Thesis

We have not covered the BlackRock Credit Allocation Income Trust (NYSE:BTZ) in almost two years, so we are revisiting this fixed income CEF from BlackRock in light of the significant changes in the market that have occurred during the period.

In our original pieces more than two years ago we correctly anticipated the rise in interest rates and the impact on BTZ given its composition. With peak rates behind us, but large question marks looming over the timing of Fed cuts, we are going to analyze the name again and highlight why the CEF is not yet a buy given the current level of credit spreads in the market.

A mainly investment grade CEF

BTZ is a bit of an odd duckling. The fund has a collateral pool that is mainly investment grade, although the CEF does contain a sizable allocation to high yield, allocation which we presume is present to cover the distribution:

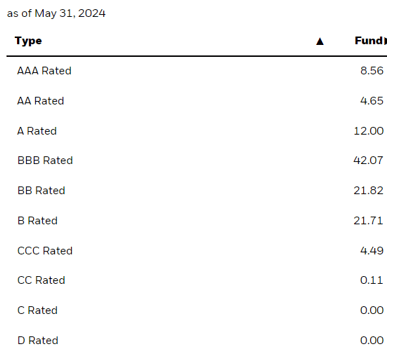

Ratings (Fund Website)

Whilst over 66% of the fund is made up of investment grade names, roughly 45% is allocated to high yield. Kindly note the BlackRock percentages are presented with the leverage included in the numbers (i.e. the total comes above 100%). The fund does run a high leverage ratio of 36%, leverage which accelerates moves both on the upside and downside.

Similarly to other BlackRock funds, we can see a bit of a bar-belled approach to the holdings composition, with roughly 9% of the fund in AAA names.

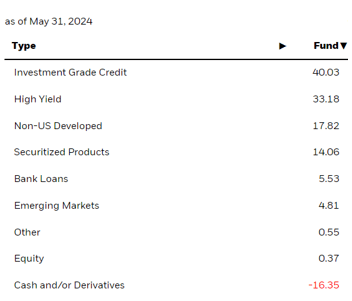

From a product standpoint, the CEF is not exclusively corporate, with large allocations to securitizations and sovereigns:

Holdings (Fund Website)

In fact, one can even argue this CEF falls in the multi-asset category rather than investment grade, although IG spreads and rates are the main driver here, closely followed by high yield spreads.

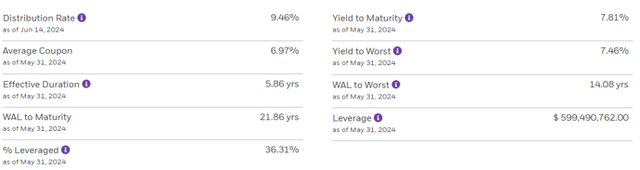

The portfolio has an effective duration of 5.8 years and a yield to maturity of 7.8%:

Analytics (Fund Website)

These characteristics put the CEF in the intermediate duration bucket.

Spreads are currently too tight

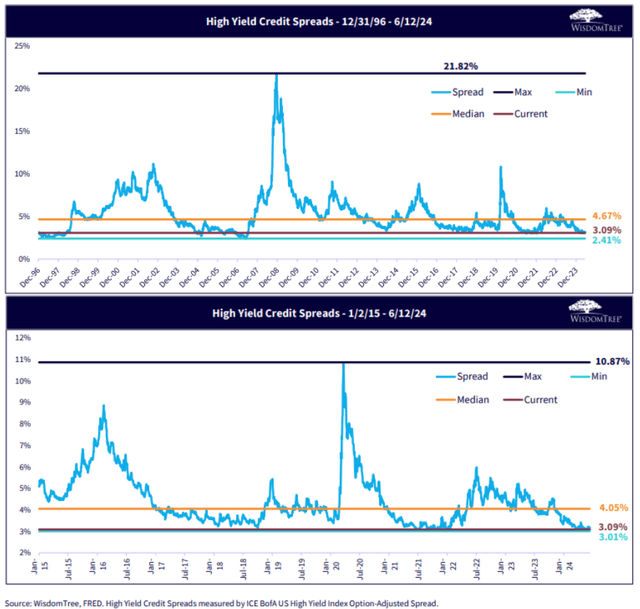

We have been repeating this theme for a while now, but credit spreads are very tight historically when looking at analytics:

Spreads (Wisdom Tree)

The above charts, courtesy of Wisdom Tree, show in an optically advantageous format what we are talking about. The current spread levels (in brown) are significantly below median levels, and in fact are very close to historical minimums. You want to buy spreads when they are wide, not at the current levels.

Morningstar analysts are also ringing the alarm bells on U.S. credit spreads:

However, even in our soft-landing scenario, we think corporate credit spreads have become too tight and should be underweighted. Over the past 24 years, only 2% of the time has the spread on the Morningstar US Corporate Bond Index been below the current spread of +86 basis points [and] only 3% of the time has the spread on the Morningstar US High-Yield Bond Index been below its current spread of +302 basis points. By way of comparison, the tightest investment-grade and high-yield credit spreads have ever traded is +80 and +241 basis points, respectively, in 2007.

Nobody is able to make a prediction regarding the duration of a low spread environment, but eventually, we are going to have a risk-off event that will reset all credit spreads higher.

