Written by Nick Ackerman, co-produced by Stanford Chemist

We recently touched on abrdn Healthcare Investors (HQH) and how the biotechnology industry within the healthcare space can be more volatile but potentially more rewarding going forward.

Today, I wanted to turn toward a more conservative investment option in the healthcare space. BlackRock Health Sciences Trust (NYSE:BME) not only invests in more traditional healthcare companies that tend to be resilient during economic downturns, but the fund also writes covered calls. Covered calls are utilized to produce option premiums that can provide an attractive monthly distribution for investors in this fund.

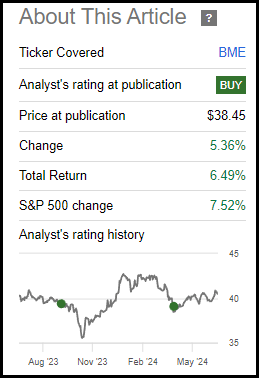

The last time we covered BME was when the fund saw its share price sink during a pullback. However, a portion of that decline was simply the fund’s discount widening out materially to a double-digit level. The discount has narrowed some since our last article, but it still remains an attractive investment option today. With the fund’s discount narrowing, that helped to provide some gains in terms of total returns.

BME Performance Since Prior Update (Seeking Alpha)

BME Basics

- 1-Year Z-score: -0.50

- Discount: -7.11%

- Distribution Yield: 6.31%

- Expense Ratio: 1.07%

- Leverage: N/A

- Managed Assets: $608.1 million

- Structure: Perpetual

BME’s investment objective is “total return through a combination of income, current gains, and long-term capital appreciation.” They will attempt to achieve this by a pretty simple investment policy – “under normal market conditions, at least 80% of its assets in equity securities of companies engaged in the health sciences and related industries and equity derivatives with exposure to the health sciences industry.”

The fund operates with a covered call strategy rather than looking at leverage in the form of borrowings. That can make it a relatively more conservative option in the closed-end fund space, with the majority of funds employing leverage. The last overwritten percentage of BME came in at 35.62%. Covered calls can be helpful in producing gains that can help support the fund’s distribution, but covered calls can also limit potential upside. With having only a portion of the portfolio overwritten and the active management, the upside cap from covered calls can potentially be better managed.

Discount Continues To Be Attractive

The last time we covered BME, the discount had widened to nearly 11%. The discount remains attractive at just over 7% today, but with the 1-year z-score going from -3.17 to -0.50, it might not necessarily be as strong of a screaming buy as it was previously. That is, at least in terms of the shorter-term 1-year perspective.

Over the last decade, the fund has often traded much higher and the share price tended to actually trade at a premium to its net asset value.

Ycharts

One of the catalysts for pushing the fund to a wider discount was that UnitedHealth Group (UNH) was being hit with bad news after bad news.

UNH has been facing several pressures that have been pushing its share price lower. In February, a cyberattack hit the company’s subsidiary, Change Healthcare. That company was only acquired by UNH in late 2022. Moody’s noted that it was a “credit negative” for the company, but never seemingly downgraded its credit, at least not at this point.

Shortly after that, the DOJ announced that it was launching an antitrust review of the company. More recently, it was noted that insiders were selling ahead of the DOJ probe being made public, which may have already been previously planned for sales. Either way, it is a terrible look for the three senior executives.

Finally, in early April, it was announced that Medicare Advantage payments were only getting a small payment increase of 3.7%. That hit shares of UNH, plus all the other major health insurance companies.

UNH is a significant position in BME, so naturally, that was negatively impacting BME. Investors could have been getting nervous and selling off BME even harder, pushing it to a discount.

It is also an election year, and that means political rhetoric against healthcare costs is on the rise. Out of the 11 sectors, healthcare isn’t the worst performing, but they are in the bottom half in the 8th position as of writing.

For what it’s worth, we still have a positive performance as well, as the sector has climbed just over 5% this year. Nothing will really likely change despite the threats of politicians, but as long as there is an overhanging threat, the risk definitely isn’t zero. So, that could have also been causing some negative pressure on BME.

