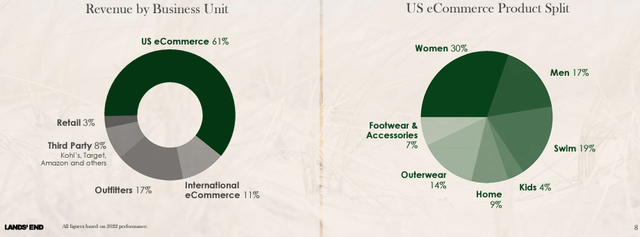

Lands’ End, Inc. (NASDAQ:LE) is a predominantly ecommerce-based retailer, selling swimwear, outerwear, footwear, and other apparel products and operates multiple brands under which the company sells its products. The company also offers B2B sales across multiple categories, offering businesses custom-branded apparel.

Lands’ End January 2024 Presentation

The company’s history on the stock market after being spun off in 2014 hasn’t been great – the stock has lost over half of its value, and with a currently overleveraged financial position, Lands’ End hasn’t been able to pay a dividend. The stock has recently risen with a 54% return in the past year, as the valuation is starting to reflect a greater likelihood for a performance turnaround.

Stock Chart (Seeking Alpha)

Lands’ End Has Poor Long-Term Demand Trends

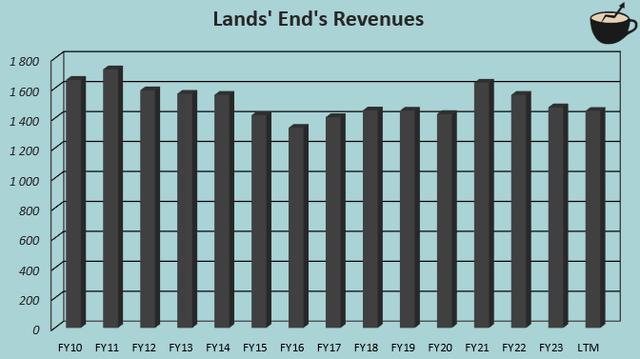

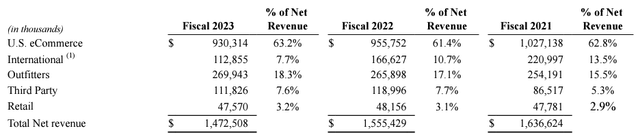

Over the long term, Lands’ End hasn’t been able to keep up good growth, and has rather seen a decline in revenues – from FY2010 to current trailing revenues after Q1, the top line has declined at a CAGR of -1.0% nominally. From FY2020, revenues have stayed very stable to the current date, albeit ultimately aided by higher inflation in the past couple of years – from FY2010 to FY2023, inflation in US apparel has reached a total of around 9.8%, whereas Lands’ End’s sales have ended up lower in nominal terms.

Author’s Calculation Using TIKR Data

With the company’s weakening profitability, and high debt adding to a current $286.1 million in long-term debt and current portions of long-term debt after Q1, leveraging higher sales is critical for Lands’ End’s future – in the past twelve months, interest expenses have added up to $46.3 million compared to an operating income of just $29.4 million.

Margin Improvements Are Clearly Needed

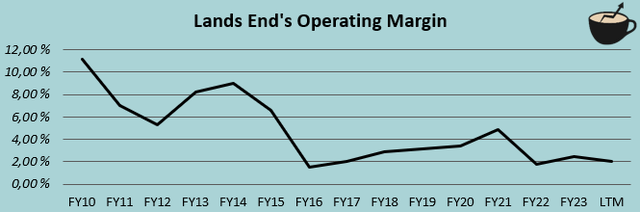

As sales have continued to trail inflation, Lands’ End hasn’t been able to sustain sufficient margins – the trailing operating margin of 2.0% is clearly too weak, and below the company’s long-term trend which has been falling along with the stagnant revenues.

Author’s Calculation Using TIKR Data

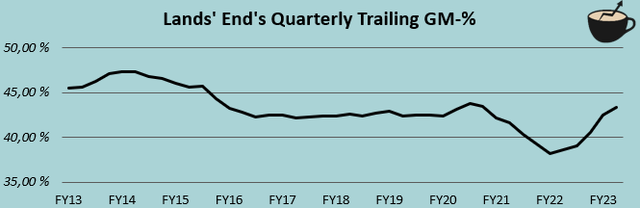

The margin does have some temporary measures weakening it – especially in FY2022 after Lands’ End has prepared for higher pandemic-time demand that was experienced in FY2021, large discounting was needed to push down excess inventories, temporarily slumping the gross margin. The trailing gross margin has now risen back into near the pre-pandemic average, but has continued to so far show upbeat momentum.

Author’s Calculation Using TIKR Data

The ultimate driver for long-term margins is still sales growth, as very stable long-term gross margin hasn’t been able to sustain earnings as declining gross profit pushes earnings down with reverse operating leverage.

New Strategy Targets Growth in Third Party Sales

The company’s strategy revolves around increasing marketplace sales and licensing sales, represented by the Third Party segment – partnerships with companies like Macy’s (M), Target (TGT), Amazon (AMZN), Kohl’s (KSS), and Costco (COST) have been able to drive greater revenues from third-party retailers.

In FY2023, third party revenues were stagnant after significant growth into $119.0 million in FY2022 from just $5.9 million in third-party sales in FY2018. The growth hasn’t stopped completely in the segment, though, as the Third Party segment showed good growth again in Q1.

