Editor’s note: Seeking Alpha is proud to welcome Axel Krause as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Investment Thesis

Amid concerns that the American consumer is reducing their spending, Monster Beverage (NASDAQ:MNST) is well positioned within the non-cyclic market of beverages. The price per can is highly affordable for the generic consumer and purchasing some cans is unlikely to jeopardize the individual’s monthly budget compared to discretionary items like electronic devices, cars or apparel. Further growth of sales, especially internationally, and a gradually improved margin despite Celsius Holdings’ (CELH) rise in market share will drive net income of Monster Beverage, in my view.

Combined with aggressive short-term share repurchases, it’s likely that EPS will be lifted to new heights, which is not reflected in the share price. MNST is priced attractively on a historical comparison. Considering that the company is about to eliminate 5.4% of shares outstanding, by means of a Modified Dutch Auction Tender Offer, the undervaluation will be even more significant. The stock of this consistent compounder is trading more than 20% below its All-Time High of March 2024. This situation may offer a great buying opportunity. Let’s delve deeper into the business and the stock.

Market and Company Overview

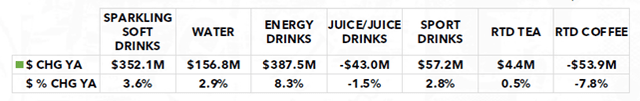

Monster Beverage is a market leader in the segment of energy drinks, besides Red Bull. Whilst its main business is still in the US and represents currently 61.8% of sales, international sales grow faster and might represent most of the revenue within the next years. According to a recent Nielsen study, the segment of energy drinks outperforms other non-alcoholic beverages like water, juice, soft drinks or coffee in terms of growth within that category. These figures are demonstrated below:

Beverage Landscape Total US All Channels (Nielsen Syndicated db Total US xAOC + Conv 13 weeks ending 12/30/2023; Investor Presentation)

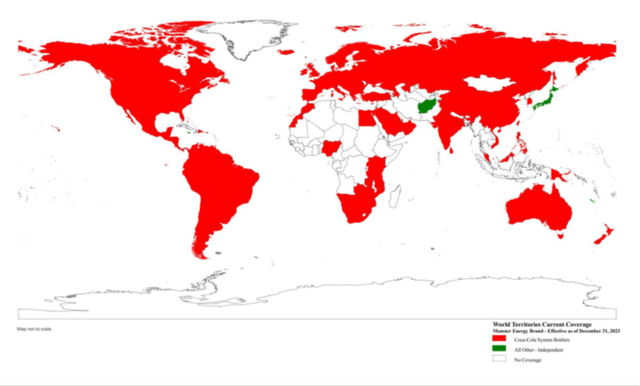

The market of energy drinks is still growing, providing a long runway for future growth. Although “one or more of the company’s energy drinks are distributed in a total of 158 countries and territories worldwide”, according to this year’s Investor Presentation, wide parts of the global population – which is steadily growing day by day – are underrepresented within Monster Beverage’s sales.

I believe that there are still markets to untap whilst existing markets serve plenty of potential for further penetration. That is what you would like to see as an investor. The below map shows the current distribution of Monster Energy drinks globally:

Where Monster Energy Drinks are available (Investor Presentation)

I like the business, especially since it is not discretionary. The price per can is highly affordable for the generic consumer and buying some cans of liquid energy does not make you overthink your monthly or your holiday budget compared to discretionary spending like sneakers, apparel, electronics, or other kinds of discretionary shopping.

Within our fast-turning world of work, leisure and steady attentiveness energy drinks are equally appealing to a variety of consumers: Young people that go out and want to dance till the morning are attracted as well as gym members that need a pre-workout booster or a construction worker whose shift doesn’t end before 10 pm. E-sports and gamers also represent a growing segment of consumers.

That wide consumer base embedded into a non-cyclic market with high margins makes it a compelling story for any investor. In Q1/2024 MNST achieved a net margin of 23.3%. Monster’s direct peers in the energy drink segment are the Austrian Red Bull, which is no public-listed company, and Celsius Holdings – a company that we will take a closer look at in the following chapter. In the last quarter, Celsius achieved net margins of 21.9%. Those figures demonstrate the high quality of the energy drink business.