Finally, I think having a lower relative distribution compared to other CEFs in a higher-rate environment could be taking its toll and seeing investors push it to a discount. We’ll discuss more about this topic specifically in the next section.

This discount can be realized too, at least partially. Thanks to the discount management program that BlackRock put into place on a number of their funds—including BME—investors have the opportunity to cash out some of their shares at 98% of NAV. It is a relatively small tender offer at only 2.5% of outstanding shares, but with four measurement periods that could be up to 10%. The first measurement period just concluded, and BME made the tender offer opportunity list as the discount averaged wider than 7.5% during this first period.

Steady Distribution

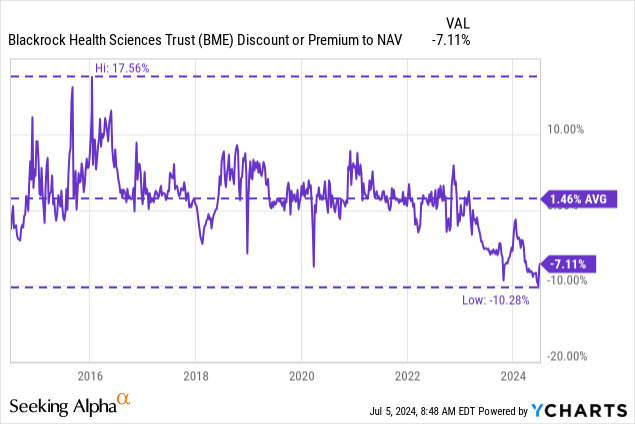

BME is one of the few closed-end funds that can boast of never having cut their regular distribution to investors while also having an inception prior to the Global Financial Crisis. That’s a very small list of only 5 other names to be able to say that.

BME Distribution History (CEFConnect)

Of course, one of the reasons is that the fund pays out a rather modest distribution to investors that can easily be managed even during downturns. At a NAV distribution rate of 5.86%, they have a lot of room for downside moves before the distribution would move into red flag territory.

This can make it a more conservative fund that can continue to put the fund in a position to be able to sustain the current distribution and not see the fund erode. In fact, I believe that we could continue to see further potential appreciation even while still getting quite a respectable 6.31% distribution rate.

Sustainable distributions are seemingly becoming more of a rarity in the CEF space as fund sponsors push distributions to higher levels due usually to prodding from activists. I think that it is great to have activists push funds to narrow discounts; I’ve certainly taken advantage of those moves myself. However, in some cases, like BME, I also like having the option of being able to invest in a sustainable distribution rate as well.

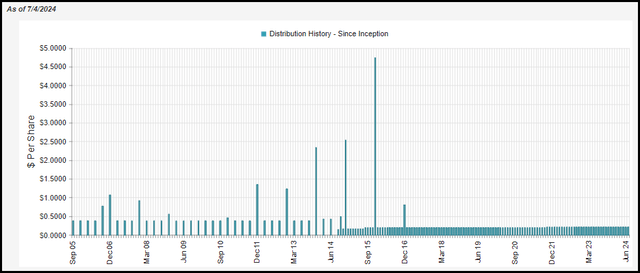

Like any equity-heavy fund, though, the fund will require capital gains to cover its distribution to investors. Net investment income coverage in their last annual report came to just 5.63%.

