Note:

I have covered Aterian, Inc. or “Aterian” (NASDAQ:NASDAQ:ATER) previously, so investors should view this as an update to my earlier articles on the company.

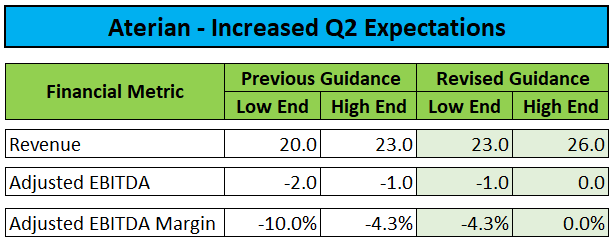

After the close of Wednesday’s regular session, e-commerce brand consolidator Aterian raised Q2 expectations for botth the top- and bottom line:

(…) The Company expects its second quarter net revenue to be in the range of $23.0 million to $26.0 million and Adjusted EBITDA loss to be in the range of ($1.0) million to $0.0 million.

These ranges are an improvement to the previously announced second quarter net revenue range of $20.0 million to $23.0 million and Adjusted EBITDA loss range of ($2.0) million and ($1.0) million, respectively.

The Company’s cash balance as of June 30, 2024 is expected to be between $17 million and $18 million and borrowing under its credit facility is expected to be approximately $10 million.

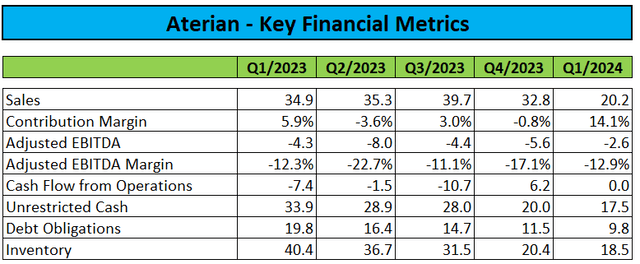

Following years of revenue declines and material cash burn, the company is finally showing signs of life.

Company Press Release

At the high-end of the new range, the company would break-even on an Adjusted EBITDA basis for the first time since Q3/2021.

Even better, Aterian appears to have largely stopped cash outflows as the company’s net cash position will be largely unchanged from Q1:

Company Press Releases / Regulatory Filings

In addition, the company announced a number of management changes with Co-CEO and CFO Arturo Rodriguez being appointed to the CEO position following the resignation of former Co-CEO Joe Risico.

Josh Feldman, Aterian’s current SVP of Finance will succeed Mr. Rodriguez as CFO.

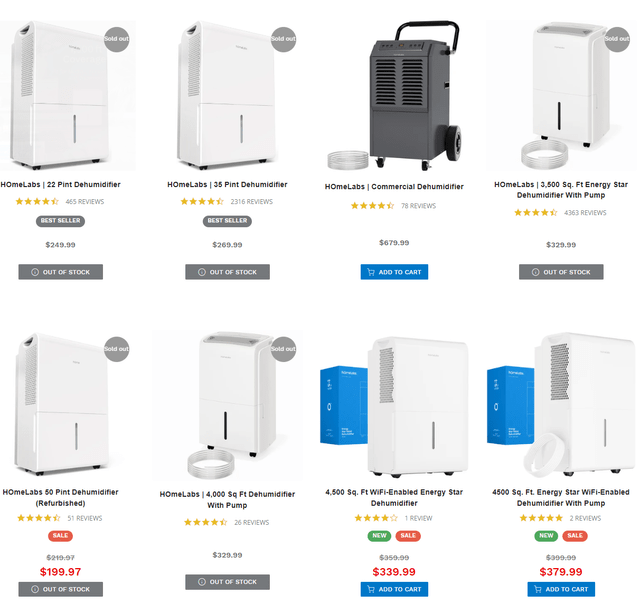

On the conference call, management attributed Q2 outperformance to seasonally strong dehumidifier sales with strength expected to carry over into the third quarter.

The revenue beat might have been even larger without several of the company’s best selling dehumidifiers being out of stock as shown on the company’s HomeLabs website:

HomeLabs Website

On the call, management also reiterated its target of achieving profitability on an Adjusted EBITDA basis in the second half of the year despite renewed headwinds from increased container freight rates.

While management acknowledged the issue in the questions-and-answers sesssion of the conference call, near-term impact is expected to be limited.

In Q1, Aterian amended its asset backed credit facility with MidCap Financial Trust at favorable terms, as also outlined in the company’s quarterly report on form 10-Q:

The Credit Facility term has been extended to December 2026 and gives Aterian access to $17 million in current commitments which can be increased, subject to certain conditions, to $30.0 million. The Credit Facility extension reduces the minimum liquidity financial covenant from a peak of $15.0 million to $6.8 million of U.S. cash on hand and/or availability in the Credit Facility. The extension fee was less than $0.1 million.

As a result, management expects liquidity to be sufficient for the foreseeable future.

In recent quarters, the company has made substantial progress in lowering cash outflows and improving the bottom line by reducing the number of SKUs and focusing solely on profitable products that are considered core to Aterian’s strategy.

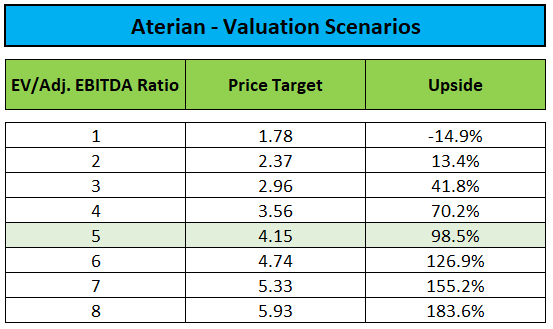

With Adjusted EBITDA profitability close at hand and a measly enterprise value of just $7 million, I would expect shares to be picked up by speculative investors ahead of the Q2 earnings release in early August.

Should Aterian manage to generate just $5 million in Adjusted EBITDA next year, the company would be valued at a forward EV/EBITDA ratio of just 1.4, a tiny fraction of market leaders and also substantially below prevailing multiples in the broader retail space.

However, given the small size of the company and considering its limited financial resources, a sizeable discount should be warranted but even assigning a still moderate EV/Adjusted EBITDA ratio of 5 would result in almost 100% upside from Wednesday’s closing price:

Author’s Calculations

However, given the company’s tiny market capitalization, limited trading volume and persistent headwinds from muted consumer demand and increased container freight rates, only speculative investors should consider taking a position in Aterian’s common shares going into the company’s Q2 earnings release in early August.

Bottom Line

Aterian’s business is finally showing signs of life. In addition, management has made good progress in increasing profitability and reducing cash outflows in recent quarters.

With Adjusted EBITDA profitability targeted for the second half of the year, a trade going into the company’s second quarter earnings release and Q3 outlook in early August looks enticing.

However, following years of declining sales and substantial cash outflows as well as persistent headwinds from muted consumer demand and increased freight costs, only speculative investors should consider taking a modestly-sized position in Aterian.

With the company apparently stabilized and Adjusted EBITDA profitability close at hand, I am upgrading my rating on Aterian’s common shares from “Sell” to “Speculative Buy” with a price target of $4.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here