For Comparison – Keurig Dr Pepper (KDP), another major player in the non-alcoholic beverage industry, reports net margins of 13.1% for the recent quarter. KDPs business model is less asset light than Monster’s or the one of beverage giant Coca-Cola (KO). Both companies outsourced the bottling almost entirely. This is one of the main reasons why Coca-Cola achieves those stellar net margins (28.2% in Q1/2024).

Monster’s margins are a testament to the high profitability of the company, which results in generally higher multiples. However, in recent history, those valuations decreased to historical lows. Let’s investigate why this might be the case in general and specifically for Monster Beverage:

Setback of Share Price and Possible Reasons

Possible reasons that could justify a lower valuation of a company (beside a general downturn in financial markets) or a declining share price could be, for example:

- Downturn of the market the company operates in

- Capital increases / Dilution of equity holders

- Upcoming regulatory requirements that affect the business negatively

- Elevated debt levels and solvency issues that may result in a default

- Loss of market share to competitors

- Higher cost base that results in lower margins and profits

- Change in management

Which of those points are valid for Monster Beverage? We already covered that MNST is based in a growing market segment. Monster has an authorized share repurchase program with approx. $642.4 million remaining available for share buybacks as of 2nd of May 2024 according to its recent earnings release. That allows them to buy back shares opportunistically. Moreover, you will notice that Monster even accelerated share repurchases within the last weeks by the mentioned Tender Offer – we will cover that topic further below. Though, MNST doesn’t intend to initiate any capital increases. There are neither signs of stricter regulations, nor do we notice elevated levels of debt or solvency issues. Therefore, the first 4 points are negligible, and we will focus on competition, margins and the management in the following chapters.

Peers – The Rise of Celsius

Red Bull is the predominant market leader in energy drinks beside Monster Beverage; however, there is a third player on the rise. Three years ago, Celsius, that is based in Florida, was only known to insiders and was far from popular. Its availability was rather regional than national. In the meantime, it turns out to be positioned 3rd within the market of energy drinks. They partnered with PepsiCo (PEP) utilizing their sales channels. That move increased the availability of Celsius’ drinks and accelerated their sales.

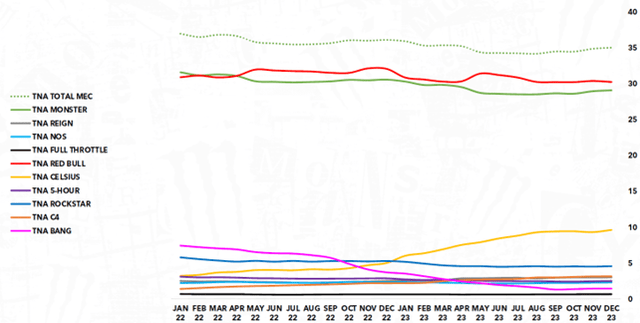

Concerns came up that Celsius Holdings (indicated in orange in the below chart) could gain market share and undermine Monster Beverage’s (in green) as well as Red Bull’s (illustrated in red) leading market positions. That idea appears to have lowered valuations of MNST within the last quarters. Let’s find out if that loss of market share is truly happening:

Total US Unit Share (Nielsen Total US xAOC + Conv TNA Energy; Investor Presentation)

Statements of the management in the recent earnings call of 2nd of May 2024 as well as recent data of Nielsen indicated that those concerns might be overrated. Celsius seems to create its own niche within the beverage market. Its “better for you”-products are rather compelling to consumers that focus on health and functional drinks, positioning Celsius generally “softer”. To my mind, Monster is positioned differently in a rather masculine appeal, representing “energy” and “power”.

Celsius Holdings is still considerably smaller than Monster Beverage. Whilst the revenue on TTM-base of MNST is $7.34 billion, Celsius’ revenue within the last 12 months was $1.41 billion, representing just a fifth of Monster’s size. We should also not neglect the marketing power that is available to Red Bull and to Monster Beverage. They can, and they will utilize their size to defend their market share. That doesn’t necessarily mean that Celsius cannot harm Monster Beverage’s business, however, in my humble opinion, the threat currently seems to be perceived overrated by the market.

Current Business Dynamics

According to the recent quarter results, Monster’s business model is not affected by Celsius’ entry in the market. Especially the international business, growing YoY by 19.5% in Q1/2024 and representing 39.2% of total sales, and the rollout of alcoholic beverages are driving growth with an increase of 21.1% YoY. Domestic business with energy drinks is growing steadily, either.