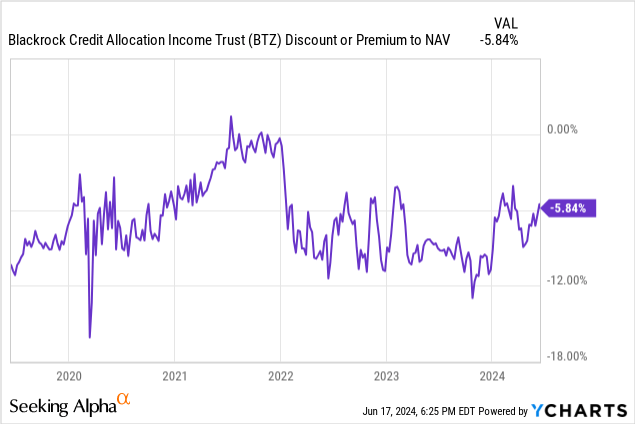

Discount has narrowed

The CEF’s discount to NAV has narrowed significantly this year:

In the past five years, the CEF has tended to trade with an average discount to NAV of roughly -7%. After touching the bottom of the range at -12% in late 2023, the CEF’s discount to NAV has rallied significantly. It now stands at -5.8%, which represents the top of the range for the 2022-2024 period, marked by the Fed hiking rates.

Therefore, from a structural standpoint today’s market is not a good one to purchase the name.

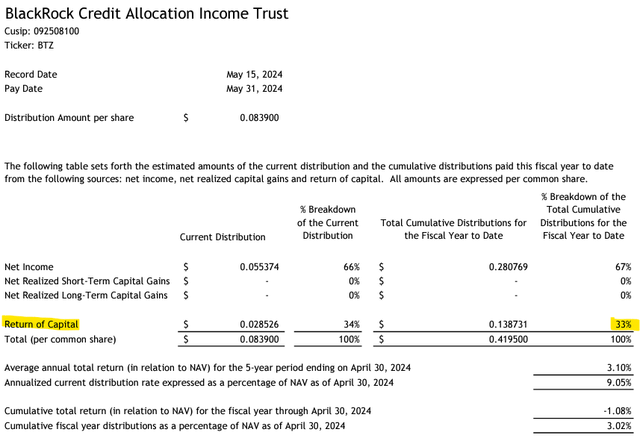

The fund is a heavy user of ROC

BTZ is a CEF that currently has a high return of capital figure in its distribution:

May Section 19a (Section 19a)

As of the May 2024 payment date, the CEF was using 34% ROC for the period, and 33% for the fiscal year to meet its distribution. That is a very high figure.

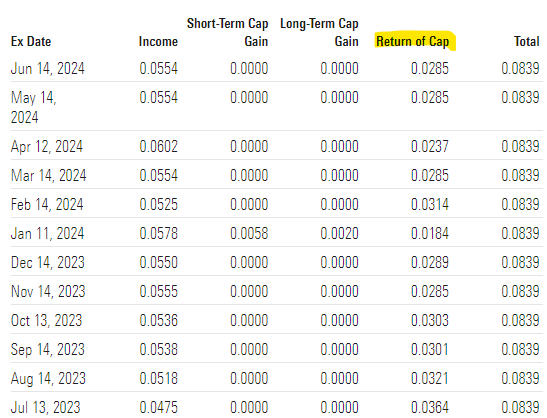

Looking at the historical breakdown of the distribution paints a similar picture:

Historic ROC (Morningstar)

The above table presents the historic ROC figures for the CEF, and we can observe that they are roughly around the 30% mark. Expect this distribution composition to continue.

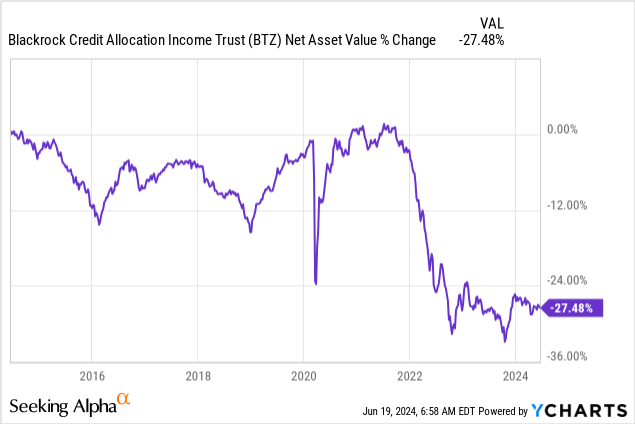

Let us have a look at the long term impact on NAV from this high ROC utilization:

The period from 2022 onwards can be ignored, because the lower NAV was produced by the higher rates environment. However, we can notice for the other part of the decade that the CEF does indeed exhibit some NAV slippage. Outside the 2020/2021 zero rates environment when credit rallied significantly, the CEF tended to exhibit a -1% to -2% slippage in NAV per year consistent with its overdistribution. This translates into the fund actually having a true cashflow yield closer to 6.7% in today’s market.

What is the forward for this CEF

The fund’s main risk factors are interest rates and credit spreads. With peak rates behind us, credit spreads are going to be the main driver going forward. We think the Fed will be higher for longer, with only one cut in 2024 (you can read more here about this ‘house view’). That leaves only credit spreads as risk driver for 2024, and we are uncomfortable with the current level for spreads. We do not know how long spreads will stay low, but we are certain that they will move significantly higher during the next risk-off event, which will put pressure on BTZ. The fund is a robust long term producer, despite its high ROC, and with current elevated risk free rates the fund represents a ‘Hold’ for us. Attractive entry points will only open up during a risk-off event that will move spreads wider and widen the discount to NAV.

Conclusion

BTZ is a fixed income CEF. The fund is overweight corporate IG collateral, but also sports a large high yield sleeve. The vehicle comes with a 9.4% yield which is unsupported, with a 33% ROC utilization currently. The fund will be driven by credit spreads going forward, and we are witnessing a historic bottoming in spread levels. Given its robust build, the name is a hold, with attractive entry points opening up only after a risk-off event that would see credit spreads increase and the fund’s discount to NAV move wider.

Read the full article here