in the global ion implanter market, ACLS has benefited enormously from China’s growing WFE market and will likely continue to grow due to future wafer fab expansions in China. However, as the domestic completion is likely to pick up in the next 2-3 years, ACLS may not hit its 2027 revenue target. I believe ACLS is fairly valued at this price. Therefore, I am giving ACLS a “hold” rating.

Read the full article here