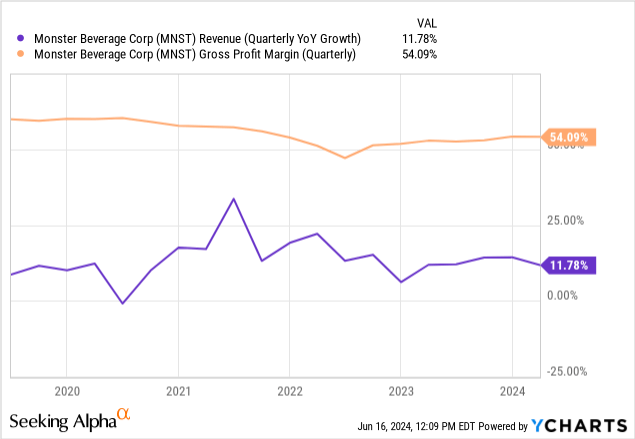

There seems no slowdown in sales or a remarkable impact on margins that may derive from Celsius’ competition in the recent quarters, as you can see in the following chart where you can see the development of revenue growth and gross profit margin:

Co-CEO Hilton Schlosberg was quoted in the Q1/24 earnings release as following:

We are pleased to report gross profit margin improvement in the first quarter, which increased significantly when compared to the 2023 first quarter. This improvement was primarily the result of decreased freight-in costs, pricing actions in certain markets and lower input costs, partially offset by geographical sales mix[…]

The management also announced that MNST plans to increase prices for its main brand, Monster Energy, in the following quarters. These price actions shall be realized in the domestic market that represents about 60% of Monster’s sales. This measure should support the margins in the short and mid terms for a considerable part of the business.

Also, overseas operations may benefit from a better cost-base as Monster’s flavor facility in Ireland will be able from this quarter onwards to supply a larger number of flavors to the EMEA region. Better service levels and lower landed costs should therefore support margins of the international business, according to the management’s statements in the earnings call of Q1/2024. Monster is also in the process of constructing a juice facility and another flavor facility in Ireland. All those actions should improve margin levels for the EMEA business, mid term.

Change in Management

The management announced in context of the last earnings release that Rodney Sacks (Co-CEO) “is considering reducing his day-to-day management responsibilities starting in 2025, while continuing to manage certain areas of the company’s business for which he has always been responsible. At that time, Mr. Sacks intends to remain Chairman of the company’s board and Mr. Schlosberg would segue from Co-CEO to CEO.”

This step appears to be prudent as Rodney Sacks remains the Chairman of the Board and will follow certain business areas of MNST also from next year onwards. Though, there is no immediate loss of knowledge and experience foreseeable. Schlosberg becoming the sole CEO in 2025 is also a testament to stability and by no means disruptive.

That’s why I see no material impact on the business or the company that may result from that change.

Historic and Current Valuation of MNST

Let’s dig deeper into the figures and into a more quantitative approach. At the time of this writing, the stock price is $48.03 per share, which shall be the basis for the following statements.