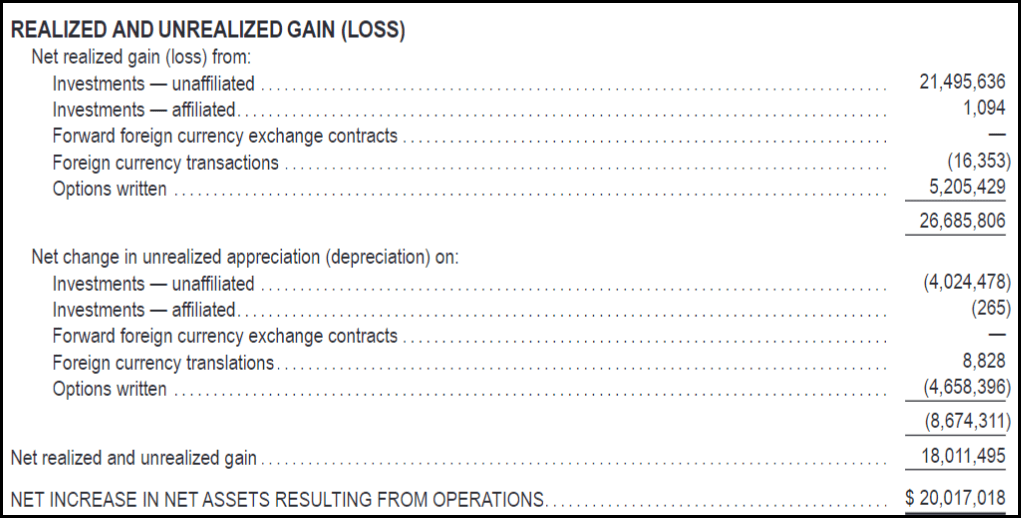

BME Annual Report (BlackRock)

The next semi-annual report is often available in early September, which will give us a look at the latest numbers. That said, I don’t suspect the NII coverage to change too materially.

That means the vast majority of the payout will need to be supported by gains. That can be helped out by the options writing strategy to generate steadier, more reliable capital gains.

BME Realized/Unrealized Gains/Losses (BlackRock)

BME’s Portfolio

BME’s portfolio hasn’t changed too materially in terms of its sector allocation. That is despite the fund’s five year annual portfolio turnover rate coming in quite active at just over 40%.

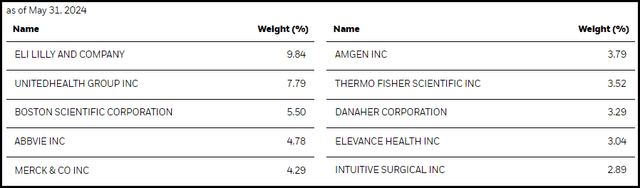

Worth noting is that nearly 50% of the fund’s portfolio is invested in these top ten names alone. That isn’t too much, unlike the Health Care Select Sector SPDR ETF (XLV) that tracks the healthcare sector, though. In fact, the latest weighting of the top ten for XLV comes to an even higher 56.56%. Here is a look at the top ten BME positions as of their latest update available for the end of May 2024.

BME Top Ten Holdings (BlackRock)

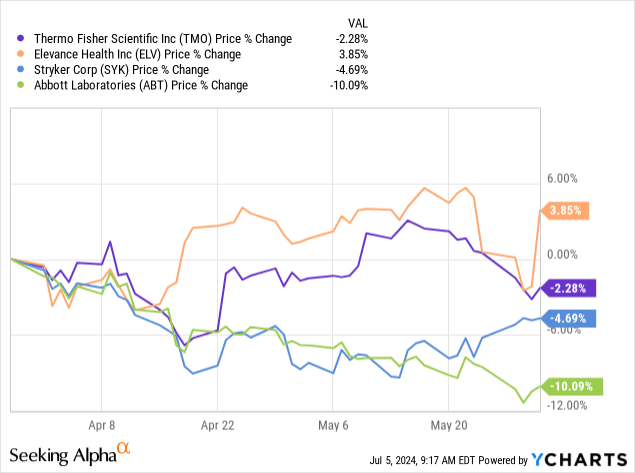

From our most recent update, we see that Thermo Fisher Scientific (TMO) and Elevance (ELV) are now included in the top ten when they weren’t at the end of March.

TMO and ELV replaced Stryker Corporation (SYK) and Abbott Laboratories (ABT). However, it is more likely that these are still positions being held in the fund and that the change was due to SYK and ABT underperforming during this period of time.

Ycharts

Conclusion

BME continues to trade at an attractive discount despite coming off of the particularly deep discount levels touched a few months ago. The fund may never hit a premium again that it historically used to trade at, but this still indicates it could be a fairly solid time to consider the fund at the current valuation. The fund carrying traditional healthcare names and utilizing a covered call strategy can also make it a relatively conservative fund. This conservative nature has helped it weather past storms. It has put them in a position to be able to boast about never having to cut its regular distribution to investors. On top of that, it was while also providing some appreciation over the long term, too.

Read the full article here