Above: iGaming, i.e. online casino games, are rapidly seen as a growth engine.

In the halcyon years that followed the SCOTUS decision in May 2018 that opened the floodgates to legal sports betting in the US, the surge in stock values in the sector was beginning to look like an Nvidia madness. Leading operator Draft Kings moved its shares from ~$9 to $71 in March 2021 before reality set in. Similar runs engulfed shares in the online gaming sector. Yes, Mr. Market said, trees do grow to the skies. Since then, prices for sports betting stocks have eased considerably. Investors began to realize, marketing costs would soar, margins were slim, barriers to entry were few. Overall, we saw growing conviction that the sector had lost its quick profit promise.

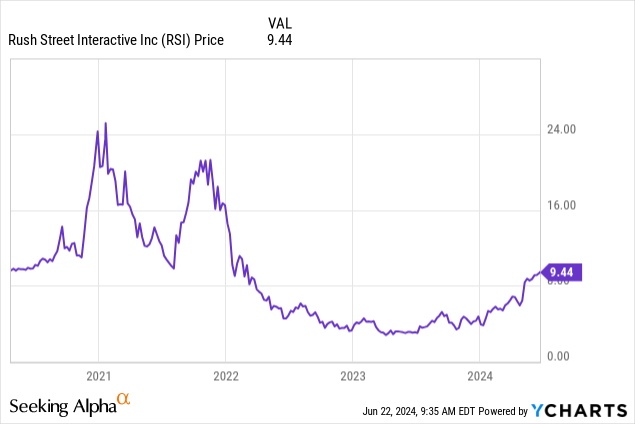

In the leap frog year of 2021, Rush Street Interactive, Inc. (NYSE:RSI) traded as high as $25, swept up in the online betting stock run. Its price recovery since then must be viewed as a run past the original surge of the post-Supreme court decision, also feeding off the flame by day traders.

Rush Street Gaming Inc., prior to legalization, operated five casinos in Illinois, Pennsylvania and Upstate New York. It was owned by billionaire lawyer /gaming/realty entrepreneur Neil Bluhm since 2009. (Est. net worth $7b). He is also a minority holder of ownerships in two major professional sports teams, as a partner of fellow billionaire Jerry Rhinesdorf in the Chicago Bulls and White Sox. RSI, its online betting business, is punching above its weight.

He also owns landmark Chicago trophy properties like 900 N. Michigan Avenue and the Four Seasons and Ritz Carlton. We detail his holdings in contrast to the relatively small net worth of RSI. It is dispositive we believe in the growing conviction among savvy investors in his stock that RSI is going to be a transaction this year.

Our buy thesis

Above: RSI peaked during the first run up of the sector, took its blows and now is once again on a run to move out of the small cap dungeon.

At present, the online sports and iGaming sector is packed with entries like sardines in a can. One reason is that the sector has drawn new operators from many sources: mainstream brick and mortar casinos, UK-based legacy operators, small fringe operators with big ambitions, and late comers with deep pockets like Disney’s ESPN and team merchandise leader Fanatics.

In total, we stopped counting at 16 operators. Yet, the cold facts are that since legalization six years ago, the US sports betting market has been mega-dominated by the two early movers, Draft Kings and Fan Duel (Now a unit of UK’s FLUT)

Both these companies come into the real money sports betting space, sprung full force from their data rich fantasy sports businesses. So much so that today, their combined share of market is easily over 73% leaving 27% for the 16 wannabe operators to fight over. The hope is that if legalization expands to more states the CAGR at 12% will expand, making enough from organic growth. My own estimate for 2030 has a market of $30b in GGR. But there won’t be more than 5 dominant operators, with the rest long having been sold to the handful of big guns.