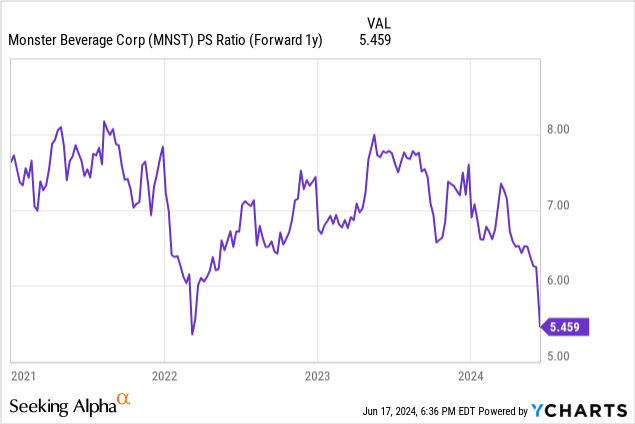

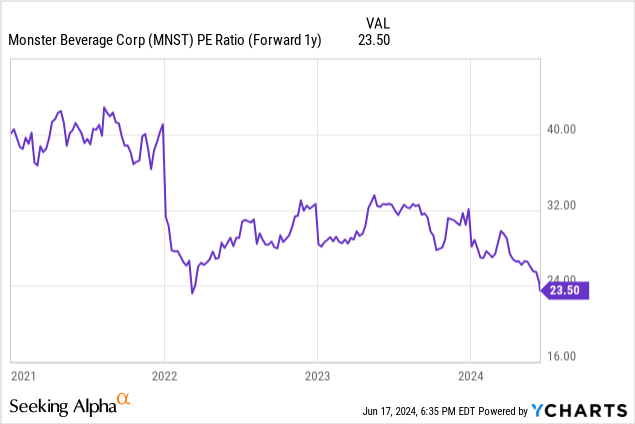

Considering price ratios like P/S and P/E, Monster Beverage is currently trading at a discount to its five-year average multiples of 8.9 for P/S and 34.4 for P/E, respectively. This is also recognizable in the following two charts stating the P/S and P/E Ratio Forward 1Y, each.

The stock trades at 5.5 related to the P/S Ratio Forward 1Y, which reflects that Monster Beverage is far from historically expensive. The discount in terms of P/E Forward 1Y is even more significant considering that the stock is currently trading at about 23.5 – even lower than the Covid-19 low and all other P/Es within the last 10 years.

Short-Term Share Buybacks of approx. 5.4% of Shares Outstanding

On 8 May 2024, the management announced to commence a Modified Dutch Auction Tender Offer that would enable the company to buy back up to the equivalent of $3 billion of shares. That offer expired on 5th of June 2024. According to a press release of June 10, 2024, Monster Beverage will acquire 56,603,773 shares at $53.00. This equals to approx. 5.4% of shares outstanding. The offer is funded using a combination of $2.0 billion of cash on hand, $750 million in borrowings under a new term loan and $250 million in borrowings under a new revolving credit facility. Given the current debt of $61.91 million, the new debt level will reach slightly less than $1.1 billion.

It would take the company less than a year to earn the equivalent of debt, considering its net income of $1.63 billion and its free cash flow of $1.50 billion for FY2023. This debt level is far from critical and should not concern investors.

Impact on Valuation and EPS

The buyback has a charming impact on Monster’s valuation that is not reflected in the charts yet. Considering 5.4% less outstanding shares, the P/E Forward 1Y reaches a level of 22.2. The Price-Sales Ratio Forward 1Y reflects a multi-year low of 5.2.

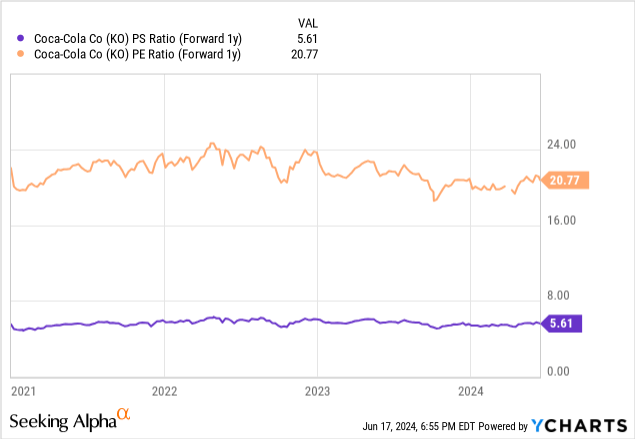

Compare those figures to beverage giant Coca-Cola, which is a high-quality company with high margins and a rock solid business: KO is trading at PE Forward 1Y of 20.8 times and P/S Forward 1Y of 5.6 times, as shown in the below chart. Both companies are valued fairly similar in this regard – KO’s valuation is slightly lower based on P/E whilst MNST is priced even more attractive based on P/S, which may result from the higher margins that KO achieves.

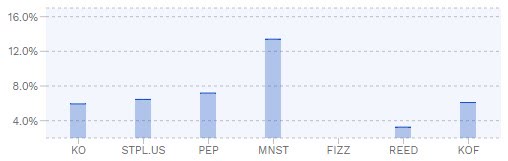

There is little to no doubt that KO is a great company, but in terms of growth, MNST is outperforming Coca-Cola and its peers like PepsiCo by far, as illustrated in the next chart. Based on 5Y-CAGRs, KO increased revenues 5.9% per year, and PepsiCo by 7.2%. MNST achieves, in the same timeframe, a CAGR of 13.4%, which is twice as much growth. I believe this fact would justify that Monster Beverage deserves a higher valuation than Coca-Cola.