Lands’ End 2023 10-K Filing

The Third Party growth so far counters weak international sales and declining retail sales over the long term – it seems that prior to the weak segments showing very minimal revenues, Lands’ End’s total revenues look to grow poorly. The third-party sales could also eat away from Lands’ End’s own ecommerce sales, as a part of the customers only shift their dollars into another retail channel instead of creating completely new demand.

Q1 Results Showed Promising Third Party Performance

Lands’ End reported the company’s Q1 results on the 5th of June, reporting revenues of $285.5 million, down -7.8% year-over-year, along with a normalized EPS of -$0.20. Both key financial metrics beat Wall Street analysts’ estimates – revenues by $15.7 million and the normalized EPS by $0.07.

Ecommerce sales declined by -3.7% in the quarter, but the Outfitters segment’s revenues declined by -$31.3 million into $37.5 million as the company’s Delta Air Lines B2B contract had previously expired, affecting year-over-year figures. The decline was offset partly by a great 62.9% growth in Third Party revenues, showing a good performance in Lands’ End’s growth strategy revolving around the segment.

Along with the report, Lands’ End slightly raised the FY2024 outlook from a prior expectation of $1.33-1.45 billion in sales and adjusted net income of $3-12 million into sales of $1.36-1.45 billion and an adjusted net income of $5.5-13 million, representing a middle point revenue decline of -4.6% but some margin leverage, likely aided by higher gross margins.

I believe that the results showed a relatively good underlying performance even though surface-level financials continued to trail – excluding the large effect from the Delta Air Lines contract expiry, ecommerce sales showed quite a stable performance in a turbulent macroeconomic sentiment and third-party revenues showed great growth. Yet, as ecommerce sales continue to trail, being Lands’ End’s majority revenue source, I believe that caution is needed, and a better turnaround isn’t yet achieved in the total sales trajectory. Notably, still, Lands’ End has been able to push the gross margin higher, and the potential for greater sales exists.

Valuation Is Unattractive In My Base Scenario

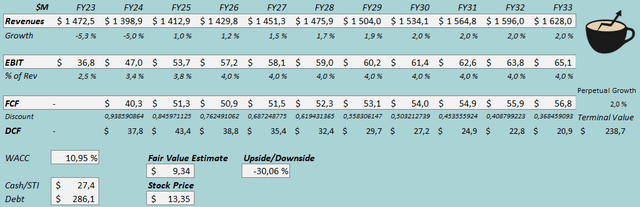

To estimate a fair value for the stock, I constructed a discounted cash flow [DCF] model. In the model, I estimate poor single-digit growth below expected inflation in FY2024-FY2029, after which I estimate the growth to stabilize at 2% as the weaker segments don’t have a notable effect on total sales growth anymore.

As gross margins have been leveraged, I estimate margin expansion from a 2.5% EBIT margin in FY2023 into 4.0% in FY2027 and forward. Lands’ End also guides for an improved net income in FY2024, relating to continued short-term margin leverage. Still, as I don’t believe in a very high growth turnaround at the moment, the margin is left at quite a weak level.

Capital expenditures continue at a low level with $30 million guided for FY2024, and there is very little need for working capital increases with Lands’ End’s growth, making the cash flow conversion good.

DCF Model (Author’s Calculation)

The estimates put Lands’ End’s fair value estimate at $9.34, 30% below the stock price at the time of writing – while some segments show turnaround potential, I don’t believe that the stock still represents an attractive entry as ecommerce sales trail and margins continue at a weak level, leveraged by high debt. Greater growth in Third Party sales could make the stock more attractive, but for the time being, I suggest caution.

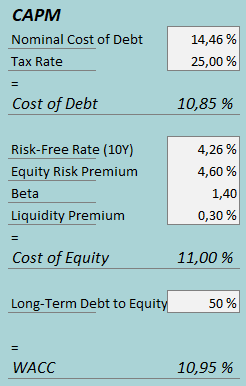

A weighted average cost of capital of 10.95% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Lands’ End had $10.3 million in interest expenses, making the company’s interest rate a very high 14.46% with the current amount of interest-bearing debt. The company’s debt-to-equity should be high in the long-term due to low earnings and equity valuation as margins trail, leading into my estimate of a 50% ratio. The company refinanced its debt in January, making the interest rate dependent on the SOFR overnight rate.

To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.26% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Seeking Alpha estimates Lands’ End’s beta at 1.40. Finally, I add a liquidity premium of 0.3%, creating a cost of equity of 11.00% and a WACC of 10.95%.

Upside Risks

While I believe that the base scenario is weak for Lands’ End’s investors, my bearish thesis could have upside risks. For example, a more sustainable sales turnaround from third-party sales exceeding my expectations could make the stock’s valuation attractive through operating leverage.

Also, better stabilization in Lands’ End’s own ecommerce sales or new significant long-term deals in the Outfitters segment could prove to show a similar change in Lands’ End’s financial trajectory.

I don’t believe such cases to be the base scenario, but investors should note the possibility of such a turnaround. The current valuation doesn’t expect very high margins, so operating leverage from moderate sales growth could make the stock attractive again.

Takeaway

Lands’ End’s sales are performing poorly in the long term, and continued weakness in ecommerce sales and retail sales have had a deteriorating effect on Lands’ End’s margins, pushing the operating margin quite near breakeven, further leveraged by high debt. While great Third Party segment sales could aid growth, the total growth outlook isn’t great for upcoming years. With the valuation being pushed up in the past year, I believe that the company’s base scenario prospects are overvalued, and I initiate Lands’ End at Sell.

Read the full article here