RSI strategy pivots from the pack

- Price at writing: $9.67

- Price at beginning of this year (Jan 24) $3.42

- 52 week range: $2.90-$9.82

What Mr. Market sees now:

RSI is the only credible operator in the space making aggressive plans to expand its footprint in Latin America. RSI launched its operations there in 2018, a first mover in a South American market that now has 224,000 active users and getting ready for Brazil (pop: 215m). Average active monthly user in the US and Canada bet value: $355. That is a good, tight place to be in the field.

The company has turned profitable in Q1’24 revenue at S127m with Adj. EBITDA of $17.7m. That will begin to fatten by Q3’24 in our view. Promotional spend was down 23%, cash on hand up to $191m.

RSI brands also have focused on iGaming-casino games offered online – that are showing growth.

RSI is guiding revenue to $845m for this year with EBITDA at $54m from its 15 states as well as new venues in Delaware and South America. It is run by veteran casino operators who have seen success in brick and mortar casinos in very tough markets. Its major holder is a deep pocketed entrepreneur whose wealth has derived from comparable fields: real estate and sports entertainment.

While its share of the market is minimal (2%), its financial strength and YTD performance solid, it doesn’t have to chase revenue with a relentless cascade of cash to assure growth. All small-cap operators have been fighting the battle of growth bought at too high a price since the get go. Not so much at RSI as it begins to thin out promo spend.

But it appears to us that they have the staying power over many rivals to arrive at a respectable share. The keys lie in sustaining moderate growth in the US and Canada in sports betting, and over perform in iGaming and South America.

google

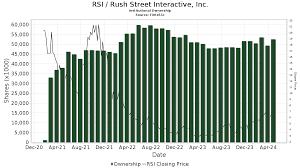

Above: Institutional holders beginning to rise again since first run.

The DKNG interest has spiked the stock and eased back, but the fundamentals will prevail.

As long ago as last March, DKNG held meetings with RSI to explore the possibilities of a transaction. The talk quieted down, with no further developments until April. At that point, the talks resumed, again without specific action. But the continuing dialogue of RSI with potential acquirers has clearly had an influence on the positive trading range of the shares.

Since then, I have watched the list of their institutional holders for a clue as to who was still holding. The list is impressive: HG Vora, Canyon, Vanguard, Divsadero, Black Rock, Nomura, Goldman Sachs, Morgan Stanley, Conversant among many others. All these still have positions well past the spikes connected to the DKNG news-or non-news.

Conclusion

Here’s the formula I believe is at work, doubling the shares in a year despite no deal consummated. Take a veteran deep pocketed major holder, add a solid performance with earnings beating projections, a fairly clean balance sheet and add recognition of a buy at $3.42, and you have a stock that could double. It did, but can it keep up?

Going forward, we like RSI’s balance between brick and mortar casinos and its growing online business. We see no major obstacles to its growth in a volatile sector with a double-digit CAGR. And we like its singular early mover strategy aimed to punching above its weight in South America.

RSI management has been through many rodeos in gaming, from legalization fights in Illinois, to the riverboat conversions and competing in markets like Chicago. All give a boost to the rationale for a move ahead to a PT we now believe reaches $12.50 without a maturation of a DKNG deal. However, I believe the big institutional holders now sitting in their ownership ranks, see a lot more. It is a clean deal with no regulatory, financial or management issues blocking a simple, flow through transaction.

I think a deal can be done comfortably for both at a cash and stock bundle of $18.50 a share to $20. Deal making is an established strategy of Neil Bluhm over many decades. He is a man in his 80s, but otherwise not going anywhere until RSI is scaled, will get closer to the negotiating table again. He is a man with the purview of a feudal lord over things sports, entertainment and gaming in the metro Chicago market.

Transaction rumors in the online gaming space across the spectrum have been a regular feature of news in the sector since almost the beginning. DKNG, among the large cap operators, has made offers to Entain, MGM’s 50% partner. MGM has made two spurned offers to that company alone. Fanatics, the team gear maker, has bought Points Bet of Australia as its partner.

A deal with RSI will close sooner or later which is why I believe it’s positive price action stays put. I’m calling it a strong buy here under $10.

Read the full article here