5Y-CAGR of Coca-Cola, US Consumer Staples, PepsiCo, Monster Beverage, National Beverage Corp., Reed’s and Coca-Cola Femsa (Finbox.com (https://finbox.com/NYSE:KO/explorer/total_rev_cagr_5y/))

Assuming MNST establishes a P/E of 30 or a P/S of 7 is rather conservative than ambitious for the next year. That would mean a potential gain of 35% or a price target of $65 within the next 12 months – on either assumption.

If the FED cuts interest rates whilst MNST further improves margins and continues to succeed their international expansion, also higher valuations are reasonable. In this case, I would assume a PE of 35 and a PS of 8.5 as justified for the stock. That figures reflect a range that the stock was regularly returning to from lower and higher valuations for the last 10 years. Based on those figures, we obtain compelling returns of 58% and 63%, respectively, if the stock reaches that valuation again. Though, over the next years, a price target of $77 doesn’t seem exaggerated under those conditions.

Risks

With lower valuations often come risks. Currently, the biggest risk for the company and its bright outlook would be that Celsius will take material market share from Monster, impacting both top and bottom line. The recent Nielsen study (revealed on 28 May 2024) could not confirm that concern, however that study reflects just a short timeframe of several weeks and only Nielsen measured channels. By no means, that period can reflect how the situation might be like in 12 or 24 months; however, it provides a meaningful insight into the current market and its dynamics.

Additionally, if the credit agreements go along with high interest rates – and in particular higher ones than the market would have expected – this would undermine Monster’s bottom line for the next couple of years (and the assumptions this analysis is based on). It would be challenging for Monster to regain past valuations if bottom-line returns are under pressure.

The risks derived from the resignation of Mr. Sacks as Co-CEO are limited in my view.

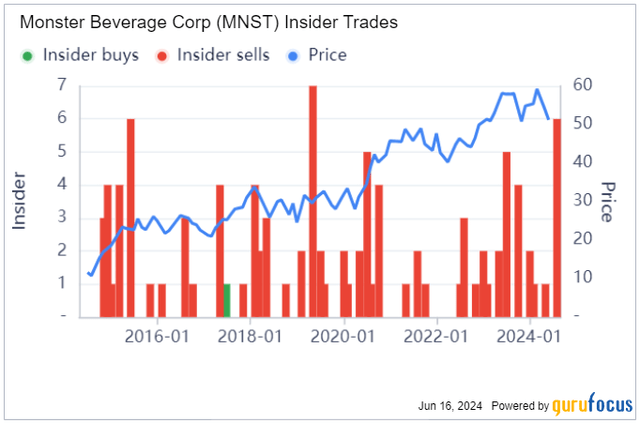

I noticed an enhanced level of insider activity at Monster Beverage. What initially concerned me was the fact that insiders were only selling within the last months. In the following chart, you see all insider trades at Monster Beverage within the last 10 years. There was only 1 insider buy during that period, whilst insiders sell regularly that stock. That’s why I see no particular reason to be concerned about the future of MNST due to insider sells of that scale.

MNST Insider Activity Within the Past 10 Years (GuruFocus)

Conclusion

Further growth of sales, especially internationally, and a gradually improved margin will drive net income of MNST. Combined with aggressive share repurchases, this will lift the EPS to new heights which is not reflected in the share price yet, I believe. The current valuation is historically low, and I see plenty of reasons why it should be restored to historical levels, representing a price target of $65 as a conservative base case scenario for the next 12 months and $77 as a mid-term target.

Whilst the tender offer undermines the company’s balance sheet to some extent and exposes future earnings to interest payments, the resilient and highly profitable business allows to take advantage of the current undervaluation and to buy back shares aggressively, in my view.

The prevailing concerns about the rising competition of Celsius are reflected in low valuations that make this consistent compounder a great buying opportunity to my mind. Even if economical headwinds come up, in my view, MNST can offer a consistent business, a healthy balance sheet and a management that has also proved in the past what it is capable of. That’s why I plan to add further shares to my portfolio near-term.

Read the full article here