My thesis

I love ordering food from restaurants through the Wolt app because it saves me tons of hours every week. I was surprised to discover today that this marketplace is an asset of DoorDash (NASDAQ:DASH). DASH dominates the online food delivery market in the U.S. and is present across 25 other countries. Dominance in the highly competitive U.S. market is a solid reason to be optimistic about the company’s potential to succeed internationally as well. The financial performance is strong and aligns with the business strength and the company already generates almost an 18% free cash flow margin. The industry is thriving and is projected to deliver a robust 12% CAGR over the upcoming decade. The valuation looks attractive at the current $113 share price with a 15% potential upside. On the other hand, the stock’s beta is relatively high and that is the reason why I am giving it a Buy rating and not a Strong Buy.

DASH stock analysis

DoorDash’s primary offerings are the DoorDash Marketplace and the Wolt Marketplace. Both marketplaces together operate across 25 countries, according to the company’s 10-K. DASH generates revenue from commissions charged from both merchants and consumers, as well as premium subscriptions like Wolt+ and DashPass.

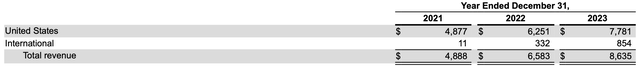

The company’s geographic presence is wide based on the number of countries, but the company still generates about 90% of revenue within the United States. The United States market is highly competitive and innovative; therefore; I think that Dash’s rapid expansion in the domestic market means that it has solid potential to expand internationally as well. International revenue was below $1 billion in 2023, meaning that there is substantial potential to drive revenue growth with more intense international expansion.

10-K

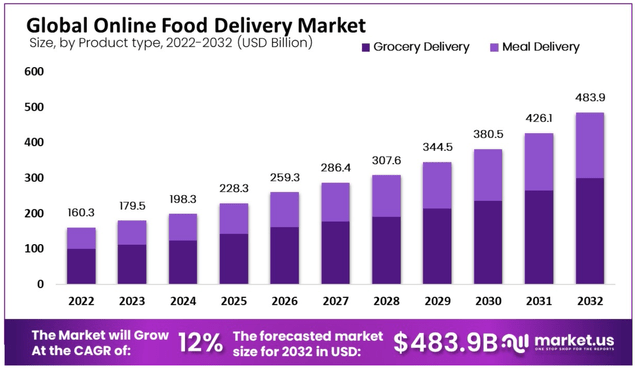

Despite DASH does not exactly specify what kind of merchants are connected to its platforms, it is widely known that the company’s marketplaces mostly connect restaurants and groceries with people who are seeking for something to eat and be delivered to their houses/workplaces. The COVID-19 pandemic with a lockdown was a big favorable factor for DoorDash, which boosted the demand for food delivery from restaurants. But that was not the one-off phenomenon and the consumers got used to the food delivered to them without spending time to go shopping or dining outside. The market grew between 2023 and 2022, and is expected to demonstrate a 12% CAGR by 2032.

market.us

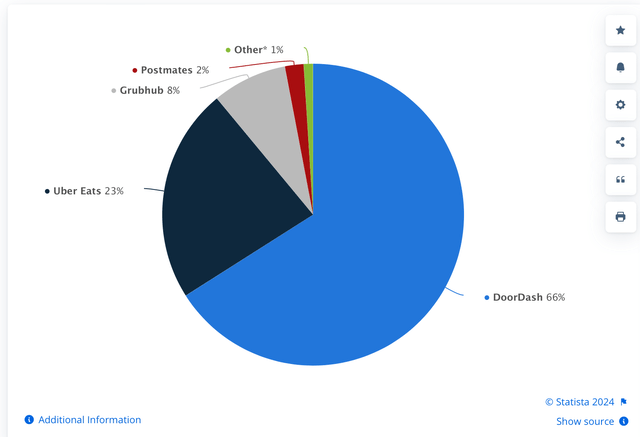

As we see, DoorDash operates in a thriving industry with solid prospects for the upcoming decade. It is crucial, because as a growth investor I do not want to invest in stagnating industries. But what is even more important is that DoorDash dominates the U.S. online food delivery market with a 66% share.

statista.com

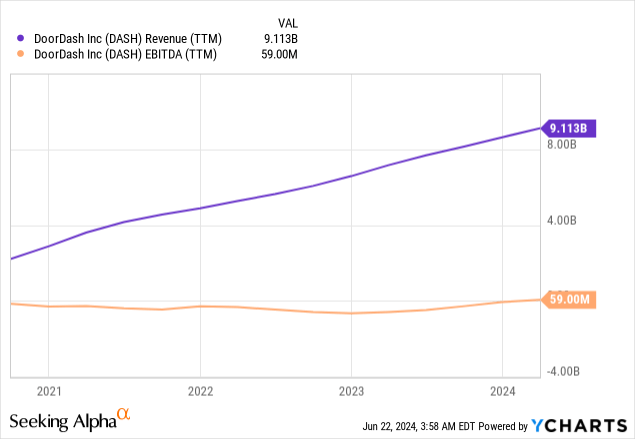

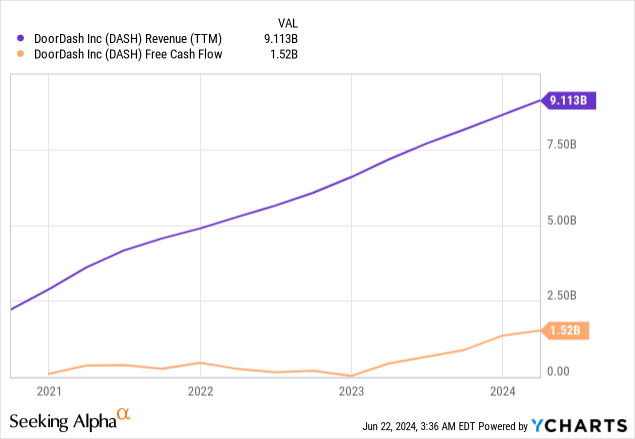

The company successfully converts its strategic strength into financial success. I want to start my financial analysis with looking at the correlation between the revenue and EBITDA dynamics. Revenue has doubled over the couple last years, aligning with the company’s dominating presence in the growing industry. Despite rapid revenue growth, the EBITDA did not improve and is still not very far from zero (on a TTM basis).

Please do not forget that DoorDash is a young company, and it requires heavy investments in marketing to make the brand more recognizable. DASH also heavily invests in R&D to improve its marketplaces and introduce new features and offerings, which is crucial to sustain its technological edge. DASH spending on sales and marketing was almost $1.9 billion in 2023, and the company also spent around a billion dollars on R&D. I think these are investments for the future, and as the company’s brand gains its strength, less marketing will be required. Therefore, I think that DASH has a very good potential to break even soon and continue expanding its profitability over the long term. Moreover, DASH has a lot of “dry powder” to allocate into growth and innovation initiatives. The company’s cash balance as of the latest reporting date was $4.5 billion with quite low leverage.

To wrap up, DASH appears to be well positioned not only to dominate in delivering food, but also has strong potential to deliver value to shareholders. The company dominates in a thriving industry, it has strong international expansion potential, and a strong potential to invest in growth thanks to its $4.5 billion cash reserve.

Intrinsic value calculation

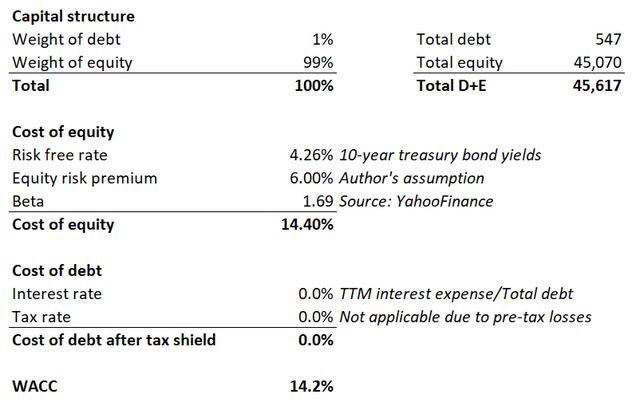

I am starting the intrinsic value calculation by figuring out WACC. Below you can see my working with the WACC calculation with all the input data commented. According to my CAPM model, the company’s WACC is 14.2%.

DT Invest

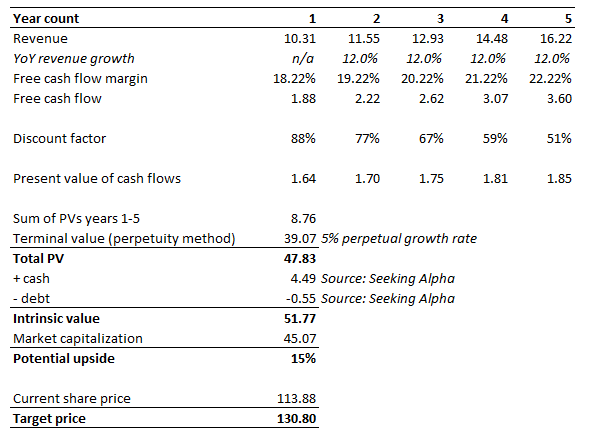

Now I can move on to the discounted cash flow (DCF) model. I start with an FY 2024 revenue assumption for year 1, which is analysts’ consensus. In my model revenue is expected to grow with a 12% CAGR, which I mentioned in the DASH stock analysis part of the article. I use a 5% perpetual growth rate, which is conservative if the current U.S. inflation level is deducted. The free cash flow margin is 18.22% for year 1 and it aligns with the actual TTM metrics. There is a solid historical correlation between DASH’s revenue growth and free cash flow. Therefore, I expect the free cash flow to improve every year as the revenue will probably grow.

Now I am putting all the assumptions together, adding the latest outstanding cash position and deducting all the debt. In my second working below you can see that the intrinsic value of the business is $51.8 billion. This is 15% higher than the current market cap, which means there is a decent potential upside. Therefore, my target price estimate for DASH is $131.

DT Invest

What can go wrong with my thesis?

So far, the company’s operating and financial performance have been solid. But we should remember that DASH’s success depends not only on its internal processes, culture, and practice. The company’s image also depends on the ability of merchants to maintain their service quality. For example, if any of the restaurant’s quality of food deteriorates this will not be due to the DASH’s poor performance. But the company’s image will likely deteriorate anyway.

A 15% upside potential might not be enough for some investors considering the stock’s high beta. Considering DoorDash’s strong business positioning and financials correlating with the business strength, I think that the stock highly likely deserves a premium. On the other hand, it is market sentiment that determines the extent of a premium. It is apparent that we are currently seeing massive optimism in the stock market as the S&P500 had set several records in 2024. Several events that are difficult to predict might cool down investors’ optimism: the Fed might start cutting rates later than expected, there might be some geopolitical escalations, spikes in commodities prices, new wave of inflation growth, and so on. Therefore, there is the risk that the stock might see deeper discounts in case a stock market correction occurs.

Summary

DoorDash is a high-quality business in a thriving industry and its financial performance moves in line with the business success. The company dominates its niche with a 66% market share in the U.S. which increases chances for a successful international expansion. The stock is attractively valued in my opinion and buying with a 15% discount looks good. On the other hand, the stock’s beta is notably higher than one and I am giving DASH a Buy rating at this share price level.

Read the full article here